Shares for the future: tech firm among 28 stocks rated good value

Slightly fewer companies meet columnist Richard Beddard’s strict value criteria this month, but one of them scores an impressive 8 out of 10. Here’s his deep dive on this £3 billion FTSE 250 company.

2nd February 2024 14:51

by Richard Beddard from interactive investor

This month, 28 shares of the 40 covered by my Decision Engine score 7 or more out of 10. That means they are Shares for the Future!

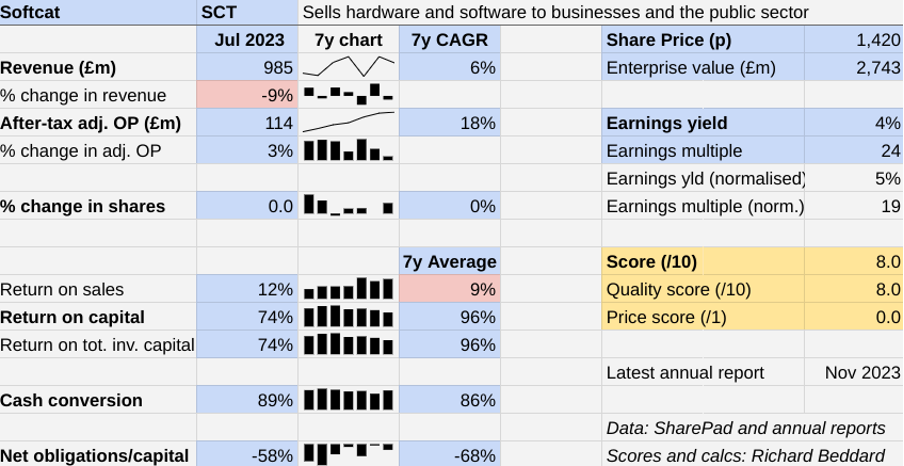

Before we reveal them, though, I need to reconfirm that Softcat (LSE:SCT), the IT reseller, qualifies. It published its annual report for the year to July 2023 back in November.

Scoring Softcat is overdue.

Scoring Softcat

Instead of totting up the numbers at the end of my write-up, this time I am scoring as we go. That way, we can better connect the story to the score.

Softcat started out in the early 1990s as one of many companies supplying small businesses with software, which they bought from a catalogue. Hence the name, Softcat.

Since then, the company has grown into the largest UK reseller of software and hardware, with almost a billion pounds of annual revenue.

Softcat floated in 2015, which gives us a decent but not extensive track record to examine.

The Past (dependable) [3]

- Profitable growth: 18% CAGR in adjusted profit [1]

- Strong finances: More cash than financial obligations every year end [1]

- Through thick and thin: Worst year, 74% return on capital in 2023 [1]

The revenue trend is actually better than the 6% compound annual growth rate (CAGR) in the table implies. It has been tarnished by changes to the accounting rules in 2018, and reinterpreted in 2021, which reduced the amount of revenue recognised in those years in comparison to previous years.

This also makes profit margins look more impressive than they were, as profit is a greater proportion of lower revenue.

The decline in revenue of 9% in 2023 is real, although not as significant as it looks.

Softcat sold less hardware, which is reported gross (including the cost of purchasing hardware from the supplier), and more software, which is reported net. This means hardware sales have a disproportionate impact on revenue, but software sales are much more profitable.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- 10 shares to give you a £10,000 annual income in 2024

Because of the inconsistency in how revenue is reported, the company uses another statistic to demonstrate the growth trend: Gross invoiced income (GII). This grosses up the software sales, and the company says it has achieved a 20% CAGR in GII over the last decade.

That said, adjusted profit growth was the slowest since the company floated in 2013. Profit rose by only 3%.

Sluggish growth was partly due to weak trading in the second half of the financial year, and partly due to rising costs. Gross profit increased by 14%, but a 20% increase in headcount, a 7.5% increase in pay, IT spending, and staff events and travel unrestricted by the pandemic, lifted operating costs by 22%.

The company says it has never had any debt.

The Present (distinctive) [3]

- Discernible business: Sells IT at scale [1]

- With experienced people: Focus on retention at all levels [1]

- That creates value for customers: Choice, expertise [1]

Softcat sells a roster of hardware and software extending from Adobe to Zscaler and including big names like Amazon, Apple, Dell, HP, Google, and Microsoft.

The company’s scale means suppliers want it to represent them, and customers can come to it confident in its broad market knowledge. Working with companies and suppliers, Softcat designs systems, implements, and manages them.

Since 80% of Softcat’s employees are selling to or advising customers, it must recruit, motivate and retain its best employees.

In the early days, founder Peter Kelly instilled radical policies. Employees democratically elected managers, voted on their own pay, and formed their own teams.

Although Mr Kelly is no longer involved directly in the business, he may still wield influence. He owns a 33% controlling interest, although he has not taken up his right to nominate a non-executive director.

When he retired as chief executive he became chair, and successor chief executives have all done the same. To my mind, this is a good way to preserve a unique culture, although it breaks corporate governance norms.

The current chief executive, Graham Charlton, has been in the role for less than a year, he was formerly chief financial officer. His predecessor as chief executive is now chair.

Mr Charlton’s replacement as chief financial officer, Katy Mecklenburgh, was an outsider. She came from ASOS.

- 2024 Investment outlook: share tips, forecasts, tax, pensions and savings

- Jeff Prestridge: these funds are robust long-term pillars of an ISA

The emphasis on the promotion and retention of talent extends down through Softcat.

It prefers to recruit people at entry level and train them up. When it opens a new regional office, it tends to promote someone from an existing office to manage it. Opportunities open up throughout the business, and no doubt the prospect of career progression encourages staff to stay.

Softcat says it has a high employee engagement score (92%) and Net Promoter Score (an NPS of 63), although its employee attrition rate of 15% in 2023 suggests there is only so much it can do to retain staff. Employees rating the company at Glassdoor, a jobs site, give it 4.4, similar to listed rival Bytes but better than Computacenter, which scores 3.9.

No doubt there are other factors, but Softcat appears to achieve its high level of employee satisfaction at lower cost than listed rivals...

Median pay | Bytes (FY 2023) | Computacenter (FY 2022) | Softcat (FY 2023) |

Salary (£) | 47,500 | 46,924 | 27,538 |

Total pay (£) | 53,336 | 49,270 | 41,929 |

Source: Most recent annual reports.

A bigger proportion of variable pay ought to moderate the impact of downturns on profitability at Softcat too.

As you would expect, motivated employees mean satisfied customers. Softcat boasts a customer NPS of 63, which is high.

I wonder how sustainable relatively low pay is, though, particularly as executive pay is not as restrained. It was 44 times the median in 2023.

The Future (directed) [2]

- Addressing challenges:Technological change - oppo or threat? [0.5]

- With coherent actions: More of the same. Adopting AI [0.5]

- That reward all stakeholders fairly: People first, good annual report [1]

Softcat is a sales machine, and its strategy is typical. It wants to recruit more customers and sell more to them.

The strategy does not make Softcat special, the people focused culture does. The company states this explicitly in its risk report, saying: “culture sits at the heart of all changes that are made in Softcat”.

The company’s culture is the first reason its new CFO gives for joining, she emphasises “the priority that was placed on this throughout the recruitment process.”

Softcat expects this culture to continue to grow its share of the growing UK market, which it currently estimates is 5%.

But I wonder about the role of resellers due to rapid changes in the delivery and nature of software. In the past, technological change has driven demand for Softcat’s services but this time it might be different.

Software companies are migrating products to the cloud, where they provide Software as a Service. They are also automating the installation and configuration of their products. These trends give organisations more control of the services they use, and enable them to pay only for what they need.

It seems likely that artificial intelligence (AI) will increase this trend. Softcat’s risk report identifies market changes as a principal risk, including channel disintermediation, aka cutting out the middleman.

- Stockwatch: this share’s not just about the 7% dividend yield

- Vodafone among dozen blue-chips about to pay £4.4bn in dividends

This year it has changed one of its core principles from “expanding our addressable market,” to “maintaining relevance and expanding our addressable market”.

To my mind this development is a negative, an admission that technological change, which has so long enabled the company, could hurt it. But it is also a positive that the company is alive to the threat and doing something about it.

It will invest to embrace new methods of distribution and consumption and, it says, it will be required to advise, design and deliver AI, for example.

Managing AI enabled desktop applications in the workplace will require new software licences and operating system and equipment upgrades. Customers will need help building the datacentres to host AI environments. AI enabled cyber-attacks require organisations to strengthen their IT systems.

Like many companies, Softcat also sees the potential for data and AI to automate aspects of its own operations.

It believes it will stay relevant using the intelligence it gathers from customers to provide better recommendations and support.

Maybe one day, though, the best software reseller will be the company with the best AI, not the best people. Or maybe its partners’ software will sell itself.

Stepping back from science fiction for a moment. Softcat is taking a reassuringly organic approach to overseas expansion.

Mostly it is serving its UK customers with small offices abroad. Its new office in the United States, for example, has nine employees, although it expects to add more as it grows.

The price (discounted?) [0]

- No. A share price of £14.20 values the enterprise at about £2.7 billion, 19 times normalised profit.

Softcat must stay relevant, but a score of 8 out of 10 indicates that it is probably a good long-term investment.

It is ranked 15 out of 40 stocks in my Decision Engine.

28 Shares for the future

I re-score each share in the Decision Engine once a year, after the publication of the annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. This month there are 28, three less than last month. Shares that score 5 or 6 out of 10 are probably fairly priced.

Keystone Law Group Ordinary Shares (LSE:KEYS) has replaced Hotel Chocolat in the Decision Engine and I have updated the scores of Dewhurst Group (LSE:DWHT), Softcat and Tristel (LSE:TSTL). Please click on a share’s name in the Decision Engine table, to see the breakdown.

Hollywood Bowl Group (LSE:BOWL), Treatt (LSE:TET), RWS Holdings (LSE:RWS) Softcat, Victrex (LSE:VCT) and YouGov (LSE:YOU), have all published annual reports and are due to be re-scored.

The annual reports of Quartix Technologies (LSE:QTX) and XP Power Ltd (LSE:XPP) are due to drop in the next month or so. These two companies are at most risk of radical reappraisal due to events during the year.

Company | Description | Score |

Supplies kitchens to small builders | 9 | |

Manufactures tableware for restaurants and eateries | 9 | |

Supplies vehicle tracking systems to small fleets and insurers | 9 | |

Designs recording equipment, loudspeakers, and instruments for musicians | 9 | |

Translates documents and localises software and content for businesses | 9 | |

Distributor of protective packaging | 9 | |

Sources, processes and develops flavours esp. for soft drinks | 9 | |

Manufacturer of scientific equipment for industry and academia | 9 | |

Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

Manufactures filters and filtration systems for fluids and molten metals | 8 | |

Whiz bang manufacturer of automated machine tools and robots | 8 | |

Manufactures surgical adhesives, sutures, fixation devices and dressings | 8 | |

Manufactures/retails Warhammer models, licenses stories/characters | 8 | |

Makes light fittings for commercial and public buildings, roads, and tunnels | 8 | |

Sells hardware and software to businesses and the public sector | 8 | |

Imports and distributes timber and timber products | 8 | |

Manufactures natural animal feed additives | 8 | |

Manufactures power adapters for industrial and healthcare equipment | 8 | |

Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | |

Distributes essential everyday items consumed by organisations | 8 | |

Develops and manufactures hygiene, baby, and beauty brands | 7 | |

Manufactures military technology, does research and consultancy | 7 | |

Online retailer of domestic appliances and TVs | 7 | |

Online marketplace for motor vehicles | 7 | |

Manufactures vinyl flooring for commercial and public spaces | 7 | |

Publishes books, and digital collections for academics and professionals | 7 | |

Manufactures rugged computers, battery packs, radios. Distributes electronics | 7 | |

Makes marketing and fraud prevention software, sells it as a service | 6 | |

Flies holidaymakers to Europe, sells package holidays | 6 | |

Manufactures specialist paper, packaging and high-tech materials | 6 | |

Sells promotional materials like branded mugs and tee shirts direct | 6 | |

Manufactures sports watches and instrumentation | 6 | |

Collects and analyses market research and opinion polls through online panels | 6 | |

Operates tenpin bowling and indoor crazy golf centres | 6 | |

Manufactures disinfectants for simple medical instruments and surfaces | 6 | |

Supplies software and services to the transport industry | 5 | |

Retails clothes and homewares | 5 | |

Acquires and operates small scientific instrument manufacturers | 5 | |

Runs a network of self-employed lawyers | 5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with an asterisk* are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns most of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares. He does not own shares in Softcat.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.