Idle cash buys this top UK fund

The Saltydog analyst has just spent more of his slush fund on this top-rated UK funds with low charges.

18th February 2019 12:33

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Saltydog analyst has just spent more of his slush fund on this top-rated UK funds with low charges.

The Saltydog analyst has just spent more of his slush fund on this top-rated UK funds with low charges.

More of the same

As momentum traders we are looking for trends in the markets – the stronger the trend the better!

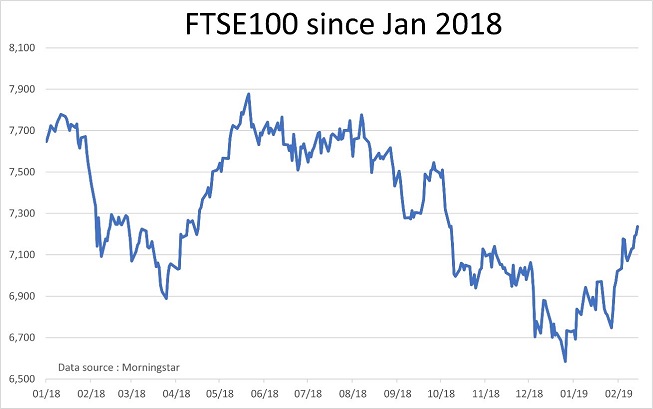

At the end of last year. it was pretty obvious that things were heading south. This can clearly be seen on a graph showing the FTSE 100 index since the beginning of 2018, and similar trends could be seen on stock market indices around the world.

Since Christmas things have started to improve. There was another small correction at the end of January, but the upward trend has now started to continue.

Just after Christmas the FTSE 100 was down at 6,585 and last week we saw it breaking through 7,200 – that's a gain of over 9%. In the states the Dow Jones Industrial Average has gone from below 22,000 to comfortably above 25,000 – a rise of more than 16%. Similar advances have been seen in stock markets around the world.

Politically, things don't seem that different to where we were at the end of last year.

Since then we've seen the UK government lose its Brexit vote, but then see off a vote of no confidence in parliament. Elsewhere in Europe, Italy is on the brink of a financial meltdown, Merkel's government is only just holding together, and earlier this year we saw riots in Paris.

At the same time the US has been in shutdown because the US congress and President Trump couldn't reach agreement over his US / Mexico wall. There's still friction between the US and the rest of the world, especially China, due to the trade wars, and that's not the only pressure on the Chinese economy.

However, markets are going up, and ultimately that's what we're looking for as investors.

- interactive investor's Super 60 fund list

- Seven funds that justify switch from cash

- How to make £10,000 from investment trusts in 2019

- Great value alternatives to the most-popular funds

Last week, I mentioned that over the last couple of months we have tested the markets with a few small investments, and on the whole we were happy with their performance. We were particularly impressed with the Investec Global Gold, Jupiter China, Fidelity Global Technology and Polar Capital Global Technology funds where we had already added to our holdings. These funds are all in our higher risk 'Full Steam Ahead' Group, or the specialist sector.

In our slightly less volatile 'Steady as She Goes' Group we have been investing in funds from the 'UK All Companies sector'. We've been holding the AXA Framlington UK Mid Cap and Investec UK Special Situations fund since January and have recently added the Baillie Gifford UK Equity Alpha fund.

As I said last week - as long as funds continue to go up, we'll keep investing but remain prepared for a quick about-turn if necessary.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.