Shares for the future: is my top 10 stock safe?

This company is worth 23% more since columnist Richard Beddard first rated it a good long-term investment last summer. Here’s what he thinks now with the share price at its highest in over 25 years.

19th April 2024 15:01

by Richard Beddard from interactive investor

I am kicking myself for not adding Macfarlane Group (LSE:MACF) to the Share Sleuth portfolio last year when I first scored it. One of the reasons I hesitated is that the company was new to me then, and novelty is appealing.

In contrast, I have written about some of the shares in the Decision Engine once a year for 15 years. The ups and downs we have experienced mean they may sparkle less, but I know them warts and all. It is a difficult comparison.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

One year on though, and I feel much the same way about Macfarlane. It is a good business, although it is slightly less attractively priced.

Scoring Macfarlane: saved by acquisitions

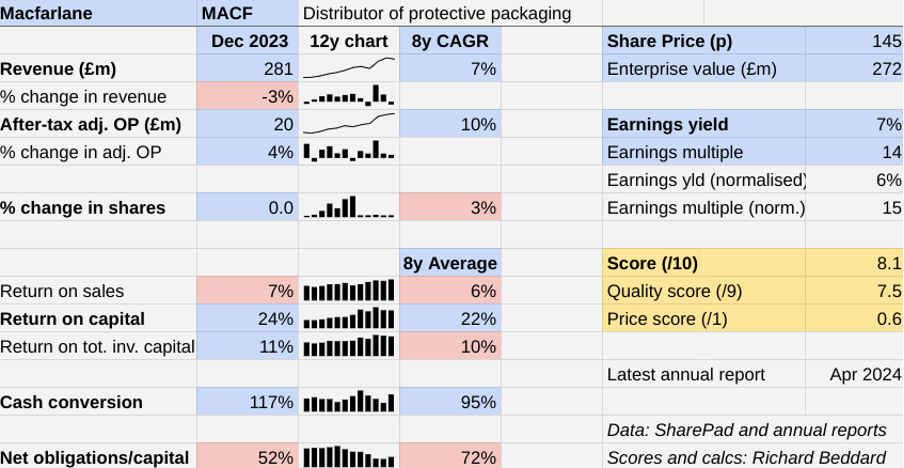

2023 was not, actually, a banner year for the protective packaging distributor and manufacturer. Revenue fell by 3%.

The Past (dependable) [2.5]

- Profitable growth: 8y profit CAGR of 10% on 7% revenue CAGR [1]

- Strong finances: Debt has reduced, but still 52% funded by lease obligations [0.5]

- Through thick and thin: Minimum ROC 10% in 2012 and 2013 [1]

That is unusual, only the third time revenue has declined in 12 years, but it follows two years of strong growth.

Macfarlane says it experienced weak customer demand from existing customers due to the higher cost of living, and as business at online retailers calmed down following a boom during the pandemic.

However, post-tax adjusted operating profit increased 4% due to three profitable acquisitions, the management of volatile input prices (paper, polythene film, timber and foam), and strong new business wins.

Although packaging is a fairly low margin business, Macfarlane has steadily improved, increasing post tax adjusted profit margin to 7% in the last three years, compared to 4% or 5% a decade or so ago.

Factoring in capital turnover, the resulting return on capital is very good - 22% on average.

The 3% Compound Annual Growth Rate (CAGR) in the share count flashing pink on my dashboard above, reflects significant share issues before 2018 when the company was routinely selling shares to fund acquisitions:

Name | Year | Consideration (£ million) | Activity | Location |

Allpack | 2024 | 3.3 | Distribution | Bury St Edmunds |

B&D | 2023 | 3.6 | Manufacturing | Barnstaple |

Gottlieb | 2023 | 3.4 | Distribution | Manchester |

Suttons | 2023 | 9.0 | Manufacturing | Chatteris |

PackMann | 2022 | 8.6 | Distribution | Eppelheim (near Heidelberg), Germany |

Carters | 2021 | 4.5 | Distribution | Redruth |

GWP | 2021 | 15.1 | Manufacturing and distribution | Salisbury and Swindon |

Leyland | 2019 | 3.3 | Distribution | Leyland |

Ecopac | 2019 | 3.9 | Distribution | Aylesbury |

Greenwoods | 2017 | 16.8 | Distribution | Melton Mowbray |

Nelsons | 2016 | 6.8 | Distribution | Leicester |

Edward McNeil | 2016 | 1.8 | Distribution | Glasgow |

Colton | 2016 | 1.3 | Distribution | Teesside |

One | 2015 | 2.8 | Distribution | Bingham |

Network | 2014 | 7.5 | Distribution | Wolverhampton |

Lane | 2014 | ? | Distribution | Reading |

Since fundraising for Greenwoods, Macfarlane’s biggest-ever acquisition in 2017, it has self-funded acquisitions, while allowing its financial obligations to decline to a respectable level. At the end of the financial year, the business was half funded by other people’s money, mostly lease obligations.

Generally, the numbers have once again moved in the right direction but I am not sure whether they are sustainable, so I have used the last eight years to calculate the averages.

Macfarlane is notable for its cash generation, 95% of adjusted operating profit is turned into cash, and it uses the cash to buy smaller versions of itself...

The Present (distinctive) [3]

- Discernible business: Distributes and makes protective packaging [1]

- With experienced people: CEO and CFO are very experienced [1]

- That creates value for customers: Expertise, range and nationwide reach [1]

The growth of e-commerce, accelerated during the pandemic, has helped Macfarlane scale up, but the main mechanism has been acquisitions.

The roll up has turned Macfarlane into a nationwide operation, allowing it to source products in bulk and consolidate warehouses. Scale advantages reduce cost, allow it to offer a wider product range to customers, and make it a particularly attractive partner to customers that operate nationwide.

Packaging is also becoming more complicated as customers seek to avoid plastic and reduce their carbon footprints.

Through its sales process and online Packaging Optimiser, the company seeks to show customers how much they can make their packaging more sustainable and save by, for example, using packaging that reduces return rates due to fewer breakages in transit, reduces waste, costs less to store and transport, and eases packing and unpacking.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: will good times return for this cheap stock?

- Four climate change winners and one big loser

Scale gives Macfarlane an advantage against regional and local distributors, while its focus on protective packaging helps it compete against large diversified international distributors (such as Bunzl).

Macfarlane is not all about storing and shifting cardboard boxes, though.

B&D, the latest company to join the manufacturing division, serves the aerospace and defence markets. In 2023 it made an aluminium satellite container for Astroscale, a company planning to launch a satellite to take space debris out of its orbit so it burns up in the atmosphere.

The Manufacturing division makes bespoke protective packaging for high value products in storage and transit. It is a much smaller but higher margin business.

The Future (directed) [2]

- Addressing challenges:UK business maturing? [0.5]

- With coherent actions: Diversify into manufacturing and Europe [0.5]

- That reward all stakeholders fairly: [1]

Although investors often regard acquired growth as bought rather than earned, I judge it less harshly when the money comes from the company’s own cash flows, and the acquisitions fit neatly into the mothership.

This describes Macfarlane’s activity since 2017, at least when it comes to bolting businesses onto its UK distribution network.

In Europe, acquisitions are riskier because they cannot be integrated so intimately. Macfarlane has yet to follow up the acquisition of PackMann, which is based in Germany, with another European distributor so its European operation is small, essentially there to supply UK customers with operations in Europe.

The shift in emphasis towards manufacturing and Europe makes me wonder whether Macfarlane’s UK distribution roll-out is running out of road.

UK distribution revenues amount to about a fifth of the UK protective packaging distribution market, according to figures given to me by Macfarlane. This makes it the UK's leading distributor.

- Stockwatch: why I’m downgrading this FTSE 100 share

- Three steps for investors as inflation cools to 3.2%

- Sector Screener: two UK tech stocks with long-term investment appeal

The company is still acquiring small distributors, though. The latest is Allpack of Bury St Edmunds acquired in March this year, after the financial year end.

European profits are growing from a very low base (7% of total operating profit in 2023, from 8% of revenue).

And Manufacturing is turning into a profit centre. Macfarlane bought GWP in 2021 and Suttons and B&D in 2023. In 2023, the division earned 24% of total operating profit from 13% of total external revenue.

Macfarlane is developing GWP into an in-house supplier for the distribution network, which may create more value but also risks complicating the business.

The price (discounted?) [0.6]

- Yes. A share price of 145p values the enterprise at about £272 million, 15 times normalised profit.

I like Macfarlane.

The company has a customer net promoter score of 60, which means customers recommend it.

It says employee retention is high at management level. At the executive level it is very high. Chief executive Peter Atkinson and chief financial officer Ivor Gray have both been with Macfarlane for more than 20 years (Mr Gray became chief financial officer in 2021).

Although Macfarlane’s median pay of £29,000 is below the national median, it is above other low paid sectors like hospitality. In 2023, Macfarlane increased the pay of lower paid employees by 8% and higher paid employees by 3%, levelling things up a little bit.

A score of 8.1 out of 10 indicates Macfarlane is probably a good long-term investment.

It is ranked 9 out of 40 shares in my Decision Engine.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. Scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Howden Joinery Group (LSE:HWDN), Bunzl (LSE:BNZL), 4imprint Group (LSE:FOUR), Judges Scientific (LSE:JDG) and Next (LSE:NXT) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.3 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Supplies kitchens to small builders | 8.6 | |

4 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

5 | Translates documents and localises software and content for businesses | 8.5 | |

6 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

7 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.4 | |

8 | Manufactures filters and filtration systems for fluids and molten metals | 8.3 | |

9 | Macfarlane | Distributor of protective packaging | 8.1 |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Imports and distributes timber and timber products | 7.8 | |

13 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

14 | Distributes essential everyday items consumed by organisations | 7.5 | |

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | |

16 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.5 | |

17 | Online retailer of domestic appliances and TVs | 7.4 | |

18 | Whiz bang manufacturer of automated machine tools and robots | 7.4 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.1 | |

21 | Online marketplace for motor vehicles | 7.1 | |

22 | Makes marketing and fraud prevention software, sells it as a service | 7.0 | |

23 | Manufactures vinyl flooring for commercial and public spaces | 6.6 | |

24 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | |

25 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | |

26 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.5 | |

27 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

29 | Flies holidaymakers to Europe, sells package holidays | 6.3 | |

30 | Manufactures military technology, does research and consultancy | 6.2 | |

31 | Surveys and distributes public opinion online | 6.1 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6.1 | |

33 | Publishes books, and digital collections for academics and professionals | 5.7 | |

34 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

35 | Manufactures sports watches and instrumentation | 5.5 | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | |

37 | Supplies software and services to the transport industry | 5.3 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Retails clothes and homewares | 4.7 | |

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Macfarlane and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.