Shares for the future: an almost perfect 10 out of 10

Analyst Richard Beddard likes this company so much he’s upgraded his score to within a whisker of perfection. He explains the rationale and why it’s not without risk.

7th November 2025 15:00

by Richard Beddard from interactive investor

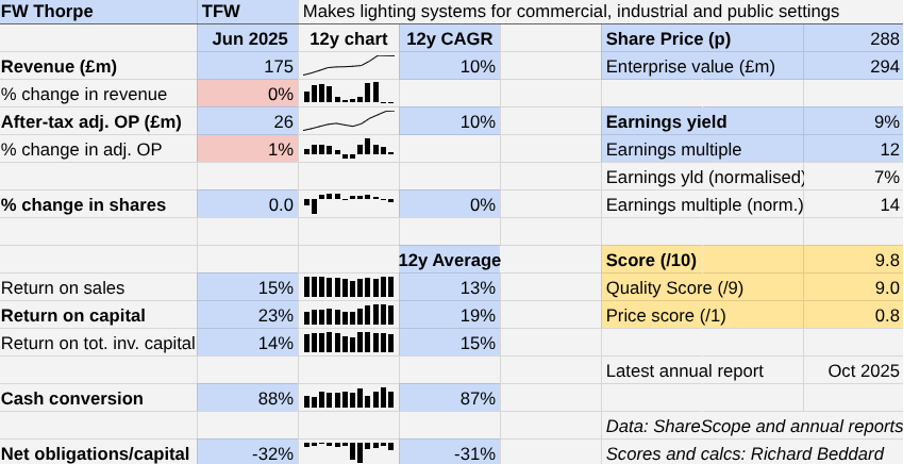

In this article, I’ve set myself the unusual task of justifying the highest score I can give to a business. This company’s share price is low too, relative to its earning power, so it scores an almost perfect 10 out of 10.

That business is Thorpe (F W) (LSE:TFW), and I’ve come to this conclusion despite it not having grown revenue for two years and [given that it] did not grow profit in the year to June 2025. The outlook for the current financial year is flat too.

FW Thorpe: people - product - purpose

FW Thorpe says “people, product and purpose” are the “engine” of its “strategic mindset”. I give it a high score because the company’s long-term performance, and plenty of evidence in the annual report, suggests that this is more than just corporate blather.

FW Thorpe makes commercial and industrial lighting systems. Its fortunes are dependent on the state of the economy. Companies install new lighting systems when they open or refurbish shops, hotels, factories, and warehouses and when governments invest in social housing, hospitals and schools. They do this more when budgets are flush with cash.

The company earns just over half its revenue in the UK and most of the rest in Europe. It is not surprising that, with economic pessimism prevalent in the UK, Germany in recession, and governments heavily in debt, FW Thorpe is not growing revenue.

It is reassuring that it’s highly profitable, cash rich, and improving products that save customers money and reduce their environmental footprint over the product’s lifetime.

Apart from flatlining growth, FW Thorpe’s numbers for 2025 are impressive, and slightly above its also impressive 12-year averages.

The company’s biggest and most profitable business is Thorlux, which makes lighting and controls for commercial and industrial markets, principally in the UK and Germany, where it owns a subsidiary, SchahlLED (acquired in 2022).

The company’s smaller UK firms are specialists, makers of emergency lighting, sign lighting, lighting for clean rooms and retailers, and road and tunnel lighting.

In Europe, it owns two Dutch subsidiaries. One makes emergency lighting, and another, Lightronics, makes rugged external lighting. Lightronics and Zemper, a Spanish subsidiary, are the most substantial businesses after Thorlux.

- Trading Strategies: why I think this mining stock is undervalued

- Insider: wave of selling among FTSE 100 directors

Most of the UK businesses performed well in 2025 including Thorlux. The exception was TRT, a loss-making road and tunnel business the company spun out of Thorlux in 2012. The company says that a new sales team at TRT has achieved profitability in the first months of the new financial year.

Its smaller UK subsidiaries improved formerly weak profit margins due to new products, cross-selling Thorlux products, and the pooling of group expertise in emergency lighting.

Thorlux’s UK performance more than compensated for a sharp decline in profitability at SchahlLED, which supplies industrial and logistics customers. Profitability at Lightronics fell too. FW Thorpe says drumming up new business and restoring profitability at these businesses is a priority.

Profit margins barely budged, despite flat revenue and rising wages and national insurance costs because the group procurement team reversed recent material cost increases.

Scoring FW Thorpe: manageable risks

Awarding a top score doesn’t mean there are no risks. The struggling subsidiaries in 2025, TRT, Lightronics and SchahlLED, are particularly exposed to the state of the economies where they operate.

Lightronics supplies social housing projects with wall and ceiling lights, and TRT supplies roads and tunnels. These are large projects that can be delayed when public finances are tight. SchahlLED does well when manufacturers are prospering.

FW Thorpe has been resilient because of its diversity. In 2025, 44% of revenue came from emergency lighting, which is made by two of its biggest subsidiaries, Thorlux (UK) and Zemper (Spain). Dutch subsidiary Famostar in also makes emergency lighting.

This year’s annual report highlights Zemper’s ALIOTH smart evacuation technology, which uses dynamic signs to route and re-route people to safe exits as the nature of the emergency changes. It has been installed at Brussels airport.

This diversity can simplify things for customers, because FW Thorpe can, as it says, supply a project from “boiler room to boardroom, and beyond”.

- Stockwatch: how much notice should we take of Warren Buffett?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Many of the company’s rivals compete on price, but FW Thorpe subsidiaries work with architects, designers, and property owners to get its products specified because of their functionality, reliability and lower lifetime costs. It holds on to the specification by providing design and installation services.

Thorlux’s decade-long development of SmartScan, a wireless control platform that uses sensors to control the level and colour temperature of lighting depending on occupancy and the time of day, has differentiated its systems. The company is introducing SmartScan into the ranges of some of its other subsidiaries including Lightronics’ exterior wall and ceiling systems.

FW Thorpe is also innovating to reduce metal and plastic, and lower the embodied carbon in its systems through the novel use of materials such as wood.

One risk that I chose to recognise in FW Thorpe’s score when I scored it last year, but have chosen not to penalise this time, is the majority holding of the Thorpe family.

Brothers Ian and Andrew, both former executives and now non-executive directors, and James Thorpe, joint managing director of Thorlux, own about 45% of the shares.

The company has been listed in London since 1965, and the family’s stewardship through recent economic turbulence and the technological transition from incandescent systems to LED systems, has been exemplary.

I worry that the erosion in tax privileges associated with the company’s listing on AIM might reduce the Thorpe family’s commitment to a listing. But on balance, I think the benefits of their involvement outweigh the risks.

The company prides itself on development from within, paying above the minimum wage, and inter-company collaboration. Both the chair and the chief executive are internal promotions, and it pays its lowest-paid workers above minimum wage rates. Pay is generous at every quartile.

FW Thorpe is a successful business that controls most of the capabilities it relies on. It owns its own factories, plants trees to offset the emissions it hasn’t been able to squeeze out of the business on its own woodland, and owns and operates its own delivery fleet. The newest lorries run on biofuel.

Its long-term approach may be illustrated by TFT, which has not yet been reliably profitable. Patience may also be required for the Ratio joint venture FW Thorpe entered into in 2023 to manufacture electric vehicle chargers. Ratio’s losses widened in 2025, but hitherto, the company hasn’t taken risks that have undermined its profitability overall.

FW Thorpe | TFW | Makes lighting systems for commercial, industrial and public settings | 05/11/2025 | 9.8/10 |

How capably has FW Thorpe made money? | 3.0 | |||

Under consistent management, FW Thorpe has profited from the adoption of LED lighting by innovating more capable systems supported by planning, installation and after-sales service, and acquiring European subsidiaries. It has achieved high Return on Capital and grown profit at 10% compound annual growth rate (CAGR) over the last 12 years. | ||||

How big are the risks? | 3.0 | |||

FW Thorpe owns its own facilities and earns strong cash flows. It has surplus cash. Acquisitions have been modest. Commercial and industrial customers cut capital spending in recessions, but Thorpe's diversity has helped it weather them. The majority family owners have been good stewards. | ||||

How fair and coherent is its strategy? | 3.0 | |||

The company differentiates itself from low-cost importers on product innovation, quality, and support. This increases the functionality of lighting, reduces the lifetime and environmental cost, and helps retain customers. FW Thorpe pays employees well and takes pride in developing them. | ||||

How low (high) is the share price compared to normalised profit? | 0.8 | |||

Low. A share price of 288p values the enterprise at £294 million, about 14 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

In my experience, it’s not unusual for companies to claim to focus on people, product or purpose. It is quite unusual for them to have the capability and commitment to achieve it, and the track record to demonstrate it.

While I think that is a good basis for the future, one worthy of a high score (up from 9.2 to 9.8), only time will tell that it is.

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

YouGov (LSE:YOU) and Volution Group (LSE:FAN) have published annual reports and are due to be re-scored.

0 | company | description | score | qual | price | ih% |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.8 | 9.0 | 0.8 | 9.5% |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.5 | 7.0% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | YouGov | Surveys and distributes public opinion online | 7.5 | 0.5 | 6.1% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | |

6 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.5 | 6.0% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 1.0 | 6.0% | |

8 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.2% | |

9 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.5 | 5.1% | |

10 | Churchill China | Manufactures tableware for restaurants, etc. | 6.5 | 1.0 | 5.0% | |

11 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | |

12 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.5 | 4.9% | |

13 | 4Imprint | Customises and distributes promotional goods | 8.0 | -0.6 | 4.8% | |

14 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.1 | 4.8% | |

15 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.2 | 4.6% | |

16 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.2 | 4.5% | |

17 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.8 | 4.4% | |

18 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.2% | |

19 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

20 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

21 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.6 | 3.8% | |

22 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | -0.1 | 3.7% | |

23 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.2 | 3.6% | |

24 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.9 | 3.3% | |

25 | Volution | Manufacturer of ventilation products | 8.0 | -1.4 | 3.1% | |

26 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.0 | 3.0% | |

27 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.6 | 2.8% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.4 | 2.5% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.6 | 2.5% | |

30 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share’s score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns FW Thorpe and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.