Shares for the future: still bullish on this top 10 stock

Recent positive personal experiences with this company have only reinforced the investment case, according to analyst Richard Beddard. Here’s his rationale.

12th September 2025 15:00

by Richard Beddard from interactive investor

Although I’ve owned shares in Jet2 Ordinary Shares (LSE:JET2) since 2009, I’ve never been able to write that I have flown with the leisure airline.

That changed when we flew to Rome on Jet2 last October for a wedding. Although it was a sample of just two flights, we felt that we were treated like customers, not luggage.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Then, in April, we decided to go on a last-minute holiday. Primed by our previous experience we booked a Jet2 package holiday in Sardinia. It was our first package holiday, and since we are quite restless travellers, it didn’t convert us. But it provided two more positive data points to my one-man customer evaluation of Jet2.

Jet2: customer first

Demonstrating that a company puts customers first is tricky, because businesses often make such claims. First-hand experience helps, but it is partial in both senses of the word.

Jet2 brandishes statistics and consumer awards, usually that it alone among package tour operators sits in the top ranks for customer service as compiled by organisations such as Which?, Feefo and the Institute of Customer Service. Jet2holidays’ and Jet2.com’s Net Promoter scores, a measure of how many customers would recommend the package holiday business and airline, are both in the mid-60s (high). Customers show their approval by returning. 61% of customers in 2025 had flown with Jet2 in the previous 25 months. It has a cancellation rate of 0.05%, meaning it lets customers down less often than its peers. During the pandemic, it was the only UK airline to refund customers promptly for cancelled flights.

It also brandishes its mantra: “People, Service, Profit” and other customer-friendly three-letter acronyms liberally throughout its annual report.

When these characteristics are repeated over a long period, and the financial performance of the business indicates the company is doing something special, I think it’s reasonable to conclude that a business is truly focused on the customer.

- Stockwatch: four key reasons this bull market could continue

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

Jet2 flies people predominantly to the Mediterranean. 80% of revenue in 2025 was from package holidays and 11% was from flights only. The rest came from non-ticket revenue, such as onboard food, drink, baggage charges, seat bookings and car hire commission.

In about two decades, Jet2 has grown from being a start-up within an air and road freight firm into the UK’s largest tour operator as defined by the more than seven million passengers Jet2holidays is licensed to fly under ATOL. This is about 21% of total licences issued under the package tour insurance scheme.

It has grown as it has added new regional airports to fly from in the UK and new destinations to fly to in Europe. That network is still expanding. In 2025, Jet2 added Luton and Bournemouth, bringing the number of UK airports it flies from to 13. It added three more Greek islands, Morocco, Jerez in southern Spain, and Pula in Croatia to its summer schedule and Tallinn, Geneva and Salzburg joined as city break destinations.

Limits to growth

The map, though, looks quite full. 85% of the UK population lives within an hour and a half’s drive of one of Jet2’s bases, and it flies to more than 75 destinations in 25 countries. Increasingly, I think, it will rely more on the second plank that has helped it grow, growing market share by being better than rivals.

Jet2’s unique ability to service customers comes from the fact that it seeks to deliver much of their experience itself. It sells most of its seats through its website, app and contact centre, it owns most of the planes it operates, its own UK maintenance hangars, and its own Retail Operations Centre stocking in-flight food and gifts. It does its own ground handling at most of its UK bases, and employs thousands of helpers overseas.

Heavy investment is ahead to support growth, because growing a fleet of planes is expensive. Jet2 plans to spend more than £6 billion over the next seven years on Airbus A320neo planes that have 23% more seats and use less fuel than the Boeing B737s it is retiring. The number of planes in the fleet should grow by 18%.

- Is global bond market sell-off a golden opportunity?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

The impact of this investment on Jet2’s balance sheet remains to be seen. On an annualised basis, the gross capital expenditure on the planes is roughly equal to Jet2’s operating cash flow in 2025, which must fund other capital expenditure and the dividend. But should cash flow grow as the business does, the impact on gearing, which is currently low, may not be significant.

I think the biggest potential limit to growth may be climate change. Jet2 identifies climate change as both the highest impact and most likely risk it faces. Not only is it likely to have to adapt to reduce or eliminate its emissions, it’s also likely to have to adapt to the heating of the Mediterranean, which appears to be making it less hospitable in summer.

In characteristic style, Jet2 is controlling what it can by buying more fuel-efficient planes, electrifying its ground fleet, and pushing for more efficient routes. It even bought a modest £2 million stake in a Sustainable Aviation Fuel (SAF) producer in 2024, although it had to write the investment off in 2025 after its ultimate beneficial owner went into administration.

Concerted action is required by the industry and government to encourage more SAF production, and progress, the company says, is slow, probably because each party would prefer the others to shoulder more of the cost.

Jet2 has secured enough SAF to meet the 2% SAF fuel mix mandated by the UK and Europe from this year, but the flight path ahead is cloudy.

Scoring Jet2: challenges ahead

Jet2 faces challenges, but I believe it’s a high-quality business. The current chief executive and chief financial officer have been on the board for more than a decade each and they worked for a long time with the company’s flamboyant founder, who retired in 2023.

I would prefer it if Jet2 disclosed the employee retention ratio, but at least it gives us the results of staff surveys. 84% of colleagues are proud to work for Jet2 and 75% would recommend it as a workplace. I think capable and motivated Jet2 staff made my travels more pleasurable.

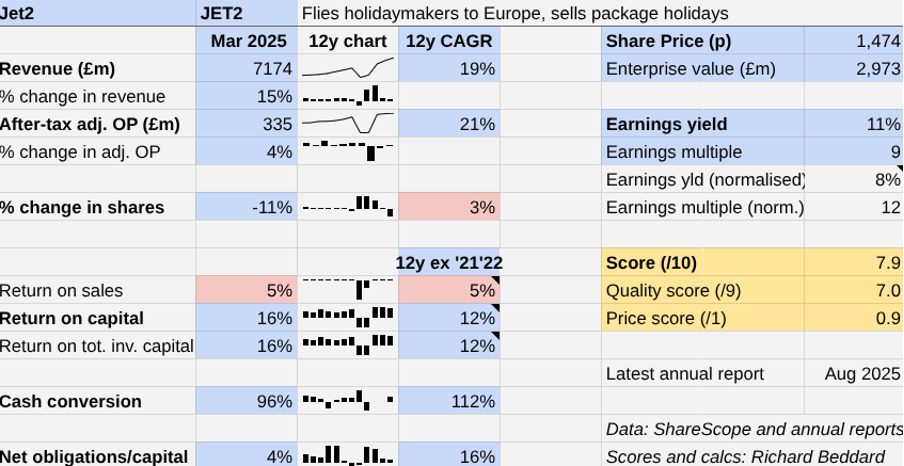

Jet2 | JET2 | Package tour operator and leisure airline | 10/09/2025 | 7.9/10 |

How capably has Jet2 made money? | 3.0 | |||

Jet2 has grown revenue and profit at double-digit compound annual growth rates (CAGRs) by flying more people to more places from more UK airports. It has largely self-funded growth by putting the customer first and controlling much of the holiday experience, particularly the flight, encouraging customers to fly with Jet2 again. | ||||

How big are the risks? | 1.5 | |||

Flying is risky, but Jet2 has profited consistently by making it easy and enjoyable. Management is very experienced, but growth may slow now that Jet2 flies from most of the UK to most of the Med. The one risk the company cannot control or mitigate by itself is a big one: climate change. | ||||

How fair and coherent is its strategy? | 2.5 | |||

The airline is increasing profit by improving the service by investing in its people. On climate change, it is buying fuel efficient planes, electrifying the ground fleet and lobbying for more SAF and more efficient routes. This isn't enough, but more progress may have to come collaboratively. | ||||

How low (high) is the share price compared to normalised profit? | 0.9 | |||

Low. A share price of 1,474p values the enterprise at £2,973 million, about 12 times normalised profit. | ||||

A score of 7.9/10 indicates Jet2 is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

Jet2: the numbers

Revenue grew 15% but after tax operating profit only increased 4% in the year to March 2025. Operating expenses grew in line with revenue, but Jet2’s planes were slightly lighter because it increased seat capacity 13% but flew 12% more customers.

The growth in less profitable flight-only passengers exceeded the growth of more profitable package tourists, weighing on profit too. This trend has intensified as the summer has worn on, and is related to late booking driven by cash-strapped holidaymakers.

At the AGM last week, the company warned that it anticipates adjusted profit for the full year to March 2026 to be only slightly higher than it was in 2025. It appears that the higher cost of living is making some of us hesitate to book holidays, but I expect Jet2 to continue to grow market share and emerge stronger, even if the industry experiences a downturn.

- Share Sleuth: a rule re-think and a portfolio awash with cash

- FTSE 100’s quality compounders plus other stocks to consider

At 15%, Return on capital, though, remains elevated compared to the long-term average (excluding the pandemic years). This may, in part, be due to a buoyant market since the pandemic, but I also believe it’s because package holidays have become its biggest revenue source by far. 80% of revenue was from package holidays in 2025.

It’s also probably because Jet2 is a formidable competitor, as evidenced by the demise of one of its closest rivals, Thomas Cook, in 2019, and its continued growth despite the concurrent rise of online travel agents, who package holidays but have much less control of the resulting product.

My numbers exclude 2021 and 2022, peak Covid pandemic, because the airline couldn’t fly for much of the time. I don’t think we will experience this in the next decade.

It’s still astonishing to me that Jet2 used up more cash in those two years than in the previous decade, and then made all the money back and more in the subsequent two years. That is testimony to the change in the scale of the operation, the skill of management and the capabilities it has built.

31 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Cohort (LSE:CHRT) and James Halstead (LSE:JHD) are being re-scored.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.3 | 7.6% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Oxford Instruments | Manufactures scientific equipment | 7.0 | 1.0 | 6.0% | |

5 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | |

6 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.9 | 7.0 | 0.9 | 5.9% |

7 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.8% | |

8 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.4 | 5.7% | |

9 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.3 | 5.7% | |

10 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.2 | 5.6% | |

11 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.2 | 5.3% | |

12 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.1 | 5.3% | |

13 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.5 | 5.0% | |

14 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

15 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.6 | 4.7% | |

16 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.7% | |

17 | YouGov | Surveys and distributes public opinion online | 7.5 | -0.3 | 4.4% | |

18 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.3% | |

19 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.4 | 4.2% | |

20 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

21 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.6 | 3.9% | |

22 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -1.1 | 3.8% | |

23 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.6 | 3.8% | |

24 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.1 | 3.7% | |

25 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.2 | 3.6% | |

26 | James Halstead | Manufactures sheet vinyl and LVT | 6.8 | 6.0 | 0.8 | 3.6% |

27 | Volution | Manufacturer of ventilation products | 8.0 | -1.3 | 3.3% | |

28 | Cohort | Manufactures/supplies defence tech, training, consultancy | 6.5 | 8.0 | -1.5 | 3.1% |

29 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.0 | -2.0 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.8 | 2.5% | |

31 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Jet2 and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.