Important information: Investment value can go up or down and you could get back less than you invest. If you're in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

What is Bed and ISA?

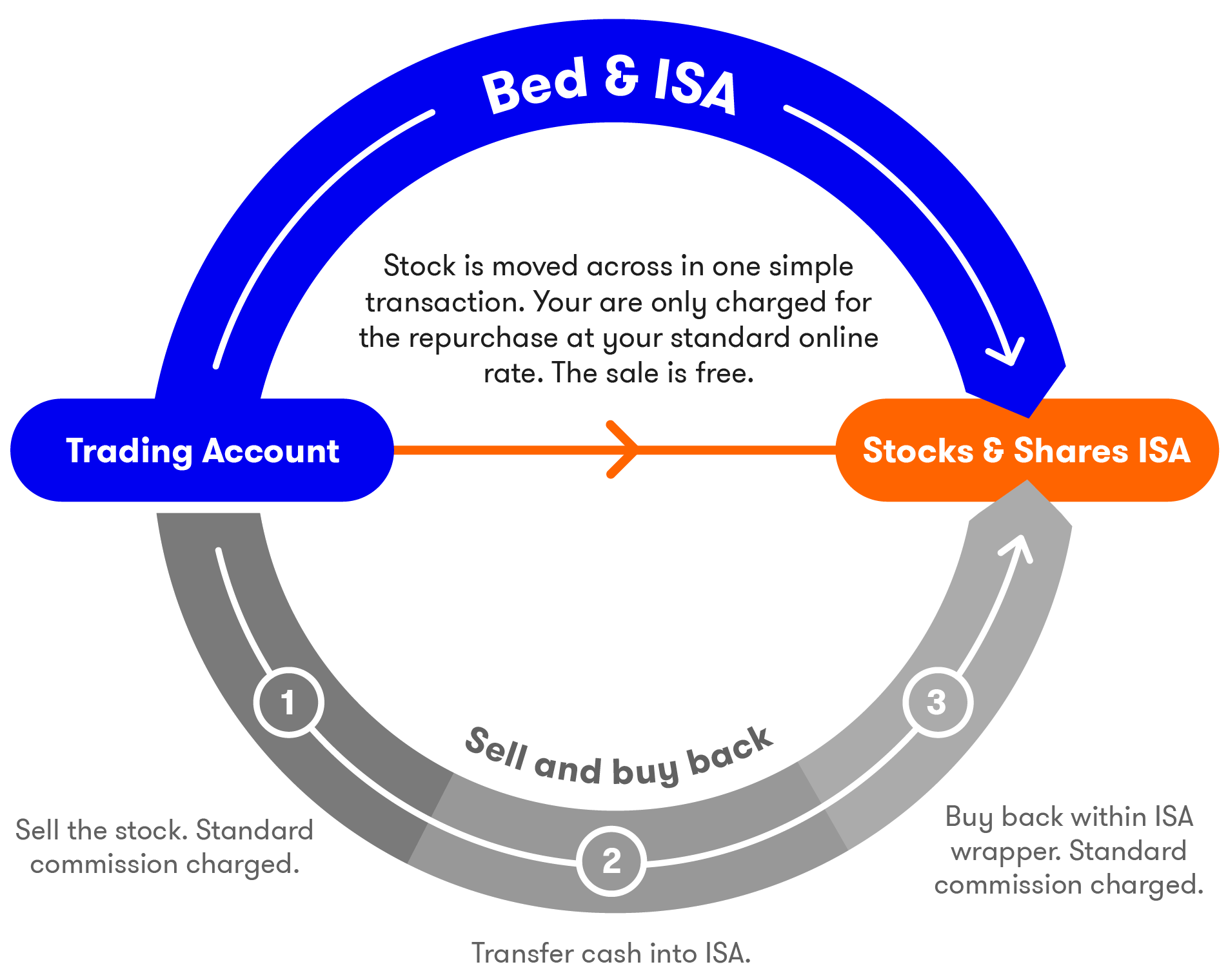

You can use a Bed and ISA to sell investments in a Trading Account and buy them back in your Stocks and Shares ISA. It’s one simple transaction which allows you to make the transfer in one fell swoop.

A Bed and ISA is a great way to take advantage of any unused ISA allowance. Once in an ISA, those investments will be sheltered from tax.

You'll only pay a trading fee on the re-purchase, not the sale. This means it’s far cheaper to Bed and ISA than to sell your investments yourself, transfer your cash into your ISA, and then repurchase the shares.

Why you might want to Bed and ISA?

Keeping your investments in a general investment account, like a Trading Account, means they’re subject to capital gains and income tax. Any dividends you receive over your annual dividend allowance (£500 for 2025/26) or above your annual capital gains exemption (£3,000 for 2025/26) will be taxed.

If you’ve got some spare ISA allowance to use before the end of the current tax year, moving them into an ISA means you’ll save more. You won’t need to pay tax on any profit when you sell or income from dividends.

Learn more about Capital Gains Tax.

Log in to your Trading Account, select Portfolio > Transfers menu then Bed & ISA. Or visit our mobile app where you can find this in the Transfer section in your Wallet.

Select your accounts, check your remaining ISA subscription, and choose the investments you want to Bed & ISA.

Leave the rest to us. We’ll let you know when the process is complete.

How Bed and ISA works

Once you have instructed a Bed and ISA, we will sell your chosen investments from your Trading Account and immediately repurchase them in your Stocks and Shares ISA.

We will only charge trading fees on the repurchase. This can be covered by any free trade credit in your account. There are no fees for the sale.

We will calculate how many shares we can repurchase in your ISA, after deducting:

- Trading fees on the repurchase

- Stamp Duty on the repurchase (0.5% on most UK shares)

- Any price movements between the sale and purchase price

As such, you may end up with slightly fewer shares in your ISA than you had in your Trading Account.

Bed and ISA rules

Only UK-listed investments are eligible.

You can use a Bed and ISA to move investments that are UK-listed and traded in Sterling. Learn how to request a Bed & ISA from your account.

You must pay stamp duty.

Government stamp duty of 0.5% also applies to the repurchase of most UK shares.

You may incur Capital Gains Tax.

Selling shares as part of a Bed & ISA may incur Capital Gains Tax (CGT). Everyone gets a tax-free allowance of £3,000. If your gains are below this amount, you won't pay Capital Gains Tax. If your gains are above £3,000, you'll pay Capital Gains Tax on profits above that amount.

However, once your investments are inside an ISA, they will be sheltered from future Capital Gains Tax.