AIM at 25: key events, star stocks and what it does best

Our award-winning writer performs a forensic analysis of AIM and picks highlights of the past 25 years.

12th June 2020 15:54

by Andrew Hore from interactive investor

Our award-winning AIM writer carries out a forensic analysis of the junior market and picks highlights of the past 25 years.

The Alternative Investment Market (AIM) celebrates its 25th anniversary on 19 June. There have been thrills and spills, but large companies have been built up as a consequence of joining the junior market and using the quotation to enhance growth.

AIM was set up after the London Stock Exchange decided to close the Unlisted Securities Market (USM), which was around for nearly a decade less than AIM has been so far. The London Stock Exchange also decided to close the rule 4.2 matched bargains trading facility.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Many of the early entrants to AIM came from rule 4.2 and the USM. The ending of rule 4.2 was later in 1995, so the initial admissions mainly came from there with the USM closing in 1996 so those companies had more time. The low average amount raised by new admissions during 1995 is predominantly down to so many of them being introductions that did not raise any cash.

| Rule 4.2 was previously known as rule 163, and then rule 535. It was effectively an over-the-counter, or OTC, market that allowed shares in companies that were not listed on the LSE to be occasionally traded through matching buyers and sellers. They did not have to follow the same rules as a quoted company. That is why Weetabix was traded there because it did not want the level of scrutiny of a listed company. Rule 4.2 became more active than the LSE wanted it to be, so it wanted to stop it. This is where JP Jenkins focused and is why it started Ofex to continue to trade in these companies. |

Early days

There were 10 companies that joined AIM on its first day and their total market value at the end of the day was £82.2 million.

Seven of the companies were introduced from rule 4.2 and the other three were also introductions. None of these 10 companies are still on AIM, with Main Market-listed investment company Athelney Trust (LSE:ATY) the only one still quoted. Most of the others were taken over. Old English Pub Company was acquired by Greene King for nearly three times the float price, and Country Gardens was taken over by Wyevale Garden Centres for six times the introduction price. Both these companies moved to the Main Market before the bids.

There are 14 companies left on AIM of the 121 that floated during 1995. Silence Therapeutics (LSE:SLN) (originally Stanford Rook) was the first of these to join, but it did move to the Main Market in 1999 and then back to AIM in 2004. Universe (LSE:UNG), previously Card Clear, has been continuously on AIM for the longest time, although the original payment card fraud prevention operations were demerged as Retail Decisions in 2000. The valuation at the time was £95.5 million and Retail Decisions was acquired for £168 million in 2006.

| AIM's survivors from 1995 | |||||

|---|---|---|---|---|---|

Company | Ticker | Original name | Flotation date | Float value £m | Current value £m |

Silence Therapeutics (LSE:SLN) | SLN | Stanford Rook | 19/07/1995 | 21.97 | 356.2 |

Universe (LSE:UNG) | UNG | Card Clear | 03/08/1995 | 7.63 | 15 |

Bezant Resources (LSE:BZT) | BZT | Voss Net | 14/08/1995 | 2.9 | 1.6 |

Finsbury Food (LSE:FIF) | FIF | Graduate Appointments | 04/09/1995 | 4.34 | 84.7 |

Wynnstay Properties (LSE:WSP) | WSP | 21/09/1995 | 4.73 | 16.4 | |

Manx Financial (LSE:MFX) | MFX | Conister Trust | 22/09/1995 | 7.19 | 10.2 |

NWF (LSE:NWF) | NWF | 25/09/1995 | 22.13 | 98 | |

Eco Animal Health Group (LSE:EAH) | EAH | Lawrence | 26/09/1995 | 12.65 | 181 |

Caledonian Trust (LSE:CNN) | CNN | 29/09/1995 | 8.52 | 15.3 | |

First Property Group (LSE:FPO) | FPO | Hansom Group | 29/09/1995 | 6.06 | 41.9 |

Westmount Energy (LSE:WTE) | WTE | 02/10/1995 | 1.23 | 18.2 | |

Journeo (LSE:JNEO) | JNEO | Toad | 03/10/1995 | 14.31 | 4.6 |

IG Design (LSE:IGR) | IGR | International Greetings | 31/10/1995 | 22.52 | 560.9 |

TomCo Energy (LSE:TOM) | TOM | Manx & Overseas | 15/12/1995 | 16.19 | 1.8 |

Some of the other companies, such as Lloyds’ insurance underwriter Hiscox (LSE:HSX), moved to the Main Market, while others were taken over. ASK Central was valued at £5.63 million when it raised money at 35p a share in October 1995. Just over eight years later, a 220p a share bid valued the restaurants operator at £213 million.

There were failures, of course, but that is to be expected in a market which specialised in immature, growing companies, some of which had flawed businesses. There were scandals as well. Trade finance provider Versailles was initially an AIM star after it floated in 1995 and moved to the Main Market. It subsequently collapsed, and it turned out that transactions accounting for 80% of business were false. Chief executive Carl Cushnie and finance director Fred Clough were sent to prison.

- AIM versus FTSE 100: why small-caps are flying

- AIM's 25th anniversary: from Wild West to runaway success?

- 10 quality AIM shares that are beating the market

Some companies decided to drop their AIM quotations. In the early days, companies did not have to obtain shareholder permission to drop their AIM quotation. The rule that 75% of the shares voted at a meeting had to agree to a cancellation was brought in later.

The share prices of five of the 14 companies are higher than when they joined AIM. The best performer of these is Wynnstay Properties (LSE:WSP), which has also consistently paid growing dividends. Wynnstay Properties is the company that has been on AIM longest and is still operating its original business. The total return over the past 24 years is 573%. Feed and fuels distributor NWF (LSE:NWF) has produced a total return of 410% over the same period.

The best performer over 24 years is broker Numis (LSE:NUM), which has generated a total return of 3,680% over the period.

Gresham House (LSE:GHE) has a better total return of 8,860%, but it was previously on the Main Market and did not transfer to AIM until December 2014. In fact, the other three of the top five performers over 24 years also transferred from the Main Market, although much earlier than Gresham House. They are Renew Holdings (LSE:RNWH), Filtronic (LSE:FTC), helped by past special dividends, and Dart Group (LSE:DTG).

One of the unintended consequences of AIM was that most of the smaller end of the Main Market has switched to the junior market and fewer than anticipated have moved the other way.

By the end of 1998, AIM was valued at £4.44 billion, which was down on £5.66 billion at the end of 1997, and that is less than the current valuation of online fashion retailer Boohoo (LSE:BOO).

Internet boom

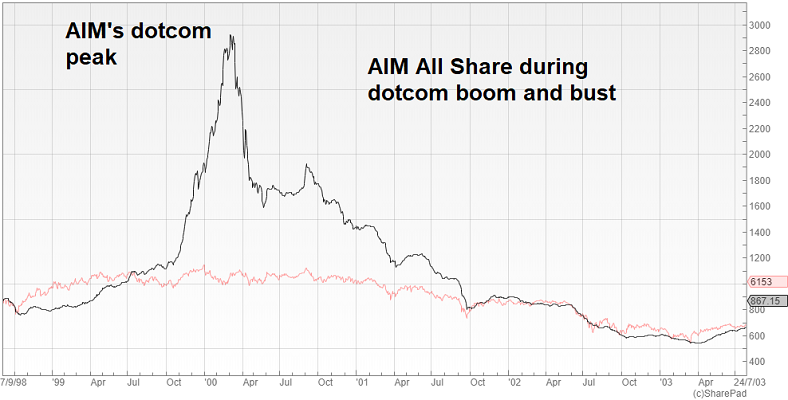

A boost in the valuation during 1999 was sparked by the internet boom. There were a significant number of companies floating with internet businesses that were still at an early stage, and others were purely ideas and not yet a business. The value of AIM soared to £13.5 billion at the end of 1999.

The flood of new admissions continued into 2000, although the markets peaked during the spring. They fell back later in the year, but AIM ended the year worth £14.9 billion. The following two years AIM’s market value was lower.

Source: SharePad. FTSE AIM All Share index in black, FTSE 100 in red. Past performance is not a guide to future performance.

One of the big AIM successes floated in October 2001. ASOS (LSE:ASC) (then known as AsSeenOnScreen) could not raise as much cash as it would have liked because of the weak stock market. At the placing price of 20p, the online retailer was valued at £12.4 million.

The ASOS share price started at a premium and subsequently fell back to 3.25p in August 2003. The share price got back to 20p in April 2004. This means that it took 30 months from the flotation to get back to the placing price. There was then a substantial acceleration in the share price.

The share price has fallen by three-fifths from its high, yet ASOS is still one of the largest companies on AIM, currently worth over £3 billion.

ASOS is not alone in having a rocky couple of years as a quoted company before prospering. Fellow online retailer Boohoo initially got off to a stronger start when it joined AIM at a placing price of 50p in March 2014. Having started at 77p, the share price was below 50p one month later. It was two years before the share price got back to 50p. The shares now trade at 368p, valuing the company at £4.6 billion.

This shows that even the better performers sometimes require patience and new companies should not be written off if the share price does not do well at first. This is particularly true of technology companies where it can take years to fulfil their potential.

Peak admissions

The largest number of new admissions was during 2005 when there were 519, followed by 462 in 2006.

This number of flotations was inflated by a flood of shells – companies that have no operating business, just cash - onto the junior market. These were generally companies valued at a few million pounds where someone had come up with a broad idea that they wanted to acquire businesses in a particular sector.

AIM decided that it did not want a lot of tiny shells hanging around and taking years to secure acquisitions. That is why it tightened up the regulations about the minimum that had to be raised by a company with no trading business. It also limited the time they could stay quoted without doing a deal. Some failed to do a deal and left AIM due to the new regulations.

2008 credit crunch

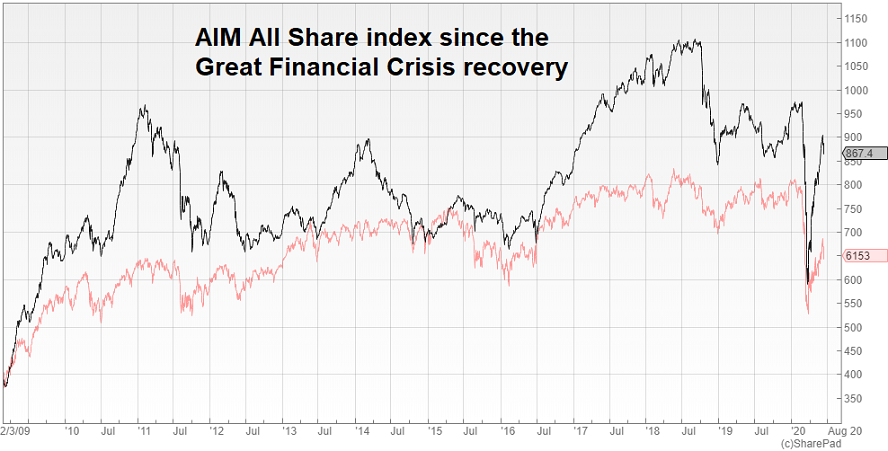

In 2007, £16.2 billion was raised by new and existing companies on AIM and, for the first time since 1999, the majority was raised by the existing companies. Every year since then, existing companies have raised more than new admissions and the difference has widened.

Even though 2008 started reasonably well, the total raised during the year was barely much more than one quarter of the previous year’s figure at £4.32 billion. That was because the credit crunch started to hit the markets.

The market value of AIM peaked at £97.6 billion at the end of 2007 and slumped below £38 billion at the end of 2008. A new peak was not reached until 2017.

AIM had a tough time, but it rode this out. Some companies decided that being a quoted company was not for them and left, or they were acquired at a low valuation. The number of AIM companies has been declining, but their average value has increased significantly.

Source: SharePad. FTSE AIM All Share index in black, FTSE 100 in red. Past performance is not a guide to future performance.

The past decade

Since 2010, there has only been one year, 2017, when more than £6 billion was raised by new and existing AIM companies. Only in 2014 have there been more than 100 new admissions in a single year.

This has been highlighted by critics who particularly focus on new admissions and number of companies quoted. Increased costs and tighter regulation have made it uneconomic for very small companies to float, thereby reducing the potential flotations. There is still a range of companies, but the size has tended to be larger.

| THE EVOLUTION OF AIM | ||||||

|---|---|---|---|---|---|---|

| 1995 | 2000 | 2005 | 2010 | 2015 | 2020 (May) | |

| Average company value (£m) | 19.7 | 28.5 | 40.5 | 66.5 | 70 | 118.5 |

| Average float fundraising (£m) | 0.6 | 6.3 | 12.4 | 11.8 | 20.3 | 7 |

| Average daily trades | 212 | 7,819 | 8,421 | 20,861 | 29,552 | 60,583 |

| Average trade value (£m) | 2 | 51.6 | 151 | 160.1 | 165.1 | 302.9 |

The average size of AIM companies has risen substantially, even though some larger companies – most recently Diversified Gas & Oil (LSE:DGOC) – have moved to the Main Market. There are 17 companies on AIM that have a valuation of more than £1 billion.

One thing that has improved enormously in the past decade is trading activity. The inclusion of AIM shares in ISAs has been a substantial element behind the growth in trading activity. Average daily trades are running at nearly four times the levels in 2007.

The average value of trades has generally been lower than the peak in 2007, but they are currently running at a new high this year. The lack of growth in the value of trades compared with number of trades suggests greater small investor involvement.

- IPO schedule for 2020 just got interesting

- Company fundraisings: what you need to know

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There can be a focus on the disasters because they provide more interesting stories, but there have been many companies that have been able to use AIM to become significant business. As well as ASOS and Boohoo, there is antibodies supplier Abcam (LSE:ABC), which in less than 15 years has increased in value from £57.5 million to around £3 billion, and the share price is more than 35 times the level when it floated.

Companies, such as video games services provider Keywords Studios (LSE:KWS), have used AIM to make acquisitions and become a consolidator in their industries, while the likes of Fevertree Drinks (LSE:FEVR) have used the quotation to finance organic growth.

Melrose Industries (LSE:MRO) started out as a shell on AIM and is now a constituent of the FTSE 100 index, and there are 15 former AIM companies in the FTSE 250 index.

All stock markets have successes and failures. AIM broadly moves in the direction of the Main Market, but there can be a lag. Brexit uncertainty and Covid-19 affect all markets. The cash raised by AIM companies to shore up their balance sheets due to Covid-19 shows that AIM is still effective in generating investment for companies.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.