Stock and fund bargains for value-focused investors

10th January 2019 09:30

by Kyle Caldwell from interactive investor

There are plenty of investments that look cheap right now. Kyle Caldwell highlights some of the best opportunities for investors to go shopping for bargains.

Thinking back a year ago, there was a notable lack of bargains for investors to consider, following a period of unprecedented market calm in 2017.

Heading into the start of 2019, the landscape has changed markedly as volatility returned with a vengeance; while this poses its challenges, however, it does create opportunities for long-term investors to 'buy low'. So here we have rounded up the main areas for investors keen to go bargain-hunting to focus on.

UK

A contrarian investor goes against the crowd, and at the start of 2019 it's difficult to find a region as widely loathed as the UK is right now. Billions of pounds exited UK funds of all shapes and sizes in 2018, in the continuation of a trend that first manifested itself following the Brexit vote in June 2016.

Given that it is in their job descriptions to invest in UK equities, UK fund managers are almost always going to put a positive spin on the region; but Nick Train, manager of the Finsbury Growth & Income investment trust (LSE:FGT), has offered a more measured perspective.

He points out that one indication of how unloved UK equities currently are is the fact that only one of the top 10 biggest companies in the FTSE All-Share index, Diageo (LSE:Diageo), has a dividend yield under 3%. On average the top 10 shares (as at end of October) were yielding a fraction under 5%.

On one hand, some UK fund managers have been viewing the high yields in the wake of share price falls as evidence of a contrarian opportunity, and adding to these large-cap names. Train, though, casts doubt about their credentials as bargains. He says: "The UK looks oversold and unloved, for sure. But is this enough to confirm that UK equities are cheap? I do think it is surprising and not encouraging that – to repeat a statistic – only one out of the top 10 shares in London has a starting dividend yield of less than 3%. It is discouraging, because it implies investors are very cautious about the prospects for cash flow growth from this group of large UK companies."

Instead of eyeing up opportunities in these large-cap names, Train is sticking to his knitting and is a happy buyer of lower-yielding shares that consistently produce dividend growth in excess of inflation. Stock examples continuing to deliver include Unilever (LSE:ULVR), Burberry (LSE:BRBY), Heineken (EURONEXT:HEIA) and Sage (LSE:SGE).

In contrast, Alex Wright of Fidelity Special Values Investment Trust (LSE:FSV) is unfazed about the extent to which UK companies are unloved. He argues that the "unrelenting negativity that investors are demonstrating towards UK equities" is making him feel more and more positive on their prospects for 2019.

He adds:

"One thing I have learned from investing in unloved companies is that you shouldn't necessarily wait for good news to become obvious before investing. By investing when all the bad news is 'in the price' and no good news is expected at all, you put the odds in your favour. I think this is a situation we are in in the UK at the moment."

Wright argues that attractive valuations can be found across the market; but, like other fund managers in what has become a bit of a trend of late, one of his focuses is in bargains in the domestic stock aisle. Three stocks examples to play this theme are highlighted below.

Moreover, it is not just the large-cap names that fund managers have been sizing up. When looking down the market capitalisation spectrum, plenty of stocks catch the eye on valuation grounds; but given the uptick in volatility and continued uncertainty over the Brexit negotiations, it is perhaps time to be more discerning. Harry Nimmo, manager of the Standard Life UK Smaller Companies Fund, certainly endorses this approach. He is focusing on 'quality' small-cap stocks in order to reduce risk and provide ‘greater resilience’ for investors at times of general market uncertainty. Examples of stocks he is backing include Cranswick (LSE:CWK) and Fevertree (LSE:FEVR).

Emerging markets and Asia

While it has been a sluggish year for UK markets, it has been a more painful one for the emerging market and Asia regions. Year-to-date both the IA emerging market and IA Asia fund sectors are down just over 10% (to 22 November), whereas the average fund in the IA UK all companies sector has lost 7%.

As has always been par for the course in regard to these fast-growing economies, macroeconomic headwinds have spooked investors. Adrian Lowcock, head of personal investing at Willis Owen, points out:

"A recovery in the stockmarket which started in 2016 vanished in 2018. Emerging markets entered a bear market in 2018 as a strong US dollar, driven by interest rate rises, and US-Chinese trade war impacted on the sector."

As a consequence, valuations have become more attractive, reaching a three-year low in respect to Asia, points out Edmund Harriss, who manages the Guinness Asian Equity Income and Guinness Emerging Market Income funds. "Asia has given up all the valuation re-rating that it has achieved since the end of 2015," says Harriss.

In contrast, a big sign of encouragement is that Asia companies' earnings appear to be in good shape. Harriss points out that between 2010 and 2015 Asia earnings contracted 0.5% a year on average, but since 2015 profits have grown 10.1% on an annualised basis.

He adds:

"For those who missed out on the recovery that played out the last time Asia shares were this cheap, it is an opportunity to come back in."

Emerging market shares also look cheap, but Lowcock agrees that when they are weighed against the Asia region, the latter looks better value at this juncture. Asia funds our panellists are backing to shine in 2019 include Schroder Asia Pacific Investment Trust (LSE:SDP) and Aberdeen Standard Asia Focus Investment Trust (LSE:AAS).

Single countries

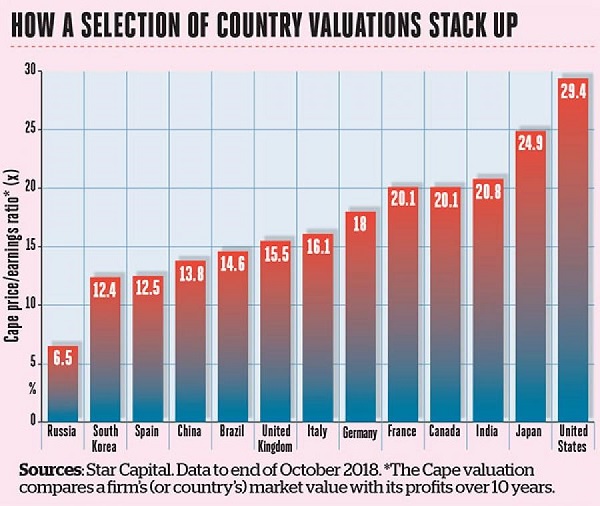

For those who are looking at countries on a case-by-case basis, there are bargains aplenty, but bear in mind that the risks may outweigh the potential rewards. According to Star Capital, a firm that keeps tabs on stockmarket valuations, three countries that look cheap at the time of writing (the end of November) relative to their long-term averages are Russia, China and Brazil. This is based on various measures of value, including the price/earnings (p/e) ratio, price to book and cyclically adjusted price/earnings ratio (Cape). However, as well as assessing valuations, investors need to take a view on each country's economy, and in addition to that the political risks.

In comparison to other countries Japan appears to be at the more expensive end of the Cape ratio rankings, but various experts have nonetheless picked it out as the potential star country performer of 2019. There is, however, a sense of déjà vu, as Japan is often a favourite with experts at the beginning of a year and has regularly disappointed.

Sam Lees, head of research at fundexpert.co.uk, says: "The Japanese market is cheap. One measure of value (there are many) is the company's stock price-to-tangible-book value. A value of 1 would mean that the price you pay as an investor is equal to the value of the company's tangible assets. In the US price-to-tangible-book value is around 10.6 times. In Japan it's just 1.33 times."

Three share tips for a post-Brexit bounce

Domestically-focused UK stocks have been hit hard by Brexit uncertainty. As a result, fund managers have been attempting to take advantage of the cut-price valuations on offer. Alex Wright, for example, has turned his attention towards Lloyds Banking Group (LSE:LLOY), which has been weighed down by concerns a no-deal Brexit will negatively impact the economy.

Wright points out:

"It is fair to expect some discount for UK domestic stocks compared to US and European counterparts, but current discounts seem excessive."

In a similar vein Adrian Gosden, who manages the GAM UK Equity Income fund, has been picking up shares in Onesavings Bank (LSE:OSB). "This domestic bank, aimed at the buy-to-let market, has struggled to gain support from investors during Brexit negotiations, as well as facing concerns around falling house prices," he says. But, on a single-digit p/e multiple for 2019, Gosden argues that the shares appear to have priced these issues in.

Finally, McCarthy & Stone (LSE:MCS), the retirement housebuilder, is held by Temple Bar Investment Trust (TMPL), managed by Alasdair Mundy. He notes trading conditions are tough, but says the firm has a strong market position and operates in an industry not suffering from disruption.

Is it time for value investing to take the stage?

For fans of value investing it has been a miserable decade or so, with markets led higher by quality and growth stocks. At some stage this trend will reverse, however; according to Jason Broomer, head of investment at consultancy Square Mile, since the October sell-off there has been a "hint of a pick-up" for value stocks.

Darius McDermott, managing director of FundCalibre, agrees a rotation from growth to value "seems to be long overdue". Funds adopting the value style that McDermott rates include River and Mercantile UK Recovery, Schroder European Recovery, Jupiter UK Special Situations, Investec UK Special Situations and Fidelity Special Values. Broomer also picks out Jupiter UK Special Situations, alongside SYZ Oyster Continental European Selection and Lazard Emerging Markets.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.