Stockopedia: signs of momentum in 10 undervalued shares

This strategy looks for persistent trends then tries to predict the future.

21st April 2021 16:11

by Ben Hobson from Stockopedia

This strategy looks for persistent trends then tries to predict the future.

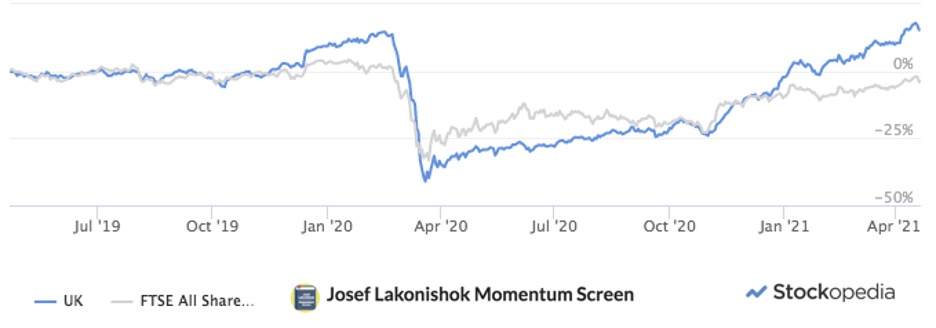

When markets fell sharply in early 2020, one investing strategy that naturally felt the pain was momentum. In calm conditions like we’ve seen since the financial crisis, momentum can be a pointer to the very fastest moving shares. But when sentiment turns south and there’s fear on the streets, the strategies that use it can suffer. But, just over a year on, there are signs that momentum is finding its way again.

The mechanics of momentum

Momentum is an intriguing factor in investing. It's the observation that trends tend to persist. Whether it’s a price trend (price momentum) or consistent earnings growth (earnings momentum), recent performance can be a predictor of what is to come.

In particular, the academics and finance professionals that have studied it have found that extreme trends often have the most predictive power. When it comes to price momentum, that means stocks with the very best price strength, or those hitting new 52-week highs. And with earnings momentum, important clues can be found in stocks beating analyst forecasts or getting significant upgrades.

- Stockopedia: how to find the most promising growth stocks in the market

- Stockopedia: 10 value investing shares proven by the ‘magic formula’

Research shows that a major reason why momentum actually happens is that extreme trends can initially create uncertainty in the minds of investors. After that, a wave of recognition takes over and more and more investors buy into the trend. And so the trend continues.

A strategy built on momentum

One of the key players in the early research into momentum was a man called Josef Lakonishok. He and his team investigated a range of potential drivers and studied what it was that actually made the strategy work.

In fact, he saw enough evidence to start his own fund management business - LSV Asset Management - which he still runs.

Over several decades, Lakonishok concluded that the flawed behaviour of investors played a role in influencing share prices. He found that they tended to be far too reliant on using the past to predict the future and had a habit of developing a mindset about a company and then paying too much for its shares.

- Stocks tipped to thrive as consumer spending unleashed

- Are you saving enough for retirement? Our calculator can help you find out

As a result, he focused on the power of combining value and momentum - finding underpriced shares that the market was starting to buy into.

Lakonishok suggested using valuation ratios such as price-to-book, price-to-earnings, price-to-cash flow and price-to-sales to find stocks that look cheap against their sector average. But he also wanted to see evidence of positive momentum in his shares.

That meant positive price momentum over six months, better-than-expected earnings or upgrades to analyst forecasts.

A model of this approach did suffer during the crash early last year, but we’ve since seen more and more shares passing the screen rules and a much-improved performance. It seems that momentum is building in a number of potentially undervalued shares, and that’s driving the performance of this strategy.

Josef Lakonishok Momentum Screen: April 2019 - April 2021

Here are some of the companies that are currently passing the list. The results have a small- to mid-cap value flavour, with names ranging from the South African PGM miner, Jubilee Metals (LSE:JLP) to travel group Stagecoach (LSE:SGC), news organisation Reach (LSE:RCH)(which used to be Trinity Mirror), facilities management and engineering group MITIE (LSE:MTO) to food manufacturer Bakkavor (LSE:BAKK) and online gaming firm Best of the Best (LSE:BOTB).

| Name | Mkt cap (£m) | P/E ratio | Relative price strength 6m | EPS surprise last year (%) | Sector |

|---|---|---|---|---|---|

| Jubilee Metals (LSE:JLP) | 360.6 | 12.1 | 104.9 | 24.7 | Basic materials |

| Stagecoach (LSE:SGC) | 547.6 | 24 | 102.8 | 12 | Industrials |

| Renewi (LSE:RWI) | 394.5 | 7.8 | 92.6 | 22.2 | Industrials |

| Reach (LSE:RCH) | 674.1 | 7 | 85.1 | 0.18 | Consumer cyclicals |

| MITIE (LSE:MTO) | 908.4 | 8.9 | 82.8 | 5.7 | Industrials |

| Just (LSE:JUST) | 1,073 | 5.8 | 82.4 | 17.2 | Financials |

| Renold (LSE:RNO) | 51.6 | 10.8 | 76.4 | 24.1 | Industrials |

| Bakkavor (LSE:BAKK) | 747.5 | 11.6 | 73.7 | 4.35 | Consumer defensives |

| Best of the Best (LSE:BOTB) | 279.1 | 35.2 | 67.3 | 11.3 | Consumer cyclicals |

| Wincanton (LSE:WIN) | 538 | 16 | 65.7 | 2.93 | Industrials |

Momentum stocks at attractive prices?

As the market continues to drag itself back to where it was prior to the Covid-19 crash, some of the strategies that were hit the hardest are beginning to recover. Price momentum is building and some companies that may have been priced down during the crisis are beginning to beat earnings expectations. Those factors are playing into the hands of a strategy that looks for value and momentum - which means it could be a useful place to look for ideas.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.