Shares for the future: my response to reader feedback

With no company reports to write up this week, analyst Richard Beddard addresses comments from readers, including the reason why commodity stocks aren’t for him.

30th January 2026 15:00

by Richard Beddard from interactive investor

This week no Decision Engine shares have published annual reports or surprised us with news that might move the needle on my scores.

By reducing the number of shares in the Decision Engine, I have created occasional space in my schedule to respond to feedback from readers, introduce new shares, revisit old ones, and discuss issues that impact our general understanding of shares like accounting, and the impact of four potential horsemen of the apocalypse: big, unpredictable risks that impact all shares, in one way or another.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

The four horsemen that preoccupy me are our ageing population, artificial intelligence (AI), climate change, and global decoupling, although the personnel may change over time!

Today, I’m starting with feedback.

Was I too hard on myself?

Three readers wrote in to comment on my review of 2025.

Fred emailed to say they thought I had been “quite harsh” on myself. Naseer emailed thoughts on what I could have done better (see below) but concluded by commenting that UK small caps are out of favour anyway, a potential get-out. Larry thinks I should capitulate and buy commodity stocks and companies with “earnings [that] are 95% outside of the UK”.

I told Fred that the published review was nowhere near as harsh as my first draft. I should also have said that to improve, I needed to criticise my decisions (and having addressed those criticisms, forgive myself).

UK small caps may be out of favour, but I do not think that or any other characteristic weighing on the portfolio should be an excuse, tempting though Naseer’s tacit invitation is.

Although the Share Sleuth portfolio mostly holds small caps and the Decision Engine mostly scores them, I do not consciously favour small companies, I favour uncomplicated businesses. Often these are small, but large companies can be straightforward too.

- Stockwatch: an exciting share off the radar of most investors

- 10 shares to give you a £10,000 annual income in 2026

The Share Sleuth portfolio holds Bunzl (LSE:BNZL), Games Workshop Group (LSE:GAW) and Howden Joinery Group (LSE:HWDN), all FTSE 100 shares with focused businesses and market capitalisations of £5 billion or so. Seven more shares have market capitalisations of more than £1 billion. Ten more are valued at over £100 million. Only three, Anpario (LSE:ANP), Solid State (LSE:SOLI) and Churchill China (LSE:CHH), fit into micro-cap territory, with market capitalisations of less than £100 million.

I’m more wedded to “quality” businesses, those that earn consistently high returns, than small companies. Investors in quality, including famous fund managers such as Terry Smith and Nick Train have also performed poorly in recent years. Can I take comfort from that?

Not really. My review focused on the performance of the businesses I wrote about, not the performance of their share prices. If the share prices are falling but the returns are still likely to come, there’s no need to worry. Eventually the quality will shine through. If the share prices are falling and I’m ignoring risks that might diminish returns, something is wrong.

I wanted my review to focus on what I could control, rather than shifts in market sentiment that I cannot control or predict. I needed to explain why I’d been slow to realise that times had changed, and begin to work out which of the four horsemen was trampling on my holdings, and which may trample on them in the future.

Larry’s suggestion, that I capitulate, and join the crowd investing in commodity stocks proposes a different answer to the same problem. Miners are doing well because the prices of the commodities they mine are doing well and they earn more money from them. Larry is saying, I paraphrase, that if you cannot beat them, join the companies most obviously benefiting from current economic and geopolitical circumstances.

Larry raises questions that I would like to answer more fully, like whether the UK really is such a terrible place to do business, and why I cannot imagine buying commodity stocks. But those questions take me away from my basic purpose to find UK companies capable of prospering through thick and thin for at least the next 10 years.

For now, my answer is that I place my confidence in a company’s unique capabilities and how it plans to make the most of them. Admittedly this can be tricky to pin down and I’ve sometimes failed, but I think it’s a more durable quality than fickle commodity prices.

Also, miners are often complicated businesses due to the location of mines in sometimes unstable regions, the imprecise measurement of deposits, the heavy investment required, and environmental considerations. While it’s possible to make money from miners, it would be difficult for me.

- Gold: a new price target, favourite stocks and when to sell

- BT, Vodafone and BAT to reward income investors in February

As for abandoning the UK, I’m biased. I want UK businesses to thrive because I live here. Prosperity brings social cohesion, and funds valuable things such as defence, health, education, welfare and national infrastructure. As my generation moves on from the world of work, the businesses I’m investing in are providing jobs to my children’s generation.

While I try not to let feelings influence my scores, seeing Jet2 Ordinary Shares (LSE:JET2) planes on the airport runway makes me feel proud. Following a Howdens’ lorry on the motorway elicits a cheer. I’m not the only person in my family who looks under the plate when they are eating out, to see if it’s made by Churchill China. I don’t feel close to companies that I cannot visit easily. These are non-financial returns on investment.

Since I liquidated the Share Sleuth portfolio’s holding in Swiss-domiciled US headquartered Garmin Ltd (NYSE:GRMN), all its holdings are UK domiciled.

Personally, though, I have for many years held a global equity fund in addition to my UK shares. Outsourcing investing in overseas markets simplifies tax, means I have to worry less about exchange rates, and allows me to focus on my home turf.

Although the part of my pension that mirrors Share Sleuth is nearly 75% of the total, that doesn’t mean it’s mainly invested in the UK.

Nearly half the shares in Share Sleuth (roughly mirrored in my own share portfolio) earn more than 75% of their revenue abroad. They are: 4imprint Group (LSE:FOUR), Advanced Medical Solutions Group (LSE:AMS), Anpario, Bunzl, Games Workshop, Churchill China, Focusrite (LSE:TUNE), Goodwin (LSE:GDWN), Oxford Instruments (LSE:OXIG), Porvair (LSE:PRV), and Renishaw (LSE:RSW). Three holdings, 4Imprint, Oxford Instruments, and Renishaw, meet Larry’s 95% criterion.

These companies are dealing with more aggressive protectionism now. Tariffs, of course, but also pressure on manufacturers in overseas markets to source locally, and constraints on exports. Many of the problems we face in the UK, the four horsemen, afflict other economies too. I’m not at all sure betting on overseas markets is the panacea it appears to be, so I’m happy to hold shares that earn revenues here too.

Only Hollywood Bowl Group (LSE:BOWL), Howden Joinery, Jet2, Latham (James) (LSE:LTHM), Macfarlane Group (LSE:MACF), Renew Holdings (LSE:RNWH) and Softcat (LSE:SCT) earn more than 75% of their revenue in the UK.

Were it not for the readers who write in, I would think less about these things much to my own detriment. So thank you, Fred, Naseer, and Larry.

Should I have been braver?

Naseer also wondered if I could have been braver and stood by more of the shares I held as their share prices fell.

While I remain confident in the quality of a share, the Decision Engine encourages me to “buy the dip”, because the price score increases as the share price declines relative to earnings.

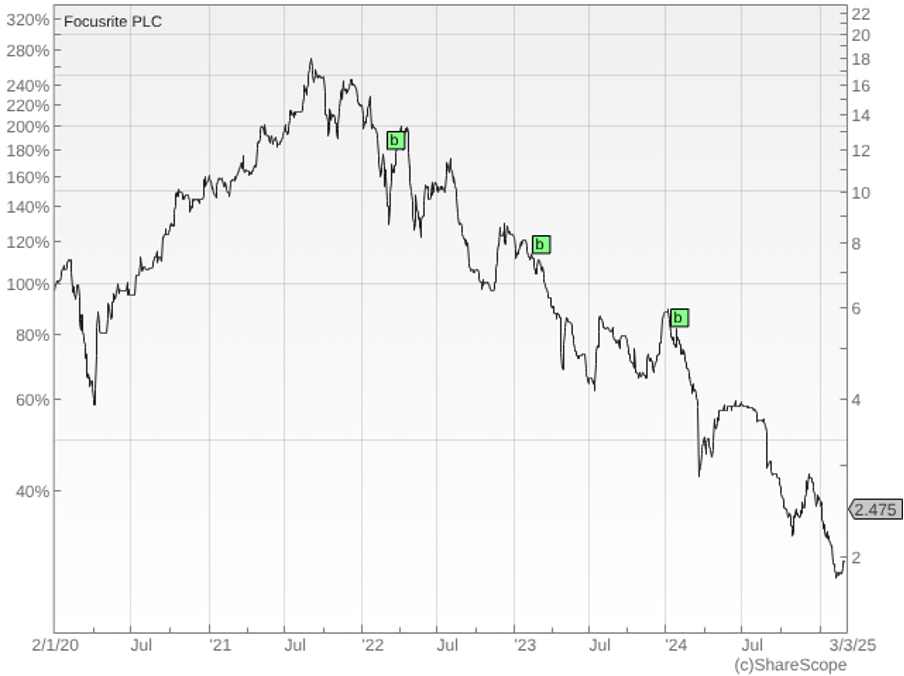

In recent years it has become more common for dips to turn into multi-year chasms, though. Perhaps the best example is Focusrite. I bought the dip three times:

A ‘b’ denotes additions to the Share Sleuth portfolio. There have been no reductions in the holding. Past performance is not a guide to future performance.

It’s more difficult for me to buy the dip now that I’ve refocused the Decision Engine on risk, made it much easier to re-score shares, and re-scored almost all of them. Other things are not equal, because in many cases I’ve reduced my scores for capabilities, risks and strategy - quality in other words. It is impossible to buy the dip if I’ve dumped a share from the Decision Engine and consequently stopped scoring it.

To buy the dip, I need to be confident that a business is becoming more profitable again, and I need to articulate why the recovery is sustainable. In other words, I must be confident the company has addressed the issues that have dented my confidence.

Naseer suggests I might have bought the dip in Anpario’s share price. In fact, I reduced the portfolio’s holding in Anpario with almost perfectly lucky timing in 2021:

A ‘b’ denotes a Share Sleuth addition, the ‘s’ is a partial reduction in the size of the holding. Past performance is not a guide to future performance.

But I didn’t load back up on shares in 2023. Anpario’s share price has doubled since then, but I don’t know if this was a missed opportunity.

I’m not looking for short-term gains. When I’m scoring shares, I’m thinking about how much bigger and stronger the company is likely to be in 10 years’ time. Anpario never stopped being a good long-term investment according to my scores. I could have bought in 2023 or 2024 had there not been higher-scoring shares to invest in. Ask me in 10 years’ time whether I made the right decisions.

- Week Ahead: GSK, BT, Shell, Vodafone, Anglo American

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It is easy for me to keep tabs on Focusrite and Anpario because they remain members of the Decision Engine. Naseer’s email has reminded me that I should keep better tabs on the shares that I have rejected in recent years. Maybe the time will come when I am confident enough to reinstate them.

The list includes Celebrus Technologies (LSE:CLBS), Cropper (James) (LSE:CRPR), James Halstead (LSE:JHD), PZ Cussons (LSE:PZC), RWS Holdings (LSE:RWS), Treatt (LSE:TET), Tracsis (LSE:TRCS), Victrex (LSE:VCT) and XP Power Ltd (LSE:XPP).

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.9 | 9.7% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Hollywood Bowl | Operates tenpin bowling centres | 8.0 | 0.4 | 6.9% | |

5 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.7 | 6.4% | |

6 | Jet2 | Flies people to holiday locations, often on package tours | 7.0 | 1.0 | 6.0% | |

7 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 6.0% | |

8 | Renew | Maintains and improves road, rail, water, and energy infrastructure | 7.5 | 0.4 | 5.9% | |

9 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | |

10 | Auto Trader | Online marketplace for motor vehicles | 7.0 | 0.6 | 5.2% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

12 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.2 | 4.6% | |

13 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 0.9 | 4.7% | |

14 | Judges Scientific | Manufactures scientific instruments | 7.0 | 0.1 | 4.3% | |

15 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.1 | 4.2% | |

16 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.5 | 4.0% | |

17 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -1.0 | 4.0% | |

18 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

20 | Volution | Manufacturer of ventilation products | 8.5 | -1.6 | 3.9% | |

21 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.9 | 3.7% | |

22 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.7 | 3.6% | |

23 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.8 | 3.3% | |

24 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.2 | 3.7% | |

25 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.7 | 2.6% | |

26 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.3 | 2.5% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -2.0 | 2.5% | |

28 | Tristel | Manufactures hospital disinfectant | 8.0 | -2.0 | 2.5% | |

29 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.7 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -2.1 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine and Share Sleuth, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.