Shares for the future: my stock scoring method explained

Analyst Richard Beddard reveals how he chooses and scores shares that he’s confident will make money through thick and thin for the benefit of everyone.

2nd January 2026 14:30

by Richard Beddard from interactive investor

Happy New Year!

During 2025, I simplified the Decision Engine to make it easier to score and re-score shares when I learned more about them. The aim was to improve my understanding of shares and communicate it better.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Guide to the Decision Engine

The Decision Engine is a list of shares that I am confident will make money through thick and thin for the benefit of everyone.

To measure my degree of confidence, I score each company against three criteria: their capabilities, the risks they must overcome to prosper, and the extent to which their strategies address those risks. The maximum score for each criterion is 3.

The scores are summarised in a table like this one:

Jet2 | JET2 | Package tour operator and leisure airline | 17/12/2025 | 8/10 |

How capably has Jet2 made money? | 3.0 | |||

Jet2 has grown revenue and profit at double-digit compound annual growth rates (CAGR) by flying more people to more places from more UK airports. Its long-standing executives have largely self-funded growth by controlling much of the holiday experience and putting staff and customers first, encouraging loyalty. | ||||

How big are the risks? | 1.5 | |||

Like all airlines, Jet2 is vulnerable to external events such as war, pandemic and the many risks of climate change. Its singular focus on family friendly holidays in the Med has seen off competitors, but a resurgent easyJet Holidays may be a more potent threat. | ||||

How fair and coherent is its strategy? | 2.5 | |||

The next stage in Jet2’s expansion is Gatwick, perhaps its biggest opportunity. It is buying fuel-efficient planes, electrifying the ground fleet and lobbying for more Sustainable Aviation Fuels (SAF) and efficient routes. This isn’t enough to address the many risks of climate change, but progress may have to come collaboratively. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 1,383p values the enterprise at £2,699 million, about 11 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

The reasons for my confidence are written in normal text. Doubts about the company’s record, serious risks, and gaps or inconsistencies in its strategy are highlighted in bold (and half a point is deducted from the score), or bold and italic if the doubts and risks could be really consequential (and a whole point is deducted).

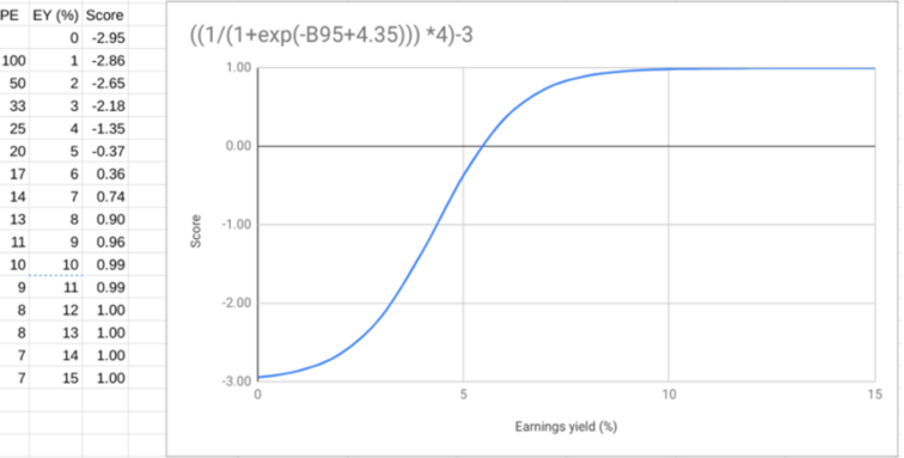

The fourth criterion is the price score. It uses a souped-up version of the venerable price/earnings (PE) ratio to determine how high or low the share price is compared to normalised profit*.

Low PEs are rewarded with a positive score up to a maximum of 1. High PEs are penalised with a negative score down to -3.

PEs are a very crude measures of value. If we are very confident a share will prosper, we should be prepared to pay more for it, which is why I roll the price up with the scores that judge the business.

The maximum score for a share is 3+3+3+1 = 10.

If we are very confident in the share but it is very expensive, its score might be close to 3+3+3-3 = 6

Consequently, as well as being a measure of my confidence in a share, the score is also a measure of relative value. The higher the score, the more likely the share is to be a good long-term investment.

To help me invest more in the highest-scoring shares, the Decision Engine uses the score to calculate an ideal holding size (ihs%) for each share as a percentage of the total value of a diversified portfolio.

The calculation is**: ihs% = score - (10 - score)

So, a top-scoring share has an ihs% of: 10-(10-10) = 10%

The perfect business with a very high price and a score of 6 has an ihs% of: 6-(10-6) = 2%

Over the holiday period, we are not publishing tables of scores, but every other week of the year you can find one at the end of my “Shares for the Future” column here on interactive investor. The latest is appended to this article. Here is a selection from it, showing the highest- and lowest-scoring shares:

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.8 | 9.6% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.8 | 2.5% |

You can click the scores to see how I scored these shares. “qual” is the combined score for capabilities, risks, and strategy, and “price” is the price score.

If you have really sharp eyes, you might have noticed Quartix Technologies (LSE:QTX) had a score of less than 6 (5.7), yet it has an ih% of more than 2% (2.5%). That is because I do not want to hold small and relatively inconsequential holdings, so the minimum ihs% is set at 2.5%.

Likewise, I do not want to make inconsequential trades, so the minimum trade size is also 2.5% of the portfolio’s total value. That means that a holding can be up to 2.5% of the portfolio’s value bigger than its ihs% before the Decision Engine suggests I reduce it. Likewise, it must be more than 2.5% less than its ihs% for the Decision Engine to suggest I add to it.

The Share Sleuth portfolio

The Share Sleuth portfolio is a model portfolio that I have managed since 2009. In the early years, I was not very systematic about picking shares. For 10 years I have used the Decision Engine to guide my trades, although I am prepared to overrule it occasionally.

We document trades in the Share Sleuth portfolio and report on its performance once a month. The most recent update was on 10 December.

* Technical note on the price score

The price is the price we would pay if we were to buy the whole business at the market price, its market capitalisation plus debt. Normalised profit is the profit before interest, tax, and acquired amortisation the company would have earned in its most recent year if it had achieved its average return on capital.

The Decision Engine uses a sigmoid function to determine the price score:

** A not very technical note on the ideal holding size

To save you from calculating the position size for every score, here is a table:

Score | Ideal holding size (%) |

10 | 10.0 |

9 | 8.0 |

8 | 6.0 |

7 | 4.0 |

6 | 2.5 |

5 | 2.5 |

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Jet2 and usually owns all the shares in the Share Sleuth portfolio and many of the shares in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.