Share Sleuth: why I am not giving up on this share

There are reasons to question this holding, but Richard Beddard is increasing exposure. He explains why.

4th March 2021 10:57

by Richard Beddard from interactive investor

Richard Beddard acknowledges that there are good reasons to question this holding, but has opted to increase exposure. He explains why.

On Monday (1 March), I added more shares in Victrex (LSE:VCT), the British-based supplier of high performance polymer solutions, to the Share Sleuth portfolio. It should have been the easiest of decisions to make, but actually I did a bit of hand-wringing.

Adding yet more Victrex

On the face of it, Victrex is a shoo-in. At the time of the trade, Victrex was the highest-ranked share in my Decision Engine, the best long-term investment of the 39 shares that I am following closely at the moment, according to my analysis.

Although I am experimenting with a new trading formula, that formula and the old one it might replace were both telling me that I could add more Victrex shares without concentrating the portfolio too much.

I felt resistance though, because I have already added Victrex shares twice before, and not too long ago, as the chart below shows.

Past performance is not a guide to future performance

Normally two purchases would amount to about 5% of the portfolio and probably put Victrex out of contention for a third, but the its lacklustre share price performance compared to the portfolio since I first added Victrex in 2016, means the holding was worth only around 3.7% of Share Sleuth’s total value.

If you are a regular reader, you will know that I try not to trouble myself about the direction of share prices. My aim is to add shares in good companies when they are good value as indicated by my scoring system.

In theory, I recognise that if the shares get cheaper or at least do not appreciate in price as much as the alternatives, that should make them more attractive.

- Share Sleuth: the 10 trades I made in 2020

- Shares for the future: a dozen good businesses

- Share Sleuth: this share has become too hot to handle

In practice, it is difficult to shake off the feeling that I might be throwing good money after bad. Particularly because I have a following on social media, and respected investors have questioned my loyalty to Victrex.

They have good reason to question me. It is not just Victrex’s share price growth that has stalled in recent years. Revenue and profit are under pressure. Victrex dominates the market, but rivals have increased their capacity to chip away at some less specialised business and the cyclicality of many of its markets: electronics, vehicles, and planes. This complicates the picture, as does the pandemic.

While the crowd may be tugging at my shoulder telling me to give up on Victrex, I have my analysis to fall back on and I re-scored Victrex only last month. I will not repeat it here, it is the second of two company profiles in this article, except to summarise:

Developing new grades, and particularly new applications for PEEK (the material it invented decades ago) takes time. Getting companies to use a different material is hard because there are implications for the safety of equipment that is sometimes carrying people through the air at hundreds of miles per hour, and in other circumstances (spinal implants, for example) installed within our bodies.

Once new applications have been developed and tested they must be approved, and new and sometimes unfamiliar markets must be commercialised.

We should not underestimate these challenges, but the company has achieved these things before, and because of its superior know-how and capacity, it should do again. Meanwhile, it is a highly profitable business churning out PEEK for countless existing industrial applications.

Victrex is now 6% of Share Sleuth portfolio

On Monday 1 March, I added 211 shares in Victrex at a share price of a fraction under £21.56, the actual price quoted by a broker. The transaction cost just under £4,559 after adding £10 in lieu of broker fees. It amounted to 2.5% of the portfolio, my minimum trade size, and brings the portfolio’s holding in Victrex up to 6% of the value of Share Sleuth.

I really hope not, as I pride myself on my independence, but I cannot rule out that at a subliminal level I may also have been influenced by Jakob Sigurðsson, Victrex’s chief executive. He bought considerably more shares, and Victrex reported it to the market earlier the same day.

Wrong said Fred

Not for the first time I must thank Fred, a reader and private investor, who has picked up an error in the Share Sleuth performance table after I provided him with a detailed log of every transaction, every addition, every disposal, and every dividend, since its inception on 9 September 2009.

Last August, Bloomsbury Publishing (LSE:BMY) paid investors a scrip dividend. This means it paid shareholders in shares instead of cash. The decision was made earlier in the year when companies were hoarding cash in preparation for the unknowable consequences of the pandemic.

This event completely passed me by, even though I own Bloomsbury shares myself. Fortunately Fred noticed, and also noticed that I had not increased the portfolio’s holding. I have added the scrip dividends to the portfolio, and as a result it, and indeed I, am a bit better off today!

Share Sleuth performance

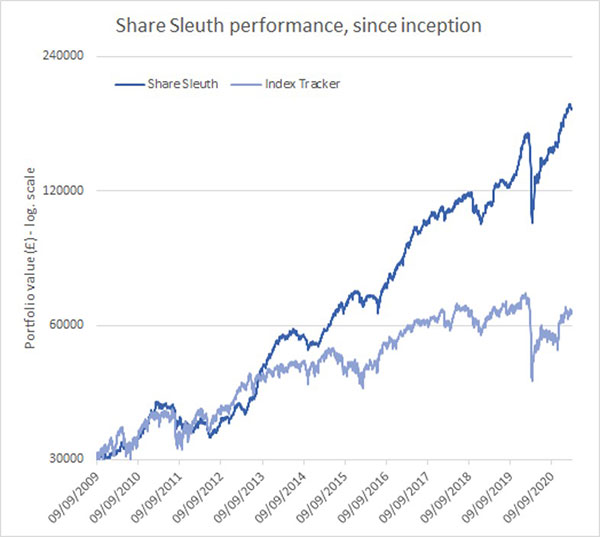

At Monday’s close, the Share Sleuth portfolio was valued at £184,217, which is 514% more than the notional £30,000 invested over the course of its first year starting in September 2009.

A £30,000 investment in accumulation units of a FTSE All-Share index tracking fund would be worth £63,715, a gain of 112% over the same period.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 6,068 | ||||

Shares | 178,149 | ||||

Since 9 September 2009 | 30,000 | 184,217 | 514 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | 1,874 | 6,593 | 10,448 | 58 | |

BMY | 1,256 | 3,274 | 3,366 | 3 | |

BOWL | 1,615 | 3,628 | 3,747 | 3 | |

CHH | 341 | 3,751 | 4,604 | 23 | |

CHRT | 1,600 | 3,747 | 9,520 | 154 | |

D4T4 | 1,528 | 3,509 | 4,546 | 30 | |

DWHT | 735 | 2,244 | 13,414 | 498 | |

FOUR | 190 | 3,688 | 4,589 | 24 | |

GAW | 76 | 218 | 7,535 | 3,357 | |

GDWN | 266 | 6,646 | 7,621 | 15 | |

HWDN | 748 | 3,228 | 5,254 | 63 | |

JDG | 159 | 3,825 | 9,635 | 152 | |

JET2 | 456 | 250 | 6,676 | 2,570 | |

NXT | 106 | 6,071 | 8,024 | 32 | |

PZC | 1,870 | 3,878 | 4,619 | 19 | |

QTX | 1,085 | 2,798 | 4,883 | 74 | |

RM. | 1,275 | 3,038 | 2,754 | -9 | |

RSW | 92 | 1,739 | 5,336 | 207 | |

SOLI | 1,546 | 4,523 | 12,059 | 167 | |

TET | 1,222 | 1,734 | 11,047 | 537 | |

TFW | 2,000 | 2,207 | 6,520 | 195 | |

TRI | 2,261 | 3,357 | 3,018 | -10 | |

TSTL | 750 | 268 | 4,500 | 1,577 | |

VCT | 534 | 10,812 | 11,524 | 7 | |

XPP | 240 | 4,589 | 12,912 | 181 | |

Table notes:

Added more Victrex

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £184,217 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £63,715 today.

Objective: to beat the index tracker handsomely over five-year periods.

Source: SharePad, 1 March 2021.

Past performance is not a guide to future performance

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the constituents of the Share Sleuth portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.