Our two winter portfolios post incredible gains

January was a stunning month for both of our ii winter portfolios, one of which generated a 14% return.

8th February 2019 16:27

by Lee Wild from interactive investor

January was a stunning month for both of our ii winter portfolios, one of which generated a 14% return.

Whether by coincidence or design, a strange stock market winter quirk exists. Over the last 24 years, data from the UK Stock Market Almanac suggests that winter investing has a stronger performance track record than any other time of the year.

Now we are at the half way point in the winter cycle and we're starting to see more daylight creep into those cold winter months.

Now in their fifth year, and following a tough fourth quarter of 2018, our own pair of winter portfolios are looking much brighter too.

The UK Stock Market Almanac data found that starting with £100 in 1994, an investor who had been invested in the FTSE All Share index continuously for the past 24 years would have seen their money grow to £261 (excluding dividends).

But if they had only invested in the market in the winter months, between 1 November and 30 April every year, then that £100 would be worth £327. Conversely, if they had chosen to only invest over the summer months they would have lost money; their original £100 would be worth just £73.

interactive investor has compiled two winter portfolios – a 'consistent' basket of reliable performers (historically at any rate) and a higher-risk 'aggressive' portfolio. Each is made up of five stocks from the FTSE 350 index to ensure sufficient liquidity. The stocks pick themselves by performing well during the winter period year after year.

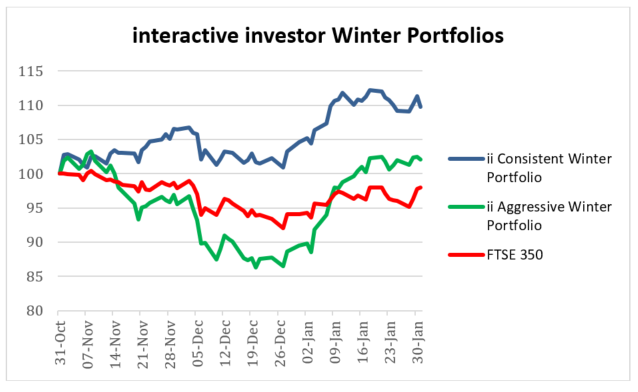

Both winter portfolios have beaten the FTSE 350 benchmark so far in 2018-19, and this year the interactive investor consistent winter portfolio has outperformed its aggressive counterpart over the first three months of the six-month strategy.

Source: interactive investor. Past performance is no guide to the future and the value of investments can go down as well as up and you may not get the full amount invested.

In their first four years, the interactive investor winter portfolios consistently outperformed their FTSE 350 benchmark index, and both the consistent and aggressive portfolios have a great history of generating market-beating returns between November and April going back at least a decade.

Our winter portfolios were not immune from a poor fourth quarter for equity markets. However, renewed optimism during January put a rocket under both baskets of shares, demonstrating the value of a portfolio approach twinned with this proven seasonal stock picking strategy.

interactive investor consistent winter portfolio

| Company | Ticker | Track record (years) | Positive returns (years) | Return in January (%) | Return for first three months of the six-month strategy (%) |

|---|---|---|---|---|---|

| Howden Joinery | HWDN | 10 | 10 | 16.0 | 7.8 |

| InterContinental Hotels Group | IHG | 10 | 10 | 2.4 | 5.5 |

| Hill & Smith | HILS | 10 | 10 | -8.0 | 11.4 |

| Greene King | GNK | 10 | 10 | 13.6 | 24.2 |

| Croda International | CRDA | 10 | 10 | 2.9 | -0.2 |

| Portfolio performance | 4.9 | 9.7 | |||

| FTSE 350 benchmark index | 4.1 | -2.0 |

Source: interactive investor. Past performance is no guide to the future and the value of investments can go down as well as up and you may not get the full amount invested.

The consistent portfolio has been the star of the show during the first half of the 2018-19 winter strategy, and it outperformed the market again in January.

Ending December up 4.6%, the consistent portfolio more than doubled profits during January, growing 4.9% versus the 4.1% monthly return for the FTSE 350. The portfolio is now up almost 10% during the first half of this six-month strategy.

Biggest risers were Howden Joinery – one of our companies analyst Richard Beddard's favourite stocks - up 16% in just one month, and pub chain and brewer Greene King up 13.6%.

Winter star Croda finally found form, but this most consistent of all winter stocks is still only flat for the three-month period. We expect more!

Intercontinental Hotels did well, and shareholders also received a special dividend worth 203.8p a share.

interactive investor aggressive winter portfolio

| Company | Ticker | Track record (years) | Positive returns (years) | Return in January (%) | Return for first three months of the six-month strategy (%) |

|---|---|---|---|---|---|

| Ashtead Group | AHT | 10 | 9 | 17.8 | -0.5 |

| JD Sports Fashion | JD. | 10 | 9 | 32.7 | 13.4 |

| IWG | IWG | 10 | 9 | 7.1 | -2.7 |

| Bodycote | BOY | 10 | 9 | 4.7 | -4.5 |

| Rightmove | RMV | 10 | 9 | 9.2 | 4.4 |

| Portfolio performance | 14.0 | 2.0 | |||

| FTSE 350 benchmark index | 4.1 | -2.0 |

Source: interactive investor. Past performance is no guide to the future and the value of investments can go down as well as up and you may not get the full amount invested.

The interactive investor aggressive winter portfolio jumped an incredible 14% in January. It had lagged the wider market through a dismal fourth quarter for equity markets, that was until the recovery began at the very end of 2018.

The portfolio is now up 2% for the first three months of the six-month strategy. That compares with the FTSE 350 benchmark index, which is down 2%.

Biggest risers were JD Sports, up almost 33% following a positive Christmas trading update mid-month.

US-focused rentals giant Ashtead, battered in recent months by fears of a slowdown in the US, leapt 18%. Analysts at JP Morgan are backing the shares to go higher still, believing Ashtead's market share could more than double in the US.

After a volatile start to the winter season, online estate agent Rightmove is also heading in the right direction, up over 9% for the month and now 4.4% better for the three months.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.