The fund firm topping the performance charts

Saltydog Investor looks at the company standing out in multiple sectors.

4th February 2026 10:03

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Over the years there have been periods when one or two investment companies have dominated our tables, with their funds regularly appearing near the top.

When Saltydog was first launched, Neil Woodford was in his heyday and his Invesco Perpetual (IP) Income and High Income funds often featured prominently in our analysis.

- Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

However, it was not only these funds that were performing well. Others, such as IP Distribution, IP European High Income, IP Tactical Bond, IP Global Equity Income, IP Emerging Europe, IP Hong Kong & China, and IP Latin America, also appeared regularly in our numbers. In 2018, the group rebranded, losing the “Perpetual”. Although Invesco funds still feature from time to time, they are far less pervasive than they once were.

Another example was Baillie Gifford in 2020. Baillie Gifford American B Acc was the top-performing fund that year, with an annual return of 122%. However, Baillie Gifford Long-Term Global Growth Invm B Acc, Baillie Gifford Positive Change B Acc, Baillie Gifford Global Discovery B Acc, Baillie Gifford Sustainable Growth B Acc, Baillie Gifford Pacific B Acc, and Baillie Gifford China B Acc were also among the top 20. That year, Baillie Gifford funds topped the tables in the Mixed Investment 40–85% Shares, Global Equity Income, Global, North America, and Asia Pacific sectors.

More recently, we have noticed Artemis funds cropping up more often than usual.

Artemis is a UK-based fund management firm founded in 1997, with main offices in London and Edinburgh. It offers a range of funds investing in the UK, Europe, the US and global markets, but is more focused on developed than emerging markets. Artemis currently manages assets of around £36.5 billion.

- Top 10 most-popular investment funds: January 2026

- Fund Battle: how these global income giants compare

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Those familiar with Saltydog Investor will know that we combine Investment Association (IA) sectors to form our own Saltydog Groups.

At the least volatile end of the spectrum is our “Safe Haven” group, which consists of the Standard Money Market and Short-Term Money Market sectors.

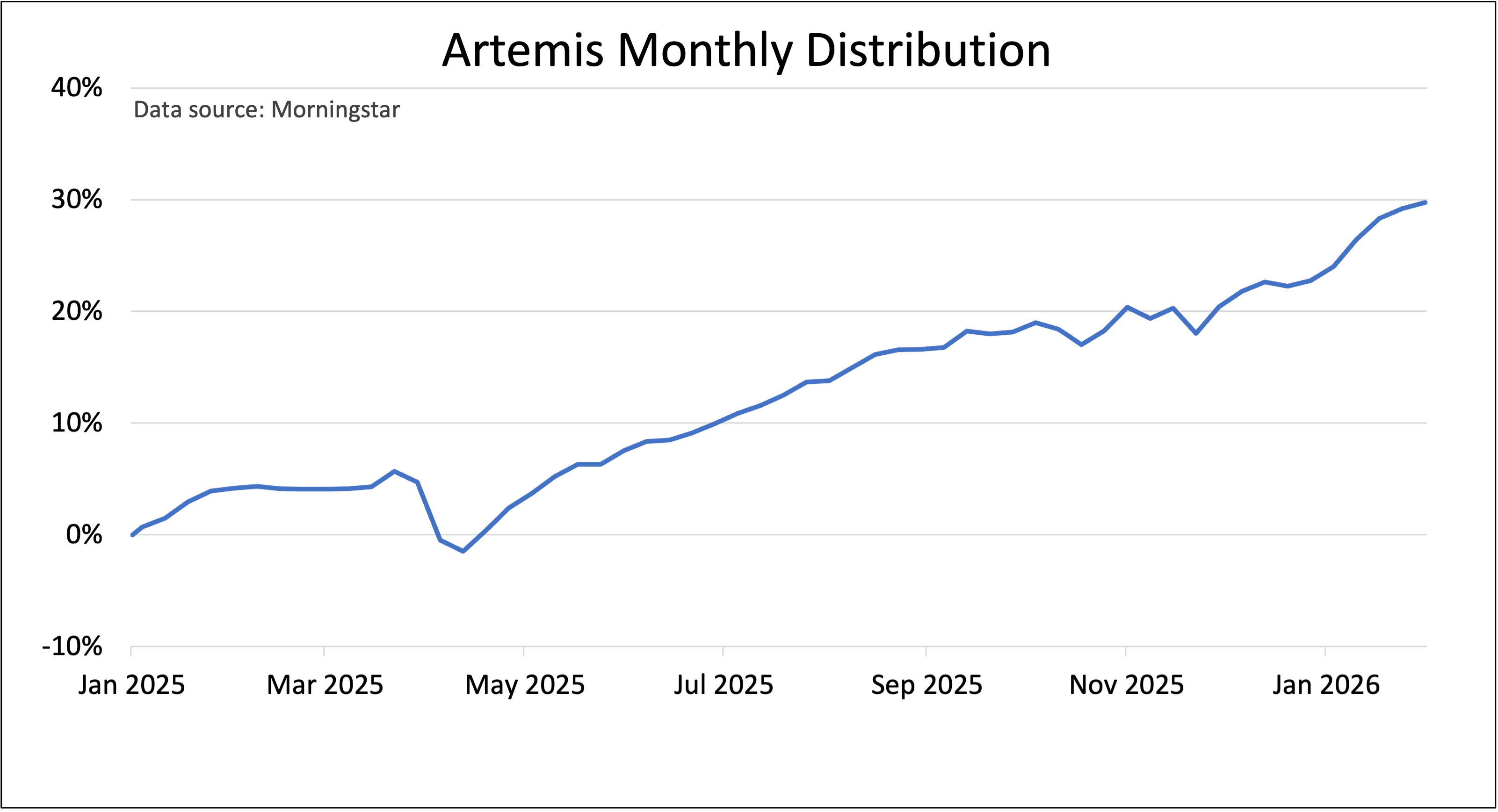

Next is the “Slow Ahead” group, made up of funds from the Targeted Absolute Return, Mixed Investment, and UK bond sectors. The leading fund in this group last year was Artemis Monthly Distribution I Acc, from the Mixed Investment 20–60% Shares sector, which generated an annual return of 23.1%.

Past performance is not a guide to future performance.

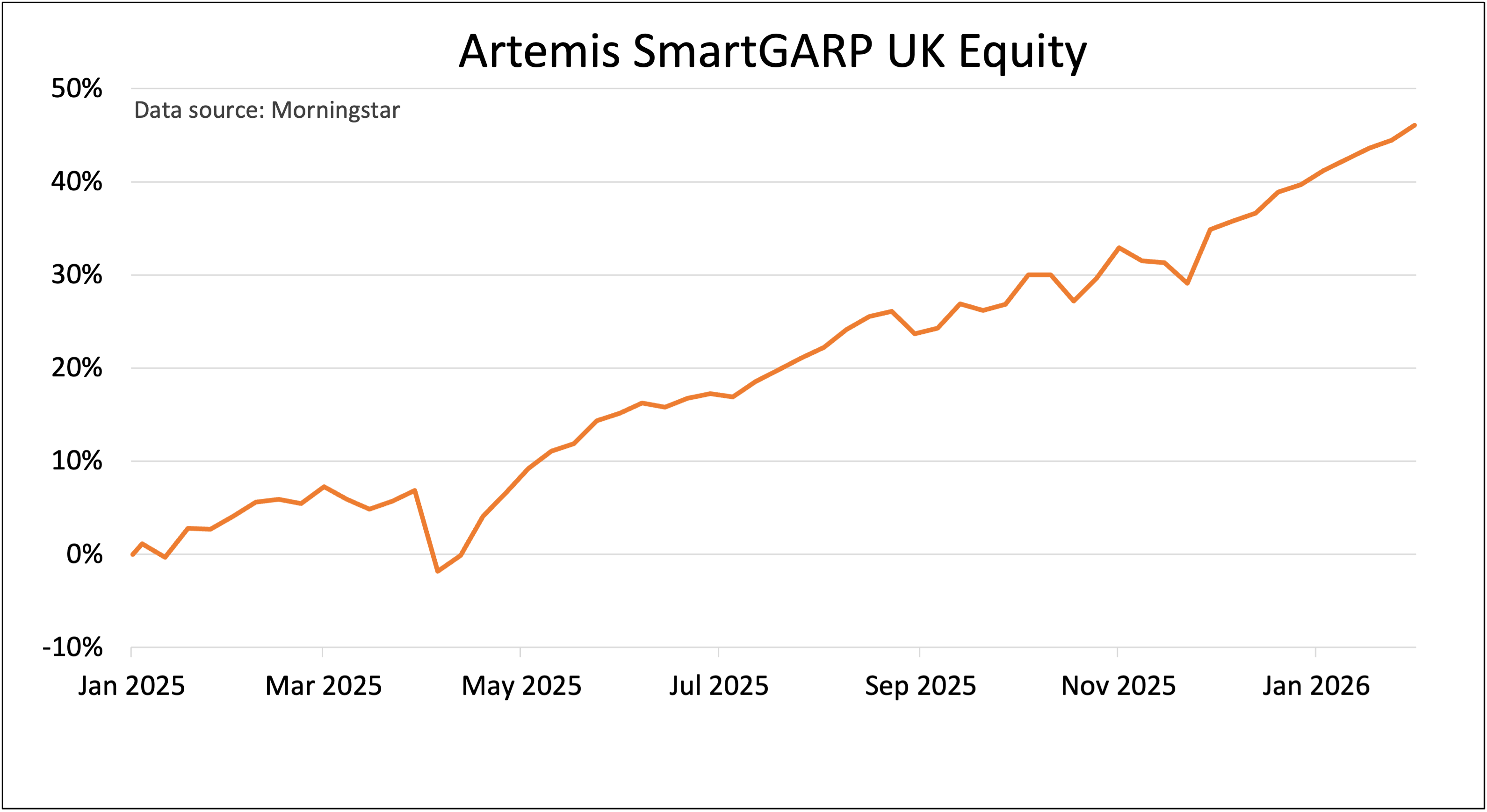

Our ‘Steady as She Goes’ group includes funds from the UK Gilts, Global Bond, Flexible Investment, UK Property, and UK Equity sectors. The top fund in 2025 was the Artemis SmartGARP UK Equity I Acc GBP fund, from the UK All Companies sector, which ended the year up 39.9%.

Past performance is not a guide to future performance.

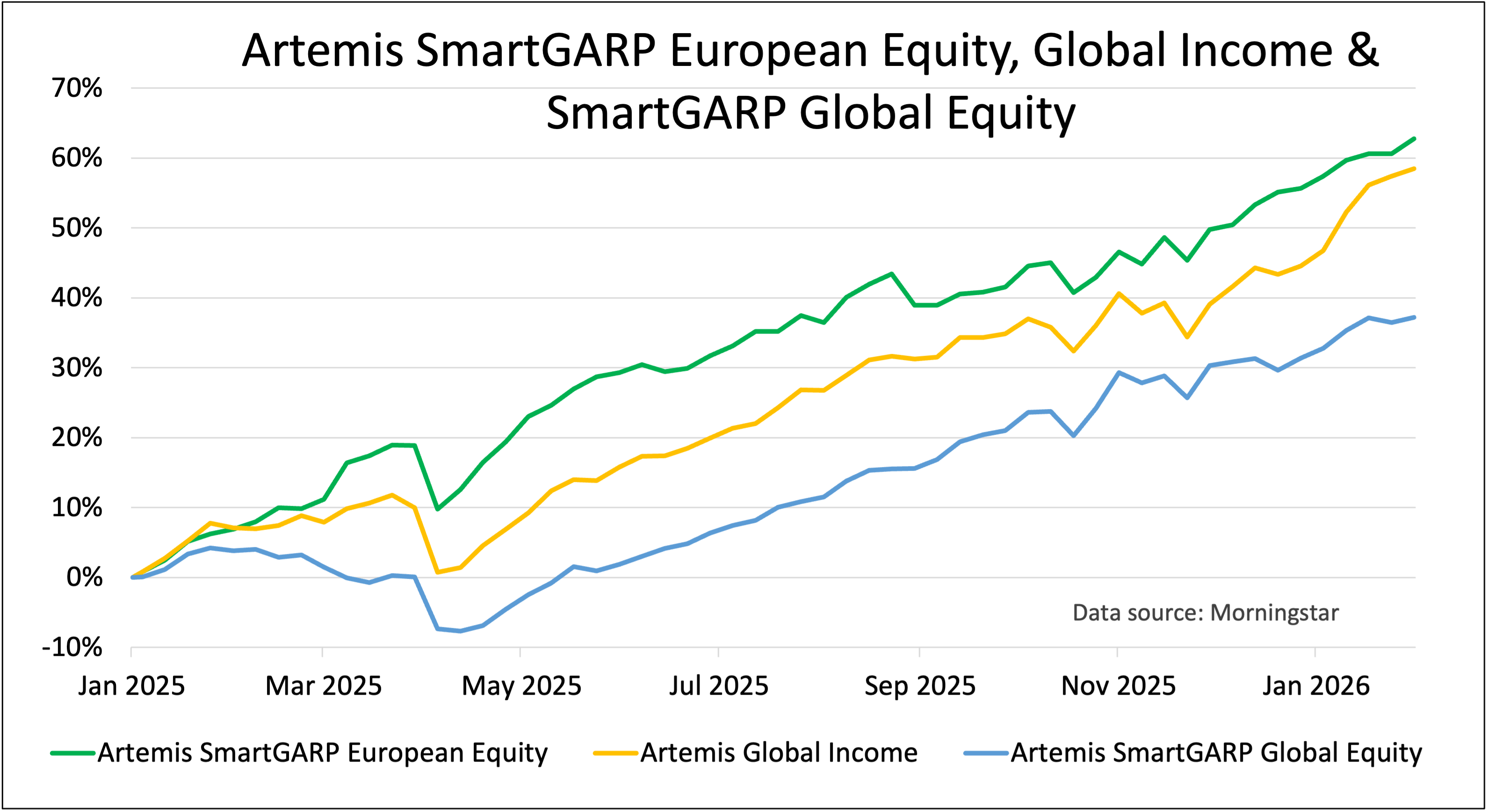

Three sectors from our ‘Full Steam Ahead’ group were also led by Artemis funds. At the top was Artemis SmartGARP European Eq I Acc GBP, from the Europe excluding UK sector, up 55.9%.

This was followed by Artemis Global Income I Acc, from the Global Equity Income sector, up 45.1%, and Artemis SmartGARP Global Equity I Acc GBP, from the Global sector, which rose by 32.4%.

Past performance is not a guide to future performance.

This recent vein of good form has extended into 2026, with several Artemis funds continuing to feature in our shortlists of leading funds. It will be interesting to see how long it lasts.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.