30 consistent funds: Annual review

A year on, we reveal the most reliable top-performing funds identified in 2018 and replace the laggards.

7th November 2019 10:19

by Jennifer Hill from interactive investor

A year on, we reveal the most reliable top-performing funds identified in 2018 and replace those that have fallen from grace.

It has by no means lost its shine, but our Consistent 30 line-up of funds that produce not just strong but also reliable returns over a three-year timeframe has seen a relatively large exodus this year. While 12 of the 30 funds remain gold or silver star performers – a decent record, given the universe of 2,141 funds analysed – 18 have fallen from grace, two more than last year and one more than the year before that.

"Over the past 12 months we've experienced a big sell-off across markets and seen central banks move from monetary tightening back to easing," says Darius McDermott, managing director at FundCalibre, a fund ratings provider.

"It has been a very volatile year, and that's perhaps why it has been more difficult to be consistent."

Nine funds leaving the line-up keep a place in the top 10% of their respective sectors over three years, compared with 10 in 2018 and five in 2017, but many of this year's outgoing funds have dropped down the rankings sharply over the past year.

Four exiled funds – Hermes Asia ex-Japan Equity, ASI Global Smaller Companies, Baillie Gifford American and Schroder Income (LSE:SCF) – have seen their performance plummet from heavenly to hellish, landing them in the bottom 10% of their sectors.

An overweight position to financials – which have been battered by Brexit-related headwinds – has hurt Schroder Income, while other funds have lost their shine due to a sharp reversal for the high-growth stocks that have supercharged stockmarket returns since the financial crisis.

Baillie Gifford, a staunch growth investment house, has the most fallen angels, three in total. "The past year has been volatile for markets and seen styles in fashion switching between growth, high growth and value," says Ben Yearsley, a director at Shore Financial Planning . "Baillie Gifford and to some extent the ASI Global Smaller Companies fund are heavily invested in 'go-go' growth areas of the market such as technology and consumer stocks. They have had a tough time so far this year, whereas value has come back a bit and steadier growth opportunities have been more in vogue."

Three of our 30 funds – Lindsell Train Japanese Equity, Pimco GIS UK Long Term Corporate Bond and Royal London Sustainable World Trust – have been shining examples of stability since the inception of our line-up in 2016.

Funds with a sustainability focus are firmly in the ascendency, with five out of the six most consistent funds across three multi-asset sectors prioritising environmental, social and governance (ESG) factors.

This is supportive of a growing body of research that shows a positive link between sustainable investing and a firm's long-term financial performance. Morningstar's analysis of academic studies on the subject and its own analysis of performance data both point to companies with higher ESG ratings outperforming comparable firms that do not have an ESG remit in both accounting and stock market terms over time.

"Portfolios with ethical credentials can be seen as proxies for new technologies, dynamic management teams and efficient processes – all of which are accretive to alpha over time," says Gary Waite, a portfolio manager at Walker Crips.

UK equity stars

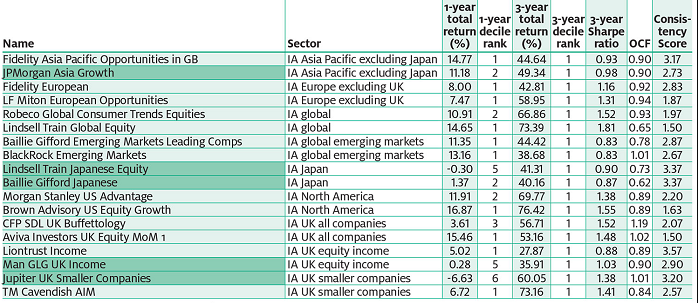

The Consistent 30 features the two most consistent top-performing funds across 15 leading Investment Association sectors. Among our three UK equity sectors, two out of six funds remain beacons of stability.

For the third year running, it is all change in the UK all companies sector. The sheer size of the sector, which is home to 167 eligible funds (the main criteria for eligibility being a three-year track record and having the same fund manager at the helm throughout), makes it incredibly difficult to retain a top-two spot. This year 25 eligible funds are among the top 10% of peers over three years – making it the second-most fiercely contested sector behind global equities.

Aviva Investors UK Equity MoM 1 and Castlefield CFP SDL UK Buffettolgy replace MFM Bowland and MI Chelverton UK Equity Growth, last year's top two performers. The incoming funds have among the highest returns over three years, at more than 50%, as well as the best consistency scores of 1.5 and 2.07 respectively.

Consistency is measured by the average decile ranking over 30 rolling six-month periods; the lower the score, the better. A score of around two means a fund has dropped out of the top two deciles a few times during the past three years but has mostly been in the first or second decile.

In the UK equity income sector, Man GLG UK Income takes gold after two years of silver status. It is the top performer over three years, having gained almost 36%, and boasts the lowest consistency score of 2.9. Liontrust Income takes silver with a three-year return of almost 28% and a consistency score of 3.57, ousting Schroder Income (LSE:SCF), a fallen angel that has lost more than 6% over the past year. Its 'deep value' style and bias towards banks have been truly out of favour.

TM Cavendish AIM is the new leading light in the UK smaller companies sector, having produced the highest three-year return at 73% and lowest consistency score of 2.57. UK smaller companies have sold off in the run-up to Brexit, and it is the only contender in this sector to have produced a positive one-year return, at almost 7%.

Jupiter UK Smaller Companies moves into second place with a three-year return of 60% and consistency score of 3.2. It succeeds TB Amati UK Smaller Companies, which featured in our Consistent 30 from the start but has slipped down the rankings over the past year.

Most consistent top-performing equity funds

Notes: Dark green = Retained from 2018. Light green = new for 2019. Source: FE, as at 1 October 2019

Global luminaries

Three out of 12 funds in global and overseas equity sectors continue to shine. Two are in the Japan sector, where Baillie Gifford Japanese retains gold and Lindsell Train Japanese Equity silver, thanks to solid three-year returns of more than 40% and good consistency scores of 3.37.

The third is JPMorgan Asian Growth (LSE:JAI) in the Asia Pacific excluding Japan sector. It retains its top spot from last year with the highest returns, at more than 49%, and lowest consistency score of 2.73.

Hermes Asia ex-Japan Equity has fallen from grace and lost the silver rating it held in 2018 and 2017. It is in the bottom 10% of funds over the past year with a loss of almost 7%, due to stock-specific issues and a value tilt. This poor performance has seen multi-manager Architas reduce exposure to the fund over the past year, particularly in its lower-risk portfolios.

"The fund has undoubtedly underperformed, but we still think the strategy has the potential to perform well in the future," says Sheldon MacDonald, Architas' deputy chief investment officer.

"Value as a style has underperformed quite dramatically this year, which has obviously hindered this and other similar style strategies, but that's not to say the trend will continue."

To balance this value approach, it uses Fidelity Asia Pacific Opportunities, which has more of a growth strategy. It is our incoming second-placed fund in this sector. McDermott at FundCalibre rates it as a "great" fund and manager Anthony Srom an "excellent stockpicker". "It's good to see this enter the table," he says.

Among global funds, Lindsell Train Global Equity and Robeco Global Consumer Trends Equities replace Morgan Stanley Global Opportunity and ASI Global Smaller Companies. The rising stars have remarkably low consistency scores of 1.5 and 1.97, respectively.

Baillie Gifford Emerging Markets Leading Companies and BlackRock Emerging Markets shine brightest among global emerging markets funds, succeeding fundamentally weighted tracker fund FP Henderson Rowe FTSE RAFI Emerging Markets and UBS Global Emerging Markets Equity.

Elsewhere, Baillie Gifford has not fared so well, as a pullback in the tech-focused names its managers tend to favour affects its consistency. In European equities, Baillie Gifford European hands its gold star to LF Miton European Opportunities and in North America Baillie Gifford American loses its top spot to Brown Advisory US Equity Growth.

Bright bonds

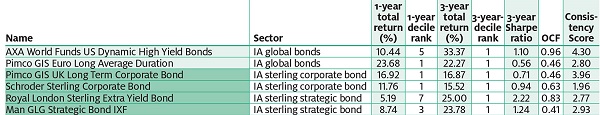

Bond funds show the greatest stability this year, with last year's sterling corporate and sterling strategic bond stars retaining their status. Many of them have chunky allocations to longer-dated bonds, which "have been the place to be invested for a long while now, as the 'lower for longer' theme has gained wider acceptance", says Yearsley.

Schroder Sterling Corporate Bond and Pimco GIS UK Long Term Corporate Bond are gold and silver among sterling corporate bonds with steady returns and attractive consistency scores of 1.9 and 3.67, respectively.

In the sterling strategic bond sector, Royal London Sterl Extra Yield Bond is number one for the second consecutive year; Man GLG Strategic Bond IXF, rebranded from Sanlam Strategic Bond after Man GLG bought Sanlam FOUR's strategic bond investment strategy and £290 million of assets last September, is number two.

Strategic bond funds, which have the flexibility to invest across the fixed-income spectrum and can arguably react more quickly to macroeconomic events, have produced the best three-year returns among sterling bond funds: 25% for the Royal London fund and almost 24% for the Man GLG one.

AXA World Funds US Dynamic High Yield Bonds, our new silver fund among global bond funds, is the top performer at 33%. However, Pimco GIS Euro Long Average Duration takes gold, despite its lower return of 22%. Its consistency score is by far the best in the sector at 2.8. These two replace GAM Star Credit Opportunities and Nomura Global High Yield Bond respectively.

Most consistent top-performing bond funds

Note: Dark green = Retained from 2018. Light green = new for 2019. Source: FE, as at 1 October 2019

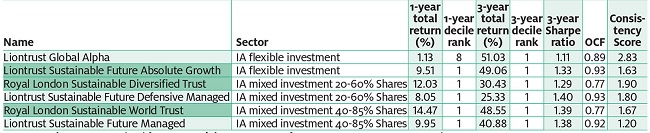

Sustainable pace-setters

Royal London and Liontrust clean up in our three mixed-asset sectors, largely with funds that invest sustainably. Royal London Sustainable Diversified Trust moves from silver to gold in the mixed investment 20-60% shares sector, knocking out AXA Global Distribution. Liontrust Sustainable Future Managed takes silver with slightly lower three-year returns (25% versus 30%) and a very similar consistency score to the Royal London fund (1.8 versus 1.9).

It is a parallel picture in the mixed investment 40-85% shares sector, with Royal London Sustainable World Trust moving from second to first – replacing Baillie Gifford Managed, which has slid down the performance table – and Liontrust Sustainable Future Managed ascending to enter our line-up. This year’s stars have returned 49% and 41% respectively over three years with consistency scores of 1.67 and 1.2.

Liontrust Sustainable Future Absolute Growth retains gold in the flexible investment sector, with a return of 49% and consistency of 1.63, while Liontrust Global Alpha takes silver from Unicorn Mastertrust, which has fallen from grace with a one-year loss of 0.5%. The rising star has delivered 51% over three years and scores 2.83 for consistency, versus 28% and 3.83 for the fallen angel.

Shane Bennett, head of investment at Cathedral Financial Management, likes the team behind the Liontrust Sustainable Future range, which is "among the pioneers" of sustainable investment. "The managers have a reputable track record of engaging with companies on areas such as scrutiny of business conduct and encouraging better reporting of material ESG factors," he says.

Most consistent top-performing mixed-asset funds

Notes: Dark green = Retained from 2018. Light green = new for 2019. Source: FE, as at 1 October 2019

Consistent 30 methodology

To make the grade, a fund's performance must have been in the top 10% of the sector in question for at least the past three years.

Crucially, a fund must also have one of the best three-year consistency scores, as measured by the fund's average decile ranking during 30 rolling six-month periods over the same timeframe.

Small funds with less than £25 million in assets are filtered out, as are funds that have not had the same fund manager at the helm throughout the three years.

We have taken charges into account and may occasionally penalise funds charging a premium price when it has been a close call between several candidate funds.

The 15 sectors analysed include the leading equity, bond and multi-asset sectors. We have excluded smaller sectors such as global equity income, and also the targeted absolute return and specialist sectors, where fund focuses and asset classes are particularly diverse.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.