The UK shares this smaller company star investor has bought

This fund manager, who has a great track record of beating the market, has been shopping for bargains.

27th January 2022 11:32

by Kyle Caldwell from interactive investor

This fund manager, who has a great track record of beating the market, has been shopping for bargains.

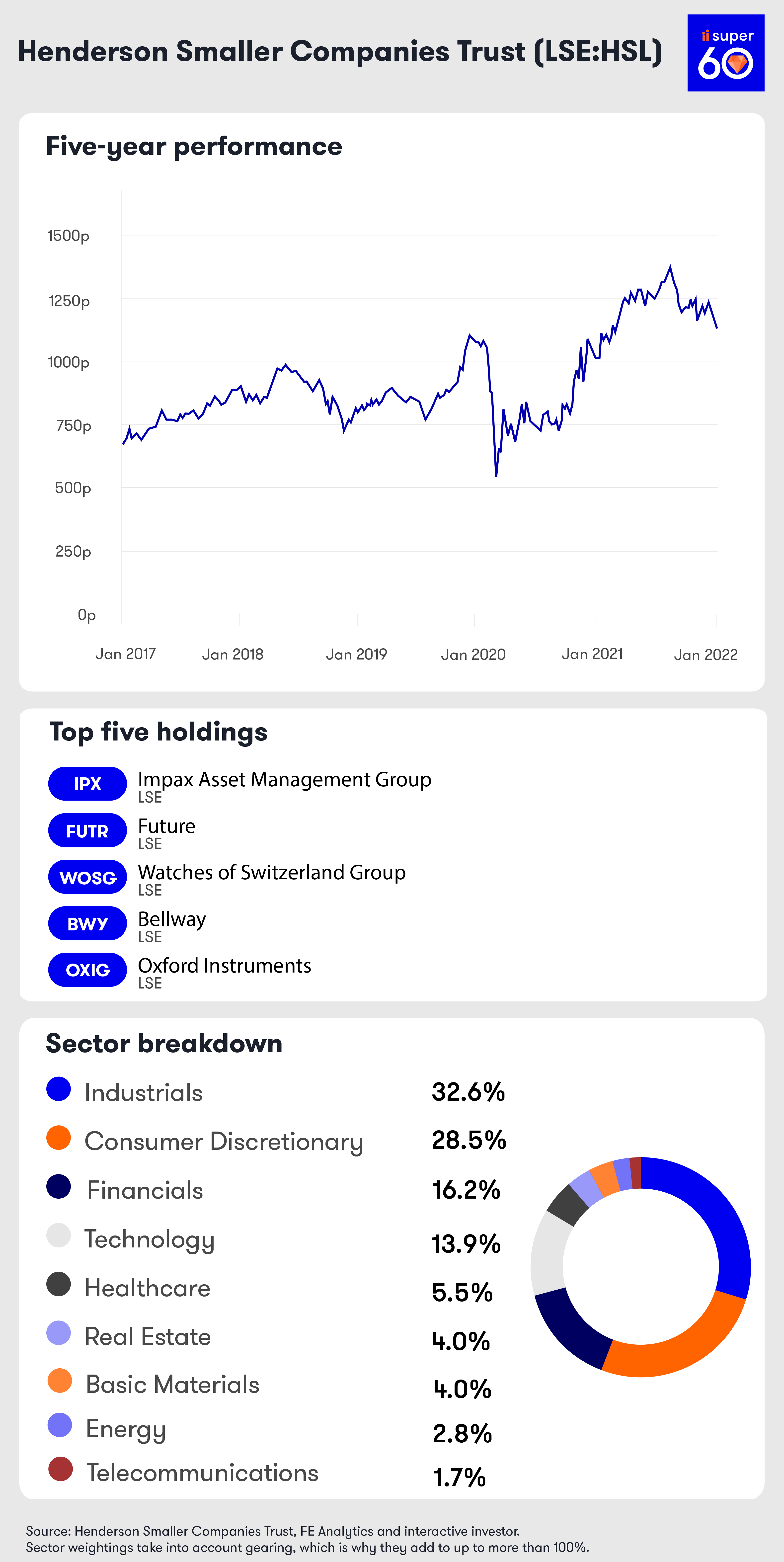

Neil Hermon, fund manager of the Super 60 rated Henderson Smaller Companies Investment Trust (LSE:HSL), has moved to take advantage of “fantastic buying opportunities” that have emerged following the recent underperformance of smaller companies.

Hermon, who has steered the trust to outperform the Numis Smaller Companies Index in 16 of the last 18 years, revealed in the trust’s half-yearly report that he had bought a number of new stocks over the period to 30 November 2021.

The new holdings are Access Intelligence (LSE:ACC), a software provider for the public relations and marketing services industries; Bridgepoint Group When Issue (LSE:BPT), a private equity manager; Devolver Digital (LSE:DEVO), a video game publisher; RPS Group (LSE:RPS), an engineering consultancy firm; SigmaRoc (LSE:SRC), an aggregates and construction materials group; Stelrad Group (LSE:SRAD), a steel radiator manufacturer; and Wickes (LSE:WIX), a home improvement retailer.

- Funds and trusts four professionals are buying and selling: Q1 2022

- Andrew Pitts’ trust tips: portfolios splutter, but potential bargains emerge

- Why financial advisers have learned to love investment trusts

Hermon said: “Our approach is to consider our investments as long term in nature and to avoid unnecessary turnover. The focus has been on adding stocks to the portfolio that have good growth prospects, sound financial characteristics and strong management, at a valuation level that does not reflect these strengths.

“Likewise, we have been employing strong sell disciplines to dispose of stocks that fail to meet these criteria.

“During the period, we have added to a number of positions in our portfolio and increased exposure to those stocks which we feel have further catalysts to drive strong performance.”

Shares exiting the portfolio include Coats Group (LSE:COA), Go-Ahead Group (LSE:GOG), Johnson Service Group (LSE:JSG) and Rotork (LSE:ROR). Sanne, St Modwen and Vectura were also sold after the companies received and agreed takeover bids.

Commenting on the outlook for markets, Hermon pointed out that corporate conditions are looking stronger. He notes that most companies are beating their initial post Covid-19 earnings and cash expectations.

He adds: “Although uncertainty remains around short-term economic conditions, the virus will pass and corporate profitability and economies are recovering. The movements in equity markets have thrown up some fantastic buying opportunities and we expect many listed companies to emerge stronger from the downturn.

“However, it is important to be selective as any recovery will be uneven and strength of franchise, market positioning and balance sheet will determine the winners from the losers in a post Covid-19 world.”

- Our outlook for 2022: key topics and investment ideas for the year ahead

- 11 investment trusts to earn £10,000 income in 2022

- Watch our latest fund manager interviews by subscribing for free to the ii YouTube channel

The trust delivered a net asset value (NAV) total return per share of -2.1% over the reporting period versus -2.8% for the Numis Smaller Companies Index. It lagged the Association of Investment Companies (AIC) UK Smaller Companies sector average, which was up 2.5%.

The company’s share price fell further than the NAV, a loss of 7.9% on a total return basis. The share price was negatively impacted by the trust’s discount widening from 3.7% at the end of May to 9.5% at the end of November. As of close of trading on 26 January, the trust’s discount stood at 7.3%.

In its six-month report, the trust’s board said it will maintain its interim dividend of 7p per share.

Smaller companies underperformed larger companies over the period. Hermon said this was driven principally by a rise in bond yields and the market rotating towards value over growth stocks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.