A bargain portfolio for the future

Our companies analyst reflects on volatile stock markets and attractive shares for long-term investors.

27th March 2020 15:27

by Richard Beddard from interactive investor

Our companies analyst reflects on volatile stock markets and attractive shares for long-term investors.

If you had asked me last year whether in my lifetime there would be a global pandemic that would shut down parts of the economy and slow down much of the rest of it, I would have replied “I don’t know. I hope not, but I suppose it’s possible...”

Preparing for the unpredictable

Like accidental nuclear war, pandemics fall into a category of things that could happen that we don’t specifically factor into our day to day decisions until they do.

That’s why, if you click on the links at the end of this article about the companies mentioned in it, you won’t find the word ‘pandemic’ in any of my analyses pre-dating March 2020.

There’s probably a very good reason for insouciance about distant uncertainties. If we were fearful of all negative possibilities, we wouldn’t be able to function, let alone invest. We might be holed up somewhere missing everything wonderful about society that we are missing now.

At the risk of generalising, investors as a group like figuring things out. We strive for certainty, but we know this is an illusion. Things we did not expect trip us up all the time. Occasionally, these things are really big.

So, as we begin to re-examine our investment strategies now one of those really big things has happened, we shouldn’t be beating ourselves up because we failed to predict a pandemic.

This might seem contradictory, but we can’t absolve ourselves of responsibility for being in some sense prepared either.

Investing in people

My strategy is codified in the Decision Engine. It has evolved over the years, but it has always been intended to enable the construction of portfolios of profitable well managed businesses at reasonable prices.

The goal has been to identify investments to buy and hold for at least 10 years, which I believe is sufficient duration for them to earn a decent return, even if something really big happens. To do that they must survive the bad times, and prosper in the good times, all the while adapting to the changing circumstances that confront them.

Ultimately, long-term investors put our faith in people: The people who run businesses, and the people they employ. All of these people work for their own reasons but, if we have selected good businesses, they also work collectively to ensure their companies survive, adapt, and prosper. These are the people I am relying on to secure my portfolios. I have never thought I could do better than them in a crisis by dodging and weaving in the stock market.

- Coronavirus stock market survival guide

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

My effort goes in upfront; into analysing businesses and investing in those I can trust. This crisis isn’t a call to action, it’s a test of decisions already made, and one of the difficult things about that test is we won’t know the strategy has passed for many years.

The Decision Engine today

For years now I’ve scored shares and ranked the most promising in the Decision Engine. Today I’m going to show you more of its guts than usual.

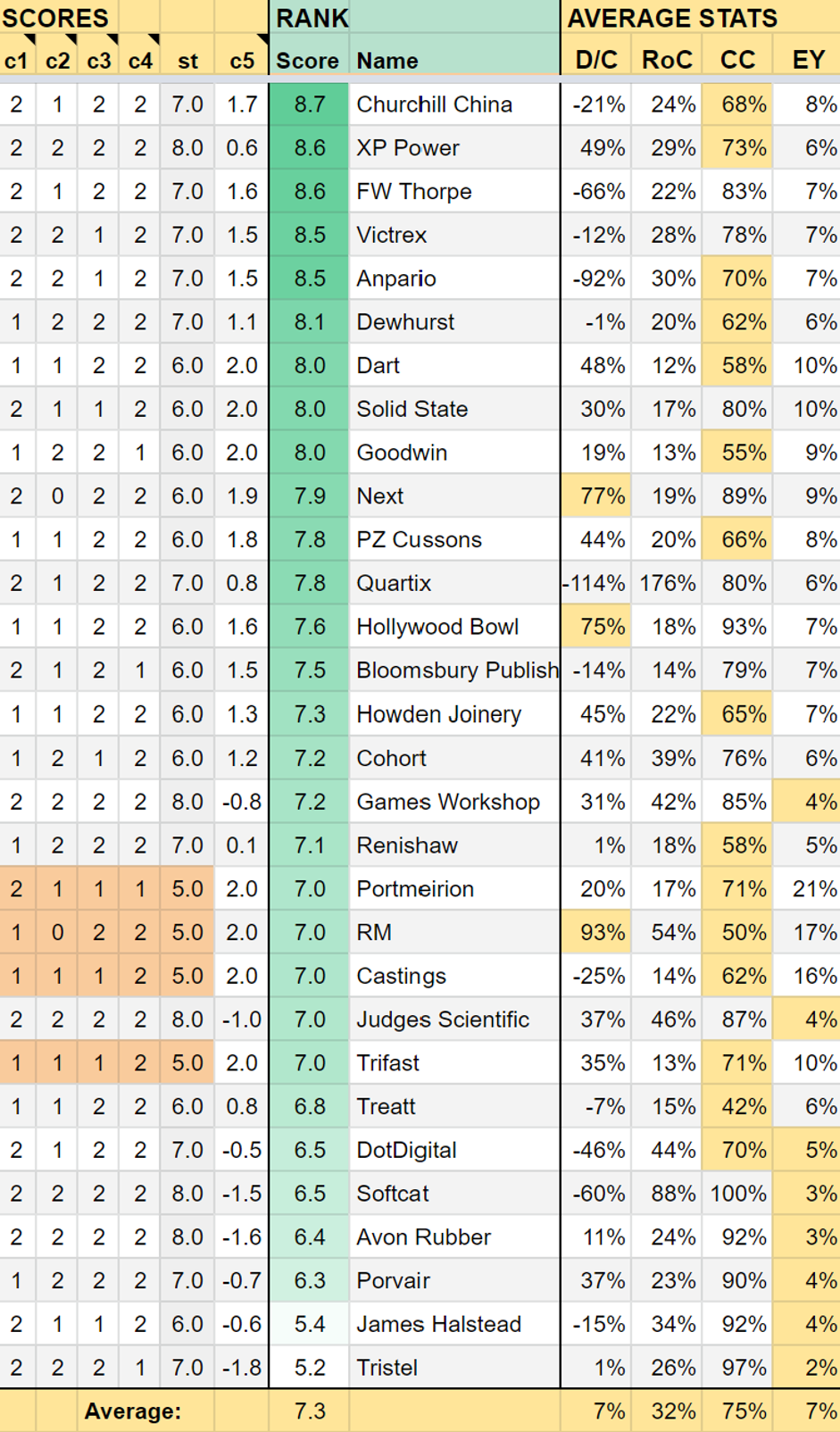

The left-hand section of the table below shows the individual scores, my confidence in the company according to the following criteria.

- c1, Does the business make good money?

- c2, What could stop it growing profitably?

- c3, How does its strategy address the risks?

- c4, Will we all benefit?

c1 judges whether the company has been profitable in cash and accounting terms, c2 examines risks, principally debt, the variability of earnings, and competition, c3 considers the strategy, how the company will grow profitably, and c4 adjudicates whether management is looking after the interests of shareholders, staff, and customers, as well as their own.

These four criteria, subtotalled in the column headed ‘st’, attest to the quality of the business, my confidence in its ability to survive, prosper, and deliver returns for investors.

But those returns will also be determined by the company’s valuation, which is scored in column c5 on a scale from -2 to 2 to give a total score out of 10.

The scores are totalled and ranked in the middle green section. I believe all of these companies are probably good long-term investments, but I’m most confident in the shares near the top of the list:

A bargain portfolio for the future

Source: The author

The right-hand section of the table shows four key financial statistics. With the exception of the first, debt to capital, they are all averaged over a number of years so we are not being swayed by freak results (a practice that will probably come into its own this year!). The figures most likely to be a cause for concern are highlighted in yellow.

Debt to capital (D/C) is a measure of indebtedness, where debt includes all financial obligations, principally bank borrowings, lease obligations, and pension scheme deficits net of cash. The lower it is the better.

Return on capital (RoC) is a measure of profitability, the higher it is the better.

Cash conversion (CC) is the percentage of profit earned in cash, the higher the better.

The earnings yield (EY) is profit as a percentage of the market value of the enterprise. The higher the better (as long as there aren’t fundamental problems with the business that are unlikely to be resolved).

There are probably lessons here for me. I may have allowed myself to be beguiled by high returns on capital, and a little too forgiving of companies that fail to earn a big proportion of returns in cash. But, generally, I think we’ve gone into this crisis in good shape, particularly in terms of debt, which may well be critical for companies shuttering their factories and stores. The average gearing for all 30 shares is only 7%, not bad when you consider that figure uses the fullest definition of debt as the numerator.

Meanwhile, the valuations of these shares have come down so far they are attractive for long-term investors almost across the board. In theory, at least, the Decision Engine taken as a whole is a bargain portfolio!

Buying it would be another matter, bearing in mind the other things I don’t know...

- 11 UK stocks where experts think the dividend is safe

- 'This bear market is not over – here's what will trigger the market bottom'

- Share trades that could have made you back a fortune

More things I don’t know

As I polish off this article (first thing Thursday morning), shares are actually up since the beginning of the week. I don’t know whether trader’s perceptions will stay positive, or we’re in for more negative shocks.

I don’t know whether all of these companies will survive the pandemic in order to prosper. Hollywood Bowl (LSE:BOWL) has closed its tenpin bowling alleys and Next (LSE:NXT) and Games Workshop (LSE:GAW) have closed their stores, though they are selling online.

Dart (LSE:DTG) subsidiary Jet2 has cancelled flights until the end of April. Churchill China (LSE:CHH), which supplies tableware to pubs and restaurants, has ceased manufacturing and will supply customers from stock. RM (LSE:RM.), which supplies schools and provides software for online marking, will endure the consequences of school closures and exam cancellations. Portmeirion (LSE:PMP) has converted its Wax Lyrical factory to manufacture hand sanitiser.

Almost all companies will experience lower levels of economic activity, except those that are being called upon to keep us fed, healthy and supplied during the crisis, of which there is at least one in the Decision Engine, hospital disinfectant supplier Tristel (LSE:TSTL).

The survival and subsequent prosperity of these companies depends on many variables some of which I haven’t even thought of, including their financial reserves, how effectively they can share pain with banks, landlords, employees and the state, and the trajectory of the pandemic. I only have a grip on the first.

These were strong companies going into the crisis and, barring the end of capitalism as we know it, I imagine they will emerge more gracefully than weaker ones. For what it’s worth, the weakest companies going into the crisis according to my scoring system are highlighted in orange in the table.

Last weekend I received an email from Steve, a reader, postulating the end of capitalism as we know it. He foresees much higher taxes, the break-up of large corporations, a roll back in globalisation, nationalisation, and lower expectations of material wealth.

It might, he says, go some way to remedying inequalities, joblessness, and climate change, but it might also mean lower returns for investors.

The end of capitalism as we know it

As a “not knower” there is little I could say about the likelihood of now being the end of capitalism as we know it. The pandemic is changing us as individuals and maybe it has the power to change society.

Of course, I hope it changes us for the better in the long-run and, as long as capitalism exists in a form that allows me to own shares, I imagine I would want to be invested in strong businesses run, and operated, by good people.

A few days ago I finished a novel: The Prince of Milk by Exurb1a (funny name I know - s/he's also a YouTube star). It was grotesquely fabulous and I really enjoyed it, but that's not why I mention it. This is the conclusion to the afterword, which I think is very wise...

"There is a kind of bravery to our condition, I reckon: brought into being without an explanation, in a potentially infinite and apparently dead universe, and expected to just get on with it as though nothing strange is going on. Well it fucking is. And it's all right to have a meltdown about the whole affair from time to time, faced with the pressures of modern existence, trying to be a good human and a good worker and a good son/daughter/parent, trying to be a good citizen, trying to be wise without condescension but uninhibited without recklessness, trying to just muddle through without making any silly decisions, trying to align with the correct political opinions, trying to stay thin, trying to be attractive, trying to be smart, trying to find the ideal partner, trying to stay financially secure, trying to just find some modest corner of meaning and belonging and sanity to go and sit in, and all the while living on the edge of dying forever.

We're all in the same strange boat, grappling with the same strange condition. But it isn't quite so scary if we all do it together. So let's do it together."

Exurb1a. The Prince of Milk (p. 340). Kindle Edition.

How I scored each company

The table below is an alphabetical list of the companies in the Decision Engine with links to my most recent profile of the company. I haven’t adjusted any scores for ‘pandemic risk’, but I have reduced the score of Hollywood Bowl by one point because of its relatively high debt (in the widest sense of the word), something I noted in my analysis earlier this year but did not factor into the score:

| Name | Description | Profile |

|---|---|---|

| Anpario (LSE:ANP) | Manufactures natural animal feed additives | http://bit.ly/swANP2019 |

| Avon Rubber (LSE:AVON) | Manufactures respiratory protection and milking equipment | http://bit.ly/swAVON2020 |

| Bloomsbury Publishing (LSE:BMY) | Publishes books, provides online collections to professionals and academics | http://bit.ly/swBMY2019 |

| Castings (LSE:CGS) | Casts and machines parts for vans and trucks primarily | http://bit.ly/swCGS2019 |

| Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | http://bit.ly/swCHH2019 |

| Cohort (LSE:CHRT) | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| Dart Group (LSE:DTG) | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| Dewhurst (LSE:DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| dotDigital Group (LSE:DOTD) | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Games Workshop (LSE:GAW) | Manufactures, retails Warhammer miniatures for collectors, gamers | http://bit.ly/swGAW2019 |

| Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | http://bit.ly/swHWDN2019 |

| James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

| Judges Scientific (LSE:JDG) | Buys and operates small scientific instrument manufacturers | http://bit.ly/swJDG2019 |

| Next (LSE:NXT) | Retails clothes and homewares | http://bit.ly/swNXT2019 |

| Portmeirion (LSE:PMP) | Designs and manufactures tableware, candles and reed diffusers | http://bit.ly/swPMP2019 |

| Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/swPRV2019 |

| PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Quartix Holdings (LSE:QTX) | Supplies vehicle tracking systems to fleets and insurers | http://bit.ly/swQTX2019 |

| Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2019 |

| Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Solid State (LSE:SOLI) | Manufactures rugged computers, batteries, radios. Distributes components | http://bit.ly/swSOLI2019 |

| Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | http://bit.ly/swXPP2019 |

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.