Shares for the future: this new stock replaces a FTSE 250 firm

As part of a review of his Decision Engine, analyst Richard Beddard has decided to swap one constituent for something more entrepreneurial with better growth potential.

10th October 2025 15:14

by Richard Beddard from interactive investor

This week, I’m scoring Cake Box Holdings Ordinary Shares (LSE:CBOX) for the first time.

Having focused the Decision Engine down to 30 members (the “going deep” part of the strategy I deployed over the summer), this marks the first step in “going wide”, the next phase. I aim to create more competition for membership by examining more contenders.

- Invest with ii: Open an investment Account | General Investing with ii | Interactive investor Offers

Cake Box is the UK’s largest fresh cream cake retailer. Its speciality is egg-free celebration cakes, which is not as restrictive a niche as you might think.

Many people of South Asian heritage, some Hindus, Sikhs and Buddhists, for example, do not eat eggs. Egg allergies are also common in babies and small children, although we tend to grow out of egg allergies as we grow up.

Celebration cakes are often shared so it is a good idea to buy an egg-free cake unless you know the dietary restrictions of everyone likely to eat it. The cakes taste good anyway, so the egg free does not seem to put the rest of us off.

Cake Box: by the numbers

Cake Box is a franchise. It opened its first shop in East London in 2008. Ten years later when the company floated in 2018, there were 91 Cake Box shops. Today, seven years after floating, there are more than 250.

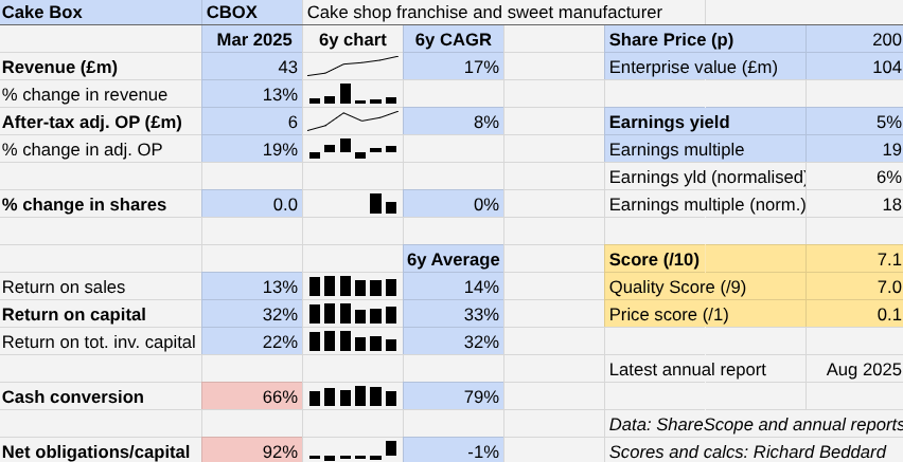

Revenue has grown at a Compound Annual Growth rate (CAGR) of 17% since flotation. Profitability took a ding in 2023, which explains slower profit growth of 8% CAGR.

I think we can put this down to experience. Already growing rapidly, Cake Box’s growth accelerated during the first year of the pandemic. But a data breach, the normalisation of trading as the pandemic weakened, director selling near the peak, and errors in Cake Box’s financial reports probably combined to puncture investors’ confidence.

Cake Box’s performance since it listed. Past performance is not a guide to future performance.

The share price fell 75% between November 2021 and November 2022, although the business remained highly profitable and cash generative.

The company beefed up its financial function and other aspects of the business, and it recruited the current chief financial officer (CFO), who previously held the same role at a large Domino’s Pizza franchise.

These improvements came with a higher wage bill though, which explains Cake Box’s decline in profit margin from the high teens in the company’s first three full years as a listed firm, to the low teens in the last three.

I think these were growing pains, profit margins have stabilised, and even with higher overheads, Cake Box looks like a good business.

Cake Box’s average return on capital (33%) and average cash conversion (79%) are very high, although cash conversion (66%) was below par in the year to March 2025, and Cake Box swung from a net cash position to being mostly funded by borrowings and lease obligations.

Cash conversion was lower than usual in the year to March 2025 because of higher than usual capital expenditure, spent on a new warehouse at Cake Box’s depot in Bradford and new IT and e-commerce capabilities. The Bradford depot is one of three. The others are in Enfield and Coventry.

- The first five years of retirement: are you prepared?

- Is 4.7% the new magic number for sustainable pension withdrawals?

Cake Box’s indebtedness stems from the acquisition of Ambala, an Asian sweet manufacturer and retailer. Ambala sweets are delicious but for a company with Cake Box’s earning power, the cost was substantial.

Ambala cost Cake Box £22 million, more than four times what it has earned in cash flow (after capital expenditure) in a typical financial year. It was mostly funded by borrowing, although the company also issued some shares.

Since the acquisition happened little more than a week before the year end in March, it added little to profit. ROTIC (return on total invested capital), was high (22%) in 2025 despite the added capital cost of Ambala, a sign that the combination should be a profitable one once Ambala makes more meaningful contributions.

Scoring Cake Box: scale and franchise expertise

Cake Box is not the only egg-free cake shop chain, but I think it’s the most virile. My searches have not revealed big direct competitors.

Eggless Cake Shop, also a franchise, was founded three years after Cake Box, for example. It has 24 stores, less than one-tenth of Cake Box’s total, mostly in the Midlands and West Country.

While Cake Box charges franchisees a modest annual fee to fund national marketing and the Cake Box website, it sets the fee at a level to cover costs, not make a profit. It makes most of its money by selling franchisees sponge, cream and other ingredients.

Buying in bulk and spreading marketing and other expenses over a wide base of franchisees, lowers costs. A national brand and click and collect capability mean 23.5% of franchisee sales come through the Cake Box website, which along with training, administrative support, audits, and the Cake Club loyalty card, binds franchisees to the mothership.

Cake Box believes that it can grow the number of cake shops to 400 in the UK. At the current rate of about 25 shops a year, the roll-out may have six years to go.

That target may change, but it’s encouraging that Cake Box is considering other options. Ambala is one. Another is overseas growth.

- The Income Investor: an alternative for those mulling shift to cash

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Earlier this year, Cake Box opened its first store outside the UK, in Paris. Selling gateaux to the French seems like a tall order, and the company is probably treating it as an experiment, but in a few months the store has received 67 reviews on Google and achieved an average of 4.7/5 (my local branch scores 4.9).

The Ambala acquisition is coherent. Both brands have South Asian roots and the combination widens Cake Box’s range of “celebratory and indulgence treats” to sweets, providing an opportunity to cross-sell.

Although the products are complimentary, the businesses are not. Ambala manufactures. It owns and operates 19 of its 22 stores. Only three are franchised.

Cake Box expects to make use of its scale to lower Ambala’s supplier and logistics costs, and make use of its franchising expertise to grow it.

This is a coherent strategy, but the company also plans to improve the efficiency of Ambala’s manufacturing, something it has less experience of, through increased automation.

This will require capital expenditure, deviating somewhat from Ambala’s capital-light business model, and complicating the story.

Cake Box | CBOX | Cake shop franchise and sweet manufacturer | 08/10/2025 | 7.1/10 |

How capably has Cake Box made money? | 2.5 | |||

Since it floated in 2018, Cake Box has grown revenue strongly and achieved high single-digit profit CAGRs by rolling out an egg-free cake shop franchise under the leadership of its founder and major shareholder (23%). The first Cake Box opened in 2008, and today there are more than 250. | ||||

How big are the risks? | 1.5 | |||

Cake Box has scale and a virile franchise model on its side, but it has incurred substantial debt due to the acquisition of Asian sweet manufacturer Ambala. Unlike Cake Box, Ambala is a vertically integrated manufacturer and retail chain, which complicates the business. | ||||

How fair and coherent is its strategy? | 3.0 | |||

400 Cake Box stores are planned in the UK and the company has opened its first foreign store in Paris. Cake Box and Ambala have Asian roots and will cross-sell indulgent treats and grow Ambala through franchising. Employees, franchisees, and customers approve of the Cake Box “family”. | ||||

How low (high) is the share price compared to normalised profit? | 0.1 | |||

Low. A share price of 200p values the enterprise at £104 million, about 18 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

I like Cake Box. It refers to franchisees as the Cake Box family.

Judging by customer ratings, as well as the financial results, the cakes and the shops are well liked. Ninety per cent of Cake Box’s employees said that it’s a “great place to work” in the survey of the same name. Franchisee satisfaction is harder to gauge, but the company says the average tenure of ownership is nine years. Fifty-four franchisees, half the total number (109), have gone on to operate more than one shop.

Although I’m leery of the debt, I’ve decided to add Cake Box to the Decision Engine, which makes it available to the Share Sleuth portfolio. To retain The Decision Engine’s focus, I must therefore drop a share. I have chosen Dunelm Group (LSE:DNLM), the homewares chain, which before its demotion was the 24th-ranked share.

Also a retailer, Dunelm’s score is 6.8, not much less than Cake Box. This decision is mostly about feelings. Cake Box interests me more. It’s probably a less-mature business than Dunelm. Perhaps it’s more entrepreneurial and has better growth potential.

Dunelm joins the list of reserves that Cake Box was on. It published its annual report on Thursday, and I may still score it.

30 Shares for the future

Here’s the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Renishaw (LSE:RSW) has published its annual reports and I’m re-scoring it.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.3 | 7.6% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Oxford Instruments | Manufactures scientific equipment | 7.0 | 1.0 | 6.0% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 5.9% | |

6 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.9% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.8% | |

8 | YouGov | Surveys and distributes public opinion online | 7.5 | 0.3 | 5.7% | |

9 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.3 | 5.6% | |

10 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.3 | 5.6% | |

11 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.3 | 5.4% | |

12 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.5 | 5.1% | |

13 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

14 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.1 | 4.8% | |

15 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.8% | |

16 | 4Imprint | Customises and distributes promotional goods | 8.0 | -0.8 | 4.5% | |

17 | Cake Box | Cake shop franchise and sweet manufacturer | 7.1 | 7.0 | 0.1 | 4.2% |

18 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.9 | 4.1% | |

19 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.5 | 4.0% | |

20 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.5 | 4.0% | |

21 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

22 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.5 | 3.9% | |

23 | Renishaw | Manufactures tools that automate factories... | 7.5 | -0.7 | 3.6% | |

24 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.2 | 3.5% | |

25 | Volution | Manufacturer of ventilation products | 8.0 | -1.4 | 3.2% | |

26 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -1.2 | 2.7% | |

27 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.7 | 2.7% | |

28 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.0 | -2.4 | 2.5% | |

29 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -2.1 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.