Three dominant themes among top funds

The leading funds are up nearly 50% in the third quarter of 2025, writes Saltydog Investor.

29th September 2025 14:21

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As we approach the end of September,a clear trend has emerged among the third quarter’s leading funds. Four of the top five are gold funds from the Specialist sector, all benefiting from the sharp rise in precious metals.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

The standout performer is WS Ruffer Gold, which has gained nearly 50% so far this quarter. Close behind are Ninety One Global Gold, SVS Sanlam Global Gold & Resources, and BlackRock Gold and General, all showing gains of more than 40%. The other fund in the top five is the WS Amati Strategic Metals fund, which has returned just under 45%.

Saltydog’s top 10 funds in Q3 (up to 27 Sept)

| Fund | IA sector | July | Aug | Sept | Q3 |

| WS Ruffer Gold | Specialist | 2.6 | 20.3 | 21.4 | 49.9 |

| Ninety One Global Gold | Specialist | 2.1 | 17.7 | 23.2 | 48.2 |

| SVS Sanlam Global Gold & Resources | Specialist | 2.2 | 16.1 | 24.7 | 48.1 |

| WS Amati Strategic Metals | Commodities & Natural Resources | 6.7 | 15.6 | 17.3 | 44.7 |

| BlackRock Gold and General | Specialist | 3.9 | 15.7 | 19.2 | 43.3 |

| Allianz China A-Shares Equity | China/Greater China | 8.5 | 15.1 | 6.0 | 32.4 |

| Pictet-Biotech | Specialist | 13.4 | 2.7 | 7.4 | 25.1 |

| Veritas China | China/Greater China | 7.7 | 4.4 | 10.5 | 24.2 |

| GAM Star China Equity | China/Greater China | 7.5 | 6.1 | 8.9 | 24.2 |

| Matthews China Fund | China/Greater China | 9.8 | 6.4 | 6.4 | 24.2 |

Data source: Morningstar. Past performance is not a guide to future performance.

The rest of the top 10 is dominated by funds from the China/Greater China sector, with Allianz China A-Shares Equity, Veritas China, GAM Star China Equity, and Matthews China all recording quarterly gains of between 24% and 32%. Pictet-Biotech, from the Specialist sector, is the only other fund to make it into the list. These results reflect two of the strongest themes of the summer: the rally in gold and the rebound in Chinese equities.

Gold has been on a remarkable run. At the beginning of 2024, the metal was trading around $2,000 per ounce. Since then, it has climbed dramatically, recently breaking $3,800 to reach yet another all-time high. The rally has been driven by several factors: record levels of central bank buying, persistent inflation pressures, expectations of US interest rate cuts, a weaker dollar, and ongoing geopolitical uncertainty.

For companies that mine gold, the results have been even more dramatic. Unlike physical gold, which simply reflects the spot price, miners’ profits are leveraged to the price of the metal. When gold rises, their earnings can increase disproportionately, driving share prices higher. That explains why funds which invest in companies associated with the mining and production of gold and other precious metals have performed so well.

The other big story of the third quarter has been China’s stock market recovery. It has been under pressure for years, weighed down by concerns about regulation, slowing growth, and strained relations with the US. However, over the summer there have been signs of stabilisation. The July trade agreement between the US and China, which included tariff reductions and a commitment to greater market access, boosted investor confidence.

Beijing has also introduced fresh policy-easing measures, including lower reserve requirements for banks and targeted support for key industries. Combined with the truce in US-China trade negotiations and renewed interest from global investors, these moves have helped the market rebound. Funds such as Allianz China A-Shares Equity, Veritas China, GAM Star China Equity, and Matthews China have all posted quarterly gains of more than 20%, making China/Greater China one of the best-performing sectors in recent months.

- The Analyst: the benefits of owning commodities in your portfolio

- Copper price rally boosts these UK mining shares

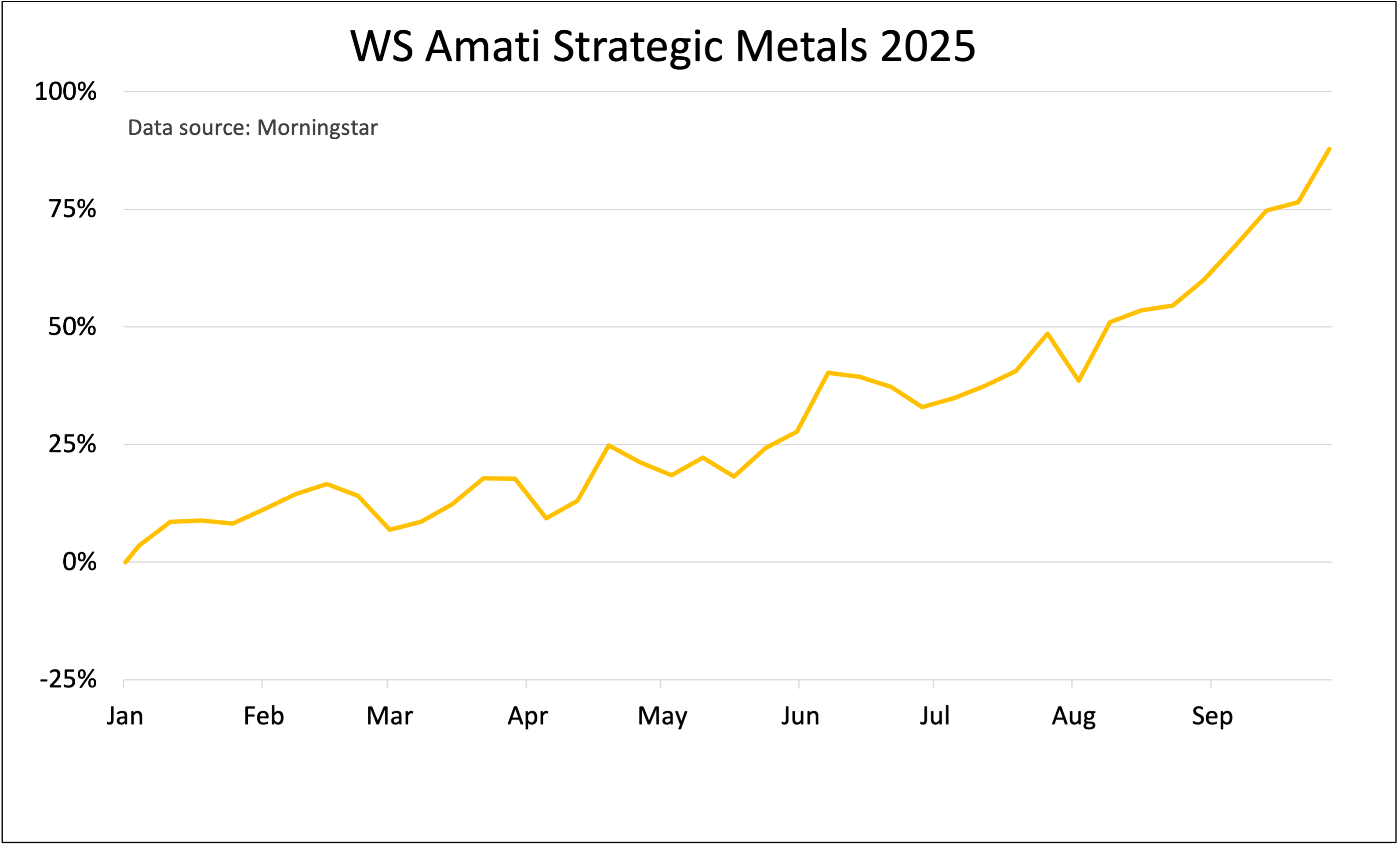

While gold and China have been familiar themes, the presence of the WS Amati Strategic Metals Fund in the top five is more unusual and worth highlighting. The fund was launched in 2021 and takes a broad approach to investing in what it calls “strategic metals”: those seen as vital to the global economy and future macroeconomic shifts.

The portfolio covers gold and silver, but also base and specialty metals such as copper, nickel, lithium, manganese, and rare earths. These materials are essential for everything from traditional industry to the technologies underpinning the energy transition. They are also critical for artificial intelligence (AI), with rare earths used in high-performance magnets, semiconductors, and specialist alloys needed for advanced computing and data centres. That gives the Amati fund a direct link to one of the most powerful global investment stories of the moment.

The fund typically holds 35 to 40 companies listed across the UK, US, Canada, and Australia, with a tilt towards mid- and smaller-cap miners where they see greater potential for value creation. Their largest holdings include companies such as Fresnillo (LSE:FRES), G Mining Ventures Corp (TSE:GMIN), Eldorado Gold Corp (TSE:ELD), Equinox Gold Corp Ordinary Shares Class A (TSE:EQX), and Pan American Silver Corp (TSE:PAAS).

Around half the portfolio is in gold-related companies, but there is meaningful exposure to silver, industrial, and speciality metals. This year the fund price has already risen by nearly 90%.

Past performance is not a guide to future performance.

The only non-commodity, non-China fund in the top 10 this quarter is Pictet Biotech. It has gained more than 25% in the third quarter, showing that while the headlines have focused on metals and China, other themes have also been performing well.

- Insider: biotech receives significant boardroom backing

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

As we enter the final quarter of 2025, the big question is whether these trends can continue. Gold’s rally has been fuelled by a unique combination of central bank demand, inflation fears, and geopolitical instability, while China’s rebound depends on policy support and global trade relations. Both are vulnerable to setbacks, but for now they remain the dominant themes.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.