Pension stories

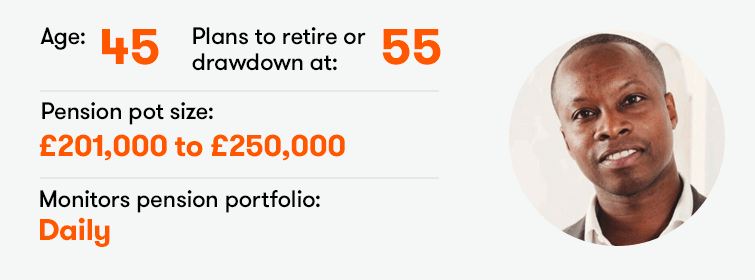

Shaun Springer

Did you find it easy to start investing for a pension?

No. I found it very complex and confusing when I began aged 25.

What current pension contributions do you make, either monthly or otherwise?

It depends on the market opportunities. Going forward, it will be circa £5,000 a month.

Have you ever taken a break from pension saving?

Yes, for two years. This was due to leaving my job to start my own marketing consultancy business in 2016.

What do you invest in for your pension?

International shares.

What are your five largest holdings?

Amazon (NASDAQ:AMZN), Cognex (NASDAQ:CGNX), DexCom (NASDAQ:DXCM), NextEra Energy (NYSE:NEE) and Lululemon (NASDAQ:LULU) (as of December 2020).

What is your investment objective/target pension pot or annual retirement income?

The aim is to get my pension pot to £1 million by the age of 55.

As a SIPP holder, what advice would you give to anyone thinking of opening one?

Understand the strategy that you want to implement to achieve your individual goals and think long term when purchasing your SIPP investments.

The aim is to get my pension pot to £1 million by the time I’m 55.

Do you have any pension savings tips?

Think long term and ensure you invest only what you can afford to lose, be it savings or otherwise.

How do you feel about your pension?

I’m happy with the current situation and am on track to meet my objectives by age 55.

How many times do you trade a month?

11 to 15.

What is your main investment focus?

Shares.

Tell us more about your trading strategy

1) Defensive stocks; 2) Dividends; 3) Growth stocks (Amazon (NASDAQ:AMZN), Tesla (NASDAQ:TSLA)).

Pensions can be a party pooper topic, but not at ii. We want to know more about the retirement hopes and fears of the nation. Please help us paint the fullest picture yet by taking part in our annual Great British Retirement Survey

Our expert’s view

Victoria Scholar writes...

Shaun is contributing a lot to his pension, at £5,000 a month, which over a year will take him to £60,000, the maximum permitted by the annual allowance.

After this point, he’d incur a tax charge on contributions and wouldn’t receive further tax relief unless he has any unused annual allowance from the previous three years. In this case he might be able to take advantage of carry forward rules.

Despite no longer being employed and now running his own company, he has stuck with pension contributions, which is great news. He has a punchy but achievable goal of reaching £1 million by 55. Given the rate of contributions he wants to make, this is within reach, as long as his investments perform as expected.

Shaun trades a lot. Once his retirement age is set and within sight, he might want to consider reducing risk, if it’s currently on the high side, just to make sure that any market falls that might happen as he gets to the point he wants to start withdrawing any lump sums or income don’t throw him off course.

Tom Bailey suggests an ETF that might interest an active SIPP trader

One ETF of potential interest might be the Xtrackers S&P 500 Equal Weight ETF USD(LSE:XDEW). This ETF weights all the stocks in the S&P 500 equally, so each stock composes 0.2% of the portfolio. This means the ETF will give less exposure to the big tech companies that have dominated the market in recent years (and appear to be well represented in Shaun’s portfolio), and gain more exposure to the value and cyclical stocks that have done worse. That should work well if the rotation from growth to value stocks continues. However, it is also the case that equal weighted S&P 500 indices have done better over the longer term.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Take control of your pension

The ii SIPP is aimed at clients who have sufficient knowledge and experience of investing to make their own investment decisions and want to actively manage their investments. A SIPP is not suitable for every investor. Other types of pensions may be more appropriate. The value of investments made within a SIPP can fall as well as rise and you may end up with a fund at retirement that’s worth less than you invested. You can normally only access the money from age 55 (age 57 from 2028). Prior to making any decision about the suitability of a SIPP, or transferring any existing pension plan(s) into a SIPP we recommend that you seek the advice of a suitably qualified financial adviser. Please note the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future.