Shares for the future: new ranking for this FTSE 100 stock

This company continues to perform better than any other business he follows, and there appears to be no near-term limit to growth. Analyst Richard Beddard updates his score.

22nd August 2025 15:01

by Richard Beddard from interactive investor

The largest of the warring factions that populate Games Workshop Group (LSE:GAW)’s fictional future universe, Warhammer 40,000, is the galaxy-spanning, authoritarian, decaying, Imperium of Man.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Games Workshop: Imperium

The Imperium is challenged from without by aliens and within from rebellion. It is constantly at war. This is the background to the principal game and many of the books that promote the modelling hobby that makes Games Workshop so much profit.

The attraction of Games Workshop is that it is an Imperium of its own, albeit a more benign one.

Games Workshop is master of its own intellectual property: the stories, characters, and rulebooks that ignite the imaginations of collectors and gamers.

It is also a master of its own operations. It manufactures miniatures in three Nottingham factories. It sells them through its 570 stores in 24 countries, its own website, and via independent hobby stores supplied by its distribution hubs in Nottingham, Memphis and Sydney.

Games Workshop has published hundreds of novels through its own imprint, Black Library, which sold 4.5 million books during the year to June 2025. It also publishes a magazine, White Dwarf, and puts out content daily on its Warhammer Community website. More than 200,000 paying subscribers receive exclusive miniatures and video content.

- 10 hottest ISA shares, funds and trusts: week ended 15 August 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

While feeding the appetite of modellers and gamers has won their loyalty, the hobby also sells itself. Gamers need other gamers to play and, the sheer number of people playing Warhammer means Warhammer is peerless in the wargaming world.

Games Workshop also earns a lucrative side income by licensing characters and stories, principally to video game companies.

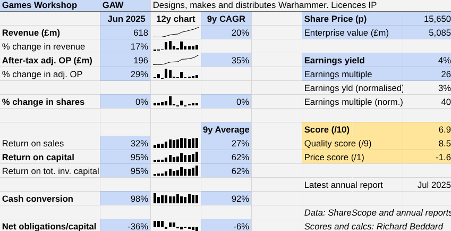

Games Workshop | GAW | Designs, makes and distributes Warhammer. Licenses IP | 20/08/2025 | 6.9/10 |

How capably has Games Workshop made money? | 3.0 | |||

For a decade under the leadership of Kevin Rountree, Games Workshop has grown revenue very rapidly and profit even more so by expertly satisfying modellers' and wargamers' thirst for new stories and characters. The company has been highly profitable and cash generative. | ||||

How big are the risks? | 3.0 | |||

Games Workshop owns intellectual property that has global appeal. It controls most aspects of making, distributing and promoting miniatures. Licence income depends on the capabilities of licensees, but this is the icing on the cake. The biggest risk is managing the many capabilities of a vertically integrated firm. | ||||

How fair and coherent is its strategy? | 2.5 | |||

The company depends on unique capabilities that could probably only be achieved through vertical integration. This appears to have led it to a top-down management style that encourages conformity. Games Workshop does not engage with journalists, or much with shareholders outside the AGM. | ||||

How low (high) is the share price compared to normalised profit? | -1.6 | |||

High. A share price of 15,650p values the enterprise at £5,085 million, about 40 times normalised profit. | ||||

A score of 6.9/10 indicates Games Workshop is a somewhat speculative investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

Having internalised most of the risks by vertically integrating, the company says the main risk is mismanagement. I agree.

In Kevin we trust

Games Workshop says it recruits for “fit” rather than skills, and no doubt attracts Warhammer enthusiasts to work for it.

Without putting a number on it, the company says staff retention is high. It promises employees a salary above the national minimum wage. This year, like last year, staff received a £6,000 profit-related bonus, which took the median wage to £39,000.

The company ramped up executive pay in 2025, though, and that has triggered questions about its culture that have been long dormant in me.

Having criticised Long-Term Incentive Programmes (LTIPs) for being formulaic and driving selfish behaviour at the expense of the organisation, Games Workshop has introduced something that looks a lot like an LTIP for the executive directors.

Kevin Rountree writes in the annual report that: “Time will tell whether it improves Games Workshop’s performance and whether it is the right change.”

What we already know, though, is it will massively increase the performance-related pay that he and other executive directors are entitled to. Games Workshop argues, as nearly all companies do, that executives’ salaries must be competitive, and that since it promotes from within, high executive pay is an incentive for people lower down the ranks.

What irked me enough to vote against the new policy when it was put to shareholders in May, is that Games Workshop prides itself on not conforming to conventional wisdom. From strategy to environmental policy, to recruitment, it does things differently.

Its earlier restraint, limiting executives to generous basic salaries and an annual bonus, was one of the most visible signs that its culture was not only different but, to my mind, worthy.

- A merger stock with 8% dividend yield and 50% potential upside

- Sector Screener: stock could be poised for more index outperformance

While the chief executive’s decade-long tenure has coincided with a massive improvement in the performance of the company, Games Workshop had a way to reward him. In fact, it used it, by giving him 300% of his salary in restricted shares in 2025.

The beauty of this one-off share award was that unlike the now enhanced annual bonus and the new triennial share award, which awards shares every three years starting with the period from 2024 to 2027, it had already been earned over the long term.

Now that the chief executive is to receive much more regular tribute, it has raised concerns that I had under the previous executive chair, then presiding over a period of sclerosis at Games Workshop.

Games Workshop does not generally talk to journalists, and its engagement with private shareholders is limited outside the annual general meeting. Through the narrow lens of its annual report, though, it places a heavy emphasis on control and conformity.

This top-down tendency may be what is required to co-ordinate so many aspects of a vertically integrated business. But one of the questions I ask myself when I research a business is whether I would like to work for it. To me, there is a mythology about Games Workshop that resembles the authoritarian Imperium it invented.

I do not think I would fit. And while that would be perfectly OK for Games Workshop, I think diversity and independence of thought can be a strength, especially when things are not going well.

We might do well to remember that, when things are going well.

Games Workshop: by the numbers

Games Workshop continues to perform better than any other business I follow.

The start year for my analysis is 2016, which was Kevin Rountree’s first full year as chief executive officer.

2025 was a very good year. Revenue and after-tax profit grew 17% and 29% respectively. They were not far off the company’s compound annual growth rate (CAGR) over the last nine years, which has been incredible.

Last year, Games Workshop believed that it would be a fair challenge to grow in the year to June 2025. It launches new editions of Warhammer 40,000 every three years, and demand tends to be highest during these years. The latest edition launched in summer 2023, so we are between editions. The next one will probably launch in summer 2026, and the impact will be felt in the full-year results for the year to June 2027.

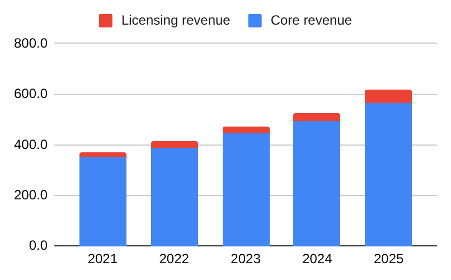

Games Workshop launched the fourth edition of its fantasy wargame, Warhammer Age of Sigmar in July 2024, though, and 2025’s numbers are also flattered by strong growth in licensing income. It may not look that obvious in revenue terms, licensing only contributed 9% of total revenue.

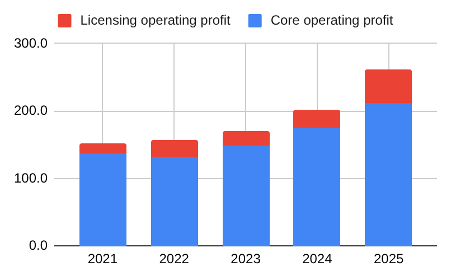

But licensing revenue is almost pure profit because the costs of generating it are borne by Games Workshop’s licensees. Consequently, the impact on profit is much greater:

In 2025, licensing profit almost doubled, contributing 19% of total profit. The company says this was largely due to the launch of Space Marine 2, published by Focus Entertainment. It is a video console game, where players battle as one of the Imperium’s genetically enhanced super soldiers.

Licensing income is the icing on the cake. It brings in additional income and introduces new people to the hobby, but it depends on launch schedules and capabilities that are largely out of Games Workshop’s control.

Long-term, licensing depends on the popularity of the collecting and gaming hobby, which provides a captive audience for video games.

In addition to potential new titles (including, perhaps, Space Marine 3) last December, it signed an agreement with Amazon for the adaptation of Warhammer 40,000 into films and TV series.

- Shares for the future: speculative small-cap with a compelling model

- Stockwatch: potential for more special dividends here

These projects will take years to develop, and Games Workshop is coy about the commercial terms. Since it does not expect to repeat the success of Space Marine 2 in 2026, and licensing revenue has a disproportionate effect on profit, it will have its work cut out, if it is to match this year’s performance next year.

The good news is that the core business of selling miniatures primarily is in very good health, so the long-term prospects for licensing income are good too.

Core revenue has increased 60% in the four years since 2021, and core operating profit has increased 55%. Typically, Games Workshop has achieved a profit margin of about 35%, with little variation.

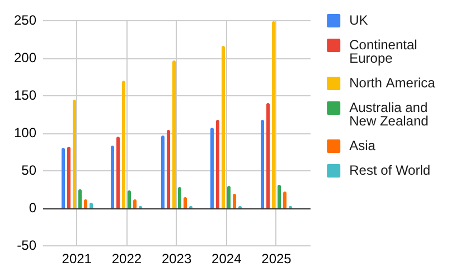

Since the hobby was invented in the UK in 1983, you might fear that it has exhausted its home market, but revenue here has grown 46% over the past four years.

The UK contributes just over a fifth of revenue. Games Workshop’s biggest market, North America, has also grown faster (71%), the same rate as its second biggest, continental Europe. Asia, where it is least well represented, is growing fastest (84%).

Given the size of these markets, there appears to be no near-term limit to growth.

20 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Latham (James) (LSE:LTHM), Goodwin (LSE:GDWN) and Jet2 Ordinary Shares (LSE:JET2) have published annual reports and are due to be re-scored.

I have included a new column in the table, ss%. It shows what proportion of the Share Sleuth portfolio is invested in a share. Share Sleuth is the model portfolio I run here on interactive investor, using the Decision Engine to guide my trades.

By comparing ss% to ih%, the ideal holding size as determined by the Decision Engine, you can see whether the portfolio’s holding is overweight or underweight.

0 | company | description | score | qual | price | ih% | ss% |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.4 | 7.8% | 6.6% | |

2 | James Latham | Imports and distributes timber and related products | 7.5 | 1.0 | 7.0% | 6.6% | |

3 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.4 | 6.9% | 6.7% | |

4 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | 7.0 | 1.0 | 6.0% | 1.6% | |

5 | Oxford Instruments | Manufactures scientific equipment | 7.0 | 1.0 | 6.0% | 4.8% | |

6 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | 4.1% | |

7 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.8% | 3.8% | |

8 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.4 | 5.8% | 3.7% | |

9 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.4 | 5.8% | 5.0% | |

10 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.5 | 0.3 | 5.6% | 3.9% | |

11 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | 7.0 | 0.8 | 5.6% | ||

12 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.2 | 5.5% | 3.4% | |

13 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.2 | 5.5% | ||

14 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.2 | 5.4% | 3.0% | |

15 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.4 | 5.2% | 2.6% | |

16 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.5 | 5.1% | 2.4% | |

17 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | 3.4% | |

18 | YouGov | Surveys and distributes public opinion online | 7.5 | 0.0 | 5.0% | ||

19 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.7% | 2.2% | |

20 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.7 | 4.4% | 2.1% | |

21 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.5 | 3.9% | ||

22 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 6.9 | 8.5 | -1.6 | 3.8% | 5.4% |

23 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.1 | 3.8% | 2.1% | |

24 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -1.1 | 3.7% | ||

25 | DotDigital | Provides automated marketing software as a service | 6.5 | 0.4 | 3.7% | ||

26 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.7 | 3.7% | ||

27 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.5 | 3.0% | ||

28 | Volution | Manufacturer of ventilation products | 8.0 | -1.5 | 3.0% | ||

29 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.0 | -1.6 | 2.8% | 6.7% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.7 | 2.5% | 4.7% | |

31 | Cohort | Manufactures military technology, does research and consultancy | 7.5 | -1.8 | 2.5% | 2.1% | |

32 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio, and ss% is the actual size of the Share Sleuth portfolio’s holding.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Games Workshop and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.