Spotting the best trusts in the ESG jungle

Kepler examines opportunities and pitfalls amid investor fever for sustainable investments.

19th February 2021 16:17

Kepler examines opportunities and pitfalls amid investor fever for sustainable investments.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

In December, we highlighted that ESG (environmental, social and governance) was the surprise ‘thematic winner’ of 2020. Perhaps not in performance terms (can anything beat the FAANGs?), but almost overnight it has become a standard part of fund presentations.

Asset flows into ESG funds also back up our contention, with huge growth in assets seen by ESG-related funds during 2020. However, as we discussed in December, within the equity trust universe there are relatively few equity trusts that offer ‘pure’ exposure to the theme. And of those that do, many stand at chunky premia.

The new US presidency is focusing on climate change as one of its four key pillars. Larry Fink, CEO of BlackRock, published his ‘Dear CEO’ letter in January, which for the second year in a row ‘majored on’ (as they say on that side of the pond) climate change – we touch on elements of his letter below.

Suffice to say, the CEO of the world’s biggest asset manager thinks that aside from posing a big risk to traditional portfolios, “the climate transition presents a historic investment opportunity”. It would appear that increasingly everyone else thinks so, too.

We examine the potential and pitfalls of being greenwashed, and look for the best opportunities to avoid it.

A new mainstream

To us Europeans (in a geographical sense), ESG is now mainstream. On the other hand, the US and Asia are still well behind the curve. This gives us (both European companies, and investment managers investing in them) a big first-mover advantage.

Closer to home, Jes Staley, CEO of Barclays, sees a huge opportunity for London to harness the international demand for financing climate-based projects. In his view, “Climate today is like technology was in 1995. If you think about it…all the Amazons, the Googles, didn’t really exist in 1995 and now it dominates 40% of the economy. I think it’s a fair argument that dealing with climate and dealing with the environment is in the same position now” (Source: BBC).

To some extent, we can see this happening already. The renewable energy infrastructure trusts (of which more below) are a classic example of an innovation that has quickly become mainstream for UK investors. Over less than a decade, the renewable energy infrastructure sector has grown from zero to net assets approaching £10 billion, with the number of funds currently rapidly expanding. The growth of this part of the closed-ended fund sector allows developers to recycle capital out of completed construction projects and channel this capital into new ones, thereby contributing to a more sustainable future.

Reallocation of capital

Last year, Larry Fink remarked that as markets started to price climate risk into the value of securities it would spark a fundamental reallocation of capital. This year he notes that “the reallocation of capital accelerated even faster than I anticipated”. He observes that between January and November 2020, investors in mutual funds and ETFs invested $288 billion globally in ‘sustainable’ assets, a 96% increase over the whole of 2019.

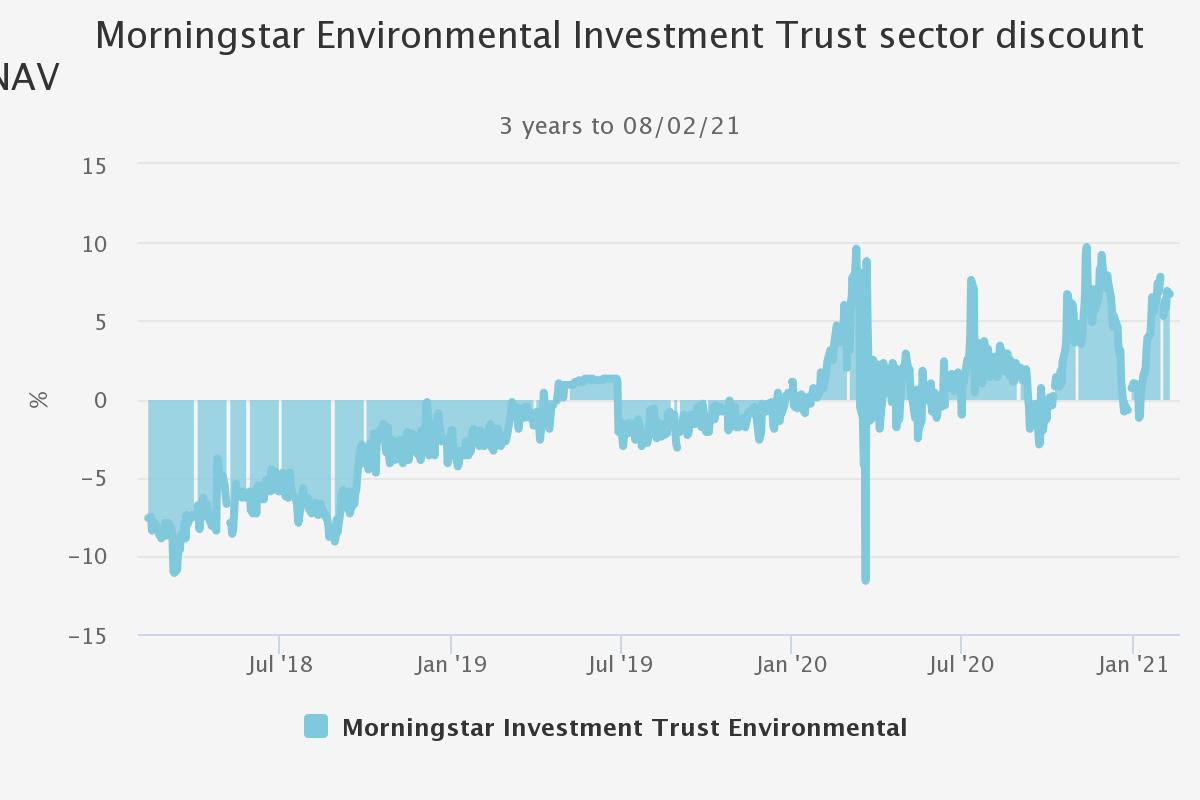

In the fund world, this has represented massive shifts in fund assets. According to a recent article in the FT, theAUM in Morningstar’s sustainable funds category hit a record of almost $1.7 trillion at the end of 2020, an increase of 50% over the year. Europe is by far the biggest market, accounting for 70% of the global universe (by AUM). Within the investment trust world, this shift is represented by premiums to NAV expanding within the relatively small AIC Environmental sector, as we show below.

Investment trust boards have also been catching the ‘sustainability’ bug. Keystone Positive Change (LSE:KPC) announced in December that it proposed to scrap its UK equity income mandate, changing its spots entirely to become a sustainable global high-growth mandate to be run by Baillie Gifford (we have written a recent update on the proposed new strategy, which can be found here). If current trends continue, we would expect other trusts to follow Keystone’s example and adopt specific ESG mandates.

Source: Morningstar

The pips are squeaking

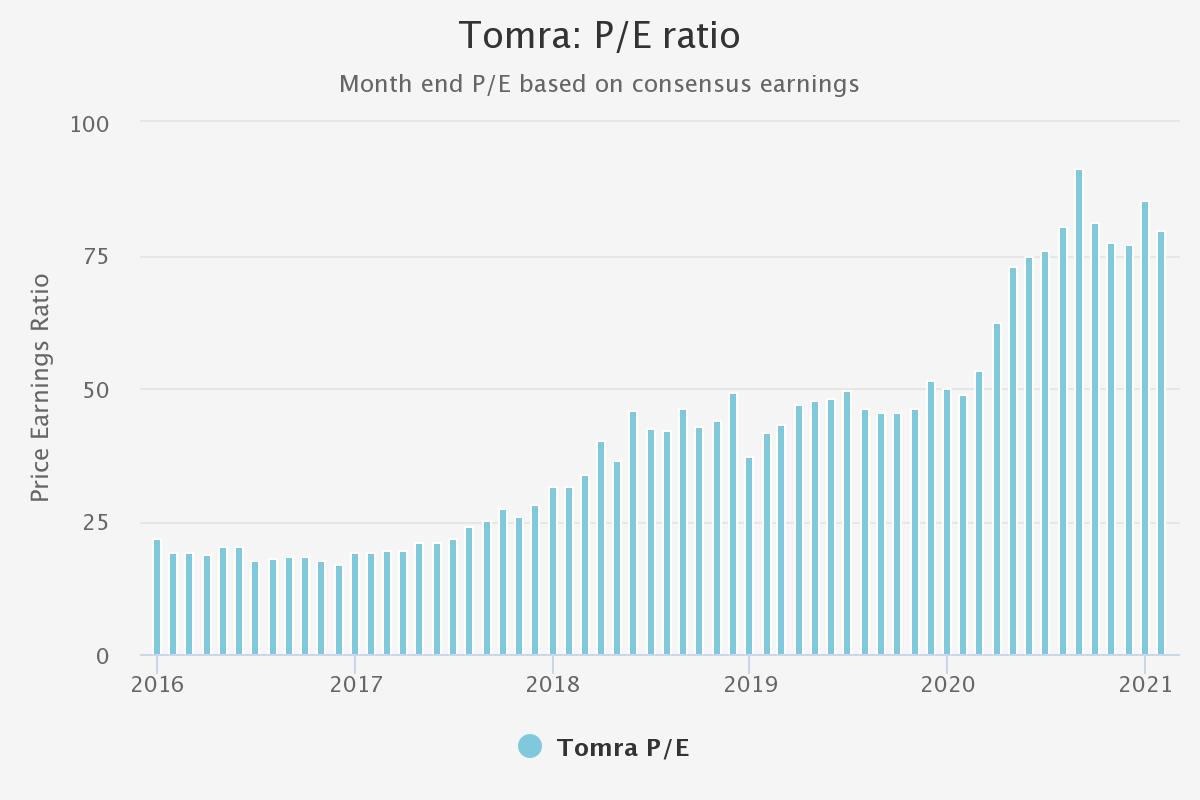

With all the excitement, there are risks for investors. Despite all the hype, things take a long time to change on the ground. And it then takes a long time for listed companies that are becoming more ‘sustainable’ to report these changes, not to mention the time it takes for analysts and data providers to incorporate them into analysis. As such, the universe of ‘sustainable’ stocks cannot hope to expand as fast as the funds that are offering access to them. There is some evidence that valuations are expanding – in some cases, quite worryingly – perhaps as a result of all this new attention being paid to a relatively narrow set of companies. TOMRA is perhaps a case in point, which has seen its P/E expand dramatically over the past five years (according to consensus estimates of earnings from Bloomberg), which we show below.

Source: Bloomberg

For specialist active managers who have the opportunity and flexibility to interrogate the numbers, this presents an opportunity. Active managers (rather than index-tracking ETFs and other passives) should by definition be able to sort those companies which are overvalued relative to their prospects from those which are more attractively valued, and thereby deliver alpha. We highlighted many trusts which in our view might suit investors in a previous article.

However, as a sign of how rapid flows have been, several active management groups are now managing inflows to these funds. Examples include Impax (with regard to Impax Environmental Markets issuing shares), and more recently Nordea Asset Management announced it will be soft closing its Nordea 1 – Global Climate and Environment Fund at €6 billion. According to Citywire, the fund strategy has doubled its assets in one year and increased sixfold since 2018. In our view, this is evidence that some areas of the market are reaching capacity, and that there is a danger of too much money chasing the ‘obvious’ names to distinctly unsustainable valuations.

Passive-aggressive risks

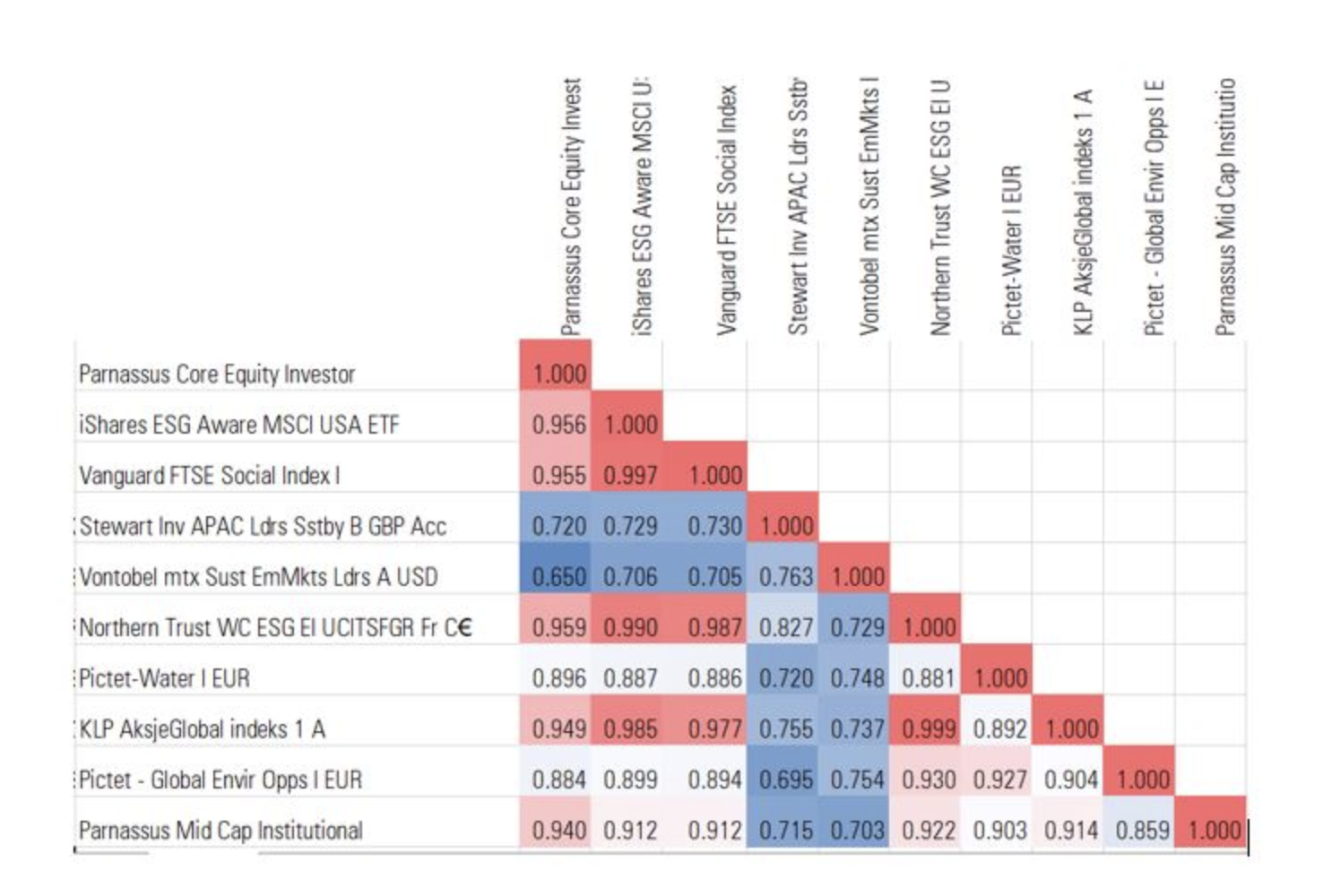

For passive investors, the risks are even greater. Many of the largest funds in the ESG space are passives (or quasi-passives). We have analysed 10 funds identified in a recent FT article as representing the largest funds for retail investors looking to access sustainability and ESG themes. Perhaps unsurprisingly, eight of them have an extremely high correlation with each other, which we show in the table below.

Correlation analysis of 10 largest ‘ESG’ funds

Source: Morningstar, Kepler Partners

Aside from the Stewart Investors and Vontobel funds (which are Asia Pacific and emerging market strategies respectively), the other eight funds have an average correlation with each other of 0.93. In our view, the table above provides statistical evidence that the largest ESG funds are potentially chasing similar stocks. The question is – what are these stocks?

Looking at the correlations of the iShares and Vanguard passive funds in the table above, we find that they have extremely high correlations with the standard indices as well. For example, the iShares ESG Aware MSCI USA ETF has a near perfect correlation to that of the (non-ESG aware) MSCI USA Index over the past three years.

Similarly, the Vanguard FTSE Social Index tracks the FTSE4Good USA Index, and has a correlation of 0.99 over the past three years to the FTSE USA Index. When we look at the underlying constituents of these funds, one finds that their top tens are almost identical. It would seem that passively invested ESG money is finding its way into almost exactly the same stocks as money invested in the non-ESG index funds. Depending on your own definition of what constitutes ESG investing, might one hold this evidence up as the ultimate in greenwashing? In our view, this shows how important it is to take an active approach to gain proper ESG exposure.

Comparison of top 10 holdings

Source: Vanguard, as at 31/12/2020

Larry Fink believes “the climate transition presents a historic investment opportunity”. And for some marketing departments, it is also a historic marketing opportunity. The gold rush into ESG has been accompanied by a massive rebranding of funds, which in some cases represents only a small amount of dressing around the edges (by definition, greenwashing).

For example, we understand that it only takes the mere inclusion of the phrase ‘ESG incorporation’ in a strategy’s (modified) prospectus for data screens to attach the ESG label to a fund. The analysis above would indicate that many investors who are looking for ESG exposure might actually be only investing in the ‘same old’ funds without realising it.

Where to go?

So you want exposure to sustainable themes? And you either want to broaden your exposure from existing non-ESG funds, or don’t want the risks of being exposed to the ‘same’ underlying companies as ‘everyone else’? Then where do you turn?

Aside from the ‘under the radar’ equity trusts exposed to ESG themes that we examine here, the alternative income sector is worth a closer look. The advantages are many: trusts can invest in private/unlisted investments (which means every underlying portfolio is entirely unique); they can hold investments for the long term; and also a majority of the returns are delivered in dividends – meaning it is easier to measure progress of the fund achieving its objectives, and as cash is returned via dividends, this can represent a de-risking exercise as time goes on.

As we discussed in this article, the high annual income returns that these funds target offer the potential for equity-like returns, but with significantly lower volatility. Importantly, from a ‘sustainability’ perspective there is little arguing about the extent of greenwashing within each fund’s marketing brochure. The assets held are the assets held, and it is up to each investor to decide whether they fit their definition of ‘sustainability’.

Each manager typically applies its own ESG approach when considering assets to purchase or to manage, but with these sorts of funds, in our view it is the asset class that will be the main determinant of whether investors view such a fund as sustainable and whether they feel it merits being included within an ESG portfolio.

The renewable energy infrastructure sector is a case in point, the underlying assets of which are unlisted and privately transacted. As the table below illustrates, there is plenty of choice for investors, and many funds are of such a scale that their shares are highly liquid. They each offer exposure to a very specific ‘sustainable theme’, which will arguably become increasingly relevant to addressing climate change as time goes on.

UK investment trust investors appear to be significantly ahead of the curve, particularly with regard to the senior management teams of ‘big oil’ who are only just waking up to the party, and who seem desperate to get into the action.

According to the FT (Oil majors join scramble for offshore wind rights in England and Wales), oil companies have been bidding ‘staggering’ prices in a recent auction run by The Crown Estate for rights to build offshore wind farms in the North Sea. As per the article, FTI Consulting was quoted as saying the highest price paid was at least 15 times what developers bid in the most recent comparable auction in the US in 2018. The renewable energy infrastructure universe arguably offers those with lesser means than BP or Total a significantly less expensive route to getting access to ready-built portfolios of these types of asset! We give examples of the various trusts available in the section below.

We would caution that while they may be in the same grouping, these trusts can have very different risk/reward characteristics. For example, solar assets are very different to those that seek to benefit from energy storage, and the risks and returns are likely to be very different over the long term. We would also caution that most of these trusts use substantial gearing at a trust level and/or within the special purpose vehicles that each asset may be owned through. This clearly presents risks and opportunities that investors should ascertain and understand.

Renewable energy infrastructure trusts

Main area of investment | Premium/ | 12- month yield % | OCF | Net assets (£M) | |

| Aquila European Renewables Income Fund (LSE:AERI) | EU onshore wind, solar, hydro | 8.5 | 3.6 | 1.70 | 270 |

| Bluefield Solar Income Fund (LSE:BSIF) | UK solar | 21.1 | 7.0 | 1.10 | 475 |

| Downing Renewables & Infrastructure (LSE:DORE) | Renewable energy & infrastructure | 0.1 | 3.1 | tbc | 120 |

| Ecofin US Renewables Infrastructure | US renewable infrastructure | 5.1 | 2.5 | tbc | 89 |

| Foresight Solar (LSE:FSFL) | UK solar | 10.2 | 5.5 | 1.14 | 581 |

| Gore Street Energy Storage Fund (LSE:GSF) | Energy storage | 16.3 | 7.4 | 2.20 | 72 |

| Greencoat Renewables (LSE:GRP) | Eurozone wind farms | 20.3 | 6.0 | 1.25 | 657 |

| Greencoat UK Wind (LSE:UKW) | UK wind farms | 17.7 | 6.0 | 1.07 | 2,244 |

| Gresham House Energy Storage (LSE:GRID) | Energy storage | 14.6 | 6.3 | 1.43 | 345 |

| JLEN Environmental Assets (LSE:JLEN) | Environmental infrastructure | 22.3 | 7.1 | 1.22 | 560 |

| NextEnergy Solar (LSE:NESF) | UK solar | 6.1 | 7.1 | 1.10 | 587 |

| Octopus Renewables Infrastructure (LSE:ORIT) | European and Australian renewables | 15.0 | 2.1 | tbc | 344 |

| TRIG The Renewables Infrastructure Group (LSE:TRIG) | UK/European onshore wind, solar | 19.5 | 6.1 | 0.98 | 2,172 |

| SDCL Energy Efficiency Income (LSE:SEIT) | Energy efficiency – global | 7.3 | 5.2 | 1.17 | 529 |

| Triple Point Energy Efficiency Infrastructure (LSE:TEEC) | UK energy efficiency | 5.6 | 1.0 | tbc | 98 |

| US Solar Fund (LSE:USF) | US solar | 12.5 | 2.1 | 1.50 | 173 |

| VH Global Sustainable Energy Opportunities (LSE:GSEO) | Sustainable energy infrastructure – global | 4.1 | 1.0 | tbc | 238 |

Source: Morningstar, Kepler Partner, as at 09/02/2021

The sector is growing rapidly – both in the number of trusts having been launched, but also through share issuance. Economies of scale mean that as these trusts gain in size, the managers can extract significant operational efficiencies (insurance, maintenance, etc.) which help to boost returns for shareholders. From a returns perspective, having scale enables proper diversification – and this is an important consideration for investors even within trusts which have a relatively small niche.

For example, Greencoat UK Wind (LSE:UKW), which is sticking to its knitting in terms of investment focus (UK wind farms only), achieves diversification by having a broad spread of assets located all around the UK. Of course, it has a bias towards the windier north of England and Scotland, but having a spread around the UK means that it is in a position to mitigate a particular region of the UK having a less windy period over the short term. We note that average wind speeds (and solar irradiation) over long time frames do not vary to any great extent. This has enabled it to pay out a steady, inflation-linked dividend since launch in 2013.

Other trusts such as TRIG The Renewables Infrastructure Group (LSE:TRIG) make diversification across geography and generation technology one of their USPs. TRIG has the most diversified portfolio of the trusts in the existing peer group, although there are potentially some new issues coming to market which will seek to broaden diversification out even further through a fund-of-funds approach (seehere). TRIG is effectively a one-stop shop investing across a range of technologies (wind, solar and battery storage so far), with a remit to invest across the UK and Europe. TRIG has continued to invest overseas in building its portfolio. TRIG’s growing scale enables the purchase of larger-sized assets, of which offshore wind farms are typical examples.

NextEnergy Solar (LSE:NESF)invests directly into primarily UK-based solar energy infrastructure assets (although it hopes to branch out geographically with future fund raises). The benefit solar energy provides in tackling climate change is clear. However, what some investors might not realise is the further commitments NESF has made to improving the environment in regards to how those assets are managed. NESF’s manager, NextEnergy Capital Group, has a dedicated team devoted to biodiversity designed to enhance the biodiversity at their sites. Although the pandemic has slowed biodiversity project completion, early results are already visible and we understand the team will be reporting regularly on progress going forward.

US Solar Fund (LSE:USFdiffers from the other solar funds in several ways. As its name suggests, it invests in solar power assets across the US. It aims to generate a progressive dividend of 5.5% of the IPO price once it is fully invested – a position that it has now achieved. As such, USF is in a strong position to be able to deliver this dividend in 2021, covered by cash generated by the portfolio. USF’s energy production is 100% contracted at fixed prices for a weighted average of 15 years (as of 30/09/2020). This is significantly longer than is typical for the other solar funds in the AIC Renewable Energy Infrastructure sector, and means that the income supporting the dividend is likely to be very stable (although it is in dollars, so UK investors take currency risk). Investing in the US solar market seems attractive to us. The US market for solar is already circa 6.5x larger than the UK’s, and is forecast to grow extremely rapidly. This means USF should be able to develop a pipeline of attractive assets rapidly should it choose to do so.

While climate change is arguably the world’s most pressing sustainability theme, there are many other issues that investors might view as investment opportunities within the ‘ESG’ universe. Within the alternative income universe, we would highlight other trusts in the property sector that investors might consider as ESG themes. Specifically, doctor’s surgery specialists Assura and Primary Health Properties. Alongside these, one might consider Target Healthcare REIT and Impact Healthcare REIT (LSE:IHR), which both invest in modern care homes.

With regard to IHR, aside from providing for an obvious social need, manager Impact Health Partners has put in place an ESG plan that commits the company to create homes which are more efficient, more climate-resilient, more comfortable for residents and staff, and more environmentally friendly. IHR aims to work with care home tenants to identify asset-management opportunities in support of these goals, such as in energy efficiency and the use of renewables. The action plan for 2020 included developing a sustainability strategy and plan, and addressing the issue of climate change.

The other subsector in the property space that could be interpreted as an ESG theme is social housing funds. Triple Point Social Housing REIT and Civitas Social Housing both focus on specialist supported housing, which means housing for those who are disabled or otherwise require support. There is a lot of demand for this housing, and these REITs offer investors a way to contribute to meeting that demand.

It is a young sector which has had some teething problems. The regulator has drawn attention to financial risks in the model the REITs use (e.g. by leasing their properties on long leases to operators with shorter-term contracts to supply services). There is also poorer-quality housing in the sector, and many operators are small scale and fall under the radar of the regulator. However, for investors who want to put their capital to work contributing to solving a social need, these could be worth considering. Residential Secure Income REIT invests mainly in retirement homes and shared ownership developments, and so the ESG angle is slightly diluted.

Cynics might say that these property and renewable energy infrastructure funds are merely positioning themselves for ESG investors, and that if investors didn’t provide capital through listed funds, they would be invested in by someone else. Nonetheless, we would argue that an investment in a medical property, social housing or renewable energy trust does a lot more good for society than investing in Amazon, Google or Microsoft via a fund with a Morningstar sustainability rating!

However, for those who wish to see an even greater ‘impact’ from their investment, the recently launched Schroder BSC Social Impact Trust (LSE:SBSI) invests in unlisted (private market) investments targeting sustainable returns, demonstrable social impact and low correlation to traditional financial and public markets. The expected yield is significantly lower than the alternative income funds we discuss above, at between 1% and 2%. This is clearly a less well-known area of investment that co-managers Schroders and Big Society Capital are aiming to access. We understand that between 30% and 50% of the portfolio will be invested in high-impact housing (which benefits vulnerable groups), 30–50% in providing debt solutions for charities and social enterprises, and 10–30% in social outcomes contracts with the UK government.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.