Top 20 funds in the second quarter of 2021

19th July 2021 14:54

by Douglas Chadwick from ii contributor

All fund sectors made gains in the second quarter, but it was a specialist fund that led the pack with a return of just over 20%.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The best-performing sector last year was Technology and Telecommunications, with an annual return of 44.8%. It was followed by China/Greater China, which had gone up by 32.8%, and Asia Pacific excluding Japan, up 26.8%. Most other developed nations made reasonable gains. The North American sector made 16.5%, Japan was up 13.9%, and Europe Excluding the UK rose by 10.5%.

The worst-performing sectors were in the UK. The UK All Companies sector went down by 6.2% and UK Equity Income lost 10.9%. The UK Smaller Companies sector did make a gain, up 7.0%, but it was still a long way behind the leading sectors.

In the first quarter of this year, the UK sectors started to recover. The UK Smaller Companies sector was the leading sector, up 9.4%, followed by the North American Smaller Companies sector, then the UK Equity Income and the UK All Companies sectors.

In the list of top 20 funds that we prepared at the end of the first quarter, five were from the UK Smaller Companies sector. The best, Premier Miton UK Smaller Companies, had gone up by 20.3% in three months.

- How Saltydog invests: a guide to its momentum approach

- Three funds that are on the march again

- The UK shares the pros are backing to play post-pandemic recovery

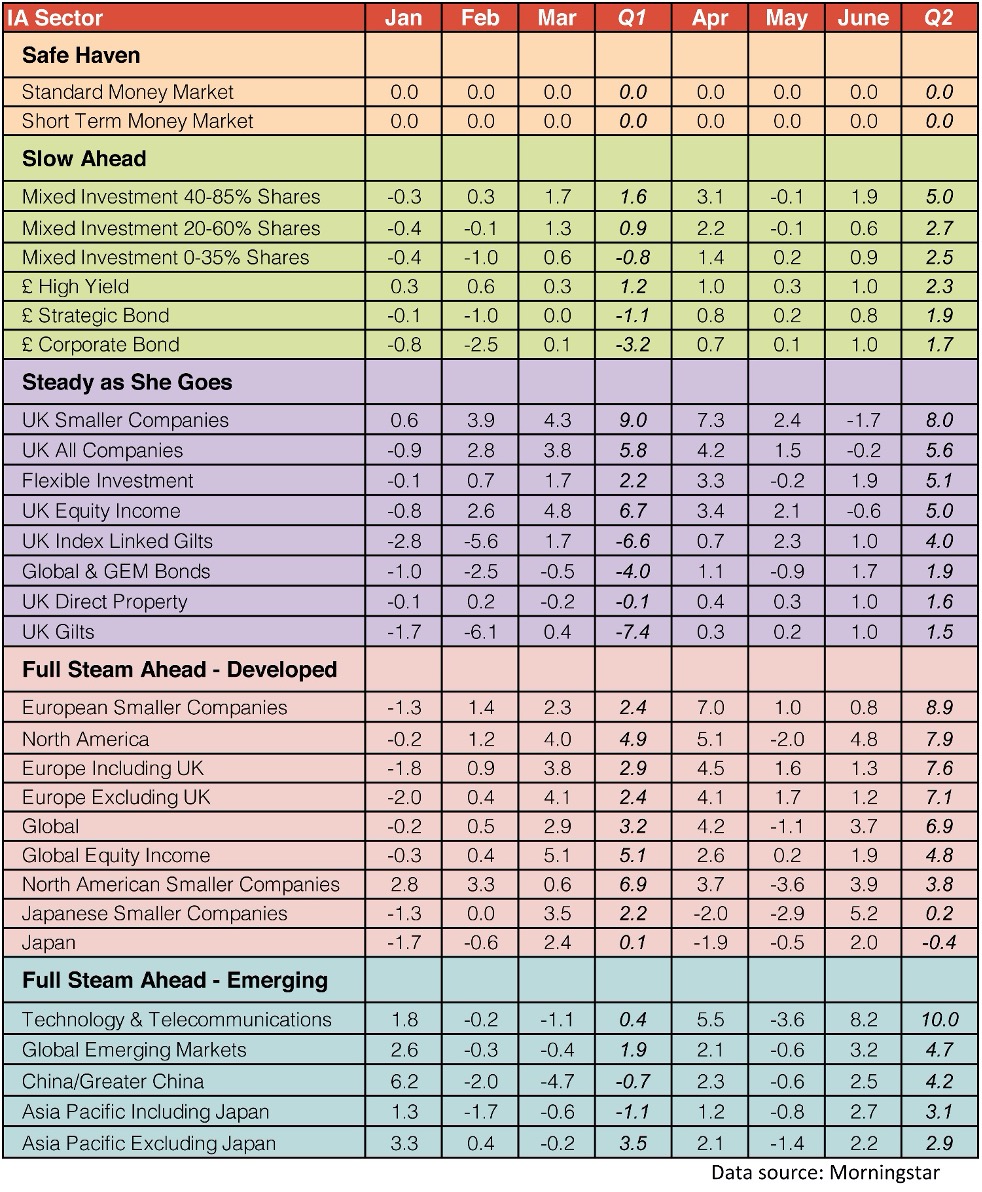

In the past three months, we have seen the European, US, Global and Technology sectors rising through the ranks. The best-performing sector in Q2 was Technology and Telecommunications, which went up by 10%, followed by European Smaller Companies.

The UK Smaller Companies sector was in third place, although it had a disappointing June, followed by the North American, European and Global sectors.

All sectors went up in the second quarter. The table below shows how the sectors performed over the last six months.

Past performance is not a guide to future performance.

Each quarter, we look at the leading funds over the previous three months. Our latest table is headed by a fund from the Specialist sector and then a North American fund. There are two other North American funds in the list. There are also two funds from the Technology & Telecommunication sector, and four from the Global sector. There are still three funds from the UK Smaller Companies sector.

| Name | IA sector | April % return | May % return | June % return | 3-month return |

|---|---|---|---|---|---|

| Threadneedle Latin America | Specialist | 7.8 | 0.5 | 10.9 | 20.2 |

| Baillie Gifford American | North America | 10.4 | -6.9 | 16.7 | 19.9 |

| T. Rowe Price Global Technology | Technology and Telecommunications | 8.9 | -3.4 | 12.6 | 18.4 |

| Liontrust Global Alpha | Flexible Investment | 11.2 | -5.3 | 12.4 | 18.3 |

| Liontrust Global Technology | Technology and Telecommunications | 10.7 | -5.8 | 12.7 | 17.5 |

| Invesco Latin American | Specialist | 6.5 | 3.4 | 6.5 | 17.4 |

| Baillie Gifford L/T Global Growth | Global | 8.5 | -5.0 | 13.4 | 16.9 |

| Liontrust Latin America | Specialist | 6.9 | 0.7 | 8.4 | 16.7 |

| Invesco Global Focus | Global | 8.7 | -3.8 | 10.8 | 15.9 |

| Liontrust UK Micro Cap | UK Smaller Companies | 8.1 | 2.3 | 4.3 | 15.4 |

| BlackRock Continental Europe | Europe Excluding UK | 7.8 | 2.8 | 3.7 | 14.9 |

| CFP Castlfd B.E.S.T Sust UK Small Cos | UK Smaller Companies | 6.9 | 4.0 | 3.1 | 14.7 |

| Marlborough European Multi-Cap | Europe Excluding UK | 9.5 | 3.1 | 1.6 | 14.6 |

| Aviva Investors UK Smaller Companies | UK Smaller Companies | 8.6 | 2.9 | 2.5 | 14.5 |

| ASI European Smaller Companies | European Smaller Companies | 9.6 | 1.9 | 2.2 | 14.2 |

| LF Blue Whale Growth | Global | 9.5 | -3.5 | 8.0 | 14.1 |

| Franklin US Opportunities | North America | 8.8 | -4.9 | 10.3 | 14.1 |

| Allianz China A-Shares Equity | China/Greater China | 6.5 | 3.6 | 3.2 | 13.9 |

| Threadneedle Amer Extended Alpha | North America | 7.7 | -2.0 | 7.8 | 13.7 |

| Baillie Gifford Positive Change | Global | 7.7 | -4.1 | 9.9 | 13.5 |

Data source: Morningstar. Past performance is not a guide to future performance.

Over the past few weeks, we have seen a couple of markets scares as Covid-19 infection rates have started to rise again and inflation figures have come through higher than expected. It will be interesting to see which sectors come through in the next few months, and whether the majority will still be making gains.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.