Shares for the future: this small-cap’s 2023 is like a fever dream

This company, which columnist Richard Beddard believes could be a good long-term investment, can currently be bought at prices rarely seen since IPO almost 10 years ago.

15th March 2024 15:19

by Richard Beddard from interactive investor

2023 was a remarkable year for vehicle tracking company Quartix Technologies (LSE:QTX), and not in a good way. It acquired a software supplier and then, after a few months and wholesale changes to the board, it decided to wind the acquisition down.

- Invest with ii: Open an ISA | Top UK Shares | Transfer an ISA to ii

Scoring Quartix: fever dream

Replaying the events is like experiencing a fever dream.

The Past (dependable) [2]

- Profitable growth: Profit has contracted [0]

- Strong finances: Net cash [1]

- Through thick and thin: Yes [1]

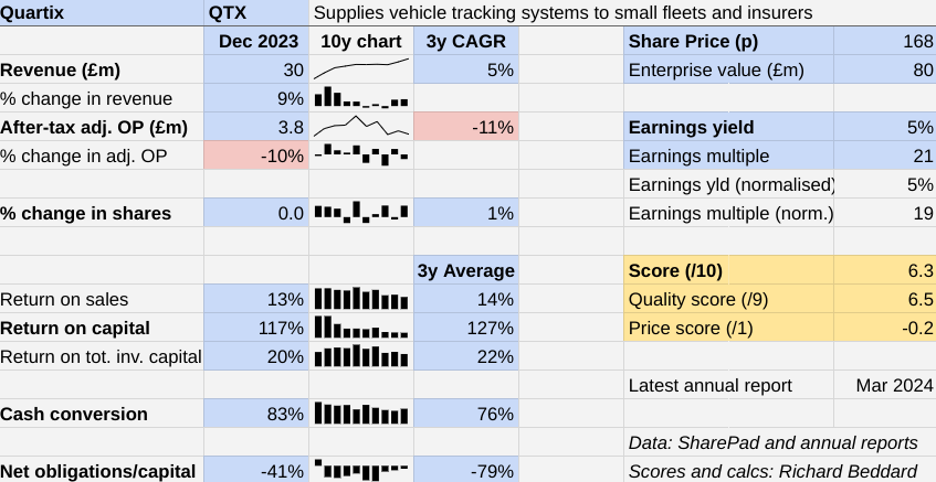

In the year to December 2023, Quartix grew revenue by 9%, but adjusted profit fell 10%, a casualty of increasing costs relating to the botched acquisition, upgrades to the tracking hardware device, and pay rises.

The profit figure ignores hefty one-off costs. The biggest, is a £3.8 million provision for the replacement of 2G vehicle tracking units with 4G units in France over the next couple of years. The older units will stop working when French mobile networks switch off 2G in 2025 and 2026.

Quartix is replacing the devices for free, to avoid losing hard won customers who pay a subscription for tracking services.

While the cash was not spent in 2023 and the provision would distort our perspective of the company’s profitability in the year, it will be spent soon.

Quartix made a similar provision in 2020, to replace soon to be obsolete US units, and it may act again when UK networks finally retire 2G, probably towards the end of this decade.

For a while, therefore, Quartix is a good deal less profitable than the adjusted figures show.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: a £1bn AIM share to consider for your ISA?

To fund the replacement of soon to be obsolete trackers from its cash reserves, Quartix has cut the dividend. This may not have been necessary had it not acquired Konetik, which is where the second exceptional cost comes in.

Having decided to wind Konetik down, Quartix has written-off £2.7 million of goodwill.

The acquisition of Konetik is inexplicable. It was the developer of EVolve, Quartix’s tool to help fleet managers plan their migration to electric vehicles (EVs) using data collected by their tracking devices.

The tool has turned out to be a dud. Delays to EV transition deadlines meant the urgency of EV migration was reduced, but had the demand been there, EVolve’s limited scalability meant it would have to have been reengineered anyway.

In one conspicuous way, EVolve was a most un-Quartix like product. Although the company initially thought it would earn recurring revenues from it, very shortly after buying Konetik it decided most customers would have only used it once.

The Present (distinctive) [3]

- Discernible business: Straightforward, effective vehicle tracking [1]

- With experienced people: Andy Walters co-founded Quartix [1]

- That creates value for customers: Low cost, low commitment [1]

Vehicle trackers help owners keep tabs on their vans' locations and how they are being driven. Principally they check drivers are where they should be, but they also help route them more efficiently and check they are driving at safe and efficient speeds.

Quartix has succeeded in this competitive market by keeping things simple and low cost. It markets a generic device from its call centre in Newtown in Wales. The service is delivered through cloud-based software that customers can configure.

Even the trackers can be self-installed, or installed by third party engineers. Contracts typically last two years, after which customers pay as they go.

Historically this offer has been most attractive to small businesses that want a simple contract and a low-cost product that works out of the box.

The fleet attrition rate, though, has risen gradually over the years from about 10%, well below industry norms, to 13.3% in 2023, which is still low according to Quartix. The average unit is installed for 7.5 years, but not so long ago it was 10 years.

These figures are very important, because marketing is Quartix’s biggest expense. Once the device is installed, the service is cheap to provide.

For most of its 23-year history, this singular focus has been maintained by one of its founders, Andy Walters.

But the Konetik debacle, which occurred at the end of the two-year interregnum of former chief executive Richard Lilwall, shows he had different ideas about the company’s direction.

The Future (directed) [1.5]

- Addressing challenges:Price deflation, 4G replacement (UK?), US expansion, Succession [0]

- With coherent actions: Focus on costs, automation, standardisation [1]

- That reward all stakeholders fairly: Staff turnover 31%! [0.5]

Konetik was a big departure for Quartix, and it surely led to the departure of Mr Lilwall, who left the business shortly after Andy Walters returned, initially to conduct a strategic review and then to run the business as executive chairman again.

It is tempting to believe we are back where we were in 2022, albeit after a distracting detour and ding to the company’s financial bumper. But there was a problem in 2022: who would manage the company when Andy Walters, who is in his late sixties, retired? It has not been resolved.

On top of that, Quartix exists in a very competitive industry, selling through price comparison sites as well as directly through telesales and its website. To grow revenue, it must grow its subscription base sufficiently to offset price erosion and cost increases.

Although pricing has been stable over the last five years, before that prices were falling. As a result, Quartix experiences price erosion when it loses business from customers who subscribed at higher rates and wins new custom at lower rates. In 2023, price erosion was 4.6%, lower than in recent years.

Aside from Konetik, costs have risen due to international expansion, wage inflation and because Quartix is shipping more expensive 4G units that will still work when the 2G networks are switched off.

In 2023, Quartix still earned most of its revenue (60%) in the UK, where it has been operating since 2001.

Perhaps demonstrating the market’s maturity, the UK subscription base increased by 7.4% in 2023, which only generated 1.3% more revenue due to price erosion.

Some of Quartix’s overseas markets are growing much faster. After the UK, it has been operating longest in France, where it has a sizable subscription base that grew 29% in 2023. It is also growing rapidly from much smaller bases in Spain, Italy and Germany.

But it is actually contracting in its third largest market, the US, despite a shift in strategy to target Texas in 2022. The company says changes of strategy there have diminished its sales resources, but it hopes to show some improvement in 2024.

Generally, Quartix’s response to strategic challenges is to get back to basics; investing in sales and marketing, improving the product, and in particular focusing on cost leadership.

The wording in the annual report is vintage Walters. The company “...recognises that, in recent years, its overhead structure has grown at a faster rate than revenues, and attention will be brought to bear on this during 2024.”

Quartix “...will continue to implement data-driven optimisation across the sales and marketing funnel and execute automation and simplification across business processes in order to drive growth.”

A third generation of its 4G product should go into production later this year, with the objective of reducing unit manufacturing costs to their lowest ever level.

While it is reassuring to see Quartix behaving more predictably again, there is one more challenge on the horizon: the retirement of the UK 2G network.

There is no firm sunset date here, and 2G is expected to live longer, perhaps even into the 2030s in some form. Replacing old units in the UK would likely be very expensive, though. The subscription base is twice the size of France, and it has retained many old customers.

Quartix’s risk report says it is seeking to minimise the cost through “various technological and commercial means.”

Although it is perhaps not surprising given the disruption, it is still worrying that voluntary staff turnover rose from an already high looking 20% to 31% in 2023. Quartix relies on its staff to support and retain customers.

The price (discounted?) [0]

- No. A share price of 168p values the enterprise at about £80 million, 19 times normalised profit.

To calculate Quartix’s normalised profit, I have used the average return on capital over the last three years, which has been low by historical standards. This is conservative.

If the company gets to grips with costs and the troubled US strategy, profitability might move back up towards historical levels.

A score of 6.5 out of 10 indicates that Quartix may be a good long-term investment.

It is ranked 30 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. Scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Manufacturer of scientific equipment for industry and academia | 8.5 | |

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

5 | Translates documents and localises software and content for businesses | 8.5 | |

6 | Supplies kitchens to small builders | 8.5 | |

7 | Distributor of protective packaging | 8.5 | |

8 | Manufactures filters and filtration systems for fluids and molten metals | 8.1 | |

9 | Manufactures natural animal feed additives | 7.8 | |

10 | Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

11 | Imports and distributes timber and timber products | 7.8 | |

12 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

13 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | |

14 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.7 | |

15 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | |

18 | Online retailer of domestic appliances and TVs | 7.3 | |

19 | Distributes essential everyday items consumed by organisations | 7.3 | |

20 | Manufactures military technology, does research and consultancy | 7.3 | |

21 | Whiz bang manufacturer of automated machine tools and robots | 7.2 | |

22 | Sells hardware and software to businesses and the public sector | 7.2 | |

23 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.1 | |

24 | Makes marketing and fraud prevention software, sells it as a service | 6.7 | |

25 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | |

26 | Online marketplace for motor vehicles | 6.5 | |

27 | Operates tenpin bowling and indoor crazy golf centres | 6.5 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

29 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | |

30 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 6.3 |

31 | Flies holidaymakers to Europe, sells package holidays | 6.2 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6.1 | |

33 | Surveys and distributes public opinion online | 5.8 | |

34 | Publishes books, and digital collections for academics and professionals | 5.7 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | |

36 | Manufactures sports watches and instrumentation | 5.4 | |

37 | Supplies software and services to the transport industry | 5.2 | |

38 | Retails clothes and homewares | 4.9 | |

39 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Quartix and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.