Shares for the future: can small-cap in hot sector stay agile?

Analyst Richard Beddard is generally impressed by this business diversifying by acquisition but highlights a creeping complexity.

19th September 2025 15:01

by Richard Beddard from interactive investor

Since Cohort (LSE:CHRT) listed in 2006 to acquire defence technology businesses, 11 firms have joined the group. EM Solutions, acquired in January 2025, is the biggest by far. It is also the company’s first acquisition headquartered outside Europe.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Cohort: growing and diversifying by acquisition

The new subsidiary adds satellite communications products to Cohort’s highly profitable Communications and Intelligence division. EM Solutions makes mobile SATCOM terminals, which it supplies to the navies of Australia, some NATO countries and Japan. It also increases Cohort’s presence in the Pacific, an area of geopolitical tension where defence spending is growing.

The acquisition is the latest step in Cohort’s diversification strategy, which has reduced its reliance on providing training and consultancy to its big UK customer: the Ministry of Defence. Manufacturing businesses are easier to scale, especially abroad, and Cohort reports that services now only contribute 20% of revenue. Revenue attributable to the MoD, either directly or through prime contractors, is about 50% of the total.

- Stockwatch: do rival shares offer a genuine hedge against uncertainty?

- Ian Cowie: a new investment trust holding for my ISA

Cohort also supplies the space, transport, and education sectors with technology and know-how, but these sidelines are diminishing. Its subsidiary SEA, one of its earliest acquisitions, sold off its space business in 2014, and in 2025 SEA sold its transport business.

Cohort’s strategic focus is entirely defence now. Perhaps that reflects where opportunities lie in a more warlike world.

Cohort by the numbers

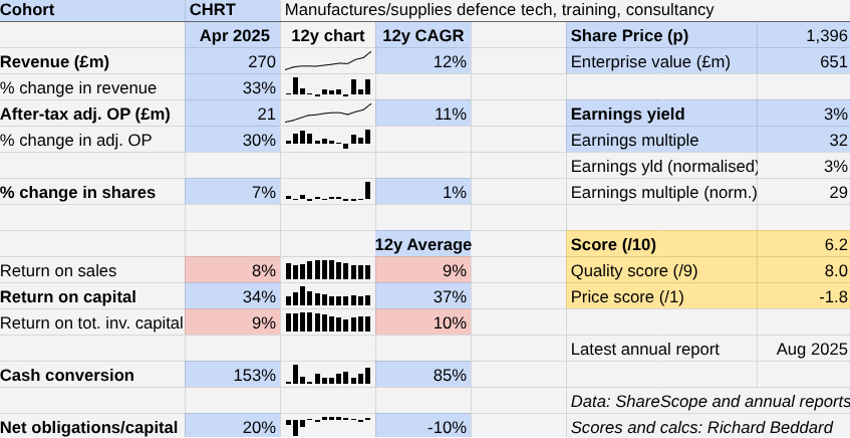

Revenue and profit growth exceeded the long-term average growth rates in the year to April 2025, helped only slightly by Cohort’s largest acquisition, which contributed three months revenue (£6.7 million) and adjusted operating profit (£1.5 million).

The strong results came from one of Cohort’s oldest subsidiaries and the jewel in its crown: MASS. A major source of MASS’ profitability is Thurbon CEMA, an electronic warfare database management system. Extended to include cyberspace (computer networks) as well as the electromagnetic spectrum, Thurbon CEMA helps protect and jam communications.

Cohort no longer reports the results of individual subsidiaries, but it says MASS was the biggest contributor to profit and MCL, another UK subsidiary, had a record year.

The results would have been better but for complications with large projects. Profit margin (return on sales) decreased because of a project involving a high degree of subcontracting and delays at businesses in the larger but less profitable of the company’s two divisions: Sensors and Effectors.

The low margin project belongs to SEA. Much of the work will be completed during 2026, and the company believes SEA’s profitability will improve after that.

ELAC, a German subsidiary acquired in 2020, is preparing to kit out four new Italian submarines with sonar systems. Due to the way it accounts for large projects, the company expects profitability to improve once it starts delivering hardware in the current year. This may allow it to release contingencies against conservative cost estimates.

- Interest rates held as inflation threat persists

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Perhaps most concerning are project delays at Cohort’s Chess subsidiary, acquired in 2018. Misfiring Chess has often depressed profitability yet its performance improved in 2024 after the company terminated some contracts. Now Chess is experiencing more contract woes and Cohort expects another recovery, hopefully a longer lasting one.

The performance of Chess, a developer of autonomous anti-drone systems, and also EID, a Portuguese manufacturer of naval and tactical communications systems acquired in 2016, leads me to question the quality of these acquisitions. EID made a loss in 2024, although it returned to profitability in 2025.

Despite high levels of operating profitability, a ROTIC of 9% suggests Cohort is generating only adequate returns on its total invested capital. This measure includes acquired intangible assets at cost, and puts the spotlight on Cohort’s big new acquisition.

EM Solutions cost £75 million, approximately three times Cohort’s next biggest acquisition and substantially more than the company earned in cash in the year to April 2025, a record year for cash generation by some distance.

Maybe Cohort paid up for quality. In the year to December 2023, EM Solutions earned about £6 million profit (EBIT) from £22 million revenue, showing it’s capable of earning decent margins.

Should this acquisition misfire like some others have, it will have a bigger impact on ROTIC. Cohort, though, expects high margin EM Solutions to improve profitability.

The company should benefit from a full-year contribution from EM Solutions in 2026, but MCL will likely contract. It is a value-added reseller and systems integrator. Unlike many of Cohort’s other businesses demand fluctuates at short notice, and its order book for 2026 is lower.

The group order book for 2026 is about £230 million, representing 79% of revenue expected in the year. That implies revenue of about £291 million, an increase of 8% or so.

Profit should grow faster if EM Solutions enhances profitability as promised and Cohort gets to grips with its low-margin projects.

Scoring Cohort

Generally, I’m impressed with Cohort. It has grown and prospered through more than a decade of low defence spending, so it ought to do well now governments are spending more.

The directors are very experienced. The chair is one of Cohort’s founders. The chief executive was one of the company’s first employees and the chief financial officer joined in its first year. All have long ties with the MoD and defence contractors.

They sold nearly £10 million in shares in July, prompting me to follow suit. Although the chair still has a significant 3% holding, it’s disappointing that the executive directors have not accumulated more shares.

They do not, though, receive exorbitant pay. The total remuneration of the chief executive in 2025, a year when Cohort paid out more in performance-related bonuses, was 15 times average pay.

The average is the mean, not the median. Generally, the median is a better measure than the mean because it removes the distorting impact of the highest earners, but since Cohort’s employees are skilled and well-paid postgraduates, the company has reassured me the median would be similar. In previous years, the mean has been less than 10 times.

My main concern is creeping complexity, necessitating a new senior appointment and the company’s reorganisation into two divisions.

When Cohort was smaller, the subsidiaries operated independently under the financial oversight of the head office. This enabled each business to respond to customers quickly, giving employees the opportunity to be entrepreneurial, while also providing customers with reassurance that they were part of a larger financially strong group.

The company still presents itself in these terms, but the subsidiaries are encouraged to share customers and expertise. I wonder if some of the agility will be lost and costs will increase as the bureaucracy grows.

On the other hand, the opportunity for collaboration may outweigh the cost. That must be Cohort’s gambit.

Cohort | CHRT | Manufactures/supplies defence tech, training, consultancy | 17/09/2025 | 6.2/10 |

How capably has Cohort made money? | 3.0 | |||

A very experienced board has grown revenue and adjusted profit at double-digit CAGRs over the long term by acquiring niche manufacturers and integrators of defence equipment and investing in them. Cohort has achieved high levels of profitability and cash generation while diversifying. | ||||

How big are the risks? | 2.5 | |||

A ROTIC of 9%, and the indifferent performance of some subsidiaries, leads me to question the quality of some acquisitions. Long-term fixed price contracts can be risky and even though Cohort has diversified, it remained dependent on four large contracts for 38% of its revenue in 2025. | ||||

How fair and coherent is its strategy? | 2.5 | |||

Cohort is reducing its dependence on the MoD by acquiring exporters and overseas businesses. This exposes it to more complexity and potentially a higher cost base, although operating profitability remains high. The directors do not earn grandiose pay, and the company’s annual report is helpful. | ||||

How low (high) is the share price compared to normalised profit? | -1.8 | |||

High. A share price of 1,396p values the enterprise at £651 million, about 29 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

31 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

James Halstead (LSE:JHD) is being re-scored.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.2 | 7.5% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Oxford Instruments | Manufactures scientific equipment | 7.0 | 1.0 | 6.0% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 5.9% | |

6 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | |

7 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.8% | |

8 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.4 | 5.8% | |

9 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.2 | 5.7% | |

10 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.3 | 5.5% | |

11 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.3 | 5.5% | |

12 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.2 | 5.5% | |

13 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | 0.0 | 5.1% | |

14 | YouGov | Surveys and distributes public opinion online | 7.5 | 0.0 | 5.0% | |

15 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

16 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.5 | 5.0% | |

17 | 4Imprint | Customises and distributes promotional goods | 8.0 | -0.8 | 4.4% | |

18 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.7 | 4.3% | |

19 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.9 | 4.2% | |

20 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.5 | 4.0% | |

21 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.0 | 4.0% | |

22 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

23 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.5 | 4.0% | |

24 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.5 | 4.0% | |

25 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.0 | 3.9% | |

26 | James Halstead | Manufactures sheet vinyl and LVT | 6.8 | 6.0 | 0.8 | 3.6% |

27 | Volution | Manufacturer of ventilation products | 8.0 | -1.4 | 3.3% | |

28 | Cohort | Manufactures/supplies defence tech, training, consultancy | 6.2 | 8.0 | -1.8 | 2.5% |

29 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.0 | -1.9 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.9 | 2.5% | |

31 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Cohort and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.