Shares for the future: modest upgrade for this FTSE 250 stock

Underperformance since the summer means this quality mid-cap is better value, which explains its promotion from seventh place to analyst Richard Beddard’s top five.

21st November 2025 15:00

by Richard Beddard from interactive investor

For nine years as a listed company, Softcat (LSE:SCT) has followed a simple employee-focused strategy. Recently, and almost imperceptibly, the strategy has become more complicated.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Softcat: recruitment and retention

Under a succession of overlapping leaders, Softcat has grown profit at a compound annual growth rate (CAGR) of 17% since it floated nine years ago. It has employed a consistent strategy: motivate employees to sell more IT to more customers.

Chief executive Graham Charlton is in his third year, but he was formerly chief financial officer. His predecessor, Graeme Watt, is chair. This overlapping style of leadership apes earlier transfers of power, defies corporate governance norms, but may have preserved and nurtured an employee-first culture that has achieved sparkling returns.

Founded in 1993, Softcat was originally a software catalogue supplying small businesses. It has developed into the UK’s largest IT reseller to the private and public sectors, claiming a 5% share of a market growing at 10% a year.

Softcat’s scale makes it attractive to big vendors such as Amazon Web Services (AWS) and Microsoft, and 400 vendors in total, enabling it to supply a broad range of products and services, and supply complex projects to increasingly large businesses.

The company’s purpose is “To help customers use technology to succeed, by putting our employees first”. Its vision is: “To be the leading IT infrastructure product and services provider in terms of employee engagement, customer satisfaction and shareholder returns.”

I wouldn’t normally quote mission statements, but Softcat’s is unusual in embedding staff into them, both as enablers of the strategy and measures of its success.

- The Analyst: understanding value and growth stocks

- How the Autumn Budget could impact your retirement

Softcat owes its culture to retired founder Peter Kelly, who is still a controlling shareholder. He believed that if work was fun and employees were passionate, Softcat would sell more.

The statistics Softcat gathers validate the rhetoric. It reports 98% customer satisfaction and a customer Net Promoter Score of 64. The source of customer satisfaction, employees, are also happy. Softcat’s employee engagement in 2025 was 88%. Its Employee Net Promoter Score (eNPS) was 55. The NPS scores indicate how likely a customer or employee is to recommend the firm. These numbers are high.

Softcat recruits apprentices and graduates with no corporate baggage “for attitude”. It trains its young account managers to “follow through on their promises”, supporting them with in-house experts. It also gives staff two days a year to volunteer or fundraise for charity, hosts an annual charity ball and an annual corporate shindig.

The company rewards successful employees with awards, significant bonus opportunities and promotion.

It seems the youth of its staff and non-financial benefits enable it to keep a lid on pay, which is nevertheless well above the UK median. Pay at Softcat is lower than at two of its listed competitors. Bonuses also contribute a greater portion of the total.

Revenue is not a good measure of sales performance. Usually, companies recognise the total billable value when they make a sale, but the rules for software and some services changed in 2018.

Software resellers are treated as agents and receive a commission net of the amount due to the software vendor. This means changes in hardware sales, out of which the vendor must also be paid, have a much greater impact on reported revenue than software sales.

This makes Softcat’s revenue more volatile than we would expect from the volumes of business it does. It’s why it uses Gross Invoiced Income (GII) as an alternative performance measure. GII grosses back up the value of software sales.

Softcat’s revenue increased 52% in the year to July 2025, inflated by a near 76% increase in hardware sales. GII increased 27%, showing the company still had a pretty good year.

Since the rules changed in 2018 (and were also re-interpreted in 2021) the revenue trend is not based on a consistent measure. It is reassuring to note that unlike revenue, GII and adjusted operating profit have grown every year in the last 20.

Softcat’s profit growth was above average in 2025 because of strong demand generally, and two large but unspecified projects to kit out data centres. This work is ongoing and will boost profit in the first half of the current financial year too (the company reported double-digit growth in the first quarter last Tuesday).

Softcat doesn’t tell us how large these projects are, but they may be highly significant. In 2025, one customer earned Softcat more than 22% of revenue, which is unusual. The consensus of current forecasts anticipates a flat 2026 and growth in 2027, but it may need to win more large projects to achieve it.

Times are changing

Lumpy revenue could mislead us in the short term, but I think the main risk facing Softcat is technological change, which somewhat counterintuitively has hitherto been a major driver of growth. Technological change encourages investment, which fuels demand for IT.

- Stockwatch: has this FTSE 100 share reached a ‘buy’ zone?

- Five AIM shares with potential for share price recovery

Softcat’s risk report, though, includes “channel disintermediation”, which suggests Softcat, a middleman, could become less relevant.

The likely mechanism would be automation and self-service, which enables customers to buy and configure software as a service online, no doubt augmented by artificial intelligence (AI) tools.

Changes to Softcat’s strategy address this risk, but they require the company to develop new capabilities that may dilute the impact of its culture.

Adaptation

Softcat says its customers are prioritising spending on data centres and cyber security, but case studies in this year’s annual report highlighted more prosaic solutions. It kitted Blaby District Council out with laptops and replaced Steel & Alloy’s ageing server infrastructure with a new system.

The company’s strategy remains to recruit more customers (customer numbers increased 1.6% in 2025) and sell them more IT (gross profit per customer increased 16.5%). The way it will achieve this has three newish strands.

The first is international. Softcat has offices in the US and Europe to serve the increased number of UK multinational companies it supplies. This year, most of the revenue from its largest customer came through its US office, which employs 20. That was, the company says, substantively all its overseas revenue.

The second is acquisitions. Softcat made its first acquisition in 2025. Oakland is tiny in comparison to Softcat and its cost (£8 million to just over £10 million depending on earn-outs) was almost immaterial. Softcat believes Oakland is significant though, bringing it capabilities in AI and data consultancy that would take years to build. It’s also expecting to learn from the experience and make more acquisitions.

- Income Investor: a blue-chip stock for income and growth

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The third is investment in Softcat’s Sales and HR systems. The company is implementing Microsoft Dynamics to improve sales performance by unifying its customer-facing services and automating functions, and to make better use of its data and AI tools.

This investment will enable staff to serve customers better, but I wonder if, as the IT becomes more capable, Softcat’s staff, hitherto its competitive advantage, will become less relevant. Automation and self-service may enable customers to buy directly from vendors, and Softcat’s service may become less distinct from that of other resellers.

Such gloomy thoughts make me wonder about Softcat’s employee-first culture, one visible aspect of which has already changed.

One of the things that endeared Softcat to me was its policy of paying executives below the median rate for peers. In the war for talent, companies usually target the median or higher, which is why executive pay has spiralled generally.

The rationale for paying below the median was that Softcat was not a complex business to run. But it is bigger and more complex now, which is why the executives are receiving a big pay hike in the current financial year.

Companies must adapt to stay relevant. In terms of executive pay though, Softcat has adapted to be more like other companies, shining light on the fact that its straightforward model may no longer be sufficient on its own to maintain growth.

The problem with that is Softcat’s evolving and more complex strategy is in its infancy. Consequently, it is, I think, less predictable.

Scoring Softcat: a pinch of uncertainty

If that sounds negative, it’s not meant to be. Softcat generates more than enough cash to invest on multiple fronts, and it may manage the complexity well. While we wait to find out, though, I’m being somewhat circumspect.

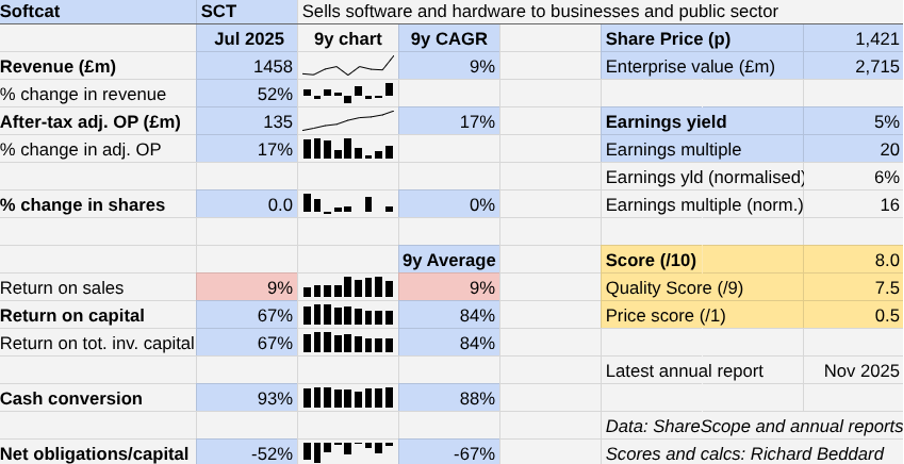

Softcat | SCT | Sells software and hardware to businesses and public sector | 19/11/2025 | 8/10 |

How capably has Softcat made money? | 3.0 | |||

Under a succession of overlapping leaders, Softcat has grown profit at 17% CAGR since it floated nine years ago by motivating employees to sell more IT to more customers. It has earned high returns on capital and strong cash flows. Its scale gives it a broad range and wide expertise. | ||||

How big are the risks? | 2.0 | |||

As the size of projects grows, Softcat's revenue may become more lumpy. Automation and self-service are enabling customers to buy and configure IT online. More customers may buy direct from vendors, and Softcat’s offering may become less distinct from rivals. | ||||

How fair and coherent is its strategy? | 2.5 | |||

Softcat’s strategy puts employees first, who put customers first. High engagement and NPS scores back this up. In response to technological change, though, the company must build new capabilities and it’s too early to say whether these will address the risk that buyers go elsewhere. | ||||

How low (high) is the share price compared to normalised profit? | 0.5 | |||

Low. A share price of 1,421p values the enterprise at £2,715 million, about 16 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

30 Shares for the future

Here’s the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Volution Group (LSE:FAN) and Tristel (LSE:TSTL) have published annual reports and are due to be re-scored.

0 | company | description | score | qual | price | ih% |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.7 | 9.3% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.7 | 7.4% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.2% | |

5 | Softcat | Sells software and hardware to businesses and public sector | 8.0 | 7.5 | 0.5 | 6.0% |

6 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 1.0 | 6.0% | |

8 | Judges Scientific | Manufactures scientific instruments | 7.5 | 0.4 | 5.8% | |

9 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.2 | 5.6% | |

10 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.3% | |

11 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.5 | 5.0% | |

12 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

13 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | |

14 | Renew | Maintenance and improvement of national infrastructure | 7.5 | 0.0 | 4.9% | |

15 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.7% | |

16 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.3% | |

17 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

18 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

19 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | -0.1 | 3.8% | |

20 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.1 | 3.8% | |

21 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.6 | 3.8% | |

22 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.6 | 3.7% | |

23 | Volution | Manufacturer of ventilation products | 8.0 | -1.2 | 3.5% | |

24 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.7 | 3.5% | |

25 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.3 | 3.5% | |

26 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.3 | 3.3% | |

27 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.9 | 3.3% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.2 | 2.6% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.6 | 2.5% | |

30 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Softcat and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.