Shares for the future: my third-favourite stock to own

Out of the 40 shares in his Decision Engine covered in this column, analyst and long-time fan of this FTSE 100 company Richard Beddard updates his score.

26th April 2024 14:32

by Richard Beddard from interactive investor

Through the rear-view mirror, fitted kitchen supplier Howden Joinery Group (LSE:HWDN) is a great business. As we peer through the windscreen though, the view of the road ahead is ever so slightly foggy.

Scoring Howdens: through the windscreen

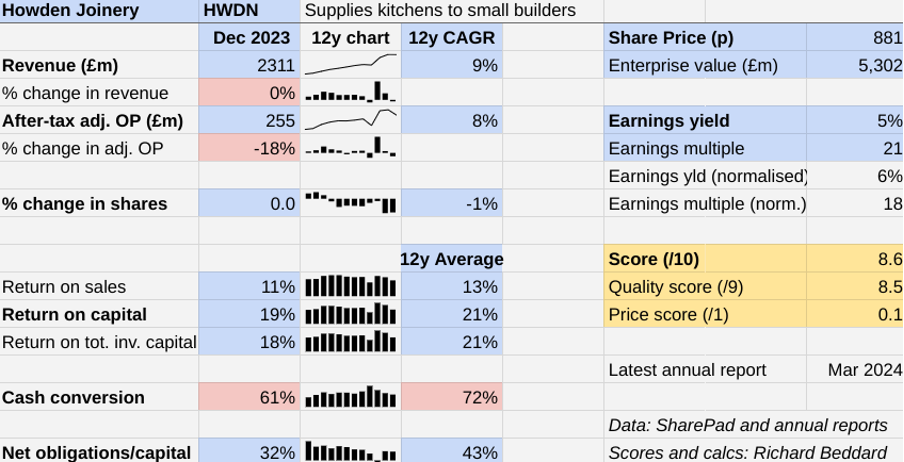

Although Howdens made less money in 2023 than it did in 2022, this is no cause for alarm.

The Past (dependable) [3]

- Profitable growth: Yes, high single digit growth [1]

- Strong finances: No borrowings [1]

- Through thick and thin: Lowest ROC 15% (2020) [1]

Having been forced to confront the shameful state of our homes during pandemic lockdowns, our attention turned to improving them, spurring strong growth at Howdens. In 2023, revenue stopped growing.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Apparently, the zeal for renovation has abated, but since revenue has increased 46% since 2019 and at a compound annual growth rate (CAGR) of 9% over the last 12 years, Howdens is still a growing business.

After tax adjusted operating profit declined 18%, and consequently on the same basis profit has grown somewhat more slowly. It has increased 18% since 2019 and 8% CAGR over the last 12 years.

Howdens explains that efficiencies compensated for cost inflation, allowing it to keep operating costs at the same level as 2022, although profit margins reduced slightly because it sold a higher proportion of lower margin lines like joinery products and worktops.

The main cause of the decline in profit was investment as the company strives to establish itself overseas and adds more depots here. We are, perhaps, deferring gratitude. Making a bit less today to make more tomorrow.

As a result, Return on Capital declined to 19%, which is impressive but also slightly sub-par.

- Stockwatch: should you have these two UK banks in your ISA?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Cash conversion was 61%, also slightly sub-par. This is not surprising. Aspects of Howdens’ business model require it to use up cash, in keeping depots fully stocked, for example, and giving customers credit. It also operates factories, which require capital expenditure.

The cost is a burden, but the fact that Howdens can afford it gives the company a competitive advantage.

Howdens did not draw on its borrowing facility at any point in 2023. In fact, it did not draw on it at the height of the pandemic in 2020.The company does not have a credit rating because it has no history of borrowing.

The Present (distinctive) [3]

- Discernible business: Vertically integrated trade only supplier [1]

- With experienced people: Yes [1]

- That creates value for customers: Product, availability, credit, confidentiality [1]

Howdens’ goal is to make life easier for builders. It does this in many ways, reiterated in my articles for many years.

It only supplies builders, so unlike rivals that also operate retail counters, pricing is confidential. This allows builders to determine their own profit margin. Howdens gives the builders sufficient credit so they can be paid before they have to pay Howdens.

Its depots are fully stocked with high quality kitchens that are easy to fit. They are located at accessible edge of town locations. Over 2,000 kitchen designers help the builders’ customers choose their kitchens, either in their own homes or online.

Since 85% of Howdens customers are small local builders located within five miles of a depot, Howdens managers are incentivised by profit share to stock the products they need and price them according to local conditions.

Obviously, the company gets something in return for this customer focus. Howdens does a lot for builders because the builders do a lot for Howdens.

The builders recruit the customers and collect the materials, so Howdens is spared the cost of expensive showrooms and delivering over the last miles. It does not spend as much on advertising as competitors who sell direct.

When Howdens was founded, this business model was both unique and very effective, which is why it has grown to account for more than 20% of the UK kitchen and joinery market. The company estimates the market is worth £12 billion, although its share of the £6.6 billion kitchen market is likely significantly higher.

- Trading Strategies: buying opportunities for long-term investors

- Positive start to 2024 for UK dividends, but there’s a sting in the tail

This scale gives Howdens access to a global supplier base and considerable purchasing power. It also means employees have many opportunities to further their careers in the business.

Scale also means Howdens is big enough to economically manufacture all the 5 million cabinets it needs a year, and many worktops, and frontals. It delivers them to depots with bought-in kitchen components through its own distribution network.

This vertical integration is one of the reasons Howdens can keep its depots fully stocked with product delivered daily.

This model has been enhanced by technology and refinements to make it more efficient over the years, but in essence it is the model deployed by the company when it was founded in 1995.

Its current guardian is Andrew Livingston, Howdens’ second chief executive. He took over from the founder in 2018 and seems to understand what a great business he inherited.

The only other executive on the board is chief financial officer Paul Haynes, who joined in 2020. Though their time at the company adds up to only 10 years, an executive committee of seven, some with considerable experience, supports them.

The committee member overseeing the company’s international growth is Andy Witts, former sales director and chief operating officer. He has been with Howdens since the beginning.

International growth is probably key to Howden’s prospects.

The Future (directed) [2.5]

- Addressing challenges:Saturation in the UK [0.5]

- With coherent actions: Expanding geographic and product markets [1]

- That reward all stakeholders fairly: Worthwhile for all concerned [1]

The company’s strategy is more of the same: more stores, more vertical integration, more product innovation, more digital, more efficiency.

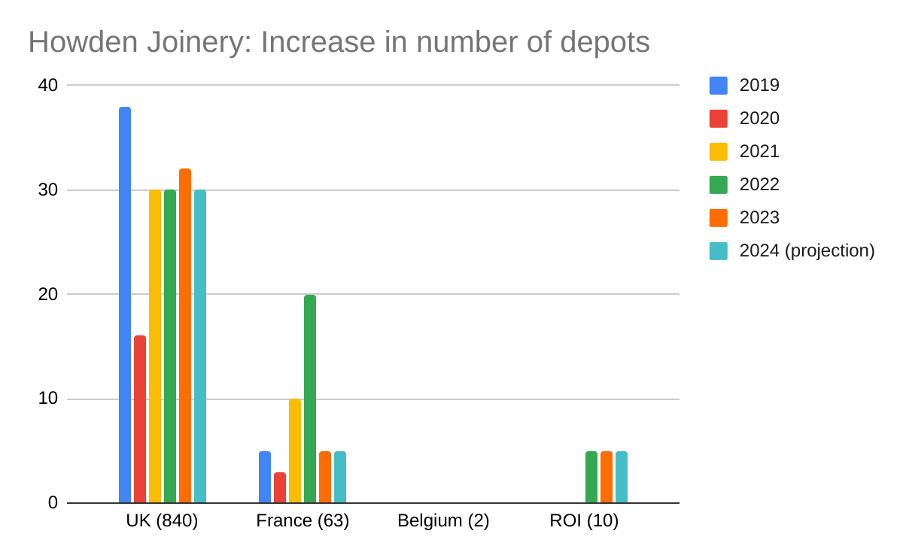

There is still some road in the UK roll-out. Howdens says there is a scope for 1,000 depots in the UK compared to 840 trading at year-end. It opened 32 during the year, two more than its projections in last year's annual report, lifting the total from 808.

The company is projecting another 30 depots in 2024, the same number of openings as it has sustained since 2021. The rate of openings is not increasing as the company grows, though, and some of the new stores are smaller and in rural areas. This makes me think 1,000 depots or thereabouts may be an actual limit, and not a target that will be raised, as it has been in the past.

At 30 depots a year, simple maths suggests Howdens will saturate the UK in four or five years. That is not an absolute limit on UK growth. The company can sell more through each depot helped by refurbishments, product launches and range extensions, but it suggests UK growth will slow.

The prospect of saturation may be why Howdens has entered the fitted bedroom market and is developing a higher priced kitchen portfolio. Most significantly it may explain a surge in depot openings in France in 2021 and 2022 and The Republic of Ireland in 2022 and 2023.

In France, Howdens has 65 depots (including two in Belgium), 7% of the 915 depots it operates. The depots are clustered around Paris, Lyon and Marseilles, which means the company can focus its marketing locally, relying partly on word of mouth.

Typically, the French buy kitchens from specialist stores and DIY chains. These do not provide Howdens-like services for builders, so Howdens senses a similar gap in the market to the one it exploited in the UK.

But depot openings in France fell sharply in 2023 to five against a projected 10. In 2022 Howdens opened 25 French depots (and closed 5). Howdens is only anticipating five additions in 2024.

As in the UK, international sales improved in 2023, but on a same-depot basis they declined. There is no word on profitability in the annual report, which probably means the French operation is losing money.

- Stockwatch: does this spectacular bull run have further to go?

- ISA insights: guides, investment ideas and tax tips

This would not be surprising. New depots take time to mature. Howdens says the managers are inexperienced, so it is focusing on team development and promotion of the depots it has already opened.

I hope this is a bump in the road. Howdens may be slowing down as it tweaks the model, before speeding up again. However, the company must demonstrate it can profitably grow in a major European market if it is to assuage concerns about UK saturation.

I do not think the Republic of Ireland qualifies because it is much smaller than France, but there is good news from the other side of the Irish Sea. Howdens is maintaining its roll-out around Dublin and Cork. This expansion may be easier because it is an extension of the UK operation.

International depot expansion is more costly than UK depot expansion. In 2023, Howdens invested about £267,000 per new UK depot (opened in 2022 and 2023) compared to £342,000 per new international depot. We also have no way of knowing if the international depots will be as profitable as those in the UK once they have matured.

Howdens is transplanting a successful business model to our closest neighbours, where it has little direct competition. This is a coherent strategy, but the risk is greater and the rewards may be lower than it has experienced in expanding in the UK.

The company can also extract more efficiencies through more vertical integration. Since the acquisition of Sheridans two years ago, Howdens has become one of the largest worktop manufacturers in the UK, which supports its ambition to supply more higher priced kitchens.

The price (discounted?) [0.1]

- Maybe. A share price of 881p values the enterprise at about £5.3 billion, 18 times normalised profit.

I like Howdens. Much as it has followed the same model since the outset, and it has also fostered the same culture, which is to be “worthwhile for all concerned”.

Its customer focus is embodied in the business model, Howdens has long championed environmental goals, and it looks after staff too.

The chief executive has earned more than £2.5 million in each of the last two years and potentially could earn more than £4 million in 2024. Even though it is a substantial business, these are large amounts, equivalent to 65 times median pay in 2023.

Such differentials are not easily justified, but it is worth noting Howdens’ employees are also incentivised. Although the median salary is below the national average at £28,000, the median employee actually earned an above average £39,000 in total pay and benefits in 2023.

This differential does not just reflect bonuses. Howdens poured more money into employee pensions during the year than any other benefit. It is unusual in paying a minimum employer contribution of 8% a year even if the employee reduces their contribution to zero.

Unsurprisingly, take-up is very high. Significant numbers of employees put extra in to gain the maximum employee contribution of 12%.

A score of 8.6 out of 10 indicates that Howdens is probably a good long-term investment.

It is ranked 3 out of 40 shares in my Decision Engine.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report. Scores change daily due to price changes.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Bunzl (LSE:BNZL), 4imprint Group (LSE:FOUR), Judges Scientific (LSE:JDG) and Next (LSE:NXT) have all published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | |

3 | Howden Joinery | Supplies kitchens to small builders | 8.6 |

4 | Manufacturer of scientific equipment for industry and academia | 8.6 | |

5 | Translates documents and localises software and content for businesses | 8.5 | |

6 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

7 | Manufactures filters and filtration systems for fluids and molten metals | 8.3 | |

8 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.2 | |

9 | Distributor of protective packaging | 8.1 | |

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | |

11 | Manufactures natural animal feed additives | 7.8 | |

12 | Imports and distributes timber and timber products | 7.8 | |

13 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.5 | |

14 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | |

16 | Online retailer of domestic appliances and TVs | 7.4 | |

17 | Distributes essential everyday items consumed by organisations | 7.4 | |

18 | Whiz bang manufacturer of automated machine tools and robots | 7.3 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | |

20 | Sells hardware and software to businesses and the public sector | 7.1 | |

21 | Online marketplace for motor vehicles | 6.9 | |

22 | Makes marketing and fraud prevention software, sells it as a service | 6.9 | |

23 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | |

24 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | |

25 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | |

26 | Manufactures vinyl flooring for commercial and public spaces | 6.4 | |

27 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.4 | |

28 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 6.3 | |

29 | Manufactures military technology, does research and consultancy | 6.2 | |

30 | Surveys and distributes public opinion online | 6.1 | |

31 | Sells promotional materials like branded mugs and tee shirts direct | 6.0 | |

32 | Flies holidaymakers to Europe, sells package holidays | 5.9 | |

33 | Publishes books, and digital collections for academics and professionals | 5.7 | |

34 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | |

35 | Manufactures sports watches and instrumentation | 5.5 | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

37 | Supplies software and services to the transport industry | 5.3 | |

38 | Acquires and operates small scientific instrument manufacturers | 4.8 | |

39 | Retails clothes and homewares | 4.5 | |

40 | Runs a network of self-employed lawyers | 4.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Howden Joinery and many shares in Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.