Best FTSE 100 and FTSE 250 stocks of 2026 so far

As the blue-chip and mid-cap markets continue to rally, City writer Graeme Evans names the big winners of the year so far, including large gains for Pan African Resources.

18th February 2026 14:31

by Graeme Evans from interactive investor

The domination of FTSE indices in 2026’s stock market rankings continued today after the FTSE 100 set a new record and Pan African Resources (LSE:PAF) helped the FTSE 250 index to a four-year high.

The 7% year-to-date rise for the FTSE 100 index has been driven by gains of 10% or more for 39 stocks, with Glencore (LSE:GLEN) and BAE Systems (LSE:BA.) now up more than 20% after today’s results.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

Other high-flying blue chips have included Marks & Spencer Group (LSE:MKS), which has rebounded by 20.9% after last year’s cyber-attack weakness, and British Gas owner Centrica (LSE:CNA) with a gain of 17%. Vodafone Group (LSE:VOD) is up 18%, while Rolls-Royce Holdings (LSE:RR.) has added another 15%.

The return of FTSE 100 merger and acquisition activity following deals for Beazley (LSE:BEZ) and Schroders (LSE:SDR) has been another factor in the performance, which today saw the top flight top 10,600.

FTSE 100 biggest risers in 2026 so far

Company | Price | Sector | Share price 2026 (%) | Share price 1 month (%) | Share price 1 year (%) | Forward dividend yield (%) | Forward PE | |

1 | 1215p | Nonlife Insurance | 46.0 | 48.2 | 45.2 | 2.2 | 11.0 | |

2 | 586.25p | Investment Banking & Brokerage Services | 44.0 | 25.5 | 51.6 | 3.7 | 15.6 | |

3 | 4791p | Beverages | 24.7 | 22.0 | 45.8 | 2.2 | 20.2 | |

4 | 2272.5p | Pharmaceuticals, Biotechnology & Cannabis Producers | 24.6 | 25.1 | 57.5 | 3.2 | 12.4 | |

5 | 498.5p | Industrial Metals & Mining | 22.6 | 4.2 | 41.0 | 1.5 | 35.0 | |

6 | 2093p | Aerospace & Defence | 22.1 | 0.2 | 56.6 | 1.8 | 27.3 | |

7 | 3471p | Industrial Engineering | 22.0 | 12.4 | 47.6 | 1.2 | 27.7 | |

8 | 2646p | Electricity | 21.4 | 12.9 | 80.8 | 2.6 | 17.7 | |

9 | 7217.5p | Industrial Metals & Mining | 20.4 | 13.7 | 42.0 | 4.1 | 14.6 | |

10 | 1370.75p | Gas, Water & Multiutilities | 20.1 | 14.1 | 45.3 | 3.5 | 17.7 |

Source: SharePad. Past performance is not a guide to future performance.

The showing is in contrast to the lacklustre form on Wall Street, where tech sector jitters have left the Nasdaq Composite down 3% by Tuesday’s closing bell and the S&P 500 index broadly unchanged. The Dow Jones Industrial Average has risen 3%.

Exchanges in Paris and Frankfurt have lifted by about 2.5%, while the Hang Seng index and Shanghai Composite reached this week’s Lunar New Year holiday up 4% and 3% respectively.

- 10 shares to give you a £10,000 annual income in 2026

- BAE Systems reports record-breaking year

- 12 small-cap shares backed by top stock pickers

The only major benchmark ahead of the FTSE 100 index has been the Nikkei 225, which is up 12% after Sanae Takaichi's landslide election victory boosted fiscal stimulus hopes.

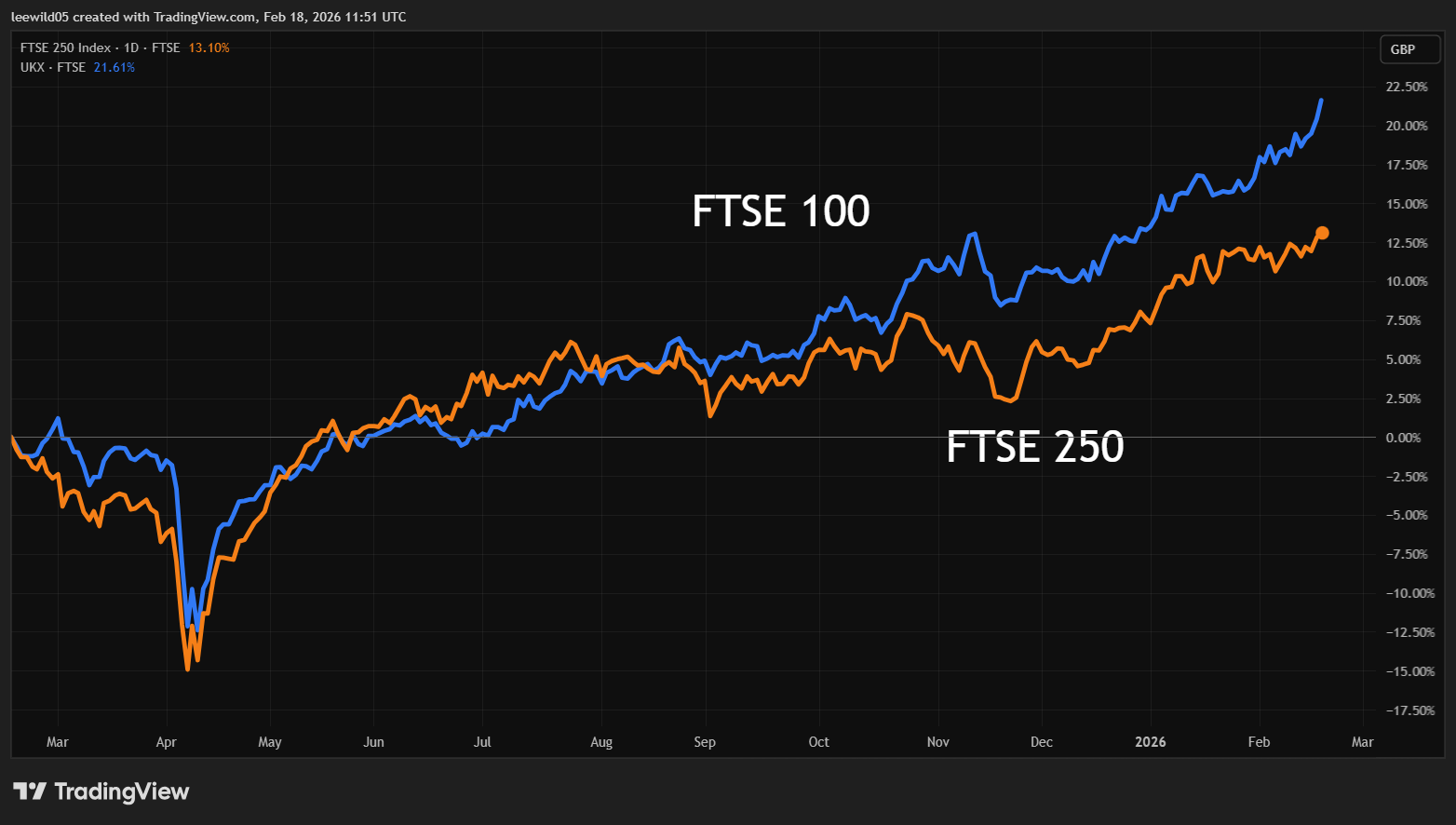

Investors have also been taking more interest in the UK market’s smaller stocks after gains of more than 5% for the FTSE AIM All-Share, FTSE SmallCap and the FTSE 250 index.

Source: TradingView. Past performance is not a guide to future performance.

Shore Capital recently highlighted the scope for earnings upgrades and valuation re-ratings as UK interest rates continue to boost the outlook.

The bank said: “While the Magnificent Seven, led by NVIDIA Corp (NASDAQ:NVDA), once again proved to be a key driver of global equity performance in 2025, we believe that further meaningful upside will require a broadening of market leadership beyond US big tech.

“In our view, UK equities, particularly at the smaller end of the market, remain unloved, undervalued and under-owned.

“With interest rates now firmly on a downward trajectory and scope for at least two further cuts in 2026, we see strong potential for earnings upgrades, re-ratings and alpha generation across the FTSE 250 and UK small caps.”

- Why fund managers are ‘uber-bullish’ despite AI concerns

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- The global funds abandoning the Magnificent Seven

The outlook for the FTSE 250 was boosted today by the latest inflation reading, which at 3% reinforced expectations for an interest rate cut in April or even as soon as next month.

Mid-cap stocks on the front foot today included Wetherspoon (J D) (LSE:JDW) and Trainline (LSE:TRN), while venture capital firm Molten Ventures Ord (LSE:GROW) rose 21.8p to 502p after Barclays upgraded its recommendation to Overweight with a 575p price target.

Raspberry Pi Holdings (LSE:RPI) jumped again, this time as high as 550p, as the shares continued their remarkable turnaround on the back of what appears to have been a social media-inspired rally. The shares have doubled in value since the start of this month.

The Times newspaper said the enthusiasm was due to the “AI ripple effect” of Raspberry Pi’s ability to run OpenClaw software, which is an open-source AI tool.

Having languished below their 280p flotation price as recently as last week, the shares are now up by 67.5% year-to-date as 2026’s best-performing FTSE 250 stock.

The next best have been the over-50s insurance and travel operator Saga (LSE:SAGA) and the oil-focused precision engineering group Hunting (LSE:HTG) following gains of about 40%.

FTSE 250 biggest risers in 2026 so far

Company | Price | Sector | Share price 2026 (%) | Share price 1 month (%) | Share price 1 year (%) | Forward dividend yield (%) | Forward PE | |

1 | 515p | Technology Hardware & Equipment | 71.6 | 71.8 | -21.4 | 43.9 | ||

2 | 518p | Oil & Gas Producers | 39.8 | 26.3 | 59.6 | 1.9 | 19.2 | |

3 | 297.1p | Renewable Energy | 39.6 | -4.9 | 119.0 | |||

4 | 245.3p | Investment Banking & Brokerage Services | 39.0 | 4.7 | 52.8 | 7.0 | 32.8 | |

5 | 684.25p | Precious Metals & Mining | 33.3 | 16.9 | 257.0 | 0.7 | 22.9 | |

6 | 256.25p | Aerospace & Defence | 31.5 | 12.4 | 56.6 | 1.2 | 27.5 | |

7 | 804.5p | Pharmaceuticals & Biotechnology | 30.4 | -10.5 | 108.0 | |||

8 | 2620p | Electronic & Electrical Equipment | 27.8 | 8.7 | 29.7 | 0.9 | 27.3 | |

9 | 26650p | General Industrials | 25.1 | 9.2 | 281.0 | |||

10 | 4508p | Investment Banking & Brokerage Services | 24.2 | 15.4 | 65.4 | 2.3 | 15.6 |

Source: SharePad. Past performance is not a guide to future performance.

Across the FTSE 250 index, 65 stocks have risen by 10% or more so far this year.

They include gold miner Pan African Resources (LSE:PAF), which only joined the second-tier benchmark in December after transferring its main listing from the upper echelons of AIM.

It is now worth £3 billion, having more than doubled its market capitalisation since September and by 23% in the year-to-date.

The company, which has operations in South Africa and Australia, provided further cheer for shareholders - including a large number of ii customers - when it announced a maiden interim dividend equivalent to 0.5474p a share.

Half-year revenue jumped by 157% to $487.1 million (£360 million), having pre-announced a 51% rise in total production to 129,000 ounces and 61.6% surge in realised gold price to $3,812 an ounce.

All-in sustaining cost (AISC) of production of $1,874 an ounce was higher than last year due to South African rand strength, employee share-based payments and higher royalty costs.

Earnings per share rose 192% to 7.30 US cents, which was in line with last week’s trading update.

Despite the higher costs, strong operating cash flows led to a 69.3% fall in net debt of $46 million. At the prevailing gold price, the group expects to be in a net cash position by the end of this month.

- City view: Glencore, Fresnillo, Endeavour, Pan African Resources

- Gold, silver and defence: reasons to be bullish and bearish

Peel Hunt, which has a price target of 180p, said a strong balance sheet gave management scope to accelerate growth options in order to boost medium-term output and earnings.

It added: “Even assuming gold prices fade, higher output should see underlying earnings stabilising around $700 million, and then climb, underpinning valuation.”

Berenberg said a step-up in spending may come as a surprise to some, with the increase mainly driven by expenditure at the recently acquired Tennant Mines in Australia’s Northern Territory.

It said: “Additional investment has been either planned or brought forward, we believe, as Pan African benefits from strong free cash flow, amid a higher gold price environment, which should enable an uplift in production volumes over the medium and longer term.”

The bank added before today’s opening bell: “Lower guided 2027 production volumes versus consensus, and a lower overnight gold price, could see shares pull back, but we would be buyers on this weakness.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.