Market snapshot: gold folds, AGony for silver

Precious metals have been the sector to own in recent months, but heavy selling has got some worried. ii's head of markets looks at this and other price-moving events.

2nd February 2026 08:21

by Richard Hunter from interactive investor

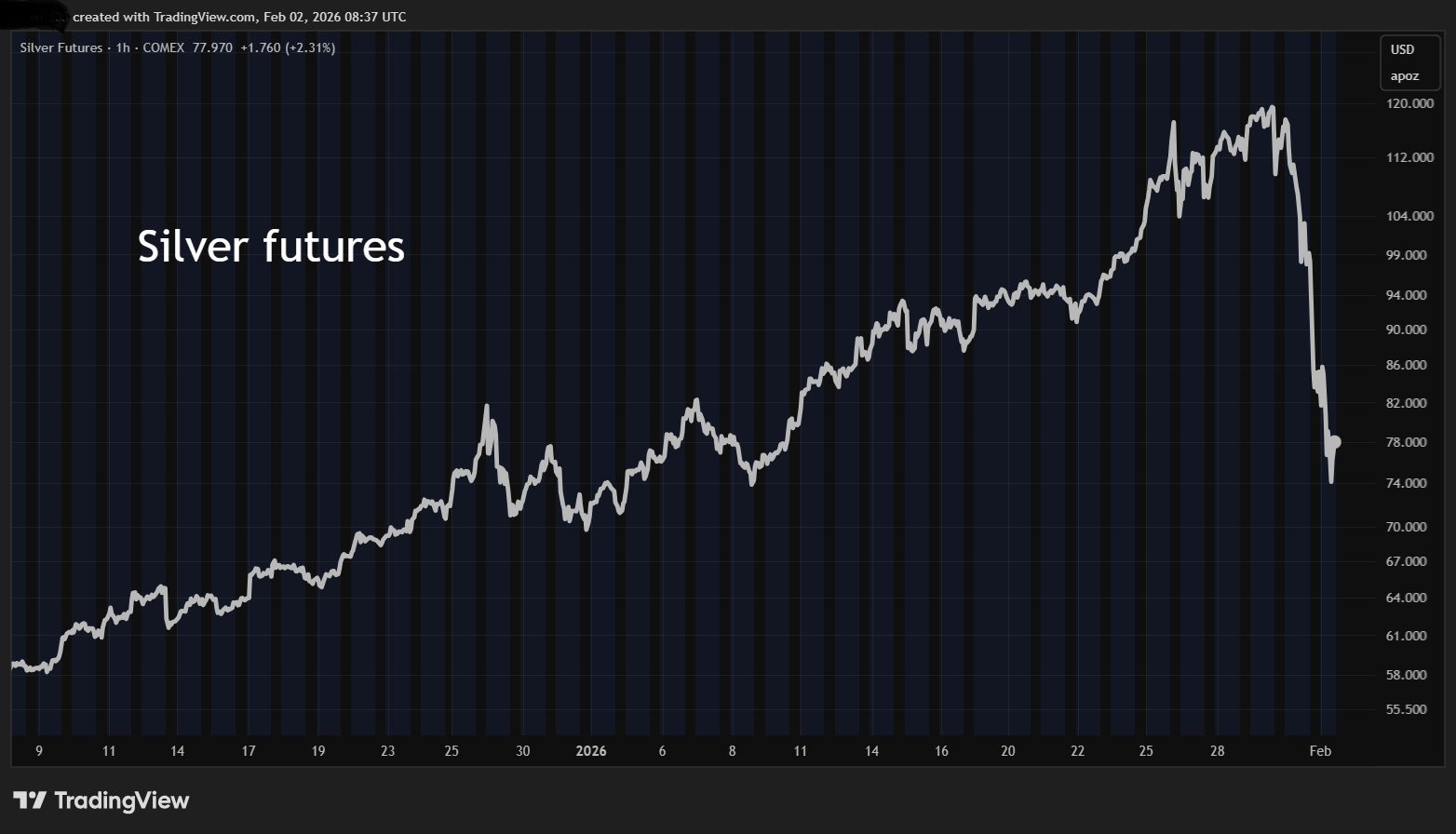

As investors were continuing to debate inflated AI-driven prices, a bubble burst elsewhere as precious markets plunged after a recent stellar run, catching markets largely off guard.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The reasons for the steep declines in gold and especially silver are not immediately obvious, although forced selling on major margin calls is likely to be a factor. The recovery of the US dollar will also have had an impact, given its inverse price relationship to gold, while there is also speculation of a heavy unwinding of long positions which has left traders rushing for the exit at the same time.

Gold has fallen a further 6%, while silver continues to plummet and has fallen by more than 25%, with a popular US silver tracker sliding 28% in a volatile session on Friday. The correction has spilled over into Asian and European markets, while at this early stage Dow futures are pointing to losses of up to 1.5% for the main indices.

Source: TradingView. Past performance is not a guide to future performance.

The moves follow a sickly end to last week for US markets, although each edged to a gain over the course of the first trading month of the year, with gains of 1.7%, 2.1% and 0.9% for the Dow Jones, S&P500 and Nasdaq respectively, and a spike of over 5% for the smaller cap Russell 2000 index.

- 10 shares to give you a £10,000 annual income in 2026

- Investment outlook: expert opinion, analysis and ideas

The announcement of Kevin Warsh as the likely new Federal Reserve Chair was received positively on balance, with investors hoping that the move protects the independence of the central bank despite his obviously close relationship with the President. Even so, there will be scrutiny over the course of this year as the intentions of the new Chair become apparent, and until the appointment it is increasingly unlikely that interest rates will be reduced.

In the meantime, investors will have much to digest as the non-farm payrolls are released on Friday, with expectations that 70,000 jobs will have been added in January, compared to 50,000 the previous month, and that the 4.4% unemployment rate will be unchanged. Of itself, such figures would do little to move the dial on Fed thinking, with the labour market stabilising although tepid.

- Week Ahead: GSK, BT, Shell, Vodafone, Anglo American

- Shares for the future: my response to reader feedback

The reporting season is now in full flight, and updates are expected across a range of sectors from the likes of The Walt Disney Co (NYSE:DIS), Pfizer Inc (NYSE:PFE) and AbbVie Inc (NYSE:ABBV). However, particular focus will fall on results from Alphabet Inc Class A (NASDAQ:GOOGL), Amazon.com Inc (NASDAQ:AMZN) and Advanced Micro Devices Inc (NASDAQ:AMD), particularly given the rough treatment which was handed out to Microsoft Corp (NASDAQ:MSFT) last week. This came amid heightening concerns over the hundreds of billions of dollars which are currently being pumped into AI development and the timeframe of any return on these investments.

Alongside the rout in precious metals, the oil price also fell by almost 5% on easing geopolitical concerns, and this dual effect conspired to drag the FTSE100 lower at the open, given the large exposure of the index to both sectors. Much as the momentum trade had propelled the likes of Endeavour Mining (LSE:EDV) and Fresnillo (LSE:FRES) to record highs, they were the largest losers with dips of 8%, followed by the rest of the mining sector and the oil majors where there were prevailing losses of between 3% and 6% as investors fled the resource trade.

- Stockwatch: an exciting share off the radar of most investors

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

There was a partial offset with some buying in more defensive stocks such as Unilever (LSE:ULVR) and the utilities, but the pressure was insufficient to stem the decline. Even so, the FTSE100 remains ahead by 2.5% in the year to date despite the weaker open, although the widespread pressure across asset classes could herald the beginning of a more guarded approach.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.