Shares for the future: a company I like at a 12-year low

This billion-pound business dominates its market, and columnist Richard Beddard believes it is probably a good long-term investment, but the shares have struggled. Here’s how he scores the company.

1st March 2024 15:43

by Richard Beddard from interactive investor

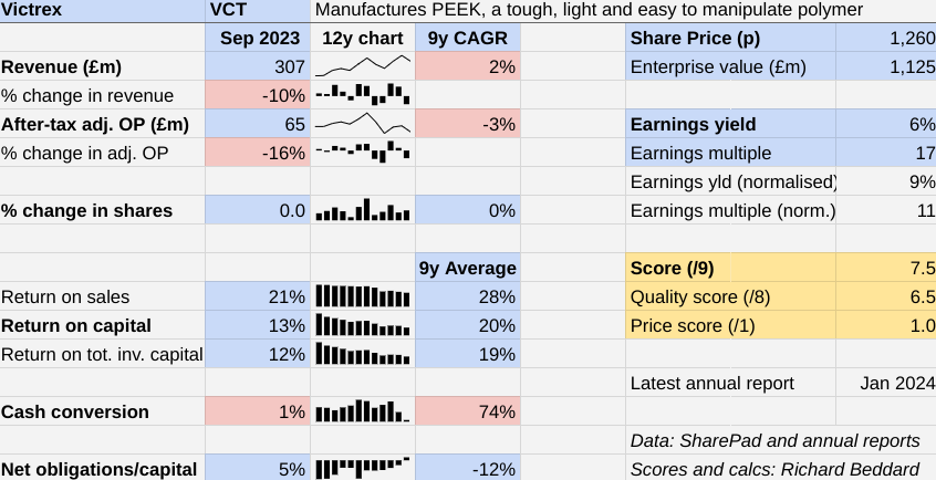

Judging by the numbers, Victrex (LSE:VCT), a manufacturer of a high-performance polymer used in a wide range of components, no longer looks like the great business it did when it launched its current strategy in 2014.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Scoring Victrex: where’s the volume?

2023 is probably a bad year to end our analysis, but we have little choice as it is the most recent one. In the annual report, chief executive Jakob Sigurdsson described it as “one of the toughest periods on record for the entire chemical industry.”

The year was marked by sharp declines in important markets like Electronics and Energy. It also capped a period of heavier than usual investment as Victrex built and commissioned a new facility in China, while simultaneously increasing the capacity of its much bigger UK factory.

Staff and raw material costs have been elevated, and the company dramatically increased stock after it ran it down during the pandemic.

Nevertheless, even over the long-term, the numbers have deteriorated. Victrex has not grown, and profitability has deteriorated over the last nine years.

That was when, in 2014, Victrex revealed its current strategy.

The Past (dependable) [2]

- Profitable growth: Profit and Return on capital (ROC) contracting [0.5]

- Strong finances: Yes, but the direction is concerning [0.5]

- Through thick and thin: Lowest ROC in 12 years: 13% (2023) [1]

A 10% decline in revenue during the year to September 2023 means Victrex has only achieved a 2% compound annual growth rate since 2014.

The problem is mostly volume. The company is hardly selling any more PEEK, the polymer it makes, than it was in 2014.

The higher costs in 2023 resulted in a 16% decline in adjusted profit, which means the company has shrunk profit at 3% compound annual growth rate (CAGR) since 2014 and now earns a return on capital of 13%, less than half the nine-year average.

Victrex has a good record of converting profit into cash, but in 2023 almost all of the cash that flowed into the business flowed out again. Cash conversion was only 1%.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: a new buying opportunity at bid target Direct Line?

For the first time I can remember, the value of Victrex’s financial obligations outweighed cash.

Victrex expects capital expenditure to reduce in coming years as it has all the capacity it needs, although it will continue investing in manufacturing processes to make them greener.

But operating expenses will increase when the Chinese facility is switched on and drag on profit until volumes ramp up. One thing getting in the way is the high level of stock, which Victrex plans to reduce. While it does, its factories will operate less efficiently.

Victrex says volumes could grow by more than 10% in the year to September 2024, but growth of all kinds is dependent on recovering markets, which has yet to happen.

The Present (distinctive) [2.5]

- Discernible business: Only specialist vertically integrated PEEK manufacturer [1]

- With experienced people: Unproven board [0.5]

- That creates value for customers: Stronger, lighter, harder wearing components [1]

Victrex manufactures PEEK, a high-performance polymer. It is used to fashion strong, light, hardwearing components used in all manner of equipment, including planes, smartphones, cars, and medical implants.

Generally, the company’s products do good. Lighter aircraft components save fuel. Better implants improve the quality of our lives. Cars with gears that vibrate less are quieter and more reliable.

Today, Victrex remains the only specialist manufacturer of PEEK.

Its rivals are a handful of European and Chinese diversified chemical companies. They source a principal ingredient, the monomer Diflouro Benzophenone (BDF), from China, while Victrex manufactures BDF in Rotherham and Teesside using a proprietary recipe and a different polymerisation process, protected by more than 200 patents.

This means Victrex has a unique version of PEEK, known as Type 1, as well as Type 2 PEEK, which is made by the others. The two variants have different properties, Type 1 is typically stiffer and stronger, but less flexible than Type 2. Victrex also makes intermediate PEEKs by processing externally sourced BDF and combines PEEK with other material to make composites, so its range is much larger.

By investing 5 to 6% of revenue in research and development, Victrex continuously seeks to further differentiate its products.

Its policy of increasing capacity ahead of demand may also ward off competition.

- Trading Strategies: a FTSE 100 stock with wide margin of safety

- eyeQ: what to do with dividend stock Aviva?

In 2023, Victrex removed bottlenecks in its main UK plant to increase its capacity, and it commissioned a factory in China. Although it has delayed starting the Chinese site up until April due to weak demand, once it is operational it will take Victrex’s total nameplate capacity from 8,000 to 9,500 tonnes, which is nearly 70% of global nameplate capacity.

No factory can achieve nameplate capacity, it means no downtime, but since the rest of the industry only has a nameplate capacity of 4,500 tonnes Victrex has in some years, if not all, manufactured way more than half of the world’s PEEK.

Victrex’s staple is PEEK resin, which is what its rivals solely produce. Customers, component manufacturers, form it into parts. But the company changed strategy in 2014, when the phrase “mega-programmes” first graced the annual report.

As well as convincing manufacturers to adopt the material, Victrex worked in partnership with them and sometimes by itself, to make new PEEK products, prove them, and stimulate demand. It identified five products capable of earning revenues of at least £50 million a year.

Jakob Sigurdsson inherited the strategy when he was recruited as chief executive in 2017, but has yet to discover the elixir of growth. Chief financial officer Ian Melling has been in the job less than two years.

The Future (directed) [2]

- Addressing challenges:Breaking into new markets [0.5]

- With coherent actions: Polymer and parts, Mega-programmes [0.5]

- That reward all stakeholders fairly: Expert and loyal employees [1]

Nine years after the mega-programme’s birth, none of them have achieved anything like peak revenue. In 2023, only 7% of revenue was earned by products not sold before 2014, and less than 4% of revenue (£11 million) came from mega-programmes.

It seems that Victrex’s policy of increasing capacity ahead of demand is costing it dearly during a period in which demand has not increased. The increase in capital invested is a factor in its reduced return on capital, as well as lower profit.

Last year, Victrex intensified its focus on medical programmes. Implants are sold in low volumes, they attract high profit margins, and demand is more consistent than for industrial markets. In 2023, while the non-medical side of Victrex struggled, medical revenue reached a new high of £65.2 million (21% of total revenue)

The company’s two medical mega-programmes are Trauma and Knee.

Trauma plates help repair broken bones. Victrex achieved US Federal Drug Administration (FDA) approval in 2023 and supplied 3,000 trauma plates through its US partner during the year. It believes the programme will earn £10 million annual revenue in the next two or three years.

Two other mega-programmes, E-mobility and Magma are closing in on the same “inflection point” where major customers are investing, the technical merits have been demonstrated and commercialisation has started.

- Stockwatch: a 9% yield and nearest example to an ‘annuity’ share

- Insider: directors get buying at BT, Rolls-Royce and BAT

Magma is a deep-sea composite pipe designed for oil and gas fields. The E-mobility programme provides polymer and parts for electric vehicles, for example housing for tightly packed wires.

The knee programme, which makes knee replacements, is still in clinical trials. Victrex expects first sales in two or three years. It is, the company says, potentially the most valuable, potentially worth significantly more than £50 million a year.

Persuading leading manufacturers to build a component with a new material is tricky though because they already have a leading product, and they tend to be risk averse.

Proving PEEK is a lengthy procedure, requiring trials, documentation and often regulatory approval. Even then, Victrex is more likely to win business from challengers who need to differentiate their products. That revenue is less significant, unless ultimately a more competitive product encourages bigger manufacturers to think again.

The Chinese plant should win business in the burgeoning domestic electric vehicle market. But Victrex also needs to defend revenue it already earns in the manufacturing powerhouse. China is in the process of mandating a higher level of domestic content in components manufactured there, a problem the new plant addresses. Victrex also faces a couple of low-cost local competitors.

Victrex earned 15% of total revenue in China in 2023, and this dependency is a significant risk while geopolitical tensions are rising.

The price (discounted?) [1]

- Yes. A share price of £12.60 values the enterprise at £1.1 billion, 11 times normalised profit.

I like Victrex for its differentiated products and unique business model. Voluntary staff turnover was 9% in quite a turbulent jobs market, and the median employee earned a base salary of £47,000 so it is probably a good place to work.

But Victrex dominates the market, so to grow it must find new markets for PEEK.

Not only is this taking much longer than expected, but the company is targeting 5-7% growth in the core business of polymer resin. Looking backwards, its growth rate has been less than 2%.

Talk of inflection points is intoxicating, the company needs them to get the volumes flowing through its factories.

A score of 7.5 out of 10 indicates that Victrex is probably a good long-term investment.

It is ranked 19 out of 40 stocks in my Decision Engine.

26 Shares for the future

Here is the ranked list of shares from the Decision Engine. I review the scores once a year, soon after each company has published its annual report. The scores change day to day due to changes in price.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Hollywood Bowl Group (LSE:BOWL) has published its annual report and is due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered sufficiently.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | |

2 | Supplies vehicle tracking systems to small fleets and insurers | 9.4 | |

3 | Supplies kitchens to small builders | 9.4 | |

4 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

5 | Distributor of protective packaging | 8.7 | |

6 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

7 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

8 | Translates documents and localises software and content for businesses | 8.5 | |

9 | Manufactures filters and filtration systems for fluids and molten metals | 8.5 | |

10 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.2 | |

11 | Manufactures/retails Warhammer models, licenses stories/characters | 8.1 | |

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.0 | |

13 | Sells hardware and software to businesses and the public sector | 7.8 | |

14 | Manufactures natural animal feed additives | 7.8 | |

15 | Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

16 | Imports and distributes timber and timber products | 7.8 | |

17 | Manufactures military technology, does research and consultancy | 7.5 | |

18 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

19 | Victrex | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 |

20 | Sources, processes and develops flavours esp. for soft drinks | 7.5 | |

21 | Online retailer of domestic appliances and TVs | 7.4 | |

22 | Whiz bang manufacturer of automated machine tools and robots | 7.4 | |

23 | Distributes essential everyday items consumed by organisations | 7.4 | |

24 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.4 | |

25 | Makes marketing and fraud prevention software, sells it as a service | 7.2 | |

26 | Online marketplace for motor vehicles | 7.0 | |

27 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.8 | |

29 | Manufactures specialist paper, packaging and high-tech materials | 6.6 | |

30 | Sells promotional materials like branded mugs and tee shirts direct | 6.3 | |

31 | Flies holidaymakers to Europe, sells package holidays | 6.1 | |

32 | Surveys and distributes public opinion online | 5.9 | |

33 | Manufactures sports watches and instrumentation | 5.9 | |

34 | Publishes books, and digital collections for academics and professionals | 5.8 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

36 | Operates tenpin bowling and indoor crazy golf centres | 5.4 | |

37 | Retails clothes and homewares | 5.3 | |

38 | Supplies software and services to the transport industry | 5.3 | |

39 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

40 | Runs a network of self-employed lawyers | 4.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Victrex and many of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.