Kepler’s investment trust tips for 2026

Analysts at Kepler Trust Intelligence review their choices for their fantasy portfolios in 2025, and reveal their ‘top picks’ for this year.

2nd January 2026 12:17

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Last year’s picks

| Analyst | Share price total return (%) | |

| International Biotechnology | RLA | 47.3 |

| Fidelity China Special Situations | DB | 41.1 |

| Fidelity Special Values | JBA | 35.7 |

| European Smaller Companies | AR | 26.3 |

| Geiger Counter | TM | 23.8 |

| Rockwood Strategic | JG | 10.9 |

| BH Macro GBP | WHA | -2.6 |

| JPMorgan US Smaller Companies | JL | -15.3 |

Source: Morningstar, 01/01/2025 to 24/12/2025.

William Heathcoat Amory

A definition of Groundhog Day is “a situation in which a series of unwelcome or tedious events appear to be recurring in exactly the same way”. Calling 2025 a groundhog year slightly depends on how your portfolio was set up. If you owned an S&P 500 tracker or a meaningful exposure to the same mega-cap tech names that have driven market leadership seemingly forever, then you have benefitted from the groundhog strategy. Just sit on these stocks, and watch your portfolio outperform the market.

On the other hand, my pick for 2025 was chosen to represent the “other case”, one in which market enthusiasm waned, big-tech momentum stalled, and market volatility rose. In such an event, I think my pick for 2025 BH Macro GBP Ord (LSE:BHMG) would have provided strong support to a portfolio.

BHMG has historically delivered its best returns when equity markets are struggling. This year, returns have been muted overall, but there was one moment in particular that served to illustrate BHMG’s diversifying properties, when US President Donald Trump’s “Liberation Day” announcements in early April set off shockwaves in equity markets and, more particularly, tech stocks. The positive returns that BHMG delivered during April served to remind investors of BHMG’s shock absorption properties in equity portfolios. In our view, this diversifier potential is one of the main attractions of BHMG to shareholders, and whilst there are no guarantees, it offers plenty of potential to mitigate losses from an AI-related correction in equity markets. As such, I would prefer to think that rather than picking the wrong stock for 2025, I just got the timing wrong.

With there being no signs on the horizon of a crack appearing in markets, the lesson I am taking from 2025 is that high-level forecasting is difficult, if not impossible. Which makes me think that perhaps this year, I should take a more fundamental view of things. As such, my choice for 2026 is Greencoat UK Wind (LSE:UKW). Renewables stocks have been beaten up hugely this year, and UKW currently trades on a discount to NAV of circa 30%.

Fundamentally, UKW is churning out plenty of electricity and being paid for it, which, with subsidies, funds the attractive dividend yielding 10.75%. A yield that high should raise eyebrows. The stock market hates uncertainty, and in this regard, the UK renewables sector and UKW do face one uncertainty — that of the subsidy regime. The UK government is consulting on the future link to inflation of subsidies, and this, as well as a waning of appetites towards higher-yielding, private asset trusts, has contributed to this significant derating.

For me, the disconnect between fundamentals and perceptions can be encapsulated by the huge rise in forecast demand for electricity. According to Greencoat, UK electrical demand is, conservatively, set to increase by 30% by 2035, driven by the electrification of transport, heat, and the expansion of data centre capacity. This sits against a backdrop of scheduled plant retirements in the next decade, with a quarter of the UK's nuclear fleet and 20% of the gas fleet set to retire. Renewables will be a key part of delivering the UK’s electricity for years to come. The government needs to make investment in the space attractive, and a ‘win-win’ conclusion to the current consultation for both bill payers as well as owners of renewable energy assets is entirely plausible. If so, it would give a boost to beleaguered share prices.

Medium term, and specific to UKW, is its structurally higher dividend cover. It is this that has enabled the trust to stick to its pledge made at IPO to raise its dividend in line with inflation each year. However, the excess cash that UKW throws off gives it options to make new investments, continue with buybacks, or reduce debt. UKW’s gearing is slightly above the company’s preferred range, and the current slowdown in private market deal activity for UK renewable assets isn’t helping. That said, in the past 12 months, UKW has completed £222 million of asset disposals at NAV. The trust has largely completed a £200 million share buyback programme, which has added 1.7p per share to NAV. We understand the team are working towards further asset disposals, with a range of potential buyers.

Fundamentally, UKW appears resilient. With the shares having derated so far, I think there is a strong prospect of a decent total return (i.e. dividends reinvested) for 2026 as its strong fundamentals are reappraised by the market.

Thomas McMahon

Having decided to throw caution to the wind with my entry for 2025, and pick a trust that could, and I quote, ‘either come first or last’, there was only one true banter result possible, and that was to finish bang in the middle, with a total return more or less in line with the FTSE All-Share. Not great, not terrible.

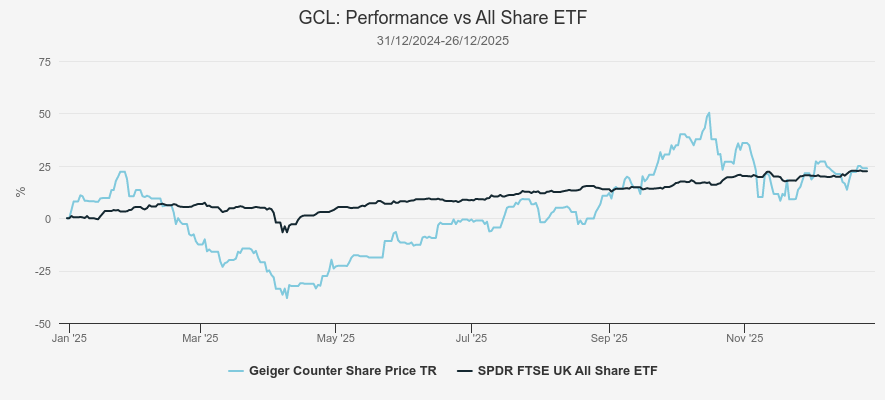

That said, Geiger Counter Ord (LSE:GCL) has been, at times, in last place in our competition, and at times in first place. By early April, it was down 38% for the year, and in mid-October it was up 50% for the year, or circa 140% from its lows. Volatility really is the name of the game with this one.

Performance over 2025

Source: Morningstar

I don’t think too much has fundamentally changed with the outlook. If anything, the direction of travel on some key factors affecting demand for nuclear power has firmed, and the bull case for the sector strengthened. The build-out of data centres for AI has proceeded rapidly, and numerous nuclear projects are planned to supply the power needed to run them. GCL is highly concentrated, with 25.5% in the largest holding, NexGen Energy Ltd (NYSE:NXE), as of the end of October. NexGen continues to progress the project to open what promises to be the largest and cheapest new uranium mine in the world. If demand for nuclear is indeed going to soar, this would be a highly desirable asset.

On the other hand, there have recently been some concerns raised by analysts about the sustainability of the capex spend by big tech. Some have questioned whether the huge numbers of NVIDIA chips apparently ordered are likely to be plugged in anytime soon or will remain sitting in boxes in a warehouse. Meanwhile, profitability from AI services remains a hope rather than a reality. I think the nuclear trade could be vulnerable to a correction in the growth trajectory of AI. However, I think the overarching need for green energy and energy security will be enough to see demand for nuclear grow substantially in the coming years. I also think AI is going to be a real and important presence in many industries, and even if we get over-capacity built out and a retrenchment, massive expansion of data centre capacity, and power will be needed.

With that in mind, I am inclined to stick and hold on to GCL for 2026. A glowing prize awaits the bold, whatever monstrous deformities the markets throw up over the course of the year. It’s time to rub the lucky elephant’s foot hanging round my neck and hope the tectonic plates don’t shift against me.

Ryan Lightfoot-Aminoff

In both 2025 and 1976, the Formula One World Championship was won by a Briton. However, the real story of both seasons was second place, with Verstappen and Lauda having staged remarkable comebacks to take the championship to the final laps of the final race despite considerable challenges. In the case of Lauda, this race came just 76 days after he was read the last rites on a hospital bed after a major crash.

Coming into the last few weeks, it looked like my pick for 2025, International Biotechnology Ord (LSE:IBT), was going to following the pattern of these two greats. At the halfway point, I was second last and facing negative double-digit total returns, however IBT rallied strongly from this point onwards, aided by a flurry of M&A activity and a pickup in the wider sector. The trust delivered the best returns in the second half of the year among my esteemed peers, to take me to a very narrow second place, only for a final flourish in the past few days leading me to capture the overall win.

Whilst my full-year return of 47% is pleasing, the sceptical part of me is marginally concerned that I have achieved such highs based on an investment thesis that, at the beginning of the year, I openly admitted went against my natural instincts; however, I am at least reassured that at the halfway point, I did say I would have doubled down given the choice which proved to be the right call.

For the first time in a while, my near-term outlook is fractionally nervous. A combination of the market melt-up in 2025 and my contrarian tilt, plus a nagging sense that geopolitical affairs could be an issue in 2026 have tempered my risk appetite. Despite this, I have based my pick for the year on a couple of factors that I think could offer resilience, as well as picking up one of the potential bright spots on the horizon.

To that end, I am going for Molten Ventures Ord (LSE:GROW) for my pick of 2026. The trust is trading at a discount of circa 35% at the time of writing, which, in my view, doesn’t fairly reflect the quality of the underlying assets. The discount has narrowed during the second half of 2025, but regardless, I believe it not only presents an opportunity for upside should my fears prove unfounded, but also downside protection, as there is arguably too much negativity in the price.

Secondly, if my slight bearishness is wrong, I believe GROW is well placed to capitalise on a potential bright spot of 2026. After three IPOs in Q4 of 2025, there are early indications of more potential new listings in the first quarter of next year in UK markets. If so, this could offer GROW’s private portfolio, in which UK companies are the largest portion, a route for realisations.

The trust’s largest holding is Revolut, a company that is heavily rumoured to IPO in 2026. Should this play out, it could prove a pivotal moment for the trust, not only providing a boost to returns, but also delivering a crucial piece of evidence that the NAV is fair, therefore that the discount is unrepresentative, whilst also freeing up capital for the managers to recycle elsewhere. As such, this could act as the catalyst for further narrowing in the trust’s discount, as well as a rerating of the asset class more generally.

Alan Ray

My pick last year was The European Smaller Companies Trust PLC (LSE:ESCT), and it turned in very respectable returns over the year. ESCT is a stock-picking, smaller companies fund that owns a very broad spread of different companies, and further, it doesn’t specialise in a single investment style, with the managers seeking returns from small, fast-growing businesses, more mature compounding businesses, as well as value opportunities and turnaround situations. So, it is a long way from being a thematic fund and one where returns over the long term have much more to do with the success of individual companies.

But 2025 was a somewhat thematic year for European markets, and ESCT probably did benefit from that. In the latter part of 2024 and over the first half of 2025, we saw a big rotation out of US equities, which was in part driven by investor worries about high valuations, and probably also in part driven by investors’ worries about trade tariffs and other concerns about the current US administration. Whatever the case, money flowing into Europe favoured lower valued and more domestically orientated businesses. Notably, European bank shares did really well, which caught many larger company active managers unawares, but also businesses involved in defence and infrastructure, which, unlike banks, involve many smaller companies. It is, as I say, a bit unfair to say that ESCT benefitted just from these themes, but they certainly helped, and as we’ll see with my pick for 2026, I think the trend of positive flows into Europe, benefitting ESCT, is quite likely to continue into 2026.

For 2026, I’m going to pick Fidelity Special Values Ord (LSE:FSV), which is the first investment trust I ever bought, all the way back in 1995. Back then, I didn’t know what an investment trust was, far less that I would build a long career in the sector. But someone much cleverer than me pointed me to it just one year after its IPO in 1994. Manager Alex Wright recently noted something to the effect that it’s easier for international investors to recognise the value opportunity presented by the UK stock market than it is for us at home.

Certainly, there has been a relentless stream of negativity about the UK market, even as the index has risen, but I think we can afford to be a bit more optimistic about the prospects for some of its best companies. This is because valuations are attractive and, say it softly, there are plenty of companies that are growing earnings. But also, it remains the case that US equities are still highly valued. Ten companies now make up 40% of the S&P 500, and much of the performance of that index has come from a subset of those.

We know from our experience in 2025 with ESCT, above, that investors have already been shifting uncomfortably in their seats over this, and the UK and European markets have done well as a little bit of money has shifted out of the US to lower-valued markets. But keep in mind that the market cap of the S&P 500 is over 18 times that of the FTSE 100, so a little bit more money flowing from the US is a lot of money if it arrives in the UK. I think FSV is incredibly well positioned to benefit from this next year and has an outstanding track record of finding the right UK companies at the right valuations over many years.

Jean-Baptiste Andrieux

My rationale for selecting a UK-focused strategy at the end of last year was that UK equities were trading at reasonable valuations (relative to other developed markets), offered an acceptable short-term macroeconomic outlook (notably compared to continental Europe), and benefitted from supportive ongoing trends such as share buybacks and M&A activity. In my view, FSV was an ideal strategy to capture these trends thanks to its contrarian, multi-cap approach.

It turned out to be a strong year for UK equities, and FSV performed even better in both NAV and share price terms. The trust benefitted from its exposure to UK banks and defence-related names, as well as takeover activity. Despite this, the performance was insufficient in the context of our competition, but I am at least relieved that I won’t be bringing home the wooden spoon in my first participation. If anything, my regret is not having actually bought shares in FSV.

Whilst having absolutely no ties to Japan and never having set foot there, I have a great appreciation for pretty much everything this country produces: from its cinema to its consumer electronics, not to mention its whiskeys. I also like some of the developments happening in the Japanese equity market, which explains my pick for 2026: Schroder Japan Trust Ord (LSE:SJG).

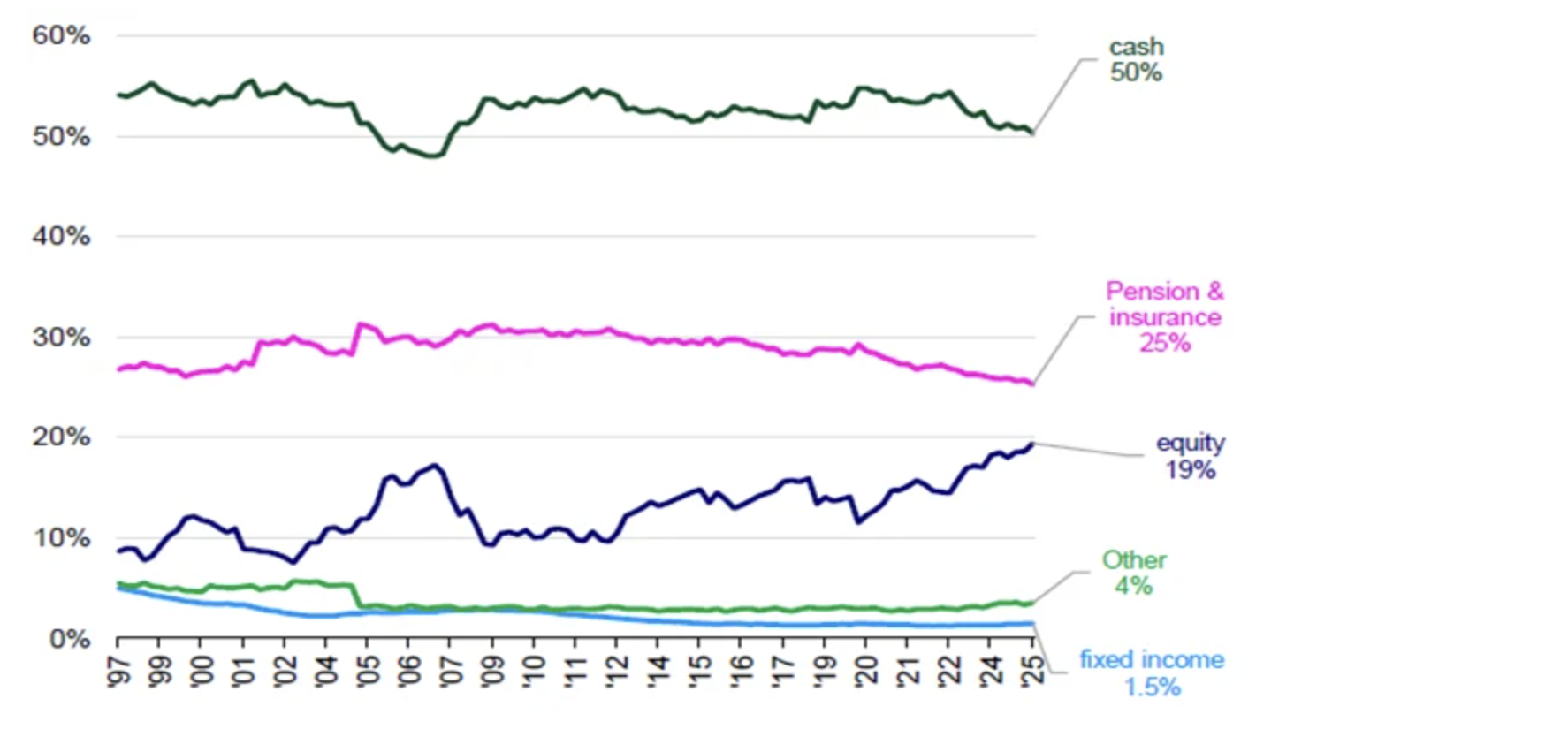

Of course, there are the ongoing corporate reforms - which aim to improve governance and shareholder outcomes, among others - that appear to be making progress, as my colleagues Alan Ray and Josef Licsauer discussed in this article. In addition, the NISA - Japan’s equivalent of the UK ISA - was revamped in 2024, with higher contribution limits and enhanced tax benefits, and the Japanese authorities are now considering launching a ‘junior NISA’. This creates incentives to put money to work, further supported by the return of inflation in Japan after decades of near-zero inflation and deflation, making holding cash less attractive. Speaking of cash, Japanese households still have about half of their wealth stored in cash, as the chart below shows.

FINANCIAL ASSETS OF JAPANESE HOUSEHOLDS

Source: Invesco, LSEG, Datastream, Bloomberg, as at 29/09/2025.

As such, I don’t think it’s irrational to expect that Japanese households will gradually reduce their cash holdings, with some of that capital flowing into the domestic equity market. After all, home bias is a nearly universal phenomenon. Moreover, with investors increasingly looking to diversify away from US equities, it’s also conceivable that Japanese equities could benefit from foreign inflows. Certainly, the risk is that these dynamics may take longer than 12 months to play out or may not materialise at all.

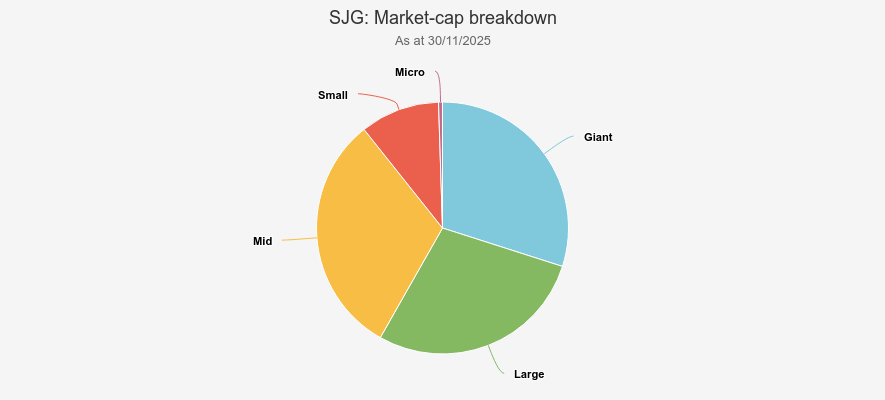

Anyway, the reason I specifically chose SJG is its focus on undervalued quality companies, its on-the-ground resources in Japan, and its bias toward small and mid caps. This segment has been slower to respond to the mandates of the Tokyo Stock Exchange and tends to be under-researched, offering opportunities to generate alpha. In addition, SJG is trading at a discount of circa 8.8% at the time of writing, so the trust also offers re-rating potential.

MARKET-CAP BREAKDOWN

Source: Morningstar.

David Brenchley

2025 represented the first time that I’ve partaken on a fund-picking competition, and I was pretty satisfied with how it went. My aim was to go hard or go home. In other words, try to pick a trust that gave me the best chance of winning, even if it also came with the risk that it would come in stone-cold last.

China seemed to fit the bill at the start of last year. It was a stock market that had built up some nascent momentum, after sliding into a three-year bear market, but where sentiment was still sceptical, with many having written it off as uninvestible.

We admittedly got off to a rocky start, as Liberation Day in April saw almost 30% wiped off the share price of my choice, Fidelity China Special Situations Ord (LSE:FCSS). The recovery since then has been impressive, with China proving itself surprisingly resilient amid a trade war with the world’s biggest economy.

China’s central government rode to the rescue. Its unveiling, in September 2024, of a series of policy measures aimed at stimulating consumer confidence seems to be bearing fruit to some extent. We’ve seen a stabilisation to some degree in the country’s property market, which has helped.

After a few pauses, tariffs on China have been slowly falling as trade talks continue. In any case, China’s investment story remains firmly focussed on consumerism, meaning the government’s domestic decisions seem, to me, to have the potential to really move the needle.

My decision now is whether to roll with FCSS into 2026 - and there are plenty of reasons why this could be a good choice - or to look for another unloved area due for a rebound.

As we move into 2026, I’m gearing up to become a homeowner for the first time and will, I’m sure, have a year of learning DIY on YouTube. That said, whilst there will be lots of work to do, we’ll be living by the ‘if it ain’t broke, don’t fix it’ mantra, which should hopefully help us focus on the real things that need fixing.

The same can be said for my trust pick for 2026: if it ain’t broke, don’t fix it. FCSS may not have won me gold last year, but it got me pretty close, and I’m rolling with it for one more year.

I did consider taking my metaphorical profits and looking elsewhere. Select Japanese smaller companies and Indian trusts stand out as potentially interesting options, but I’ve written lots about the factors driving China’s stock market rally, not only from the point of Chinese equity fund managers, but also broad emerging markets investors. The conclusion I’ve come to is that the market still looks attractive.

Clearly, with the FCSS holding in my SIPP sitting on profits of circa 60%, valuations are no longer rock bottom, yet they still look low compared to others. Indeed, the MSCI China Index had a forward price-to-earnings (PE) ratio of c. 12.7x on 28/11/2025, according to MSCI. That’s still lower than the circa 13.5x forward PE of emerging markets as a whole (albeit only slightly).

The first leg of China’s recovery was largely driven by fiscal and monetary policies aimed at trying to stimulate consumer demand and a recovering property market. The second leg may be driven by China’s so-called anti-involution campaign, which could have a real impact on company fundamentals.

The goal of the campaign is to combat excessive competition in key industries such as electric vehicles, solar, and e-commerce. Competition in these industries is fierce, meaning companies operating here become locked in brutal price wars, which diminishes the returns they can make. The median profit margin of 33 of China’s listed automakers fell to just 0.83% in 2024, from 2.7% in 2019, according to LSEG data. It could also lead to mounting deflationary pressures, something the government is keenly worried about.

Should the campaign succeed, it could lead to higher profit margins, which could tempt some investors who have shunned them because of the historically low margins.

China is already catching up to the US when it comes to technological innovation. This also comes with a lower valuation: the MSCI China Tech 100 Index has a forward PE of circa 16.6x, a circa 70% discount to the MSCI USA Information Technology Index. Should tech investors get scared of US tech’s overvaluation, China could benefit due to this low valuation.

In addition, despite the low valuations and the recovery we’ve seen, investors remain sceptical. China was the biggest underweight in the emerging market universe, as at 31 October 2025, according to HSBC.

The bank found that the average emerging market fund was 4.6% underweight China, much larger than the next biggest underweight, which was Taiwan at 2.7%. I’m hoping that the China recovery remains a big theme moving through 2026.

Jo Groves

Rockwood Strategic Ord (LSE:RKW) fired me to glory last year with a 30% return, which I may have mentioned once or twice. Pride comes before a wobble, however, and this year’s 11% return has nudged me down the table in a distinctly Liverpool-like fashion. A timely reminder about managing expectations: a double-digit gain isn’t too shabby given the headwinds buffeting UK equities and almost three times the AIC UK Smaller Companies sector average.

There were notable success stories, with Vanquis Banking Group (LSE:VANQ) more than doubling its share price in 2025 and Centaur Media (LSE:CAU) not far behind. Things were not quite so rosy at M&C Saatchi (LSE:SAA) and STV Group (LSE:STVG), but that’s the rub of a high conviction portfolio. With the Budget finally in the rear-view mirror and Rockwood’s quasi-private equity approach, I’m still backing the trust to find value in the unloved small-cap sector.

It’s always a gamble picking a trust on a blistering run, and International Biotechnology Ord (LSE:IBT) certainly fits the bill with a 50%-plus rise over the last six months. I’ve enjoyed some of the spoils, having owned IBT for the past year, but I’m backing it to keep shining in 2026.

Top of the list is the managers’ knack for getting the big calls right, from rotating into small and mid caps to backing rare diseases over oncology. Ailsa and Marek also have an enviable track record of investing in exactly the sort of derisked assets being snapped up by big pharma to plug their multi-billion-dollar patent gaps. With interest rates drifting lower, political clarity improving, and M&A seemingly continuing unabated, I’m hopeful that IBT will fire me back into pole position for next year.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.