Six investment trust tips for 2022

30th December 2021 11:37

The Kepler Trust Intelligence team on their top picks for the year ahead.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Once upon a time I was lucky enough to spend a few days on a junket to Morocco, where I stayed at a hotel in Marrakech called La Mamounia, occupying the grounds of a former royal palace built by Sultan Mohammed ben Abdallah in the 18th century and described by Winston Churchill as ‘the most lovely spot in the whole world’.

On my last night at the hotel, I won approximately 52 million dirhams* in the hotel casino and, feeling somewhat groggy the following morning after celebrating my victory until the wee hours, was somewhat disappointed to learn that the exchange rate at the time meant I had in fact won about £2,002**. My victory was made more hollow when I learned that, because of currency controls limiting the amount of money you can take out of the country, I would be allowed to take home only £160.

That sense of bittersweet victory was familiar, then, when I learned this week that my choice for the ‘top performer’ of 2021 – Invesco Perpetual UK Smaller Companies (LSE:IPU)- was the best performer of the lot in NAV terms (see table), delivering total returns of 27.3% over the year to 28 December. Thanks to the vagaries of cruel fate (and discount movement), however, it had been roundly trounced in share price terms by William Heathcoat Amory’s choice, Oakley Capital Investments (LSE:OCI) (OCI), which was up 52.1%.

Our 'top picks' for 2021

| TRUST | TICKER | 1Y NAV TOTAL RETURN | 1Y SHARE PRICE TOTAL RETURN | ANALYST |

| Invesco Perpetual UK Smaller Companies | IPU | 27.3 | 27.3 | Pascal Dowling |

| Oakley Capital Investments | OCI | 27.2 | 52.1 | William Heathcoat Amory |

| Miton UK Microcap | MINI | 27.2 | 32.1 | William Sobczak |

| Henderson Opportunities | HOT | 18.2 | 23.1 | Thomas McMahon |

| Scottish Mortgage | SMT | 15.2 | 14.4 | David Johnson |

| Golden Prospect Precious Metal | GPM | -17.5 | -18.9 | Callum Stokeld |

| Average performance (all of our picks) | - | 16.3 | 21.7 | - |

| MSCI World (£) | - | 23.4 | 23.4 | - |

Source: Morningstar. Past performance is not a reliable indicator of future results

Our 'top picks' for 2022

| TRUST | TICKER | DISCOUNT/PREMIUM | ANALYST |

| Ruffer | RICA | 1.7 | Pascal Dowling |

| Hipgnosis Songs | SONG | -0.6 | William Heathcoat Amory |

| BlackRock Throgmorton | THRG | 1.5 | Thomas McMahon |

| AVI Global | AGT | -8.3 | David Johnson |

| BlackRock Smaller Companies | BRSC | -2.8 | John Dowie |

| Miton UK Microcap | MINI | -7.4 | Also John Dowie |

Source: Morningstar, as at 28/12/2021

Pascal Dowling

I chose IPU because I thought the UK, having been beaten black and blue first by Brexit and then by the meandering incompetence of the government’s early handling of the Covid crisis, was finally going to get a break on the back of Kate Bingham and Co’s spectacular success in pushing through the vaccine programme.

To quote myself (as is the wont of the severely delusional everywhere) at the time: “The UK has been at the bottom of the heap for investors for a long time, and the true impact of the coronavirus in economic terms is yet to be felt here as elsewhere, but we are in my view in a better position than most to move forward once the vaccine becomes widespread, with the vast, insoluble uncertainty that was the Brexit deal (or no deal) no longer holding its foot on the neck of our fortunes.”

However less than a week after my comment above, the UK entered a lockdown which lasted in one form or another until the start of August. The comments section of any national newspaper will show you that there are sharply polarised views for and against lockdowns, and even the most senior figures in government at the time seemed somewhat confused about the rules. Matt Hancock, lockdown sceptic?

I have no wish to share any opinion on whether lockdowns are a good idea or not but, clearly, the threat of another one cannot be written off. Even if that doesn’t happen here, it is already happening in Europe, and even if we ignore ongoing strife caused by the virus we still have the West’s increasingly sour relationship with China, the threat of war in the Ukraine, apparently useless governments in most Western countries, and runaway inflation to contend with as we consider the year ahead.

Against that backdrop it is perhaps unsurprising that my choice for the win in 2022 – given that cash isn’t an option in this game – isRuffer Investment Company (LSE:RICA). RICA a defensive strategy, with the potential to perform strongly in an inflationary environment and a remit allowing the managers to ‘go anywhere’ in their pursuit of positive returns, which they prioritise over everything else.

For full disclosure, I have owned RICA since 2016 and, while there have been periods where it has seemed somewhat plodding when markets have been in bullish mode, it seems to me that there are few better options for investors at this point in time, when uncertainty is the only reliable theme, and inflation appears to be just beginning.

William Heathcoat Amory

For those looking to invest over the long term, equities are the only game in town in my view. However, picking a trust on a one-year time frame, one might have a different view at times.

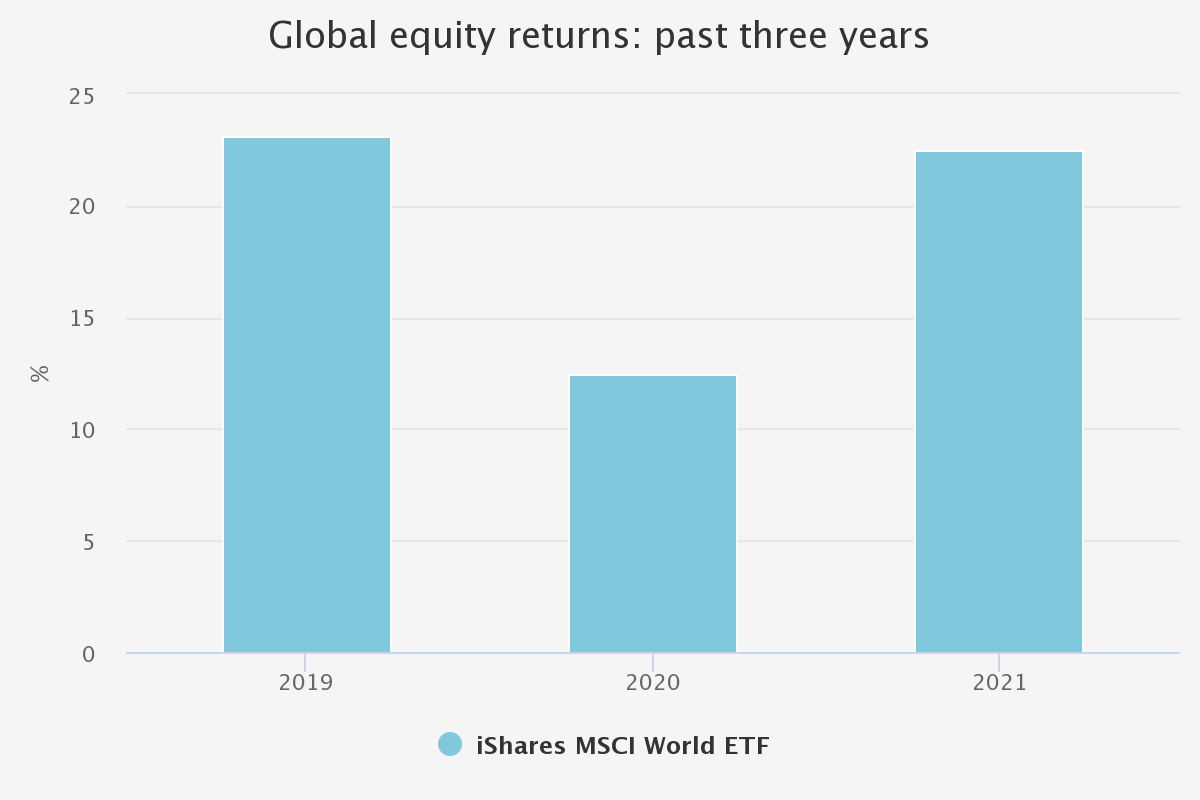

Looking back, equity returns over the past three years have been exceptional. The graph below shows returns each calendar year from an MSCI World ETF. 2019 and 2022 have been significantly ahead of long-term annual return expectations, and 2020 wasn’t bad either. Compounded total returns over the past three years have been in the order of 57% (in Sterling). The party can’t continue indefinitely, and so while I’m not running for the door, one might expect a small degree of mean-reversion next year?

As such, my pick for 2022 is Hipgnosis Songs (LSE:SONG), a music royalty fund that in many ways was ahead of its game having IPO’d three and a half years ago. Barely a week goes by now without an announcement of a major artist selling their back catalogue. Private equity firms are now scrambling for a piece of the action. While there are perhaps some reasons to be cautious, I believe that SONG offers the prospect of a relatively steady income (uncorrelated to equity markets, and potentially with a link to inflation) and the prospect of capital growth.

SONG has a broad portfolio of 146 catalogues representing 65,413 songs, although most of the value and income resides in only a few hundred of the highest quality (SONG owns 20 of Billboard’s ‘Greatest of All Time Hot 100’ songs). 2022 looks set to be a strong year for live performances once the summer comes around, and music streaming continues to build in popularity around the world, both of which should serve as a positive tailwind to income.

SONG offers a dividend yield of 4.1%, and trades at a small discount to NAV (0.6%) at the time of writing. On a total return basis, SONG is unlikely to keep up with global equities if 2022 sees another strong year. However, if returns are more muted (or negative) then I think there is a strong chance that it will outperform equity strategies on a total return basis. Fourth time lucky?

Source: Morningstar. Past performance is not a reliable indicator of future results

When I chose Oakley Capital Investments (LSE:OCI) last year it was trading on a discount of 19% to NAV. At the time I said: “OCI’s historic performance, its narrow sector focus in areas which have proved resilient to Covid-19, and its significant cash balances giving it plenty of room for manoeuvre, mean that it should deserve a significantly narrower discount.”

Looking at the table above it is clear that, having delivered solid NAV total returns, the accelerant effect of that closing discount and the clear lead that translated to in share price performance terms made it the right call.

Thomas McMahon

I think 2022 will be a year of recovery, even if it may not feel like it yet. Omicron surely spells the end of the pandemic, at least in terms of its ability to threaten shutdowns of the UK and US economies, and probably the EU too. China is in a more serious situation with the lower reliability of its domestic vaccines and its zero-covid policy, which will have knock on effects through the world economy. However, I think developed world equities should do well nonetheless. With large caps having seen significant run ups – growth during phase one of the pandemic and value during phase two – I think small caps might be a more interesting place to be.

I am backing BlackRock Throgmorton (LSE:THRG) to have another good year. The trust has a remarkably consistent track record of outperformance, and I think this could continue. There will undoubtedly be disruption from high inflation, and I suspect central banks will only raise rates modestly, meaning inflation will remain higher than they might like. However, smaller companies should be relatively more insulated from these pressures if they are operating in areas of secular growth. The high levels of net exposure Dan Whitestone has been running on the trust in the final quarter of 2021 indicate his bullishness on the portfolio.

Last year I chose Henderson Opportunities (LSE:HOT). The shares were up 30% by the end of April 2021 but HOT is always volatile and investors seem to like to sell in and out to take advantage of the cyclicality and gearing, and so the shares have re-rated since then. However, I suspect as soon as sentiment improves the trust will see another rally. Timing is very important with these shares; but much better is to hold for the long term through multiple cycles – as long as you can stomach the volatility.

David Johnson

My previous pick of Scottish Mortgage (LSE:SMT)had, prior to the Omicron outbreak, been on track to once again be one of the top-performing investment trusts overall, at least in NAV terms. Yet my pick for the next 12 months marks a substantial change in investment style. I think AVI Global Trust (LSE:AGT) is potentially one of the best-performing equity trusts over the next 12 months.

AGT offers what I believe is a highly idiosyncratic source of return, thanks to its clearly delineated portfolio, split between: closed-ended investment funds, family-backed holding companies, and asset-backed special situations (typically focused on Japan). Each of these categories is a highly idiosyncratic type of holding, not only setting AGT apart from its peers but also, hopefully, insulating it from what may be a turbulent 2022. With the ever-present spectre of Omicron, coupled with seemingly inevitable interest rate rises, it is in my mind a difficult time to make a call about which specific style of investing will reign supreme. In such an environment I would prefer to hold a global equity strategy that relies more on truly different sources of return, one that I believe will be less sensitive to the current market environment. The managers of AGT have already proven their success in generating returns and the trust is the best performing global equities trusts this year (as at 28 December 2021) in NAV terms yet its 8.1% discount is amongst the widest in the Global sector; if performance can continue this may end up being a powerful combination.

John Dowie

I joined the team in Q3 this year, so have the benefit of a blank slate in terms of past predictions. Now, it has been said that it's tough to make predictions, especially about the future. My inclination is not to make heroic assumptions about 2022 and place bold bets, but rather to lean into long-term trends that will hopefully provide an edge over time.

With the preamble out of the way, one of the most noticeable long term trends in the UK market is the outperformance of smaller companies versus their larger peers. In the last 20 years, the Numis Smaller Companies plus AIM ex IT benchmark (representing the bottom 10% of stocks by size on the London main market, plus the AIM market, and excluding investment companies) has outperformed the FTSE 100 by 236% (as at 30/11/2021), the small-cap index beating the large cap index in circa two-thirds of 12-month rolling periods over this time interval. There are plenty of reasons why this makes sense: smaller companies are considered to have greater scope for growth, are more nimble, less bureaucratic, easier to coordinate and more innovative. Whatever the underlying reasons, if one believes this trend will continue it is not unreasonable to tilt towards smaller companies within an allocation to UK equities.

There is, of course, a rich set of options in the investment trust world to access UK smaller companies, and a major decision is whether to pick a trust managed with a growth, value or balanced style. Continuing the theme of conservatism I will pick two strategies that take very different approaches that will hopefully do well as a blend irrespective of stylistic rotations in the market (no doubt my old English teacher accuses me of impaling myself on the fence). These are Miton UK Microcap (LSE:MINI)and BlackRock Smaller Companies (LSE:BRSC). These two funds are complementary: BRSC focusses on small and mid-cap companies on the main market whereas MINI focusses on micro-cap AIM stocks. MINI is conservatively run, currently has no gearing and has bought portfolio protection in the form of puts. BRSC is structurally geared to maximise the growth potential of the portfolio. BRSC has a ‘quality growth’ portfolio, focussing on companies that will deliver long term compounding growth via innovation. MINI focusses on undervalued companies that will generate surplus cash in the near term. In other words, with a bit of luck BRSC will zig when MINI zags and vice versa, providing a balanced exposure to UK smaller companies that aims to deliver the long-term capital growth potential of the asset class without too many short-term hiccups. Given the extreme style rotations we have witnessed in markets in 2020 and 2021 this approach seems prudent, if only to manage our own behavioural biases (a topic for another day!).

*This may be a slight exaggeration (I was, after all, very, very drunk).

**This is approximate (I have no idea what the exchange rate was, apart from disappointing.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.