Why Saltydog is preparing to reduce UK exposure

Douglas Chadwick on why Saltydog could lock in some of the gains UK funds made since the Covid jab news.

1st February 2021 15:32

by Douglas Chadwick from ii contributor

Douglas Chadwick explains why Saltydog is considering locking in some of the gains UK funds made since the first Covid-19 vaccine breakthrough on 9 November.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In the last quarter of 2020, the UK stock market made a strong recovery. The FTSE 100 went up by 10.1% and the FTSE 250 went up by 18.3%. The bulk of the gain came in November as optimism grew after the Pfizer-BioNTech vaccine was found to be more than 90% effective in preventing Covid-19.

The Investment Association’s UK Equity Income was the leading sector in November with a one-month gain of 15.7%. We had noticed that it was doing well during the month and our demonstration portfolios invested in the Merian UK Equity Income fund. The UK All Companies and UK Smaller Companies sectors were also performing well, so we invested in the Artemis UK Select and the Franklin UK Smaller Companies funds.

The average returns were lower in December, but the UK Equity Income sector was still up by 3.7%, the UK All Companies sector made 4.5%, and the best-performing sector was UK Smaller Companies, which rose by 7.5%.

As we started 2021, our Tugboat portfolio had 22% invested in funds from these three sectors. In the Ocean Liner portfolio, it was 24%, and we increased it to more than 30% by adding the Premier Miton UK Smaller Companies fund.

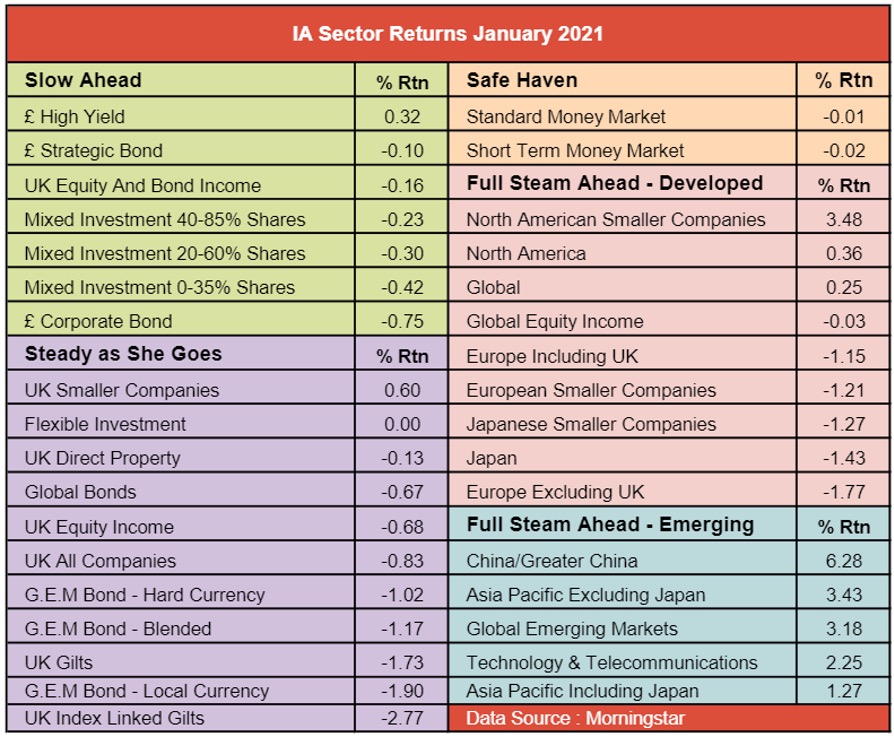

Although the UK sectors started the year well, they have struggled over the last couple of weeks and given up most, if not all of their early gains. The UK Smaller Companies sector ended the month up 0.6%, while UK Equity Income was down 0.7% and UK All Companies was down 0.8%.

Past performance is not a guide to future performance

Selecting funds to invest in is relatively straightforward. We just look for the best performing funds in the leading sectors based on their recent returns.

It is harder to decide when to sell. We use several criteria, but the one that tends to be triggered most often is our ‘three weeks in decile six or worse rule’.

It is not unusual for a fund to have a couple of poor weeks and then recover, so we like to give them some leeway. Each week, we calculate a decile ranking for all the funds in each of our Saltydog groups, based on the returns that they have achieved over various different time frames. The top 10% are in decile one, the next 10% are in decile two and so on. The worst 10% are in the tenth decile.

Having selected a fund for our portfolios we expect it to stay in the top five deciles each week. After three consecutive weeks in decile six or worse, we will usually sell or reduce our holding. When we reviewed our portfolios last week the Merian UK Equity Income and Artemis UK Select funds had both had two weeks in the lower deciles. If they have not improved in a week’s time, we will take the appropriate action

It is not a disaster, the Merian fund is still showing a profit of 4.4% in less than three months and the Artemis fund is up 3.3%, but maybe it is time to lock in some of the gains.

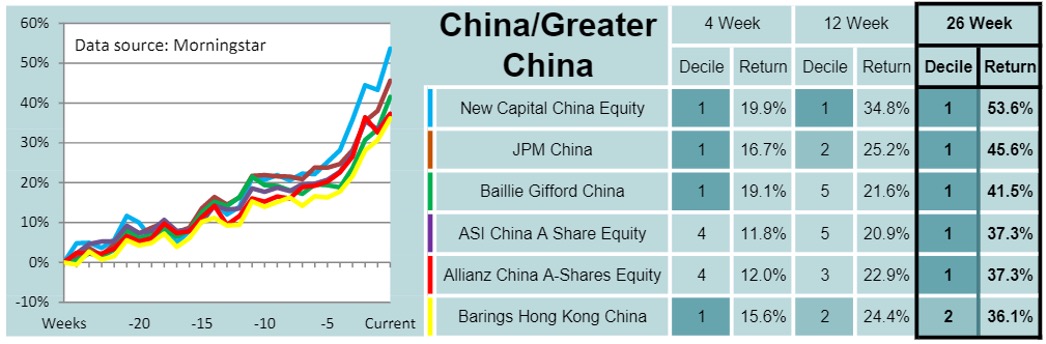

In the last month, the China/Greater China sector has seen the best returns, up 6.3%. Two weeks ago, our Ocean Liner portfolio invested in the New Capital China Equity fund. When we looked last week, it was still at the top of its sector with the best returns over four, 12 and 26 weeks. At that point, we decided to add it to our Tugboat portfolio.

Funds listed in the table: New Capital China Equity, JPM China, Baillie Gifford China, ASI China A Share Equity, Allianz China A-Shares Equity, Barings Hong Kong China

Past performance is not a guide to future performance

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.