Stockwatch: share tips, IPOs, tech and value in 2025

US tariffs ironically helped create the circumstances for stock markets to achieve record highs. Analyst Edmond Jackson reviews how this affected his strategy and share tips.

23rd December 2025 09:46

by Edmond Jackson from interactive investor

The course of equities in 2025 was dominated by April’s plunge in response to US “reciprocal tariffs”, later back-tracked to varying degrees, setting up a bull run not dissimilar to the Covid recovery from late March 2020.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Economists likewise predicted global disaster, but reality involved muddling through challenges, with shares attaining record highs – another reinforcement of “buy the drop”. Financial authorities have managed by various means to dodge a major equities bear market since 2008/09, aiding consumer confidence in the US especially.

Should another panic materialise, the Pavlovian response is thus deeply ingrained, as well as the ‘fear of missing out’, or FOMO. It would probably take a mix of higher inflation and a genuine recession – delayed effects of US tariffs – to finally break this pattern.

Tariffs context contributes to ‘bowl’ type charts

The tariffs-induced slump, then a rally that gained momentum, greatly assisted bullish ‘bowl’ chart patterns which enticed momentum buyers.

From a company analyst view, it was frequently hard to identify underlying catalysts to justify the extent of sentiment shift. In retrospect, various UK equities were modestly rated to justify this.

By mid-summer the uptrend required fresh validation, otherwise consolidations and even downtrends set in. BT Group (LSE:BT.A), which I rated “buy” from 102p in October 2020 and again at 124p in November 2023, was a classic example. Shares hit a five-year high of 217p last August but have since retreated to 181p where a 4.6% prospective yield lends support:

Source: TradingView. Past performance is not a guide to future performance.

More recently, in March 2024, I favoured Vodafone Group (LSE:VOD) with a “buy” case at 67.7p when the CFO and chairman bought £2.3 million worth around 69p. These shares enjoyed a sustained bull run following April’s Trump tariffs inflection point. Around 96p currently, the prospective yield is similarly 4.5% albeit expected earnings cover slightly trailing BT at 1.9x. This probably was justified by November’s interims showing revenue up 7.3% and profit also cash flow at the upper end of guidance for the March 2026 year.

- The UK stock market outlook for 2026

- Watch our video: why we’ve boosted our dividend to yield above 6%

The £22.4 billion company is also 75% through a £3.5 billion buyback programme contributing to 12% earnings growth expected for March 2027, in line with the forward price/earnings (PE), which currently offers a better growth dynamic than BT.

The comparison thus usefully elicits how shares rallied up to mid-summer before markets became more exacting as to fundamentals.

Source: TradingView. Past performance is not a guide to future performance.

Does lack of IPO vigour compromise UK bull market?

‘New issues’ as they were known, especially in the 1980s, are an important driver providing fresh stories to raise animal spirits. In the mid to late 1990s came a wave of technology-driven flotations as the internet gained popular appeal.

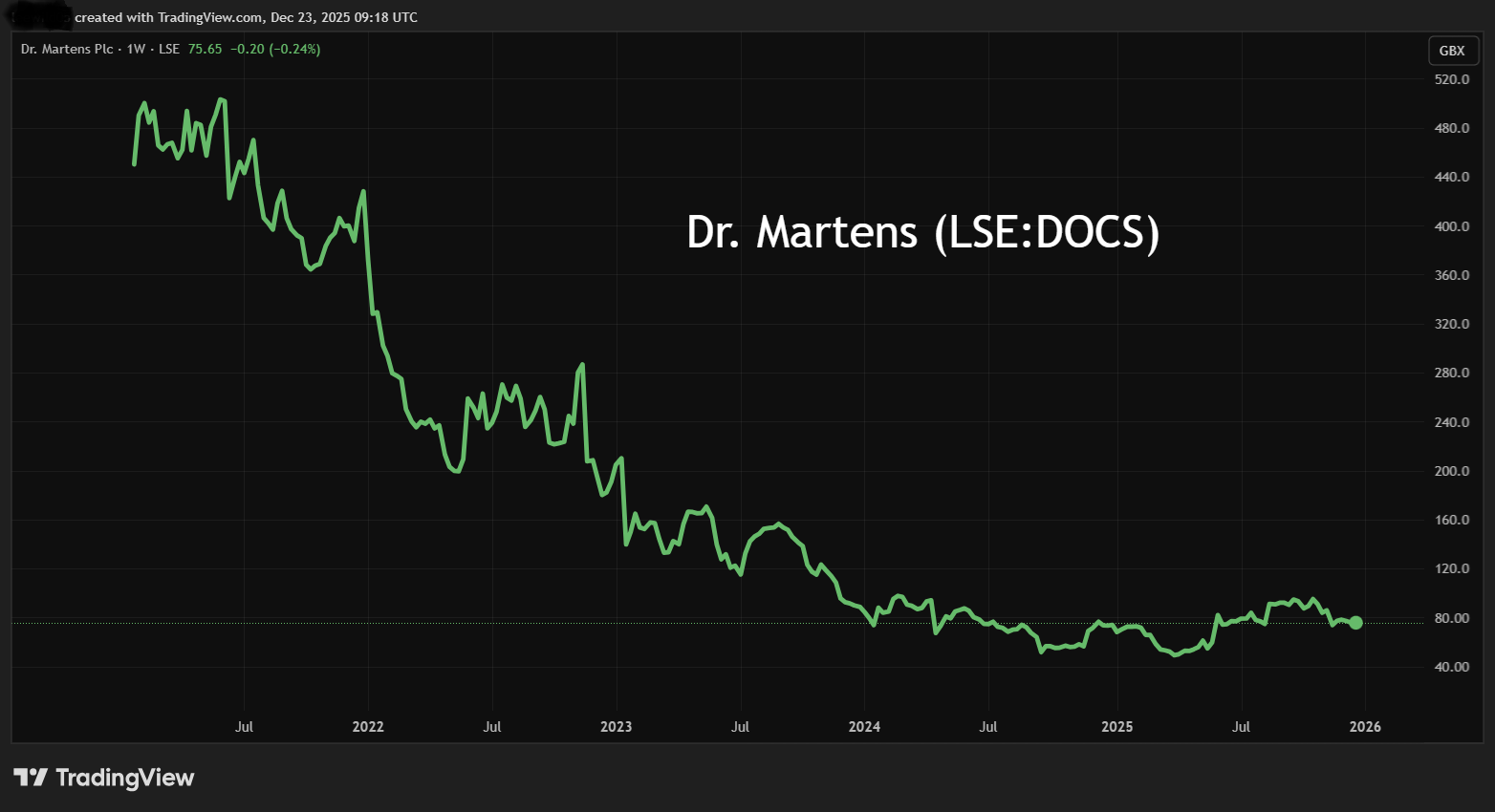

But the last wave of IPO’s post-Covid largely involved private equity unloading businesses that proved disappointing, a prime example being footwear group Dr. Martens Ordinary Shares (LSE:DOCS):

Source: TradingView. Past performance is not a guide to future performance.

I engaged Dr Martens several times in 2023 when its CEO bought £400k worth of shares at 129p, with modest buying by non-executive directors also. A UK institution acquired 5% and a US activist hedge fund around 3%, engaging with management to improve performance.

With hindsight I should have focused on customer reviews saying the boots, nowadays made in the Far East, were not the same quality as years ago. “Buy” stances at 140p and 153p that year proved premature despite the PE looking a modest 10x and yield 4%.

From last April the shares still doubled to near 100p by late September but have slipped to 76p where the forward PE looks near 15x forward PE and the yield 3.2%. A non-executive director since last March - former president of Levi’s Americas - did however buy a total £160k worth around 79p earlier this month.

Scant flotations has meant equity analysis chiefly involves raking the coals of long-listed companies, looking for fresh glimmers, but does not offer the depth and breadth of new stories like a healthy pipeline of IPOs.

My emphasis has thus shifted to classic “value” situations given a paucity of new growth shares, among them past favourites such as Beeks Financial Cloud Group (LSE:BKS) and billings software group Cerillion (LSE:CER) which reached big PEs, hence have traded volatile-sideways this last year. My next review piece will engage value investing.

Aside from investment trusts, the takeover boom has slowed

I also notice reduced takeovers lately, as if economic uncertainty has paused both private equity and industrial operators.

Versus 2024 when many companies I followed were bought out, this year only pawnbroker H&T Group succumbed, acquired in August for close to £300 million by a US operator seeking a European platform. Terms of 650p per share plus an 11p final dividend constituted a 90% premium to where H&T traded last January after I drew attention to H&T various times as a “buy” from 260p at end-2018.

This extent of premium affirmed how a modest PE approach to stock-picking can work well if the business has a strong market position – H&T being the UK market leader – although six years shows the kind of patience that can be required for value to crystallise.

- AIM’s biggest companies and how they performed in 2025

- 10 hottest ISA shares, funds and trusts: week ended 19 December 2025

I concede missing a wave of takeovers and consolidation in investment trusts where the sector has shrunk nearly 20% in three years, triggered by average discounts to net asset value around 15% that attracted activist shareholders. My excuse is being more business-oriented, while a lot of these trusts can look cheap and takeovers are easier to spot in hindsight. Anyway, the trend does look set to continue.

Growth type ratings have become scary

In the UK, “life-saving technology” group Halma (LSE:HLMA) is one of the best examples of a highly rated growth stock, although its PE has persistently been at a big premium to its variable earnings growth rate. This helps explain the shares plunging from over 3,000p to below 2,000p in 2022.

Since 2024 though, Halma has enjoyed 65% upside to 3,625p currently, 31x expected earnings versus a 0.75% yield.

Source: TradingView. Past performance is not a guide to future performance.

I struggle with this extent of premium, especially when the story is nothing new. It’s why, when examining Halma at 2,150p after a 30% drop in 2022, I concluded “hold” rather than “buy”.

In this respect the US has held more interest for me over years to engage the occasional technology growth share like Amazon.com Inc (NASDAQ:AMZN), Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT) when their shares were out of favour in the last decade. I recall PE multiples nearer 10x than well over 30x nowadays and prospects well priced-in.

In terms of fresh compelling stories, I did draw attention to NVIDIA Corp (NASDAQ:NVDA) as a “buy” at $40 equivalent (before a 10-for-1 stock split) in June 2023 given its potential for global market share. At $185 currently the shares are below a $201 peak as fears grip AI valuations, but unless Chinese rivals manifest, I would not be surprised to see a high PE persist. Currently on 40x trailing earnings, the question seems chiefly to be what extent of drop would be needed to buy.

Similarly, with Palantir Technologies Inc Ordinary Shares - Class A (NASDAQ:PLTR), which I drew attention to in April 2024 at $22 on news of a game-changing partnership with Oracle Corp (NYSE:ORCL) to provide secure cloud and AI solutions to businesses and governments globally. The company was only just breaking into profit but looked a high-class AI story. Palantir has enjoyed a great bull run this year to over $200, currently $184.

Where are such examples in the UK? Chipmaker ARM Holdings ADR (NASDAQ:ARM) was thepre-eminent UK technology growth share with global reach, albeit acquired then re-floated on Nasdaq. It would seem part of the dilemma with a high-taxation economy, how the critical mass of tech-talent is liable to coalesce elsewhere.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

Lee Wild, head of editorial at ii, owns BT shares.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.