Shares for the future: how the Decision Engine fared in 2020

Lessons learned from ‘the most terrifying year of investing’.

23rd December 2020 09:04

by Richard Beddard from interactive investor

Here’s what our contributor has learned from ‘the most terrifying year of investing’ he can remember.

I am starting this review of an incredible year of scoring and ranking shares in October, because that month I explained how the Decision Engine, the scoring and ranking system, is my method of determining relative value.

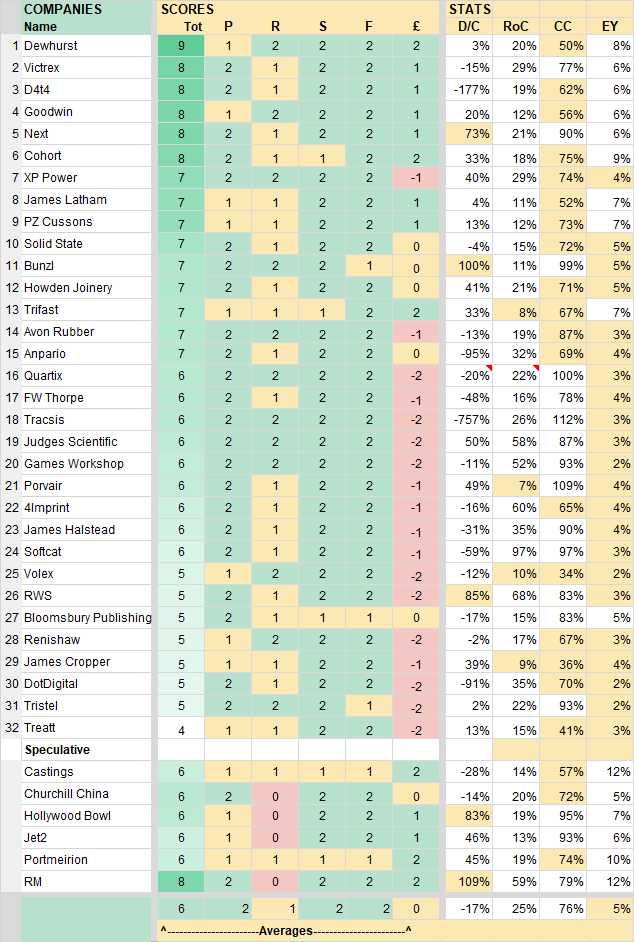

Each share can score up to two points for profitability, up to two points for risks, up to two points for strategy, up to two points for fairness and between minus two and two points for price, which adds up to a total score out of 10.

Although I would not include a share if I thought it unlikely to be a good long-term investment, shares near the top of the list, those scoring closest to 10, are most attractive.

Shares nearest the bottom, scoring closest to zero, are least attractive.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

Every month, usually as the end of the month approaches, we publish the rankings (for this month’s Decision Engine see the end of this article).

This is what I have learned running the system during the most terrifying year of investing I can remember.

- Richard Beddard: first time scoring this hugely predictable FTSE 100 stock

- Richard Beddard: this AIM share appears to be unstoppable

- Share Sleuth: the share I am holding off buying

January

In the first update of the year I bemoaned the fact that only seven companies scored more than seven out of 10.

Soaring share prices, the most volatile and significant criterion of the five I score, had reduced the scores of most of the shares below the arbitrary value I considered to be the boundary between a share that was undervalued and one we might consider fairly valued.

I said: “The answer to this problem is, as always, simple but not easy. I need to find companies of equal quality or better, trading at lower valuations. It is simple because I can express it in a sentence. It is not easy because the quality hurdle is high. The Decision Engine is full of good businesses that I know quite a bit about. Learning enough about new businesses to unseat the existing ones takes time and often what I learn will lead me to believe they are not good enough.”

Success in 2020, therefore, would be determined by the number of good companies I could find also trading at relatively low prices (in relation to their profits).

March

Events, though, temporarily shifted my focus from value to survivability.

While we were experiencing unprecedented personal restrictions with unknowable consequences for the economy, many of us also had to come to terms with the fact that our portfolios were, for the weeks spanning late February and early March, in free-fall.

In those few weeks the value of my Share Sleuth Portfolio peaked at about £161,000. In March it bottomed out close to £102,000, a decline of 37%.

I stopped worrying about prices being too high for the obvious reason that in most cases they were not anymore. In that month’s update, 23 shares scored seven or more out of 10.

Amazingly Games Workshop (LSE:GAW), Renishaw (LSE:RSW), Quartix (LSE:QTX) and Judges Scientific (LSE:JDG), companies almost always ranked low down the list because of their soaring prices, were in my arbitrary buyzone.

We labelled that edition of the Decision Engine ‘A bargain portfolio for the future’, and it probably was.

Buying it though would have been another matter, since it included retailers (Next (LSE:NXT) and Games Workshop), a package tour operator (Jet2 (LSE:JET2)), a tenpin bowling chain (Hollywood Bowl (LSE:BOWL)), and Churchill China (LSE:CHH) (a supplier of tableware to the hospitality industry).

These businesses, or aspects of them, were all but closed, and I would spend the next few months wondering what to do about them, although I was not about to throw them out. I said:

“Ultimately, long-term investors put our faith in people: The people who run businesses, and the people they employ. All of these people work for their own reasons but, if we have selected good businesses, they also work collectively to ensure their companies survive, adapt, and prosper. These are the people I am relying on to secure my portfolios. I have never thought I could do better than them in a crisis by dodging and weaving in the stock market.”

The pandemic was a test of decisions made long ago, and not a call to action.

May

I reaffirmed my contrarianism in an update on 1 May when I declared the future a mystery to me.

Like many people I was bamboozled by the pandemic and unable to think through the implications for the economy or my shares, but fortunately I had outsourced the pandemic response: “Implicit in this strategy is a constant vision of the future, that it won’t be so radically different from the past that good companies cannot adapt to it.”

I found succour instead in writing about my fears, and those of readers who had emailed me.

And I channelled my energy into revamping the Decision Engine, streamlining the back end, improving the presentation, and of course diligently analysing five or six companies a month, to feed the engine.

September

What a long-term investor really wants to do is to switch off from the news flow and focus on the things that really matter: the fundamental qualities of the businesses we are researching.

But over the summer I could not switch off, because I was tormented by a small group of shares that defied analysis because their prospects were so radically reduced by the pandemic.

Games Workshop had already shown itself to be capable of thriving, and extremely clear guidance from Next indicated it would survive the first phases reasonably unscathed. Both companies were saved by their online operations.

- Shares for the future: the latest list revealed

- Find out more about interactive investor SIPP and pensions here

Jet2, Hollywood Bowl, and Churchill China could not just ramp up sales via an alternative channel, though, and that put me between a rock and a hard place. The rock was my confidence these businesses would thrive again, the hard place was that social distancing was and still is preventing that.

To remove them from the Decision Engine would require me to remove them from my portfolios, but I did not want to. These were the kind of shares that should soar as the pandemic abated, or indeed in anticipation of it.

To better communicate to readers how I felt about these shares, I deemed them speculative and hived them off into a separate table.

Today

Though the pandemic is not yet over, I feel the Decision Engine has passed a test. I review each company once a year and I have lost faith in only two, Castings (LSE:CGS) and Portmeirion (LSE:PMP).

The Decision Engine is a larger and more diverse universe of shares to construct portfolios from because it contains eight more shares than it did in January: D4t4 (LSE:D4T4), James Latham (LSE:LTHM), Bunzl (LSE:BNZL), Tracsis (LSE:TRCS), 4imprint (LSE:FOUR), Volex (LSE:VLX), RWS (LSE:RWS) and James Cropper (LSE:CRPR).

The average score of all the shares in the Decision Engine has increased from 6.4 in January to 6.8 today, so it is a more attractive gaggle to pick from.

And under pressure, I did not lose faith in the process of scoring and ranking shares, instead I worked to improve it.

Thanks to everyone who emailed questions and constructive criticism, it really is encouraging and helps me reflect on what I do.

Happy New Year.

Scores on the doors

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Tot: Total, P: Profitability, R: Risks, S: Strategy, F: Fairness: £: Price

D/C: Debt as a % of operating capital, RoC: Average return on capital, CC: Ave cash conversion, EY: Earnings yield (norm.)

Links

Click on the name of a company to see how I scored it.

| Name | Description |

|---|---|

| 4Imprint | Sells promotional materials such as branded mugs and T-shirts direct |

| Anpario | Manufactures natural animal feed additives |

| Avon Rubber | Manufactures respiratory protection equipment and body armour |

| Bloomsbury Publishing | Publishes books and online resources for academics and professionals |

| Bunzl | Distributes essential everyday items consumed by organisations |

| Castings | Casts and machines parts for vans and trucks, primarily |

| Churchill China | Manufactures tableware for restaurants and eateries |

| Cohort | Manufactures military tech. Does research and consultancy |

| D4t4 | Developer and integrator of customer data platforms |

| Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs |

| DotDigital | Developer of marketing automation software |

| FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels |

| Games Workshop | Manufactures/retails Warhammer models, licenses stories/characters |

| Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres |

| Hollywood Bowl | Operates tenpin bowling centres |

| Howden Joinery | Supplies kitchens to small builders |

| James Cropper | Specialist paper and high-tech materials manufacturer |

| James Halstead | Manufactures vinyl flooring for commercial and public spaces |

| James Latham | Imports and distributes timber and timber products |

| Jet2 | Flies holidaymakers to Europe, sells package holidays |

| Judges Scientific | Acquires and operates small scientific instrument manufacturers |

| Next | Retails clothes and homewares |

| Portmeirion | Designs and manufactures tableware, candles and reed diffusers |

| Porvair | Manufactures filters and filtration systems for fluids and molten metals |

| PZ Cussons | Manufactures personal care and beauty brands, in the main |

| Quartix | Supplies vehicle tracking systems to small fleets and insurers |

| Renishaw | Whiz-bang manufacturer of automated machine tools and robots |

| RM | Supplies schools with equipment and IT, and exam boards with e-marking |

| RWS | Translates documents and localises software and content for businesses |

| Softcat | Sells hardware and software to businesses and the public sector |

| Solid State | Manufactures rugged computers, battery packs, radios. Distributes electronics |

| Tracsis | Supplies software and services to the transport industry |

| Treatt | Sources, processes and develops flavours esp. for soft drinks |

| Trifast | Manufactures and distributes nuts and bolts, screws, and rivets |

| Tristel | Manufactures disinfectants for simple medical instruments and surfaces |

| Victrex | Manufactures PEEK, a tough, light and easy-to-manipulate polymer |

| Volex | Contract manufacturer of connectivity components and power cord |

| XP Power | Manufactures power adapters for industrial and healthcare equipment |

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.