Share Sleuth: the two trades I made to cut cash pile

Richard Beddard had enough cash at hand to fund three additions at the minimum trade size of £5,000. After reviewing his options, he settled on adding to one holding and introducing a new member to the portfolio.

10th December 2025 09:36

by Richard Beddard from interactive investor

Share Sleuth entered the month with more than £16,000 in cash, enough to fund three additions at the minimum trade size of £5,000.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Adding Softcat

The first share I considered was newly re-scored Softcat, which, on Thursday 20 November, was ranked 5th by the Decision Engine. Share Sleuth’s holding was worth 2.3% of the portfolio’s size, but the algorithm suggested 6% was more appropriate. The difference, 3.7%, was well above the minimum trade size of 2.5% of the total value of the portfolio.

Softcat (LSE:SCT) has grown entirely organically. This gives me confidence. My fears about Softcat are ill-formed because they concern the future. I wonder whether the advantages it has built in terms of reputation and scale will prevail in an artificial intelligence (AI) enabled future, when people may be a less critical factor in selling and configuring IT.

Fear is a powerful emotion, and there is a risk that it colours my judgement. The company believes AI will augment account managers and it is upgrading its computer systems. It has acquired a data and AI consultancy to improve its capabilities.

My score reflects the risk in the strategy shift, even though it is almost imperceptible so far.

I felt the fear and did it anyway. On 20 November, I added 349 shares in Softcat at just over £14.23 a share. The total cost was £5,002, including £10 in lieu of broker fees and £24.84 in lieu of stamp duty.

I also considered three other shares. Like Softcat, they are underrepresented in the portfolio. Technically, that means that I could add shares worth 2.5% of the portfolio’s total value and the holding would still not exceed the ideal holding size suggested by the Decision Engine.

This is how they ranked on 4 December:

# | company | description | score | qual | price | ih% | ss% | ih%-% |

15 | Auto Trader Group | Online marketplace for motor vehicles | 7.0 | 0.1 | 4.3% | 4.3% | ||

16 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -0.9 | 4.2% | 1.7% | 2.5% | |

17 | Volution Group | Manufacturer of ventilation products | 8.5 | -1.4 | 4.2% | 4.2% |

Share Sleuth is fully invested in the top 14 highest-scoring shares ranked in the Decision Engine. Auto Trader Group (LSE:AUTO), Cohort (LSE:CHRT), and Volution Group (LSE:FAN) ranked 15th, 16th, 17th, are underrepresented.

The ss% column shows that Share Sleuth has no holdings in Autotrader and Volution, so the ideal holding size (ih%) is also the maximum trade I could make as a proportion of the whole portfolio (ih%-ss%). Cohort, though, is 1.7% holding with a 4.2% ideal holding size. The difference is 2.5%, bang on my minimum trade size.

Car marketplace Autotrader is a live situation. I re-scored the shares last week after I learned of a dealer rebellion. Dealers are paying customers and I want to sit with my judgement for a while, and wait until we have an understanding of the financial consequences for the company (if there are any) before confirming the score with a trade.

- Five macro themes tipped to shape markets in 2026

- Insider: heavy director share buying at these four companies

I ummed and ahhed mightily about defence technology mini conglomerate Cohort. The company revealed at its August AGM that its immediate growth prospects appear mixed. That confirmed a message sent by the directors, when they sold large numbers of shares in July.

Under normal circumstances this may not have troubled me. The performance of some of Cohort’s businesses can be quite volatile and growth tends to come in lumps. Some years are good, and others are not bad. Over the years, I have found it worthwhile to roll with the ups and minor dips. As for director sales, the share price was so high in July, I reduced Share Sleuth’s holding too.

I reduced Share Sleuth’s holding in July 2025 and December 2024, having held the shares since 2012 and added to the holding in 2017.

But Cohort’s half-year results are scheduled for 10 December. They will confirm how the company performed in the half year to October, compared to the very good first half last year. And we should find out how confident the company is of the full-year result.

On 10 December, this article will be in limbo. I will have filed it, and it will be in the process of being published. Although I doubt Cohort will reveal anything in the half-year results that would cause me to change my long-term perspective on the company, I will look a bit of a berk if there is a second warning and the downward price momentum continues. I am waiting to see what December brings. It feels cowardly.

- The Income Investor: does BP have dividend investing appeal?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

That leaves Volution, a manufacturer of ventilation products. I rate the business highly (its quality score is 8.5/9), but so do other investors and traders (its price score is -1.4). I could think of nothing to stop me adding shares to the portfolio, so I have.

On Thursday 4 December, I added 830 shares at a price of just over £6.16. The transaction cost just over £5,150 after adding £10 in lieu of broker fees and £25.58 in lieu of stamp duty.

No reductions

Also on 4 December, the Decision Engine suggested I reduce my holdings in two shares. I doubt their identities will be a surprise. In recent years they have been one-way trades.

# | company | description | score | qual | price | ih% | ss% | ih%-% |

23 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.7 | 3.5% | 6.3% | -2.8% | |

25 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.8 | 3.4% | 5.9% | -2.5% |

I am not obeying the Decision Engine this month.

I have already reduced Share Sleuth’s holdings in Games Workshop Group (LSE:GAW) and Goodwin (LSE:GDWN) this year. The suggested trades are borderline - both close to my minimum trade size of 2.5% of the portfolio’s total value. And if I hold on to these holdings at their current size, I finally achieve my goal of returning Share Sleuth to being within one trade of fully invested.

I have taken profit from Share Sleuth’s Games Workshop holding more times than I care to remember!

The month ahead

I am about to enter a quiet period as the Christmas holiday approaches, when I plan to reflect on my system, and document it a bit better.

Apart from Tristel (LSE:TSTL), which has published its annual report, I am not planning to rescore any shares until the new year. Between now and then I expect annual reports from Renew Holdings (LSE:RNWH) and Hollywood Bowl Group (LSE:BOWL).

Here’s the Decision Engine, showing Share Sleuth holdings and their holding sizes:

0 | company | description | score | qual | price | ih% | ss% | ih%-% |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.8 | 9.5% | 8.6% | 0.9% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | 5.8% | 1.4% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | 5.8% | 1.2% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.2% | 4.3% | 1.8% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | 5.3% | 0.7% | |

6 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 5.9% | 4.7% | 1.2% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | 3.8% | 2.1% | |

8 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.1% | 2.6% | 2.5% | |

9 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | 2.6% | 2.4% | |

10 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | 5.0% | 0.0% | |

11 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.1 | 4.8% | 5.8% | -1.0% | |

12 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.6 | 4.8% | 3.5% | 1.3% | |

13 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.2 | 4.6% | 4.6% | 0.1% | |

14 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.7 | 4.3% | 2.0% | 2.3% | |

15 | Auto Trader | Online marketplace for motor vehicles | 7.1 | 7.0 | 0.1 | 4.3% | 4.3% | |

16 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -0.9 | 4.2% | 1.7% | 2.5% | |

17 | Volution | Manufacturer of ventilation products | 8.5 | -1.4 | 4.2% | 4.2% | ||

18 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | 2.2% | 1.8% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | 2.6% | 1.4% | |

20 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | -0.1 | 3.8% | 3.8% | ||

21 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.9 | 3.8% | 3.8% | ||

22 | Judges Scientific | Manufactures scientific instruments | 6.8 | 7.0 | -0.2 | 3.6% | 3.6% | |

23 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.7 | 3.5% | 6.3% | -2.8% | |

24 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.7 | 3.5% | 3.5% | ||

25 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.8 | 3.4% | 5.9% | -2.5% | |

26 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.4 | 3.2% | 2.8% | 0.3% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.5 | 2.9% | 2.2% | 0.7% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.4 | 2.5% | 3.9% | -1.4% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.7 | 2.5% | 2.1% | 0.4% | |

30 | Tristel | Manfactures disinfectant for medical instruments and hospital surfaces | 7.0 | -1.8 | 2.5% | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio, ss% is the actual size of Share Sleuth’s holding, and ih%-% is the difference between ideal and actual sizes.

Share Sleuth performance

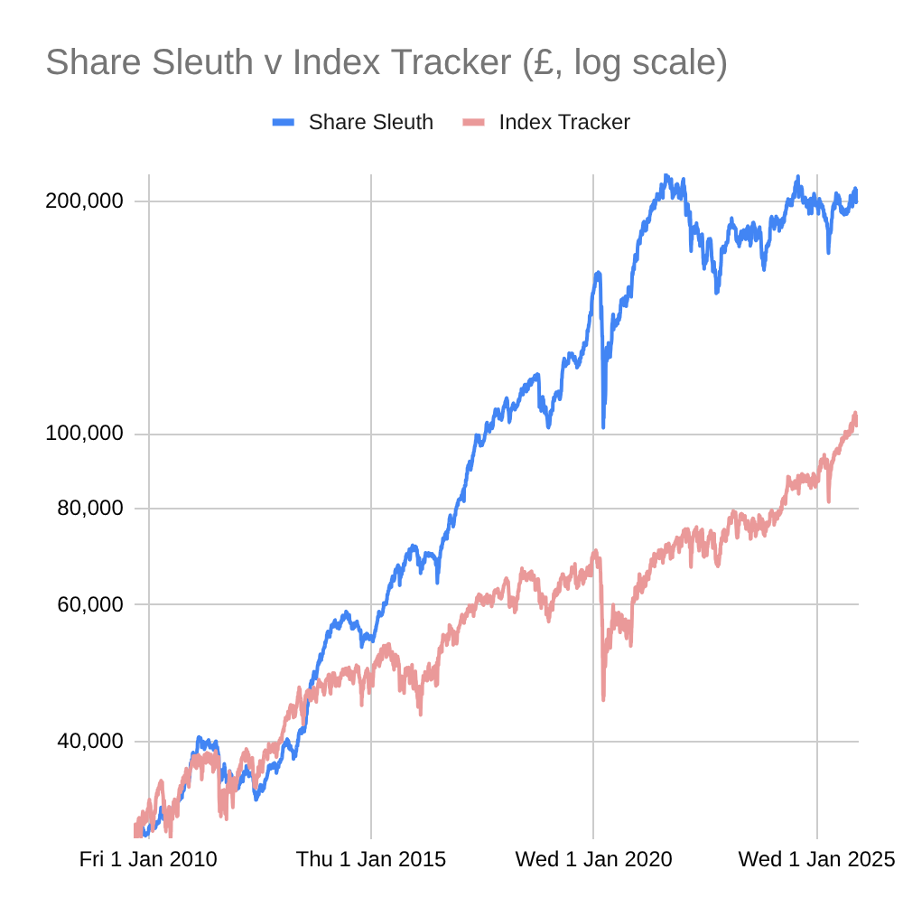

At the close on 3 December, Share Sleuth was worth £206,681, 589% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £104,327, an increase of 248%.

Past performance is not a guide to future performance.

After dividends paid during the month from Anpario (LSE:ANP), Bloomsbury Publishing (LSE:BMY), Thorpe (F W) (LSE:TFW), Games Workshop, Goodwin, and Howden Joinery Group (LSE:HWDN), Share Sleuth’s cash pile is £7,187.

The minimum trade size, 2.5% of the portfolio’s value, is £5,167.

Share Sleuth, 03 Dec 2025 | Cost (£) | Value (£) | Return (%) | ||

Cash (3% of portfolio) | 7,187 | ||||

Current holdings (24 shares) | 199,493 | ||||

Total, and performance since 9 September 2009 | 30,000 | 206,681 | 589 | ||

Benchmark: FTSE All-Share index tracker (acc) | 30,000 | 104,327 | 248 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,077 | -9 |

ANP | Anpario | 1,124 | 4,057 | 5,867 | 45 |

BMY | Bloomsbury | 1,882 | 8,354 | 9,410 | 13 |

BNZL | Bunzl | 417 | 9,798 | 8,974 | -8 |

BOWL | Hollywood Bowl | 1,972 | 4,971 | 5,462 | 10 |

CHH | Churchill China | 1,495 | 17,228 | 5,307 | -69 |

CHRT | Cohort | 326 | 1,118 | 3,495 | 212 |

FAN | Volution | 830 | 5,151 | 5,121 | -1 |

FOUR | 4Imprint | 116 | 2,251 | 4,460 | 98 |

GAW | Games Workshop | 66 | 4,116 | 13,094 | 218 |

GDWN | Goodwin | 58 | 1,403 | 12,180 | 768 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,066 | 16 |

JET2 | Jet2 | 822 | 5,211 | 10,965 | 110 |

LTHM | James Latham | 1,150 | 14,437 | 11,903 | -18 |

MACF | Macfarlane | 7,689 | 10,011 | 5,382 | -46 |

OXIG | Oxford Instruments | 505 | 10,044 | 10,302 | 3 |

PRV | Porvair | 906 | 4,999 | 7,212 | 44 |

QTX | Quartix | 1,618 | 3,988 | 4,401 | 10 |

RNWH | Renew Holdings | 1,310 | 9,804 | 11,882 | 21 |

RSW | Renishaw | 234 | 6,227 | 8,132 | 31 |

SCT | Softcat | 675 | 9,995 | 9,720 | -3 |

SOLI | Solid State | 5,009 | 6,033 | 7,764 | 29 |

TFW | Thorpe (F W) | 6,153 | 14,861 | 17,721 | 19 |

TUNE | Focusrite | 2,020 | 14,128 | 4,596 | -67 |

Notes

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

Objective: To beat the index tracking fund handsomely over five year periods

Source: ShareScope.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio except Volution (a situation he will probably remedy after the week-long gap he must leave between writing about a share and trading it).

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.