Wild’s Winter Portfolios 2025: recovery begins

After a poor start for the new winter portfolios, the second month has been better, and the improvement has spilled over into January. Lee Wild discusses recent performance.

12th January 2026 11:06

by Lee Wild from interactive investor

After a tough start to the winter period, Wild’s Winter Portfolios spent December reclaiming some of the ground lost a month earlier. Sentiment clearly improved from mid-month as both the US and UK central banks cut interest rates, meaning UK indices enjoyed the best of the traditional Santa rally.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

December began with the FTSE 100 more than 200 points adrift of the record high achieved just a couple of weeks earlier. However, after a short period trading sideways it sprang to life. By the end of the month, both the blue-chip index and FTSE 350 had risen 4.8% in less than three weeks. The beleaguered AIM All-Share rose 5.1%.

For the month as a whole, the FTSE 100 added 2.2% and AIM 1.6%. By comparison, the American S&P 500 index and Nasdaq Composite ended December with a monthly loss.

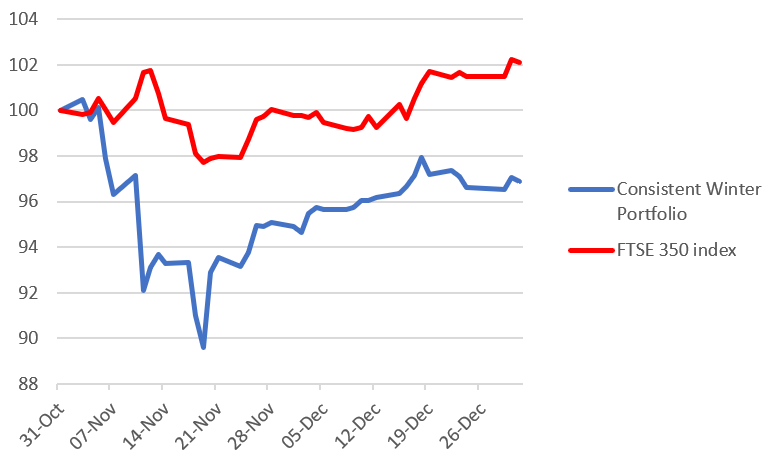

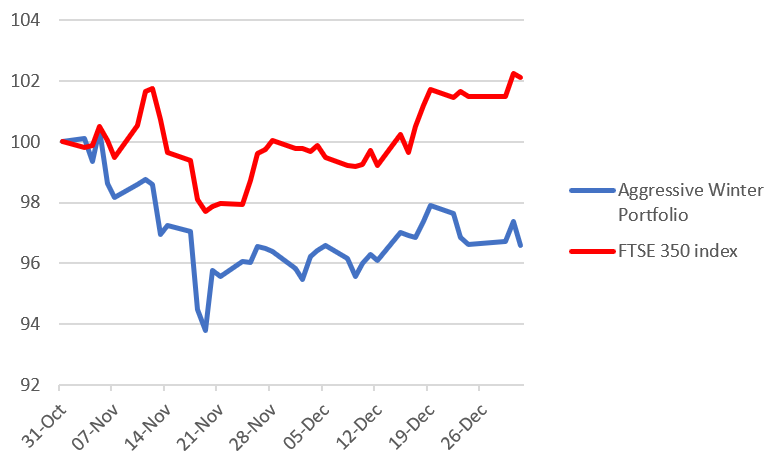

A 0.2% increase for the month meant Wild’s Consistent Winter Portfolio is now down 3.4% for the winter so far, with Wild’s Aggressive Winter Portfolio adding 1.9% to sit 3.1% lower two months into the six-month strategy. After a flat start to the winter, the FTSE 350 benchmark index rose by 2.1% in December.

As a reminder, the consistent winter portfolio is made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade. Entry criteria is relaxed slightly for the aggressive winter portfolio, giving up some consistency in return for potentially bigger profits. Still, all constituents must have risen in at least eight of the previous 10 winters.

- Investment outlook: expert opinion, analysis and ideas

- 20 value-focused top share picks for 2026

- 21 top growth stocks for 2026

Diversity helped the FTSE 350’s outperformance last month. With the price of gold, silver and other precious metals going through the roof, the index’s mining constituents provided a significant boost. Among them were Hochschild Mining (LSE:HOC) and Fresnillo (LSE:FRES), which both jumped 27% in December, Pan African Resources (LSE:PAF) leapt 21%, Atalaya Mining Copper SA (LSE:ATYM) 20% and Endeavour Mining (LSE:EDV) 11%.

Other miners, including Antofagasta (LSE:ANTO) and Glencore (LSE:GLEN), chipped in with impressive returns, up 19% and 13% respectively. Banks such as Shawbrook Group (LSE:SHAW), Close Brothers Group (LSE:CBG) and Metro Bank Holdings (LSE:MTRO) also did well, rallying between 14% and 16% over the month.

Wild’s Consistent Winter Portfolio 2025-26

Past performance is not a guide to future performance.

Best of the consistent bunch in December was November’s villain FirstGroup (LSE:FGP), ending the month up 7.9%. However, the bus and train operator has still got a lot of making up to do having slumped almost 16% at the start of this seasonal strategy following a profit warning. It’s currently down 9.2% this winter.

Insurance firm Admiral Group (LSE:ADM) was the only other one of the five constituents in the consistent portfolio to post a gain, and it was by the smallest of margins. Shares added 0.1%, narrowing their winter deficit to 3.1%.

- The shares attracting fund managers at start of 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Safety products conglomerate Halma (LSE:HLMA) spent £230 million on E2S designs, which develops and makes high-performance detection devices for highly hazardous environments. But the shares still slipped 0.6% in December leaving them fractionally lower for the winter so far.

IT services firm Computacenter (LSE:CCC) remains the only stock in this basket of shares to boast a winter gain so far, up 2.2%, and that’s despite losing 1.3% in December. There is hope here though, as the shares are up almost 9% in January. Fingers crossed.

Soft-drinks maker AG Barr (LSE:BAG) gets the wooden spoon this month for its 3.9% decline, which drags its performance over the past two months down to -6.7%.

Wild’s Aggressive Winter Portfolio 2025-26

Past performance is not a guide to future performance.

FirstGroup (LSE:FGP)’s appearance in both this season’s portfolios provided a monthly boost, although the aggressive basket of shares still bears the scars of the transport firm’s recent slump.

BAE Systems (LSE:BA.), which started this winter strategy not too far from record highs, also clawed back some lost ground. Shares added 3.8% in December, narrowing its seasonal deficit to 8.4%. Like Computacenter, BAE has also had a cracking start to 2026, rallying 18% to a new best. Let’s hope the defence giant can at least consolidate those gains.

- Stockwatch: still time to buy this FTSE 100 defence share?

- Insider: where FTSE 100 directors are still finding bargains

Keller Group (LSE:KLR) is one of two aggressive portfolio stocks which ended December in positive territory for the winter so far. The engineering contractor added 2.6% to trade up 4.9% overall, ending 2025 near a record high.

The other is fantasy wargames company Games Workshop Group (LSE:GAW), which, despite giving back 2.5% last month, is still up 18.8% since the end of October.

Food packager Hilton Food Group (LSE:HFG) brings up the rear, with a 1% drop in December, extending its winter decline to 21.7%. A number of recently announced changes to the senior leadership team have had little impact on a share price still reeling from a warning in November. An update on a business review is expected alongside a full-year trading update on 29 January.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.