Shares for the future: time to downgrade this AIM stock

With several internal considerations and with the shares down sharply to near an eight-year low, analyst Richard Beddard explains why he’s taken the red pen to this company’s score.

14th November 2025 15:00

by Richard Beddard from interactive investor

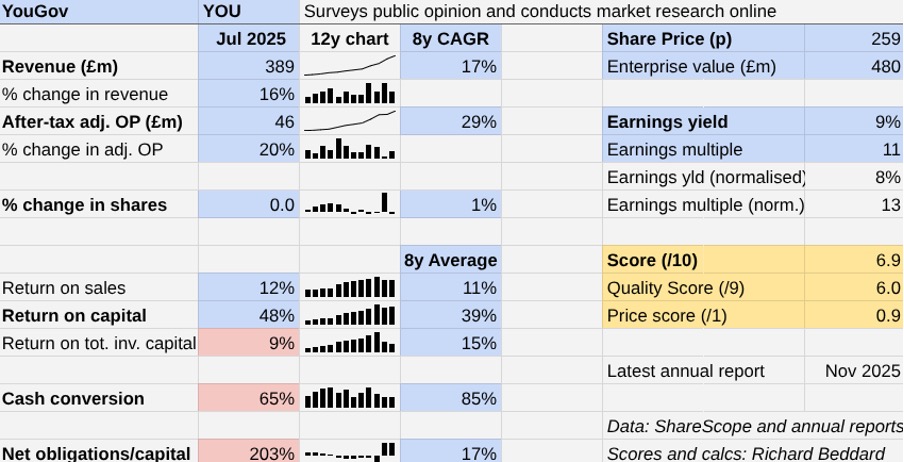

YouGov (LSE:YOU) is a conundrum. The market research firm most famous for its opinion polls is still achieving strong growth in revenue and profit, but the bottom fell out of the share price in June 2024. The company’s founder has returned as interim chief executive.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Stephan Shakespeare was previously chief exec between 2000 and 2023. Under his leadership as CEO, chair and then interim CEO, YouGov has grown revenue at a compound average growth rate (CAGR) of 17% and adjusted profit at 29%.

Its success is predicated on its proprietary panel. YouGov runs an online community of tens of millions worldwide. This enables it to survey people continuously and sell the results to customers on demand and online.

It can predict election results accurately and rapidly. This capability enabled it to become the most quoted market research service worldwide, despite much larger competitors.

Buying growth

There are strong reasons to be cautious about this year’s growth, and the previous year, when revenue grew but profit contracted significantly.

The first is that profit has been heavily adjusted due to restructuring, and also the acquisition of CPS last January.

- Stockwatch: a view on Burberry and the luxury goods sector

- Share Sleuth: how this trio of trades came to pass

Excluding cash costs related to restructuring and acquisitions inflates profit relative to cash flow, which explains weaker cash conversion in 2024 and 2025.

The company’s modest return on total invested capital (ROTIC) and high level of net financial obligations are also by-products of the CPS acquisition.

In the year to July 2025, CPS, rebranded as YouGov Shopping, accounted for 33% of revenue and 38% of adjusted profit. It was not part of YouGov in 2023.

The acquisition provided a one-off bump in revenue and profit at the expense of YouGov’s strong balance sheet. This bump in revenue masks stalled revenue growth at YouGov’s two established divisions, and a sharp decline in their profitability.

The worst-affected division is Data Products, which is still very profitable. This is what YouGov does best. It is the high-margin component of the business model. Investment in data products has increased over the last couple of years but revenue has not, squeezing margins.

Bespoke market research, a significant but less profitable part of the business, is also struggling.

While YouGov anticipates “modest progress” in revenue and adjusted operating profit in the year to July 2026, there are uncertainties that prevent me from writing 2024 and 2025 off as a “blip” in performance.

Radical risk?

The first is the “interim” in Stephan Shakespeare’s title. Although the board is not currently searching for a replacement chief executive, it will once it is “confident in the growth trajectory”.

Then there is the changing market research arena. Earlier in its history, YouGov was unusual in relying on its own panel for market research, and in delivering the results rapidly over the internet. The big traditional market researchers sourced survey panels from specialist panel providers, and their research was largely bespoke.

Now, rivals have embraced automation and developed in-house panels and YouGov’s claim is that it is the “gold standard”. While the size of YouGov’s panels and its devotion to quality may mean it is the best, being unique was perhaps more compelling, in a world where everybody claims to be the best.

Market researchers are also turning to AI to create so-called synthetic panels. These simulate or make small and unrepresentative panels bigger.

Synthetic data is cheaper but produces panels of questionable quality. In defending its gold standard, YouGov is committed to human data, and it prefers to tweak it using its established statistical methodology (known as MRP - Multi-level Regression and Post-stratification).

- Don’t risk your portfolio by hyperfocusing on tax

- Rolls-Royce remains bullish about its nuclear option

This comparison, synthetic data versus human data plus MRP, is beyond me to adjudicate except to say YouGov’s techniques are accepted. At the moment, synthetic data seems to be a bit like the Wild West.

This may be a genuine point of differentiation. But it may not stop some customers choosing the cheaper option. Synthetic data is also in its infancy. It may improve.

Meanwhile, YouGov must finance investment in its data products to maintain the gold standard as customers in Europe seek to spend less because of economic uncertainty, and the company may be constrained by its financial obligations. The debt is about four times 2025’s free cash flow.

Since YouGov remains highly profitable, and cash conversion should improve now that restructuring is complete, the company is probably not financially stressed. But lower financial obligations would be reassuring while we learn more about market research in the age of AI and geopolitical instability.

Strategic plan: back to basics

A new strategic plan launched in 2024 and largely implemented in 2025, streamlined YouGov’s administrative functions, discontinued underperforming products, and closed operations in unspecified non-core regions. It targeted a 7% reduction in headcount, the disposal of some sites and £20 million in annual costs.

The company is also encouraging salespeople to redirect customers to its flagship high-margin subscription products such as BrandIndex, which allows brands to monitor their health, and profiles, which helps organisations understand their target audiences for marketing.

The company plans to double down on its “foundational capabilities”, by investing in panel quality, the panellist experience, and panel recruitment, and invest in the products that use this information.

- How the Autumn Budget could impact your retirement

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It is using AI to help customers interrogate and analyse data better. Panellists receive rewards for answering surveys, and the company is already employing AI to screen for fraudulent responses. Customers can search using natural language queries and analyse open-ended responses to understand why brands have become more or less popular.

Imminently, YouGov plans to launch an AI tool to help customers of YouGov Profiles to create personas data points such as age, attitudes, media consumption, and behaviour, learn about their lifestyles and attitudes, and market to people with these characteristics more effectively.

In the past, YouGov has acquired businesses for their data collection and technical capabilities and to increase its geographical coverage. Recent examples include Yabble, which makes its AI-powered market research tools, and CPS (Shopper), which collects purchase data, such as receipts, and generates insights from it.

The prospect of acquisitions is not emphasised in the annual report. The company probably cannot afford them without raising money from investors, and I don’t think they would be appropriate until YouGov is growing again under its own steam.

Modest ROTIC (Return on Total Invested Capital) indicates past acquisitions have yet to deliver good returns.

I’m no expert in market research, which is why, in scoring the risks particularly, I’ve erred on the side of caution:

YouGov | YOU | Surveys public opinion and conducts market research online | 12/11/2025 | 6.9/10 |

How capably has YouGov made money? | 2.5 | |||

Under the leadership of Stephan Shakespeare, YouGov has grown adjusted profit at 29% CAGR over the last eight years, despite a considerable contraction over the last two that was offset by a large acquisition. Acquisition and restructuring means 2024 and 2025 profits are heavily adjusted. | ||||

How big are the risks? | 1.0 | |||

YouGov's success comes from its large proprietary online panel, but rivals have developed their own. Rivals are also experimenting with cheaper AI-generated synthetic panels of dubious quality. The acquisition of CPS in 2024 saddled YouGov with considerable debt and management is in flux. | ||||

How fair and coherent is its strategy? | 2.5 | |||

YouGov has streamlined products and operations. It continues to prioritise investment in its panel and high-margin subscription products. So far, this has delivered lower returns. It is committed to human data, but using AI to help customers interrogate and analyse it. | ||||

How low (high) is the share price compared to normalised profit? | 0.9 | |||

Low. A share price of 259p values the enterprise at £480 million, about 13 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

*Last week YouGov was ranked fourth in the list with a score of 8.0.

Instinctively, I like YouGov. It makes a lot of information available to the public as a service and to increase its profile, recording 13 million visits to its public data websites in 2025. That data is sourced with panellists’ explicit permission, a model I’d like to grow in popularity!

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Softcat (LSE:SCT) and Volution Group (LSE:FAN) have published annual reports and are due to be re-scored.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.6 | 9.3% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.5 | 6.0% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | |

6 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 1.0 | 5.9% | |

7 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.2 | 5.6% | |

8 | Judges Scientific | Manufactures scientific instruments | 7.5 | 0.1 | 5.3% | |

9 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.2% | |

10 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.5 | 5.1% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

12 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | |

13 | Auto Trader | Online marketplace for motor vehicles | 8.0 | -0.6 | 4.8% | |

14 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.2 | 4.7% | |

15 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.4 | 4.3% | |

16 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.2% | |

17 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

18 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.0 | 4.0% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

20 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.6 | 3.9% | |

21 | YouGov | Surveys public opinion and conducts market research online | 6.9 | 6.0 | 0.9 | 3.7% |

22 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.8 | 3.4% | |

23 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.4 | 3.2% | |

24 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.9 | 3.2% | |

25 | Volution | Manufacturer of ventilation products | 8.0 | -1.4 | 3.2% | |

26 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.5 | 3.0% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.6 | 2.7% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.4 | 2.5% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.5 | 2.5% | |

30 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.1 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.