ii winter portfolios 2018-19: Consistency wins the day by huge margin

11th January 2019 16:10

by Lee Wild from interactive investor

December proved an horrific month for global stockmarkets, but interactive investor's Consistent Winter Portfolio is still significantly outperforming the wider market, reports Lee Wild.

What a stinker 2018 proved to be. After making a number of record highs during the first half of the year, stocks turned tail late summer and conspired to deliver the fourth quarter from hell. The new calendar year has started brightly for interactive investor's pair of winter portfolios, but that won't be reflected in December's ghastly figures.

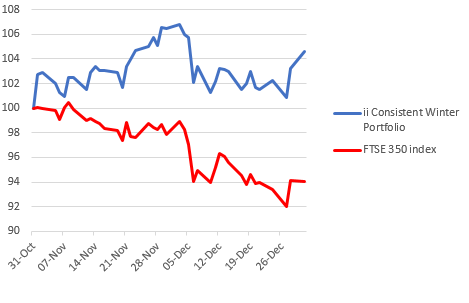

The FTSE 350 benchmark index fell 3.9% in December and is down 5.9% since our winter portfolios launched at the end of October. The interactive investor Consistent Winter Portfolio is our star performer so far, generating a 4.6% gain for the two months despite a 1.7% decline in December.

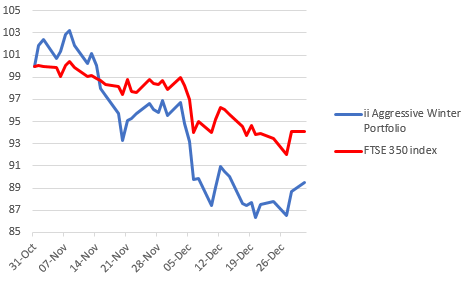

It's been tougher for our higher-risk basket of shares – the interactive investor Aggressive Winter Portfolio – which fell 6.3% last month and was down 10.5% for the two months to 31 December.

However, the two portfolios of five stocks each are here on merit, with statistics demonstrating an impressive track record of generating strong positive returns over the past decade. Indeed, all five constituents of the consistent portfolio have risen every winter (November to April) for the past decade. Even stocks in the aggressive portfolio, where the rules are relaxed slightly to give potential for even higher returns, have each made a profit in nine of the past 10 winters.

Currently, still less than half way through the third month of this six-month seasonal strategy, things are looking much better. A peak at the latest stats (to 9 January 2019) shows the consistent portfolio up 9.7% since launch and the aggressive portfolio down 1.9% versus the FTSE 350 down 3%. More on that next month.

interactive investor Consistent Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

Only two of the 10 constituents across the portfolios generated positive returns in December, and that they were both consistent portfolio stocks helps explain the success of this steady basket of shares.

As all around it struggled, InterContinental Hotels Group (LSE:IHG) rose a fraction under 1% last month, investors appreciative of its defensive qualities. Despite concerns about slowing global growth, this has not shown up in IHG's numbers. Indeed, one analyst just upgraded the shares in a note titled A resilient business model at a fair price, which sums up the broader attitude to the Crowne Plaza and Holiday Inn owner currently.

Our consistent superstar this year has been Hill & Smith (LSE:HILS). The motorway crash barriers firm edged higher in December, taking its overall gain during this strategy to 21% at year-end. It seems 1,200p may prove a level of resistance, but the fundamentals at this mid-cap are sound.

Elsewhere in December, kitchen supplier Howden Joinery (LSE:HWDN) gave up 2.2% and remains the worst-performing 'consistent' stock. However, it has made a slow start in previous years, typically picking up around annual results time late February/early March.

Speciality chemicals giant Croda International (LSE:CRDA) and pubs group Greene King (LSE:GNK) fell almost 4%, but here too, there is reason for optimism. Croda has risen over the winter months for at least the past 14 years, so history is on its side.

Greene King continues to surprise, however. Few who look at the five-year chart believe the brewer could possibly be a winter winner. But it is, and it's set about proving the doubters wrong with a stunning 21% rally in the two months to 31 December.

A strong Christmas update, including a record Christmas Day as Brits ate out to save on the post-feast washing up, reignited interest in the shares. A forward price/earnings multiple of just 9.4 and prospective dividend yield of 5.6% are a real attraction.

interactive investor Aggressive Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

It wasn't just US tech stocks like Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) that racked up double-digit percentage losses in December.

Concerns around the UK retail sector hobbled trainers-to-tracksuits chain JD Sports Fashion (LSE:JD.), while workspace provider IWG (LSE:IWG) succumbed to fears around the domestic and global economy. Losses in December were 11.7% and 10.1% respectively.

US-focused equipment rental firm Ashtead (LSE:AHT) has also remained out of favour, despite decent half-year results, amid concerns of an imminent downturn in the US construction market and weaker economy in general. It fell 6.9% last month.

Elsewhere, heat treatment engineer Bodycote (LSE:BOY) and property website Rightmove (LSE:RMV) each lost just over 1%, down with the market rather than any stock-specific catalyst. However, there are concerns around the former, where it’s feared good progress at the aerospace business could be offset by autos and industrials.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.