Experience of an AIM investor: tactics, tips and big profits

A real investor who’s been trading small-cap stocks for over 20 years shares his strategies, memorable investments, including one which paid his four children’s tuition fees, plus some tips for others interested in owning smaller company shares.

2nd July 2025 08:46

by Lee Wild from interactive investor

The AIM market, designed for mostly smaller growth companies, celebrated its 30th birthday in June. It proved a roaring success during the dotcom boom in the late 90s and early noughties but has fallen out of favour recently. It has been a very profitable hunting ground for many investors over the years, though, and remains home to plenty of high-quality growth businesses.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

We spoke to one seasoned investor who loves trading AIM stocks. He shares with us his strategies, investment technique, memorable investments and some of the lessons and tips he has for others interested in owning smaller company shares.

Age: 63

Job: retired doctor

ISA portfolio value: £213,000

David has an interactive investor ISA and recently transferred his wife's ISA and SIPP to ii, which he manages on her behalf. Apart from a few investment trusts, most of the holdings are small-cap shares, many of which are listed on AIM.

“IHT is not currently a concern in any of my investment decisions,” he says. “I’m in receipt of a pension and the investments are mainly to generate income and capital growth for the future that I may not need, but you never know.

“I’ve got four children in their 20s and 30s, so they’re all educated, but they’ll need money for houses, weddings, etc, so I want to have enough money if they need it.”

David has been investing in small-cap shares for over 20 years but has been an active investor for much longer. “I started with investment trusts and unit trusts, then branched out into shares. I gravitated toward AIM as I got older.”

The trigger was opening an account with a leading stock market data site where one of the writers covered small-caps and AIM. “His intuition got me interested. I liked his style and way of looking at companies and analysing businesses. I also read TheNaked Trader by Robbie Burns.”

“Now, it’s more like an intellectual pursuit. My wife would be happy if I took money out, but it’s definitely an intellectual interest. I’d rather take some risk.”

‘I thought I was the best investor around’

The first AIM stock David bought was RWS Holdings (LSE:RWS)in 2008 when it fell below 50p. “I invested £20-30,000 and doubled my money in a short period of time. I thought I was the best investor around! I saw it tipped in a newspaper as good value after its shares had fallen.

“The profit paid for our children’s university fees. It was purely luck; there was no skill involved whatsoever. I’m much more careful now.”

David always invests lump sums. There’s no “rigid plan”, it’s “pretty much on a whim, although assuming there’s money there to invest after some due diligence”.

- AIM at 30: the best-performing AIM shares over the decades

- AIM at 30: the most generous dividend-paying stocks on AIM

Asked how he picks his stocks and decides how much to invest, David told me he top slices stocks that have done well and sells ones that have done badly, then either tops up existing holdings which he knows and understands, or sometimes buys something new. But he’s only bought two or three new companies this year and got out of more to reduce his number of holdings.

“I’m down from 100 stocks in my portfolio to about 75, but the objective is to get it down further than that,” he says. “I need to trim the rubbish down and stay in the good stuff.

But occasionally I read something and buy. Something might catch my eye, or I’ll see something in the comments section of an article. I might invest £2,000 or perhaps £5,000 if I’m really confident.”

My current AIM portfolio

Share price performance (%) | |||||||

Name | Sector | Price | Market cap (£) | 2025 | 1 year | 3 years | 5 years |

Basic Resources | 10.5p | £306 | 96 | 119 | 924 | 1350 | |

Basic Resources | 65p | £169 | 56 | 5 | -26 | 53 | |

Travel and Leisure | 52.4p | £154 | 48 | 39 | 110 | 319 | |

Basic Resources | 47.4p | £962 | 38 | 77 | 148 | 171 | |

Consumer Products and Services | 27.6p | £71 | 38 | -38 | -87 | -82 | |

Construction and Materials | 18.5p | £41 | 19 | 3 | -48 | -20 | |

Financial Services | 71p | £112 | 15 | 3 | -40 | -33 | |

Industrial Goods and Services | 315.5p | £580 | 12 | -11 | 33 | 104 | |

Technology | 184p | £108 | 4 | 47 | 328 | 142 | |

Financial Services | 60.4p | £55 | -3 | 62 | 216 | 188 | |

Basic Resources | 3.5p | £110 | -5 | -51 | -76 | -10 | |

Industrial Goods and Services | 77p | £24 | -9 | -17 | 27 | 69 | |

Technology | 1540p | £455 | -12 | -3 | 64 | 417 | |

Consumer Products and Services | 52p | £38 | -13 | -49 | -63 | 32 | |

Technology | 233p | £157 | -17 | 39 | 47 | 177 | |

Health Care | 41p | £29 | -17 | -13 | -72 | -84 | |

Technology | 800p | £49 | -22 | -33 | -26 | -11 | |

Energy | 7.875p | £10 | -23 | -43 | 135 | -46 | |

Industrial Goods and Services | 92.5p | £342 | -49 | -51 | -74 | -84 | |

Source: ShareScope 25 June 2025. Past performance is not a guide to future performance.

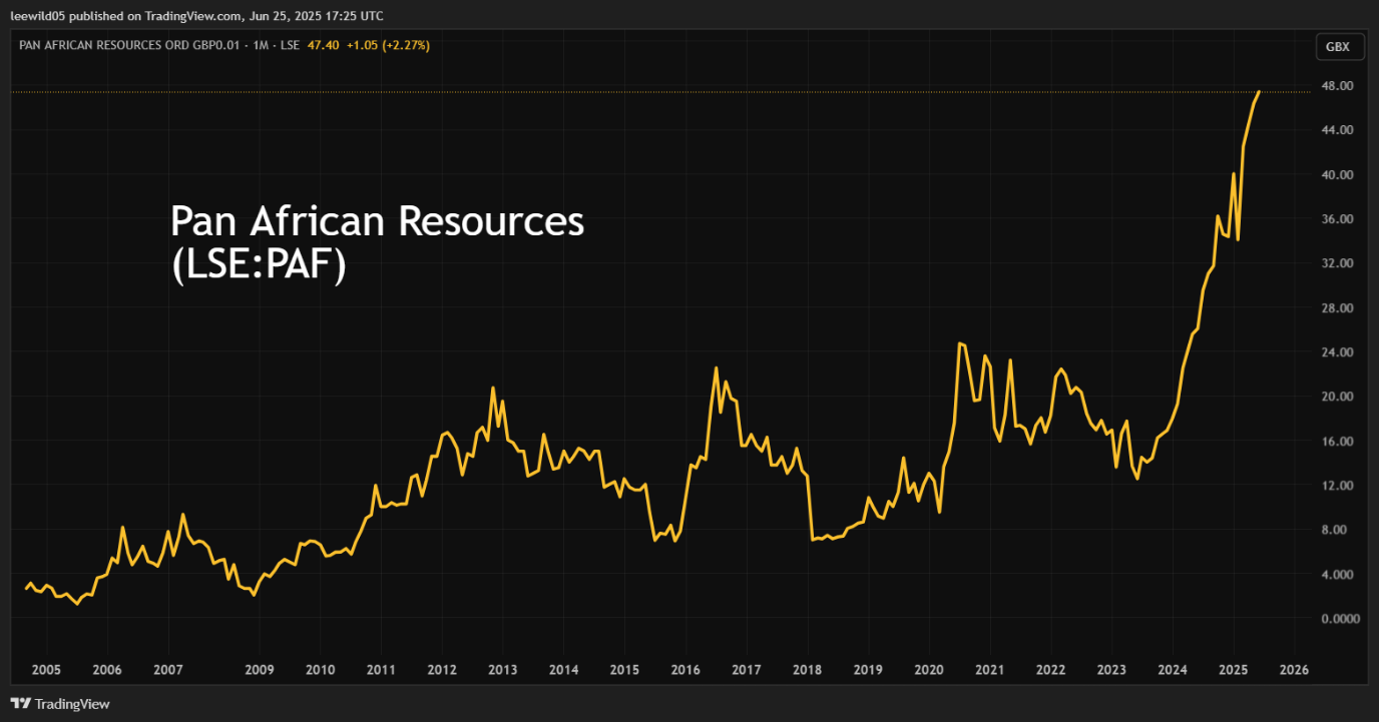

David “loves” mining and oil stocks despite not always serving him well. “I currently do own miners – my biggest holding is BlackRock World Mining Trust Ord (LSE:BRWM). I’ve also got Metals Exploration on AIM that’s done well, and Pan African Resources, but I have lost money on Sylvania Platinum.”

Source: TradingView. Past performance is not a guide to future performance.

‘I’m used to handling uncertainty and risk’

Investing in AIM is typically riskier than buying established FTSE 100 companies with global reach, many of which have been around for decades. Not everyone is comfortable with that approach, but David is: “I think I can tolerate the risk. I can live with large losses. My wife can’t do that. It’s partly to do with my personality and perhaps my job. I was a doctor, so used to playing the likely possibilities. I’m used to handling uncertainty and risk, and I’ve taken that into investing.”

Once you’ve decided your investing style and the level of risk that suits your circumstances and your personality, and when you have small-cap shares in your portfolio, at some point you will likely want to sell.

‘My weakest thing’

For many investors, deciding your exit strategy is crucial – pressing the sell button can often be the hardest thing to do.

“It’s my weakest thing,” admits David. “I used to have stop losses, but they’d chuck me out and then go up, so I stopped using them. But I recognise it’s more difficult to sell than buy.

“I’m still bad at it, but I will cut my losses if something’s going really bad. If it’s a 20-30% loss, I’ll have a conversation with myself about getting out. It depends on fundamentals of the company: is the business really at risk, or will they need to raise capital?

“Takeover bids are a nice way to get out! And that’s another reason I’ll invest. Bid speculation will pique my interest, and I’ve been lucky because there’s been a lot of that. Quite a few of my exits have been takeovers.”

- DIY Investor Diary: how I earn a return from churn

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Top slicing is also a favourite strategy. “Hopefully I sell before a stock begins to fall. If I’ve made 100% profit, I’ll sell – a good example is gold play Pan African Resources. I top sliced after making a 150% profit.

“I also used to chat with a friend who’s a chartist, and we’d influence each other. I’m more a value investor and focused on fundamentals; he was more of a chartist. We complemented each other quite well.”

‘This stock has been a real winner for me’

Given many AIM stocks are small businesses raising money to bankroll what they hope will be a phase of rapid growth, share price gains can be significant. Blue-chip companies have already gone through their own periods of outsized returns. Rarely outside of a takeover situation do you hear of FTSE 100 stocks doubling in value. But on AIM, this can be quite common. Already this year, 29 AIM shares are up 100% or more. The best performer – Fiinu (LSE:BANK), a fintech company – is currently up 1,600%.

And it’s Pan African Resources, which claims to be one of southern Africa’s highest- margin and lowest-cost gold miners, that sticks out for David. “This stock has been a real winner for me,” he says. “I bought at 16p but acquired more in stages between 15p and 20p. They’re now around 50p. I invested £5,000 to £10,000 and I’ve probably made £15,000. I still own some, even after top slicing.”

David also owned Warpaint London (LSE:W7L), which supplies high-quality cosmetics at affordable prices.Hetop sliced that too, then sold the rest when he’d made a 100% profit. Warpaint shares are currently 30% below their September 2024 peak of 650p.

Source: TradingView. Past performance is not a guide to future performance.

‘Steer clear of jam tomorrow stuff’

While there isn’t a specific type of AIM share that he’d invest in, there are companies with certain characteristics that David will avoid.

“I tend to steer clear of stocks with a market cap of less than £10 million, and I’m wary of companies worth less than £25 million. If I do invest in something like that, it will just be a punt with £1,000 or less.

“That said, I do always steer clear of loss-making biotechs; the jam tomorrow stuff. Companies have got to be making money.”

Lessons learned

It doesn’t matter how long you’ve been investing, or how much knowledge and experience you’ve acquired, it seems there’s always something more to learn. And it’s no different when it comes to investing.

David’s list of dos and don’ts might seem familiar, but whether it’s new information or ideas that confirm your own approach, it’s always interesting to see how other people invest.

“I think it’s important to buy on fundamentals - is the company making a profit? Is there a risk of the company needing to raise money and therefore dilution of your stake in the business?

- Don’t invest money you can’t afford to lose

- Diversify

- Be wary of high levels of debt

- Don’t be tempted by a good story alone – jam tomorrow stocks

“It’s all very common advice, but I think it’s all true. For me, it’s got to be a very sound company. Don’t mess around with businesses that don’t have a sound financial basis.”

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.