Wild’s Winter Portfolios 2025: a half-time round-up

After completing the third month of this six-month investing strategy, Lee Wild discusses recent performance of these seasonal portfolios including a mix of big winners and losers.

11th February 2026 09:04

by Lee Wild from interactive investor

January was a strong month for global stock markets, a broad-based rally driven by some quite improbable geopolitical tensions. Few would have predicted President Donald Trump’s threat to annex Greenland, and so shortly after American forces captured the leader of Venezuela. It accelerated a shift to defence stocks and haven assets, and both of Wild’s Winter Portfolios also continued to narrow seasonal losses.

- Invest with ii: Open an ISA | ISA Investment Ideas | ISA Offers & Cashback

The FTSE 100 wasted little time breaking above 10,000 for the first time, eventually trading as high as 10,257 mid-month. It ended January with a 2.9% gain. It was similar for the FTSE 350 benchmark index, although investors continued to pick up beaten-down small-cap shares, with the AIM All-Share index up 6.7% for the month.

UK stocks continued to outperform many overseas rivals. The S&P 500 added a modest 1.4%, the Nasdaq Composite tech index rose less than 1%, while the German and French exchanges were fractions either side of flat.

Precious metals miners Fresnillo (LSE:FRES) and Endeavour Mining (LSE:EDV) remained in demand, as did sector heavyweights Glencore (LSE:GLEN), Rio Tinto Ordinary Shares (LSE:RIO) and Antofagasta (LSE:ANTO). But the takeover of Beazley (LSE:BEZ) and further buying of military manufacturers BAE Systems (LSE:BA.) and Babcock International Group (LSE:BAB) were also key drivers of the FTSE 350.

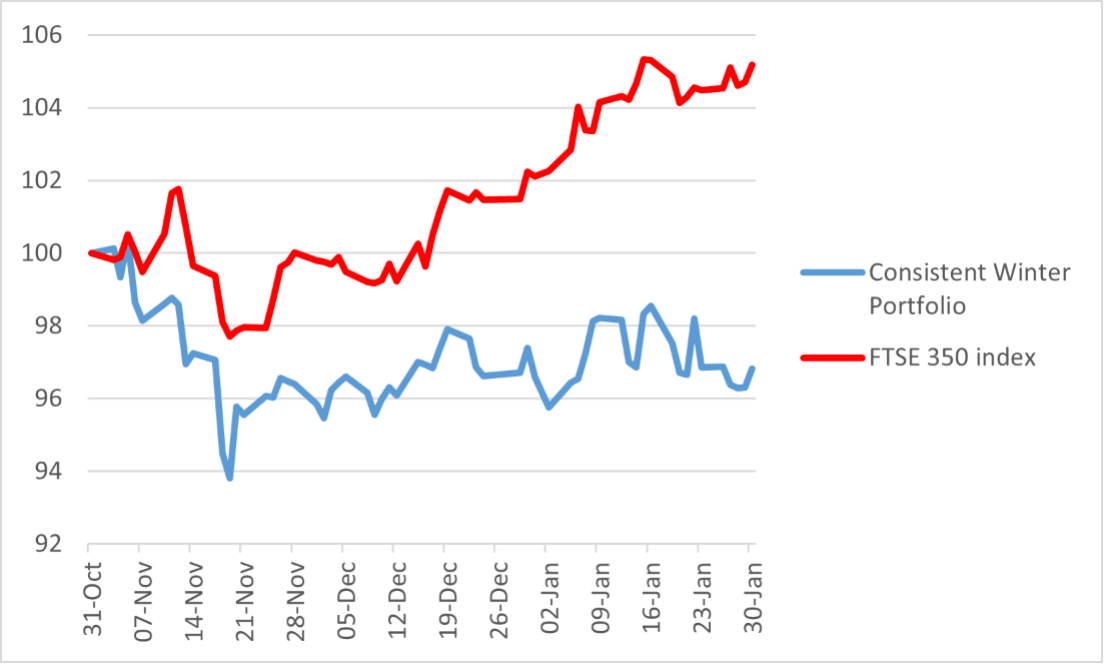

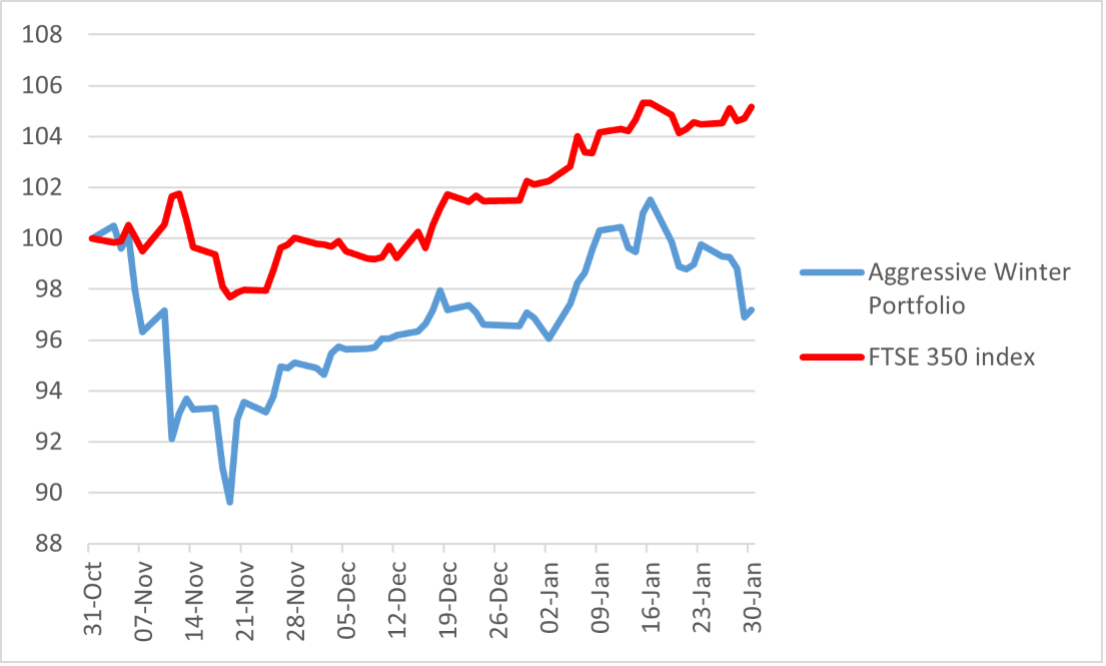

At the halfway stage of this six-month seasonal strategy Wild’s Consistent Winter Portfolio is now down 3.2% following a second month of modest 0.2% gains. Wild’s Aggressive Winter Portfolio narrowed its deficit to 2.8% as it added 0.3% in January. The FTSE 350 had its best month of the winter so far, up 3%, taking gains for the past three months to 5.2%.

As a reminder, the consistent winter portfolio is made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade. Entry criteria is relaxed slightly for the aggressive winter portfolio, giving up some consistency in return for potentially bigger profits. Still, all constituents must have risen in at least eight of the previous 10 winters.

Wild’s Consistent Winter Portfolio 2025-26

Past performance is not a guide to future performance.

IT services firm Computacenter (LSE:CCC) remains the only winner in this winter’s consistent portfolio, increasing seasonal returns to 16.1% following a 13.6% advance in January. In a trading update ahead of annual results, it said adjusted pre-tax profit for 2025 would be no less than £270 million, comfortably ahead of the £243.4-259 million expected by analysts.

Management was particularly pleased with consistently strong growth throughout the year with both enterprise and so-called hyperscale customers in North America. Order intake there remained strong during the second half.

Soft-drinks maker AG Barr (LSE:BAG) delivered positive returns for the month, a 2.2% jump narrowing its winter deficit to 4.6%. Halma (LSE:HLMA) also eked out a 0.2% advance, leaving the safety products conglomerate within a fraction of breakeven for the three months. That’s despite chief technology officer Catherine Michel’s decision to sell £535,000 of Halma shares near a record high at £36.68.

- 10 shares to give you a £10,000 annual income in 2026

- Investment outlook: expert opinion, analysis and ideas

For once, transport operator FirstGroup (LSE:FGP) did not win the wooden spoon. Its shares still fell 2.2% in January, taking winter losses back to 11.2%. There was no market-moving news last month, but it looks like investors will need more convincing if FirstGroup shares are to claw back more of November’s price slump.

Insurance firm Admiral Group (LSE:ADM) felt the brunt of downgrades from City analysts. Goldman Sachs got the ball rolling with a cut to ‘sell’ from ‘buy’ with price target drop to 2,920p. It worries about a negative impact on margins from rising ‘burn costs’, which are the expected cost of future claims. The introduction of autonomous vehicles, near-term inflation risk and longer-term structural risks could also weigh on consensus earnings estimates.

RBC and Barclays joined in, the former cutting Admiral’s rating to ‘sector perform’ from ‘outperform’ and the latter reducing its price target to 3,100p.

Wild’s Aggressive Winter Portfolio 2025-26

Past performance is not a guide to future performance.

Defence contractor BAE Systems is star of the show in this aggressive basket of shares, rallying 15.2% in January. After a very poor start to the winter, the shares have now returned 5.5% for the seasonal strategy so far. There were no company announcements during the month, but geopolitical tensions ratcheted up by Trump in Greenland especially, have got people worried.

Engineering contractor Keller Group (LSE:KLR) had a good month too, a 6.4% return extending its winter gains to 11.6%. Again, there was nothing from the company, but shares hit a record high in the first half of the month when broker Berenberg said ‘buy’ and raised its price target to 2,100p from 1,900p.

But that’s where the good news ends. FirstGroup appears in both portfolios this year, so its 2.2% decline hurt. But it didn’t hurt as much as food packager Hilton Food Group (LSE:HFG)’s 6.7% loss, which takes its deficit so far this winter to a miserable 27%. The company’s trading update at the end of the month was meant to report conclusions of a strategic review aimed at turning the business around. It didn’t.

- Are high fees chipping away at your investment returns?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Instead, management said annual results for 2025 would be meet expectations for adjusted profit of £72-75 million, but that various export restrictions and inflationary pressures would reduce that to £60-65 million in 2026. Results of the review will be published alongside annual results scheduled for 31 March.

Former star of this aggressive portfolio, Games Workshop Group (LSE:GAW) gave up 9.9% in January. The fantasy wargames company had generated winter gains of as much as 24% in December but is now up a more modest 7% over the past three months. That’s despite record half-year results published mid-month and a price target upgrade by analysts at Jefferies to 21,850p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.