Shares for the future: maximum score for price but risk increases

This company scores highly for price, which bumps up its ranking, but is a current position of 13th in the Decision Engine a bad omen? Analyst Richard Beddard explains his rationale.

27th September 2024 15:00

by Richard Beddard from interactive investor

I last evaluated Focusrite (LSE:TUNE)in December 2023 after it published its annual report. I was enamoured. It was a good company and the price was cheap.

Since then, the supplier of music equipment has announced it has made less revenue and profit in the year just concluded (but yet to be reported) than it did in the year to August 2023.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

Focusrite anticipates that it will report £157 million revenue, 12% lower than in 2023. Adjusted operating profit will fall further, judging by analysts’ forecasts, maybe by as much as 50%.

Although previous years’ declines in profit were less dramatic, it is the third consecutive year that profit has fallen.

The share price has plumbed depths last visited on the way up in 2018.

“b” indicates an addition to the model Share Sleuth portfolio

I rescore shares at roughly the same time every year, so I will be re-evaluating Focusrite in December or January, when I have all the facts in its forthcoming annual report.

But the news emerging this year has provoked me to rethink last year’s analysis. I should have been more circumspect then. We need to be more circumspect now.

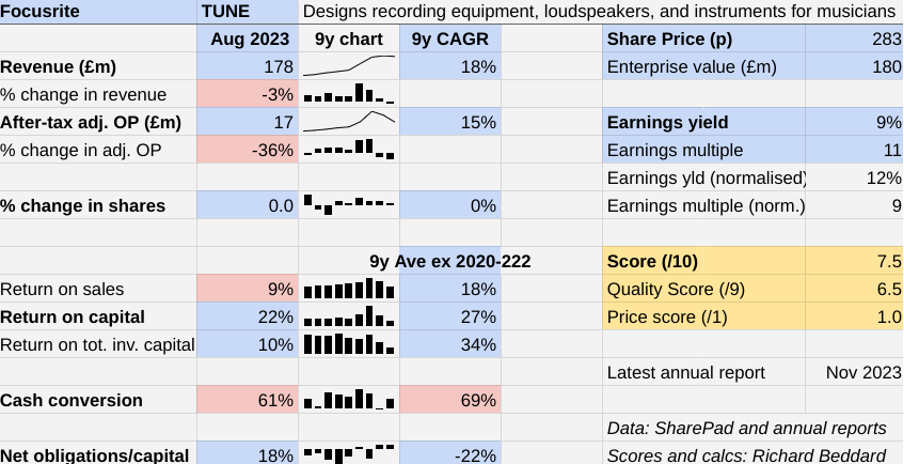

These are the numbers for the year ending August 2023 with my revised quality score:

As you can see, Focusrite still scores 7.5/10.

The main reason it scores so highly, though, is price. The price score has the potential to add up to one point to a company’s score but deduct up to three points.

Focusrite’s price score is at the maximum of 1, even though I have changed how I calculate it.

I compare the share price to the profit a company would have achieved had it earned its average return on capital in the most recent financial year. The average is taken from a representative number of years.

Usually these years are contiguous, but the last nine years are probably not representative because of a boom in demand for Focusrite’s biggest products during the pandemic.

- Stockwatch: should you buy this recovery story?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

To value the business more conservatively, I have excluded the bumper returns from 2020 to 2022.

Even so, at 285p, the share price is so low that Focusrite still gets a maximum score. The price is 9 times normalised profit.

This really is one of those occasions when you ask yourself whether it is you who is mad, or all the traders who got the share price to where it is today.

Having rescored the quality factors, I reckon we’re all culpable. I was too optimistic. The herd is too pessimistic...

Rescoring Focusrite

Erring on the side of caution, I have reduced Focurite’s “quality score” by 1.5 points.

Most of my doubts result from not knowing, rather than knowing. For example, the pandemic effect may mask the impact of other, perhaps less transient factors.

Two of these factors, brand maturity and China supply, I recognised last time but I may have underestimated their importance.

And I did not consider Focusrite’s acquisition programme to be a problem, but it might be.

The great thing about a scoring system is that it can embrace uncertainty. When I scored Focusrite last December, I did not feel as uncertain as I do today.

Here are the revised scores:

The Past (dependable) [2.5]

- Profitable growth: Nearly 20% compound annual growth rate (CAGR) revenue and profit [1]

- Strong finances: Not reliant on debt [1]

- Through thick and thin: Pandemic weirdness [0.5]

The Past score is unchanged. It is, after all, based on the past!

The phrase “pandemic weirdness” acknowledges that Focusrite’s extraordinary growth and profitability between 2020 and 2022 was unsustainable and its past record might be misleading me.

The bubble was created by locked-down musicians who recorded more music and started up podcasts in their bedrooms and home studios.

They used Focusrite’s biggest selling products, principally the Scarlett digital interface. This piece of kit enables musicians to plug their instruments into a computer and record audio.

Demand has declined since then because people have other things to do. Retailers and distributors are running down their enlarged stocks before buying more equipment from Focusrite. And Focusrite introduced a new version of Scarlett into this overstocked market.

One caveat. If the results for 2024 are bad enough, the Past score might change when I score Focusrite in December or January. That is because the year to August 2024 will be in the past then and the averages and growth rates will be different.

I do not think it is likely, but it is possible.

The Present (distinctive) [2.5]

- Discernible business: Famous brands, some of them mature [0.5]

- With experienced people: chair is founder and large shareholder [1]

- That creates value for customers: ease of use, 24/7 support [1]

The Present score is half a point lower. Focusrite told us in last year’s annual report that some of its established brands have more than 30% market share. They are not expected to grow faster than the market, which is contracting due to the pandemic effect.

As Focusrite’s biggest selling product, Scarlett, has been market leader for 11 years, I think we should assume it is one of these brands. This limits the attraction of Focusrite as an investment, unless the company can find new sources of growth.

This is one of the problems Focusrite is addressing...

The Future (directed) [1.5]

- Addressing challenges: new sources of growth, China supply [0]

- With coherent actions: innovates, acquires established brands [0.5]

- That reward all stakeholders fairly: run by enthusiasts, good NPS scores [1]

The future score is a whole point lower than it was in December.

I recognised the risk that mature brands might be difficult to grow, but I may have underestimated the risk presented by Focusrite’s long supply chain. Focusrite sources more than half of its products in China.

Events this year show we do not just have to worry about tariffs and trade wars, which the company may address by shifting some manufacturing to other countries in Asia.

That does not help with geopolitical risks closer to home though, like conflict in the Middle East, which has disrupted shipping, increased costs and lowered expectations for profit in 2024 and maybe beyond.

It may be an overreaction, but I am raising the risk level and reducing Focusrite’s score for “addressing challenges” from 0.5 to 0. The challenges are severe.

I should also have recognised that Focusrite’s acquisition programme is very young.

The acquisition of Adam Audio in July 2019 was the company’s first since 2004. Adam Audio’s speakers are used by recording artists like its interfaces, but when the company acquired Martin Audio, it entered a different market. Martin Audio makes loudspeakers for playing music. They are used on tour, and in venues.

- Insider: director spends £100k on shares at 15-year low

- Will Labour make these big changes to the state pension?

Subsequent acquisitions have been folded into two divisions, Content Creation, of which the original Focusrite is the biggest business, and Audio Reproduction, home of Martin Audio.

Thinking more clearly now, I am on the fence about whether these acquisitions have created value. Focusrite has been quite aggressive, spending more than it has earned in free cash flow since 2019.

It is too soon to be confident that Focusrite is a good acquirer, especially as we are judging it through a period when returns have been far from normal.

Focusrite must change to accommodate its acquisitions. It has chosen to integrate sales and administrative functions and to get subsidiaries working together on products.

While the intention is to be more efficient and reduce cost, integrating businesses can be disruptive, and Focusrite is fairly new to it.

I have reduced Focusrite’s score for “coherent actions” from 1 point to 0.5.

Balance of risk

There is a lot to like about Focusrite. It has market-leading products, experienced management and a good reputation. Even though it is experiencing weaker demand, it says it is gaining market share.

But it has also become bigger and more complex since 2019, and this combined with the risks to its long supply chain make me more nervous about the future.

Its score of 7.5 reflects this balance of risk. It is probably still a good long-term investment, but it is currently ranked 13 by the Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Cropper (James) (LSE:CRPR) has published its annual report, and I am currently re-scoring it. Its score is provisional.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.4 | ||

5 | Distributor of protective packaging | 8.4 | ||

6 | Supplies kitchens to small builders | 8.4 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.1 | ||

8 | Whiz bang manufacturer of automated machine tools and robots | 8.0 | ||

9 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.9 | ||

11 | Manufactures military technology, does research and consultancy | 7.7 | ||

12 | Manufactures filters and filtration systems for fluids and molten metals | 7.6 | ||

13 | * | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | |

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Manufactures computers, battery packs, radios. Distributes components | 7.5 | ||

16 | Sells hardware and software to businesses and the public sector | 7.4 | ||

17 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

18 | Surveys and distributes public opinion online | 7.3 | ||

19 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.2 | ||

20 | Distributes essential everyday items consumed by organisations | 7.1 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 7.0 | ||

22 | Translates documents and localises software and content for businesses | 7.0 | ||

23 | Manufactures natural animal feed additives | 7.0 | ||

24 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.7 | ||

26 | Online retailer of domestic appliances and TVs | 6.6 | ||

27 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

28 | Online marketplace for motor vehicles | 6.6 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

30 | Retails clothes and homewares | 6.2 | ||

31 | Acquires and operates small scientific instrument manufacturers | 5.9 | ||

32 | Manufactures sports watches and instrumentation | 5.8 | ||

33 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.8 | |

34 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.6 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.5 | ||

39 | Manufactures specialist paper, packaging and high-tech materials | 3.6 | ||

v Frozen v | ||||

na | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Focusrite and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.