Top-performing sectors and funds to play them

10th September 2018 10:47

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In the first of a new series of articles, Saltydog analyst Douglas Chadwick reveals some of the strongest market trends and identifies the leading funds to track.

Every week we look at the top 50% of funds in each of the Investment Association sectors. We calculate their average performance over various time periods, from one to 26 weeks, and rank them based on their cumulative return over the last four weeks.

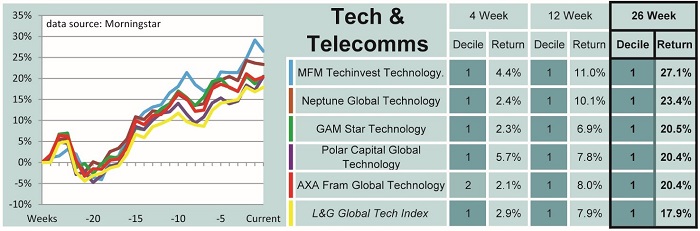

Latest numbers show the Technology and Telecommunications sector up 1.7% and it now tops the list with a four-week return of 5%, overtaking the North American sectors.

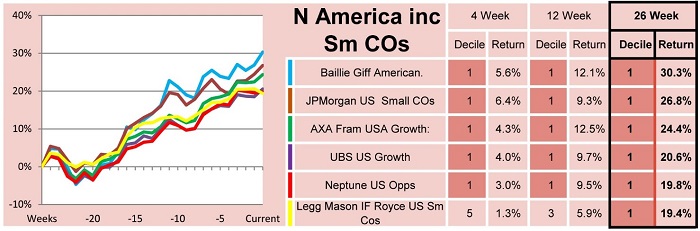

For some time these sectors have been performing well, helped by the underlying performance of the US economy and the strengthening of the dollar relative to sterling. Since the beginning of April, the Dow Jones Industrial Average has gone up by nearly 10%. The S&P 500 is up 11.5% and the NASDAX is up over 15%. At the same time the value of the pound has moved from above $1.40 to below $1.30, this benefits UK investors with exposure to overseas funds.

• Saltydog Portfolio: allocation to technology sector 'essential' for investors

• Share Sleuth doubles stake in this AIM tech stock

The funds in the Technology and Telecommunications sector tend to invest in the large information businesses which have matured over the last 20-plus years – Apple, Microsoft, Amazon, etc. The American funds also invest in these companies so it's not surprising that some of the results are similar.

The funds below have been selected because of their performance over the last six months, but they have also done well over the last four and 12 weeks. We currently hold a number of these funds in our demonstration portfolios.

Past performance is not guide to future performance

Past performance is not guide to future performance

The dominance of the Technology and dollar based investments is also reflected in our ETF and Investment Trust analysis.

The ETFs tracking the NASDAQ, S&P 500 and the Russell 2000 have all done well, but the ishares S&P Small Cap 600 has done the best – up 4.5% in four weeks, 9.2% in 12 weeks and 25.2% in 26 weeks.

In the Investment trusts, the Allianz Technology Trust and Polar Capital Technology head up the technology sector, and in the USA Smaller Companies sector the Jupiter US Smaller Companies and JPMorgan US Smaller Companies trusts look promising.

Conclusion

Our only concern is the reliance of these funds on the tech giants, which we all know have large price/earnings (PE) ratios and many think are due a correction. Momentum investors we will carry on holding them as long as they are going up, but we are limiting our overall exposure.

There are other areas within technology, such as Artificial Intelligence, Robotics, Healthcare and Medical Research which look interesting and may be a way of mitigating this risk.

Funds currently on our radar include Smith & Williamson Artificial Intelligence, Syncona (cancer treatments), Pictet Robotics, and the Worldwide Healthcare Trust.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.