Shares for the future: why this company is still a top two stock

After last year’s record high, these shares are now good value and a good long-term investment, according to analyst Richard Beddard who grilled bosses at the recent AGM.

29th August 2025 15:09

by Richard Beddard from interactive investor

We have been renovating our house this year. When I say “we”, I mean a local builder is renovating our house and presenting us with decisions about materials and methods on an almost daily basis.

This has enabled me to kick the tyres on two businesses serving the building trade that I rate highly as long-term investments: Latham (James) (LSE:LTHM) and Howden Joinery Group (LSE:HWDN). Our builder is ordering the timber for a porch and a verandah from Lathams, and it looks like our interior doors will come from Howdens.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Both firms, he says, have been good to deal with. And they have lived up to some of their claims. Howdens on range, and Lathams on its environmental commitments.

James Latham: relationship business

From the customer perspective there are similarities between the two businesses. Both companies supply the trade only. Lathams says this is due to the nature of its business and its delivery vehicles. By the nature of its business, it may be referring to repeat business, which is one of the reasons Howdens focuses on trade customers.

Lathams supplies panel products such as plywood and Medium Density Fibreboard (MDF), timber, and speciality engineered woods and decorative surfaces like laminates and worktops. It also supplies products made from timber, like unfinished door blanks, decking, cladding, and decorative mouldings.

The company has a nationwide network of 12 depots in the UK, and two depots in Ireland. Many of them operate 24 hours a day, five days a week, ensuring joiners, timber merchants, kitchen and furniture manufacturers, and shopfitters have the product they need, when they need it.

Materials are often specified by architects and designers. Lathams runs seminars, has two physical showrooms and a digital showroom to help them choose.

Most of the products are imported through the ports of Tilbury, Liverpool and Grangemouth, where the company also holds stock.

In normal times, Latham’s growth has been steady, not spectacular, and profitability in terms of return on capital has also been stable. I think we can put this down to experience, investment, and an efficient and gradually expanding network.

- Stock pickers strike back as value investing returns

- Trading Strategies: does Rolls-Royce still offer growth potential?

In terms of expertise, the company has been involved in the industry since James Latham established it to import furniture and hardwood from America in 1757. Today, Nick Latham runs the business, an eighth generation descendent of the founder. He heads an extremely experienced board. Some of Lathams’ depot directors have been with the business for decades.

The company has decided to build a National Distribution Centre, which will reduce the risk of holding inventories in third-party warehouses at ports, and manage stock more efficiently.

By creating more capacity, the company can increase the volumes of commodity woods and wood products it sells, and increase the range of speciality products, which earn higher margins.

Occasionally, Lathams expands the network by acquiring depots. In 2019, it moved its footprint beyond the mainland UK by acquiring a site in Ireland. In 2021, it acquired two more sites, this time in Northern Ireland.

At the annual general meeting (AGM) last week, I got the impression that disruption during and after the pandemic reinforced the company’s already strong imperative to control its supply chain. The National Distribution Centre is part of the solution, helpfully funded by the windfall profits the company made.

- Huge month for dividends as Lloyds Bank, BP, Shell, L&G pay out

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

As I tried to wheedle the secrets of the company’s success from the executives, two of them independently commented that business is not complicated. The company invests heavily to meet its customers’ expectations. It prefers, for example, to own its warehouses and vehicles. The cost of this investment itself is a barrier to entry. Perhaps it is not complicated. Investment over time compounds.

Regrettably one thing I could not wheedle, is the revenue split between specialty and commodity products. It would help us confirm that Lathams is about more than just shifting volumes if we could see the contribution of specialty products rising. Lathams says the information is commercially sensitive.

Lathams: the numbers

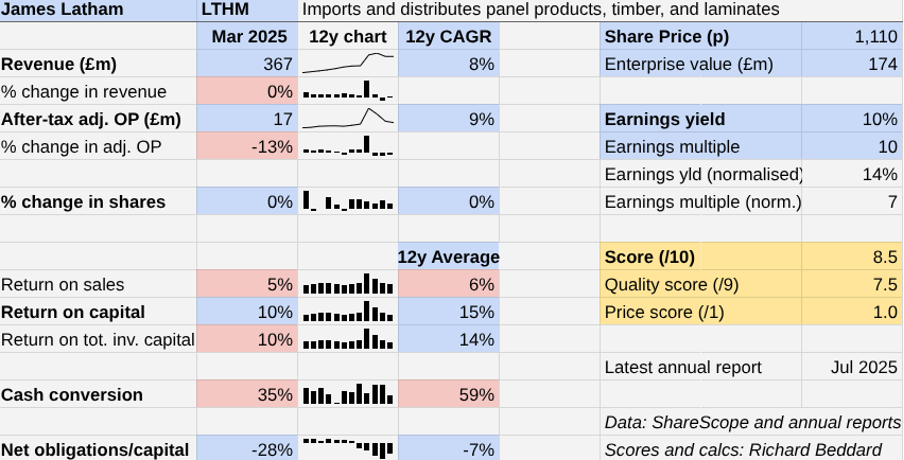

James Latham reported a small growth in volumes in the year to March 2025 but lower margins as customers chose cheaper products and a competitor went into liquidation in the second half of the financial year, briefly flooding the market for some products.

While there may be some room for improvement, Lathams’ adjusted after-tax profit margin was very similar to before the pandemic. After-tax return on capital of 10% is at the low end of quite a tight normal range that tops out at 13% (excluding exceptional levels of 35% achieved in 2022 and 22% achieved in 2023).

Lathams must tie up capital in stock and warehouses, which goes some way to explaining relatively weak cash conversion. Nevertheless, it has a sizable cash surplus despite paying a special dividend in the previous financial year.

Scoring James Latham: rising above

As we have seen, timber shortages can lead to high prices, overstocking and over-supply. This can affect profitability when prices fall, although as we have also seen, by stocking a wide range of speciality products, adeptly managing stock, and maintaining a strong financial position, James Latham has risen above these events in the recent past.

I imagine Lathams treats employees well, depot managers and key promotions are lauded in the annual reports, and the company runs share schemes and a training academy. It does not disclose employee retention statistics, but Lathams tells me retention is high. It will consider including the statistic in future annual reports.

James Latham | LTHM | Distributes imported panel products, timber, and laminates | 27/08/2025 | 8.5/10 |

How capably has James Latham made money? | 2.0 | |||

Family run James Latham has grown revenue and adjusted profit at high single-digit CAGRs by investing in stock, capacity, efficiency and by bringing new products to market. This investment is self-funded and reflected in relatively weak cash conversion. | ||||

How big are the risks? | 3.0 | |||

The company says competitor risk is low, probably because of its market-leading position and financial strength. The timber industry is cyclical but sound finances, a wide product range and stock management have enabled Lathams to chart a steady course through economic ups and downs. | ||||

How fair and coherent is its strategy? | 2.5 | |||

Lathams is expanding its range of speciality products and the capacity of the depot network. Its ownership of property and plant suggests a long-term ethos that probably extends to employees. Disclosing the revenue split between commodity and specialised products would help us judge its strategy. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 1,110p values the enterprise at £174 million, about 7 times normalised profit. | ||||

A score of 8.5/10 indicates James Latham is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the quality scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

I have removed DotDigital from the table because I do not plan to re-score the share when it publishes its next annual report, probably in November.

Removing shares with lowish quality scores allows me to consider alternative shares. Last time I scored DotDigital it got 6.5 out of 9 for quality.

Jet2 Ordinary Shares (LSE:JET2) and Cohort (LSE:CHRT) have published annual reports and are due to be rescored.

Focusrite (LSE:TUNE), Goodwin (LSE:GDWN) and James Halstead (LSE:JHD) are in the process of being re-scored, so I have disconnected the links to the breakdowns of their previous scores.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.2 | 7.9% | |

2 | James Latham | Distributes imported panel products, timber, and laminates | 8.5 | 7.5 | 1.0 | 7.0% |

3 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.5 | 6.9% | |

4 | Oxford Instruments | Manufactures scientific equipment | 7.0 | 1.0 | 6.0% | |

5 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 1.0 | 5.9% | |

6 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.1 | 5.9% | |

7 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.8% | |

8 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.3 | 5.6% | |

9 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.5 | 0.4 | 5.6% | |

10 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.3 | 5.5% | |

11 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.2 | 5.4% | |

12 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.2 | 5.4% | |

13 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.4 | 5.1% | |

14 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.5 | 5.1% | |

15 | Focusrite | Designs recording equipment, synthesisers and sound systems | 7.5 | 6.5 | 1.0 | 2.5% |

16 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 2.5% | |

17 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.8% | |

18 | YouGov | Surveys and distributes public opinion online | 7.5 | -0.2 | 4.6% | |

19 | James Halstead | Manufactures sheet vinyl and LVT | 7.3 | 6.5 | 0.8 | 2.5% |

20 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.7 | 2.5% | |

21 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.5 | 3.9% | |

22 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.6 | 3.8% | |

23 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -1.1 | 3.7% | |

24 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.1 | 3.6% | |

25 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.8 | 3.5% | |

26 | Volution | Manufacturer of ventilation products | 8.0 | -1.4 | 3.2% | |

27 | Goodwin | Casts and machines steel and processes minerals for niche markets | 6.5 | 8.0 | -1.5 | 3.0% |

28 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.5 | 2.9% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.6 | 2.5% | |

30 | Cohort | Manufactures military technology, does research and consultancy | 7.5 | -1.8 | 2.5% | |

31 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns James Latham and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.