Shares for the future: a top 30 stock gets penalised

This British company has an impressive history but it’s having to make hard choices, and analyst Richard Beddard is concerned enough to downgrade his score.

17th October 2025 15:00

by Richard Beddard from interactive investor

Page 1 of Renishaw’s annual report is devoted to a portrait of Sir David McMurtry and a caption: “Sir David McMurtry, 5 March 1940 – 9 December 2024.”

It honours the company’s co-founder and former chair, who invented Renishaw (LSE:RSW)’s first product and developed the business. Renishaw has often heralded him as steward of its culture of innovation and collaboration.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Renishaw makes equipment that inspects machined components (known as industrial metrology), checking they meet the required specification at various stages of production. It also makes position encoders fitted on machine tools in factories to measure their position and control their movements (position measurement).

These two manufacturing technologies earn Renishaw almost all its revenue and profit. They are currently collected with Additive Manufacturing machines, 3D printers, in a division that contributed 94% of revenue and 98% of adjusted profit in 2025.

A much smaller division, Analytical instruments and medical devices, makes spectroscopes, machines that reveal the chemical composition and structure of materials, and neuromate neurosurgical robots.

Renishaw is mooting the sale of neuromate, having already closed another neurological business that 3D-printed catheters for delivering drugs into the brain. It appears the company was no longer confident that the loss-making business would deliver sufficient returns. The same may be true of neuromate.

Renishaw is cancelling some of its big bets and refocusing on what made it great. This is probably a response to diminishing profitability in recent years.

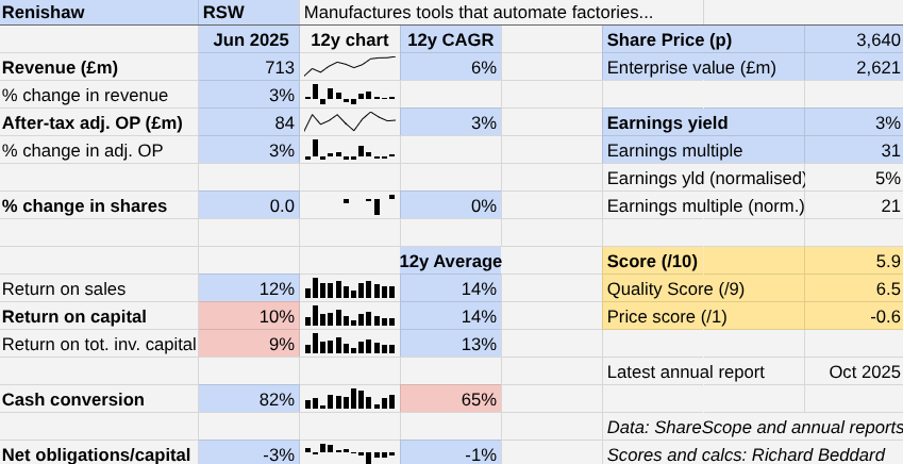

Renishaw: by the numbers

While Renishaw earned its highest-ever revenue in the year to June 2025, profit is still below its 2018 high. Return on capital was 9% in the year to June 2024 and only a fraction better in the year to June 2025, dragging the average down to 14%.

Revenue has grown at a compound annual growth rate (CAGR) of only 6% over the last 12 years and profit at 3%.

Averages and long-term growth rates are significant because demand for Renishaw’s products is volatile, and revenue and profit can vary dramatically from year to year. Even the long-term growth rate is difficult to interpret, because it is influenced by the company’s performance in the first and last years.

This volatility stems from Renishaw’s customers who by and large make machine tools for cyclical markets, or are distributors or manufacturers in those markets. Their spending on machines waxes and wanes with demand for the end product.

- eyeQ: cheapest US Mag 7 stock triggers bullish signal

- Could this risky approach solve the UK’s productivity puzzle?

Renishaw’s position encoders are used on semiconductor manufacturing equipment, for example, which are in demand due to the artificial intelligence (AI) chip-buying spree. Automotive manufacturers use industrial metrology products such as co-ordinate measuring machines (CMM’s), and that side of the business fared less well in 2025.

Cash conversion was better than usual in 2025, as capital expenditure fell. The company has significantly expanded its factory in Miskin, South Wales, in recent years so perhaps we can expect spending to remain lower for a while, despite still heavy but more focused product development.

Scoring Renishaw: flux

Although chief executive Will Lee is well established, the people around him are in flux. Sir David has died, and the company’s longstanding finance director is retiring at the end of the financial year. Renishaw has an interim chair but is seeking a permanent one.

The two founding families still own just over 50% of the shares. Sir David’s son, Richard McMurtry, and John Deer’s granddaughter, Camille Deer, have joined the board as non-executives, which the company says reflects the families’ commitment to the business.

Renishaw | RSW | Makes tools and systems for manufacturers | 15/10/2025 | 5.9/10 |

How capably has Renishaw made money? | 2.0 | |||

Under its co-founders, Renishaw has grown profit at single-digit CAGRs by developing and patenting ever more precise and easy to use tools that automate manufacturing processes and quality control in factories. Long-term growth rates are unreliable though, because profit is so volatile. | ||||

How big are the risks? | 1.5 | |||

Demand depends on capital spending in cyclical manufacturing industries, which is volatile. Low-cost competition from China may be eroding profit margins. Increasing protectionism presents an as yet unrealised threat, given Renishaw's high proportion of sales in China and the US. | ||||

How fair and coherent is its strategy? | 3.0 | |||

Renishaw has refocused on its highly profitable manufacturing technologies. By bringing products to market more quickly and selling more systems it expects to stay ahead of competitors, add more value and win more custom. Voluntary staff turnover is low | ||||

How low (high) is the share price compared to normalised profit? | -0.6 | |||

High. A share price of 3,640p values the enterprise at £2,621 million, about 21 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere). Renishaw previously scored 6.8. | ||||

The changes in management may have made it easier for Will Lee to tweak the company’s strategy, which doubles down on Renishaw’s metrology technologies and Additive Manufacturing. It is bringing products to market faster, and offering more software systems to collect data from machines and control them.

Next year, the company will report the performance of three new segments: Industrial Metrology (IM), Position Measurement (PM) and Specialised Technologies.

Essentially, Renishaw has broken up its Manufacturing Technologies segment, giving the two main components segments of their own and lumping Additive Manufacturing in with Spectroscopy and neuromate (unless it is sold).

According to numbers recently released by Renishaw, Industrial Metrology is the biggest division, responsible for about 60% of revenue in 2025. Precision Measurement, brought in about 30% of revenue that year. Both divisions are capable of 20% operating profit margins.

Specialised Technology is loss making. If my calculations are correct, Additive Manufacturing contributed to the losses. Once Renishaw disposes of neuromate, therefore, Additive Manufacturing is probably Renishaw’s last big bet on a newish technology. This makes sense as, like most of the rest of the business, AM is a manufacturing technology and is relevant to many of the same customers.

Mainly used for prototyping and low-volume manufacturing, Renishaw expects AM will become a high-volume manufacturing technology as engineers grow familiar with its capabilities and design more components for manufacturing this way.

- Ian Cowie: this niche investment trust keeps paying its way

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Spectroscopes are a bit of an outlier. They are mostly sold to academic institutions, but Renishaw is building its industrial customer base.

Renishaw is simplifying, and as a result its strategy is more coherent. By exiting the neurological businesses, it is freeing itself from no doubt taxing approval and sales processes maybe better addressed by a specialist medical equipment company. However, healthcare markets offered some respite from industrial cycles.

I have penalised Renishaw’s score because of its susceptibility to these cycles, and also because of its dependence on China and the US, which are escalating their protectionist policies.

China is the world’s workshop, the object of much of Renishaw’s ambition, and the source of more than 25% of existing sales. It is also home to low-cost competition, which Renishaw is commendably upfront about in its annual report. The US, which is also disrupting trade with tariffs, was responsible for 20% of revenue in 2025.

Renishaw is serious about competing with its low-cost rivals. It plans to develop entry-level products in these markets and continue to drive down costs using its own products to automate production. It is considering manufacturing in low-cost (wage) regions, although I imagine this would be a real wrench.

Otherwise, it is relying on its traditional strengths to compete; reputation, patented products, and close ties to equipment manufacturers and distributors through local sales offices.

This self-sufficiency has always appealed to me, and it is also reflected in an engaged workforce. Voluntary staff turnover in 2025 was 6% for the second year running. This will be tested in 2026, as the company seeks to improve efficiency through voluntary and compulsory redundancies.

Strategy is about making hard choices. In refocusing the business, that is what I think Renishaw is doing. However, the external environment appears hostile, so while I approve of the strategy, the risks are also considerable.

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Thorpe (F W) (LSE:TFW) has published its annual report and is due to be re-scored.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | 0.4 | 7.7% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | YouGov | Surveys and distributes public opinion online | 7.5 | 0.5 | 6.0% | |

5 | Oxford Instruments | Manufactures imaging and etch and deposition systems | 7.0 | 1.0 | 6.0% | |

6 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 5.9% | |

7 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.9 | 5.9% | |

8 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.8% | |

9 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.3 | 5.7% | |

10 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.4 | 5.2% | |

11 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.5 | 5.0% | |

12 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

13 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.0 | 5.0% | |

14 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | 0.0 | 5.0% | |

15 | 4Imprint | Customises and distributes promotional goods | 8.0 | -0.6 | 4.9% | |

16 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.3 | 4.5% | |

17 | Judges Scientific | Manufactures scientific instruments | 7.5 | -0.3 | 4.4% | |

18 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.8 | 4.3% | |

19 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.2 | 4.3% | |

20 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

21 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.5 | 4.0% | |

22 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.0 | 4.0% | |

23 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.4 | 3.9% | |

24 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.9 | 3.1% | |

25 | Volution | Manufacturer of ventilation products | 8.0 | -1.5 | 3.0% | |

26 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.6 | 2.7% | |

27 | Renishaw | Makes tools and systems for manufacturers | 5.9 | 6.5 | -0.6 | 2.5% |

28 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.0 | -2.4 | 2.5% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.9 | 2.5% | |

30 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Renishaw and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.