Pension stories

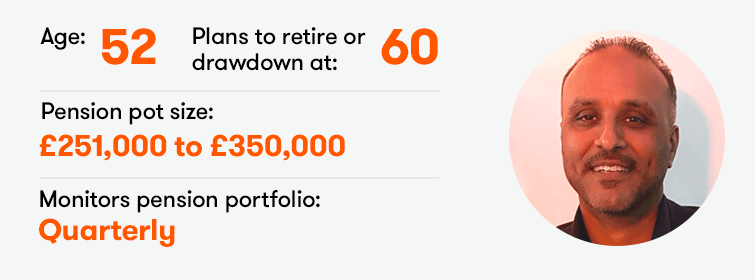

Jatinder Dhanoa

Did you find it easy to start investing for a pension?

Yes. I started saving at 25.

What current pension contributions do you make, either monthly or otherwise?

£10,000 per annum.

Have you ever taken a break from pension saving?

Yes, for about five years. I didn’t have enough money spare from my company to contribute to a pension.

What do you invest in for your pension?

Funds, ETFs, and direct equities.

Would you ever consider investing pension money in international stocks?

Yes.

What are your five largest holdings?

Shell (LSE:SHEL), BP (LSE:BP.), Vistry Group (LSE:VTY) and a couple of international funds (as of November 2020).

What is your investment objective/target pension pot or annual retirement income?

I am targeting an annual retirement income of £40,000.

As a SIPP holder, what advice would you give to anyone thinking of opening one?

Diversify your portfolio and have a mix of direct equity investments alongside funds or ETFs and compare the performance of them quarterly or every six months. If you are performing better through your own direct investments, why bother paying a fee for a fund to invest on your behalf?

Start saving for a pension as early as possible... and learn to live within your means while saving for your retirement.

Do you have any pension savings tips?

Start as early as possible. First, you receive contributions from the government (free money). Second, you can build up a sizeable pot through lower contribution. Because the money is paid from your gross salary, you do not miss it and you learn to live within your means while saving for retirement.

How do you feel about your pension?

I didn’t think about it at an early stage. I had a workplace pension and I thought of it as a savings pot with money that I would never personally handle and so would not miss (as it was going out directly from my salary).

Is there anything relevant/significant that affects your attitude towards saving for the future?

I have a property portfolio, which will hopefully provide a good retirement income in addition to my pensions.

Pensions can be a party pooper topic, but not at ii. We want to know more about the retirement hopes and fears of the nation. Please help us paint the fullest picture yet by taking part in our annual Great British Retirement Survey

Our expert’s view

Victoria Scholar writes...

Jatinder has built up a really solid pension pot and it’s great that he is still contributing. He’ll be able to access some of his pension when he turns 55 but it’s important he’s aware that if he takes any taxable income from his pot, the amount he can contribute and still get tax relief will fall to £10,000 . That could be an issue if he ever wanted to increase his pension contributions.

He has a good range of investments in his SIPP and knows what he is investing in. He also has a property portfolio for retirement income, but doesn’t mention ISAs. Income taken from ISAs is tax-free, so they might be something to consider as his target retirement income is £40,000, which, if it comes from pensions and buy-to-let property, will incur income tax.

Dzmitry Lipski suggests a fund which might interest an investor in their 50s

A more conservative investor could consider a cautious multi-asset fund to preserve their capital. Capital Gearing Trust (LSE:CGT) is a long-only, multi-asset portfolio of bonds, equities and property, with small holdings in infrastructure, gold, and cash.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Take control of your pension

The ii SIPP is aimed at clients who have sufficient knowledge and experience of investing to make their own investment decisions and want to actively manage their investments. A SIPP is not suitable for every investor. Other types of pensions may be more appropriate. The value of investments made within a SIPP can fall as well as rise and you may end up with a fund at retirement that’s worth less than you invested. You can normally only access the money from age 55 (age 57 from 2028). Prior to making any decision about the suitability of a SIPP, or transferring any existing pension plan(s) into a SIPP we recommend that you seek the advice of a suitably qualified financial adviser. Please note the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future.