Shares for the future: the 22 stocks I think are good value now

3rd February 2023 14:42

by Richard Beddard from interactive investor

Our columnist uses some coarse language as he re-examines the newest constituent in his list of 40 shares he thinks are good long-term investments. Here’s why.

Before we get to this month’s Decision Engine ranking, I want to dwell on its newest constituent, Auto Trader Group (LSE:AUTO).

A couple of emails from readers and an article about the enshittification of the world’s biggest platform businesses such as Amazon.com Inc (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL) (Google), have got me fretting.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Not my word

That is right, I wrote enshittification. It is not my word. It was coined by the author, journalist and stern critic of the monopolistic tendencies of capitalism, Cory Doctorow.

A platform brings businesses and consumers together in a marketplace. Google’s search engine brings consumers to advertisers. Amazon brings together retailers and consumers. So does Auto Trader but it specialises in cars.

To flourish, platforms must balance the needs of both sides in the exchange and their own commercial imperative to make money, but Mr Doctorow says that is not happening at some of the biggest platforms.

He writes, enshittification is the process by which platforms die: “... first, they are good to their users; then they abuse their users to make things better for their business customers; finally, they abuse those business customers to claw back all the value for themselves. Then, they die.”

We can see enshittification in the pollution of search results with sponsored links, and the gradual cranking up of fees companies such as Google and Amazon levy on advertisers and retailers.

Doctorow is describing a mechanism that is gradually eroding my goodwill towards these businesses. Were there an alternative, I would switch from Google’s enshittified search engine, and I put up with Amazon’s enshittified everything store because it delivers more cheaply, quickly and efficiently than any other retailer. That is, if we subscribe to Prime, a bargain that gives Amazon the opportunity to shake us down with price rises once we have become dependent on it.

I felt a burden had been lifted when I deleted my account with the chronically enshittified Facebook years ago, and wonder whether I would feel the same way about Twitter now, which is polluting the feeds we read by giving precedence to users who pay.

Since Auto Trader is the dominant online used car marketplace in the UK, it is in a good position to abuse buyers and sellers. It serves up sponsored ads in its listings, and my correspondents have questioned whether locked-in dealers will continue to stump up for its increasing fees.

The ability to raise prices is one of the hallmarks of a business that does something valuable, but we need to know Auto Trader is adding at least as much value as it is extracting.

Price and volume

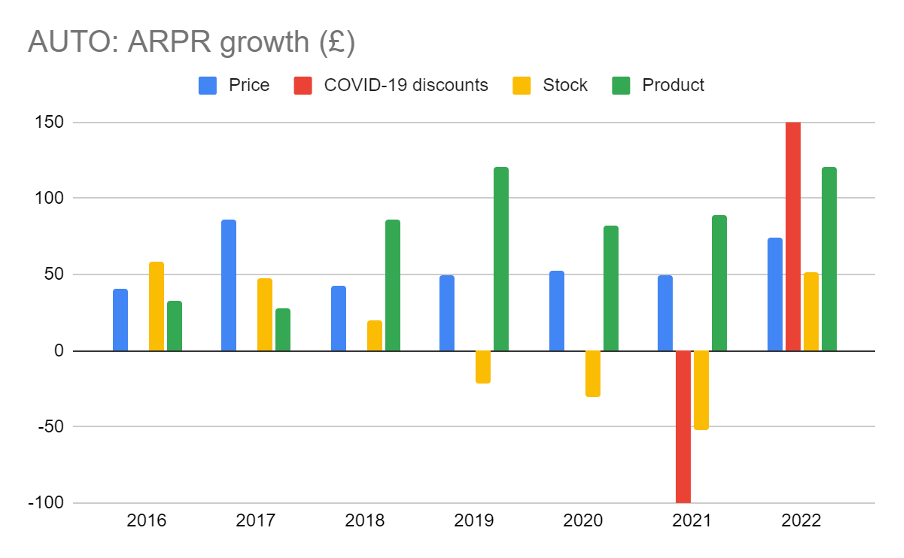

The company decomposes annual growth in average revenue per retailer per month (ARPR) into three buckets: Revenue growth from changes in price, and from selling more, which it puts into two buckets: stock and product.

Stock is the number of vehicles advertised on Auto Trader and Product is what it sells on top of the basic listing, principally more prominent advertising but also, for example, the ability to sell outside a retailer’s home region, and customise Auto Trader “stores”, retailer’s self-administered pages on the platform.

The chart above shows the split. In the first two years after Auto Trader floated in 2015, price (the blue bars) was the most significant factor in ARPR growth, but since then Product (green bars) has been more significant.

The yellow bars (stock) show declines in 2019, 2021, and 2022 due to shortages of used cars. The red bars represent free advertising and discounts offered by Auto Trader during the lockdowns to help retailers sell more and stay afloat when they could not sell from their own forecourts. They were withdrawn in 2022. The impact on revenue growth was so large, -£712 in 2021 and +£639 in 2022, I have truncated the bars so the underlying trend in price, stock and product is visible.

Over the whole period, Auto Trader grew ARPR by £958, from £1,252 per month in 2015 to £2,210 per month in 2022. The biggest component of the growth was product, which contributed 58% of total growth, then price (including the Covid-19 discount effect), which contributed 34%. Stock growth contributed the remaining 8%.

Auto Trader is selling more to its customers, and not just charging them more, which is surely a good sign.

There is an element of inevitability in Doctorow’s enshittification diagnosis that I do not agree with. Balancing the competing interests of employees, shareholders, suppliers and so on is something all businesses do, although it may be harder for platforms because they have more to balance. They have two categories of stakeholders who consider themselves customers: retailers/advertisers and consumers.

Marks in the sand

Platforms that show restraint and make the best trade-offs between the needs of these groups should flourish and prosper.

Judging whether a company is operating judiciously is difficult. Monitoring the price component of revenue growth will tell us whether Auto Trader is becoming more or less dependent on price increases, but it cannot tell us whether these increases are sustainable. And new products can sometimes be a way of justifying charging more for something that was part of the package before, in effect a price increase by another name.

Customer satisfaction scores would give us more confidence, but Auto Trader does not publish a customer engagement score, or net promoter score.

There are other places we can go to find out what people think of Auto Trader. Its mobile apps are rated in the Apple App Store and on Google Play. These tell us mostly what consumers think. The Apple app scores a healthy 4.8/5 stars, but the Android App only scores 4.2/5. Auto Trader’s Trustpilot score is 4.7/5. The reviews tell us the audience is happy, but a minority complain about, in not so many words, enshittification.

These scores are little marks in the sand.

Notes and addenda

Since the last update a month or so ago, I have re-scored Dewhurst (LSE:DWHT), Focusrite (LSE:TUNE) and Treatt (LSE:TET). You can see how I scored them in the table below, which ranks 40 shares I think are good long-term investments. Click on a share's name to see a breakdown of the score, and please note a share’s score may have changed since I scored it due to movements in share prices.

As a rough rule of thumb, I think of shares that score seven or more out of 9 as good value, and shares that score 5 to 7 as fairly priced. There are 22 of them this month.

Shares marked with an asterisk* score less than 5 out of 6 for Profitability, Risks and Strategy. They are more speculative.

0 | Company | Description | Score |

1 | Designs recording equipment, loudspeakers, and instruments for musicians | 9 | |

2 | Supplies kitchens to small builders | 9 | |

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

4 | Imports and distributes timber and timber products | 8 | |

5 | Manufactures natural animal feed additives | 8 | |

6 | Translates documents and localises software and content for businesses | 8 | |

7 | Manufactures tableware for restaurants and eateries | 8 | |

8 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | |

9 | Online marketplace for motor vehicles | 7 | |

10 | Retails clothes and homewares | 7 | |

11 | Sells hardware and software to businesses and the public sector | 7 | |

12 | Manufactures/retails Warhammer models, licenses stories/characters | 7 | |

13 | Sources, processes and develops flavours esp. for soft drinks | 7 | |

14 | Whiz bang manufacturer of automated machine tools and robots | 7 | |

15 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7 | |

16 | Manufactures power adapters for industrial and healthcare equipment | 7 | |

17 | Manufactures sports watches and instrumentation | 7 | |

18 | Manufactures military technology, does research and consultancy | 7 | |

19 | Distributor of protective packaging | 7 | |

20 | Manufactures specialist paper, packaging and high-tech materials | 7 | |

21 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7 | |

22 | Manufactures filters and filtration systems for fluids and molten metals | 7 | |

23 | Acquires and operates small scientific instrument manufacturers | 6 | |

24 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6 | |

25 | Manufactures personal care and beauty brands | 6 | |

26 | Sells promotional materials like branded mugs and tee shirts direct | 6 | |

27 | Publishes books, and digital collections for academics and professionals | 6 | |

28 | Supplies vehicle tracking systems to small fleets and insurers | 6 | |

29 | Manufacturer of scientific equipment for industry and academia | 6 | |

30 | Manufactures vinyl flooring for commercial and public spaces | 6 | |

31 | Distributes essential everyday items consumed by organisations | 6 | |

32 | Online retailer of domestic appliances and TVs | 6 | |

33 | Develops and integrates Customer Data Platforms | 6 | |

34 | Manufactures disinfectants for simple medical instruments and surfaces | 6 | |

35 | Operates tenpin bowling and indoor crazy golf centres | 6 | |

36 | Supplies software and services to the transport industry | 5 | |

37 | Manuf's rugged computers, battery packs, radios. Distributes electronics | 5 | |

38 | Supplies schools with equipment and IT, and exam boards with e-marking | 5 | |

39 | Flies holidaymakers to Europe, sells package holidays | 4 | |

40 | Chocolate maker and retailer | 4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Hollywood Bowl (LSE:BOWL), Hotel Chocolat (LSE:HOTC), RWS Holdings (LSE:RWS), Tracsis (LSE:TRCS) and Victrex (LSE:VCT), have all published annual reports since I last scored them. I have updated the figures that calculate the price scores, but have yet to re-score the other criteria.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in most of the shares in the Decision Engine.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.