Please remember, investment value can go up or down and you could get back less than you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling.

What is a Trading Account?

Our Trading Account is an everyday instant access, flexible investment account, with no minimal initial payment or annual contribution limits.

It puts you in control of your investing, with access one of the widest ranges of investments on the market, including shares, funds, trusts, ETFs, bonds and gilts. And you can hold up to 9 different currencies, helping you avoid paying currency exchange fees every time you buy and sell international shares.

The Trading Account is an individual account. We also offer a Joint Trading Account.

Why choose to open an ii Trading Account?

Better value

- £0 to join and leave, and a flat monthly fee that doesn't increase if the value of your account does.

- We give you a free trade and free regular investing each month in return for your fee.

Control

- Choose where and how your money is invested using our secure online platform and mobile apps.

- Access to the widest range of investments of any UK provider, including direct market access to international shares.

Security

- Trusted by over 450,000 people.

- Fully Financial Services Compensation Scheme (FSCS) protected.

An investment platform you can trust

- We are the UK’s #1 flat-fee investment platform, with over 450,000 customers.

- We are multi award-winning. In 2022 alone we were named Best Low Cost Stockbroker (ADVFN), Best Stockbroker for International Dealing (ADVFN), Best Buy Pensions (Boring Money Best Buy) and more.

- To ensure its safety, any money you hold with ii is placed in a bank account which is established with statutory trust status. This means your money is kept separate from our own.

- You are also protected by the Financial Services Compensation Scheme (FSCS).

- And if you are not satisfied with our service, it’s completely free to leave.

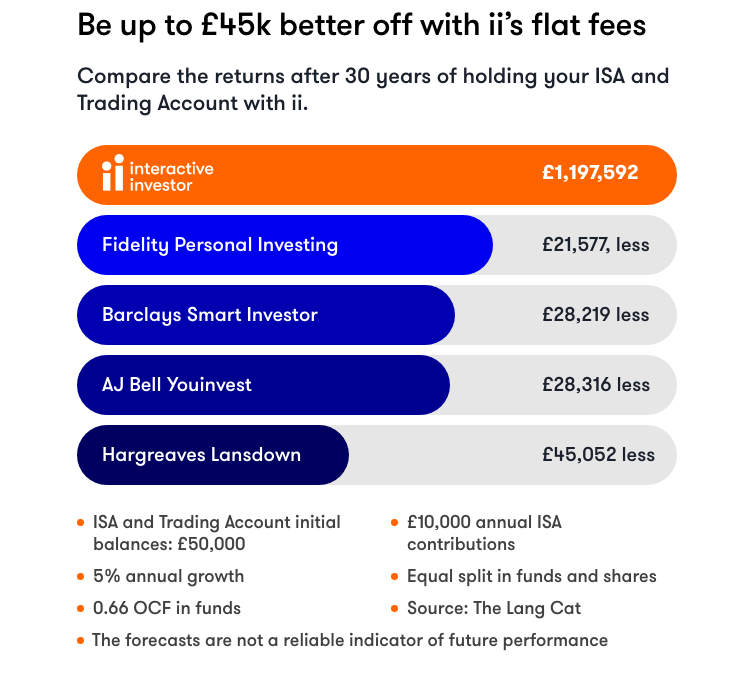

*We've crunched the numbers: If you invested in both our Trading Account (General Investment Account) and ISA, after 30 years you could be better off by £45k. That's more than £1,000 difference a year, just for using us over another platform. Lots of things can affect your final figure. But the lower the fees, the more money you'll keep for yourself. This is just for illustration if all other factors were the same. Don't just take our word for it: check our working out here.

Trading Account fees and charges

- Our Trading Account costs £11.99 a month. You can also open a Stocks and Shares ISA and as many Junior ISAs as you have children, at no additional cost.

- Add a SIPP for just £10 a month extra.

- Your first trade each month is free. Additional trades usually cost £3.99.

- It’s free to top up your investments each month with our regular investing service.

- There are some activity-based charges for things like Stamp Duty and foreign currency exchange. View our charges page for a full list.

Ready to open your Trading Account?

What do you need?

- To be 18 or over and a UK resident

- Your address

- Your debit card (to check your identity)

- National insurance number

How much will it cost?

- £11.99 a month.

- Once you have funded your account you will be charged your monthly subscription.

If you're already a customer simply log in to open a Trading Account.