Shares for the future: how I rank one of AIM’s biggest companies

This company scores very well in many areas, but the shares are in demand and trade close to prices last seen in summer 2022. Here’s what columnist Richard Beddard thinks about the business and its valuation.

16th February 2024 15:07

by Richard Beddard from interactive investor

As YouGov records another impressive set of results, I am struggling to find any threat likely to stop it growing, a sizeable acquisition and change in leadership in 2023 notwithstanding.

Scoring YouGov

The Past (dependable) [3]

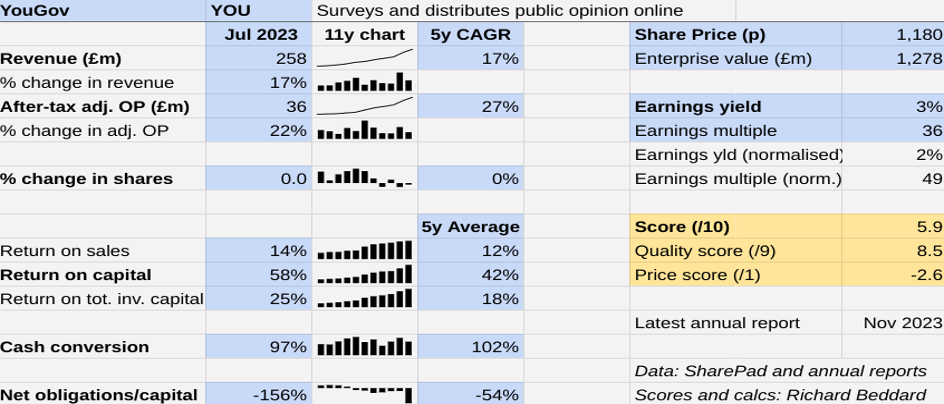

- Profitable growth: 5-year CAGRs: 17% (revenue), 27% (profit) [1]

- Strong finances: Net cash (will be weaker in 2024) [1]

- Through thick and thin: Lowest 5-year Return on Capital (RoC): 32% (2019) [1]

YouGov (LSE:YOU), a market research and data analytics firm, has grown revenue strongly and fairly consistently over the long term, but as the business has matured profit growth has accelerated.

The year to July 2023 was fairly typical - revenue grew 17% and adjusted operating profit grew 22%. The company earned a return on operating capital of 25% and converted nearly 100% of profit into cash.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

A surge in net cash during the year is not entirely due to its excellent performance. More than half of it came from a £50 million share placing just before the year end in July.

The money was raised to part-fund a €315 million acquisition, which was settled after the year end.

Judging by the numbers, YouGov was a good business, and it is flourishing now.

YouGov publishes its half-year results next month, but it has already disclosed it expects to meet analysts’ expectations for the full year. Analysts expect the growth trend to continue.

But the numbers will look different in July 2024 thanks to substantial debt, now that it has paid for the acquisition. The analysts reckon YouGov’s growing cash flow will have wiped out the debt by 2026.

The Present (distinctive) [3]

- Discernible business: Data/online first market research [1]

- With experienced people: Blend of experience and potential [1]

- That creates value for customers: Fast turnaround, low cost [1]

Founded in 2000, YouGov made its name predicting elections, which quickly earned it a strong reputation and lots of publicity.

Although the company earns a fraction of the revenue of long-established research firms, YouGov says it is the most quoted research firm in the world.

Its success was not just because it was good at predictions, it was also because it could produce them quickly.

From the outset YouGov recruited its own panel of people to survey online, while traditional rivals predominantly interrogated panellists by telephone or mail, often using panels sourced from third-party providers.

Continuous polling means YouGov’s data is always up to date. YouGov calls it “Living Data”.

Organisations use this data to find out about our attitudes and behaviour. Advertisers use it to test ideas and advertisements. Brand owners use it to monitor what we think of their brands.

The data powers subscription products, fast turnaround self-service surveys and custom research produced by YouGov researchers.

Today YouGov’s panel numbers over 26 million people, 59% of which have been active in the previous 12 months.

Co-founder Stephen Shakespeare says it is YouGov’s biggest asset, and on the face of it, maintaining and growing the asset is remarkably cheap. YouGov paid out £18 million in rewards, gift cards or cash, in 2023.

Large panels make it easier to generate a representative sample of the population, and the more representative a sample the better the predictions.

The importance of the panel is also demonstrated by YouGov Plus, which YouGov launched in 2023. This is a panel consisting of super users helping YouGov to improve its own offering.

For some panellists, the prospect of being heard is as important as financial reward, and since we are increasingly sceptical about how big companies use data, it is heartening to find one with a more reciprocal and transparent policy.

This may be a powerful competitive advantage, reducing the financial outlay, increasing the quality of responses, and reducing the potential for fraud.

Judging by one measure, though, panellists are less happy than they were, so perhaps YouGov needed to do something. Panel retention has declined 10% to 59% since 2022. The company still describes it as “strong”.

YouGov’s speed is not just down to its Living Data, though. It delivers data through an online platform, which clients can interrogate themselves. This is much more efficient than traditional consultancy.

The prime mover since the company’s foundation is Stephen Shakespeare, who has stepped down as chief executive to become non-executive chairman.

He will mentor Steve Hatch, the new chief executive, who has previously worked in market research, advertising and most recently as Meta’s Northern Europe vice-president. It sounds like the perfect curriculum vitae.

The Future (directed) [2.5]

- Addressing challenges:In house market research, technology [0.5]

- With coherent actions: Enterprise sales, self-service, new products [1]

- That reward all stakeholders fairly: Yes, but would like more data [1]

With the launch of the YouGov Platform in 2023, the company reached something of a milestone. It is predominantly a provider of software and data.

In 2015, the company earned 36% of total revenue (about £26 million) from data products and services, and £50 million from custom research, like a traditional consultancy.

In 2023, it earned 52% of revenue (about £134 million) from data products and services.

This productisation of market research is partly a response to clients increasingly doing research in-house, a trend other market research companies are responding to. YouGov has less work to do though, because unlike traditional firms it has always been digital.

It has also made YouGov very profitable. Software and data services can be scaled at little incremental cost, while scaling up bespoke consultancy usually requires more people. YouGov can consult more efficiently too because its researchers use the same technology platform.

YouGov plans to focus its sales effort on large enterprises, big customers for the platform and ad hoc research derived from it with the help of YouGov researchers.

It will focus its marketing on other customers, who can buy products and services digitally, with “low-touch” support from YouGov researchers if need be.

It also plans to develop new products by combining its data with other sources of data, like streaming history, purchase data and banking data. This part of the strategy took a step forward with the acquisition of GfK’s consumer panel business last year.

GfK brings YouGov a panel of 100,000 European households representing the purchasing decisions of 50% of European GDP (145 million households).

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Bed and ISA: the handy tax trick to boost your wealth

It has long-standing relationships with Fast Moving Consumer Goods (FMCG) companies, strengthening YouGov’s presence in one of its weaker sectors.

YouGov believes it can use GfK’s capabilities to develop a more holistic view of the consumer by combining household purchase data with YouGov’s data on consumer profiling, media consumption and brands.

It also plans to extend GfK’s capability into the US, by far its biggest market and a fast growing one too. As recently as 2011, the US was first among equals with the UK, but although revenue has grown significantly in both territories, it earns over twice as much in the US today.

Maintaining the balance between YouGov’s profit motive and the needs of clients and panellists is the work of YouGov’s employees.

The company emphasises training and development in its annual report, with a striking goal. Stephen Shakespeare says: “I want every YouGov employee to be able to look back and know that YouGov was the place where they did career-defining work.”

However, the annual report is disappointingly devoid of statistics on employee satisfaction, retention, and median pay. It quotes an employee engagement score of 4 out of 5, but that is all I could find.

The price (discounted?) [-2.6]

- No. A share price of £11.80 values the enterprise at just under £1.3 billion, 49 times normalised profit.

Because I use the 5-year average to compare YouGov’s price to its adjusted profit, the shares look expensive. I use it out of caution. If we assume this year’s return on capital is indicative of what the company will earn in future, then the earnings yield rises to 3% (about 36 times adjusted profit). Not exactly cheap then!

A score of 5.9 out of 10 indicates that YouGov is probably fair value.

It is ranked 34 out of 40 stocks in my Decision Engine.

25 Shares for the future

Here is the ranked list of shares from the Decision Engine. I review the scores once a year, soon after each company has published its annual report. The scores change day to day due to changes in price.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Treatt (LSE:TET), Victrex (LSE:VCT) and Hollywood Bowl Group (LSE:BOWL) have all published annual reports and are due to be re-scored.

If I think a share is likely to be downgraded next time I score it, there will be a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

We will not know for sure until I have scored these companies again, but extra caution may be necessary.

0 | Company | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.4 | |

2 | Supplies kitchens to small builders | 9.4 | |

3 | Supplies vehicle tracking systems to small fleets and insurers | 9.1 | |

4 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.9 | |

5 | Sources, processes and develops flavours esp. for soft drinks | 8.8 | |

6 | Manufacturer of scientific equipment for industry and academia | 8.7 | |

7 | Distributor of protective packaging | 8.7 | |

8 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | |

9 | Translates documents and localises software and content for businesses | 8.5 | |

10 | Manufactures filters and filtration systems for fluids and molten metals | 8.4 | |

11 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8.2 | |

12 | Manufactures/retails Warhammer models, licenses stories/characters | 8.1 | |

13 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.0 | |

14 | Manufactures natural animal feed additives | 7.8 | |

15 | Imports and distributes timber and timber products | 7.8 | |

16 | Sells hardware and software to businesses and the public sector | 7.8 | |

17 | Manufactures power adapters for industrial and healthcare equipment | 7.8 | |

18 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.7 | |

19 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | |

20 | Distributes essential everyday items consumed by organisations | 7.5 | |

21 | Develops and manufactures hygiene, baby, and beauty brands | 7.5 | |

22 | Manufactures military technology, does research and consultancy | 7.5 | |

23 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.4 | |

24 | Online retailer of domestic appliances and TVs | 7.4 | |

25 | Online marketplace for motor vehicles | 7.2 | |

26 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.8 | |

27 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | |

28 | Makes marketing and fraud prevention software, sells it as a service | 6.8 | |

29 | Publishes books, and digital collections for academics and professionals | 6.5 | |

30 | Manufactures specialist paper, packaging and high-tech materials | 6.4 | |

31 | Flies holidaymakers to Europe, sells package holidays | 6.4 | |

32 | Sells promotional materials like branded mugs and tee shirts direct | 6.4 | |

33 | Manufactures sports watches and instrumentation | 6.3 | |

34 | Surveys and distributes public opinion online | 5.9 | |

35 | Operates tenpin bowling and indoor crazy golf centres | 5.6 | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.5 | |

37 | Retails clothes and homewares | 5.4 | |

38 | Supplies software and services to the transport industry | 5.4 | |

39 | Acquires and operates small scientific instrument manufacturers | 4.9 | |

40 | Runs a network of self-employed lawyers | 4.9 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with a question mark are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard does not own YouGov shares, but he owns many of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.