Shares for the future: making America clean again

This company has a big opportunity in the US, and analyst Richard Beddard believes it’s good to enough to warrant a higher score. It’s also a share he’d buy at the right price.

12th December 2025 14:36

by Richard Beddard from interactive investor

Credit: Sean Gladwell via Getty Images.

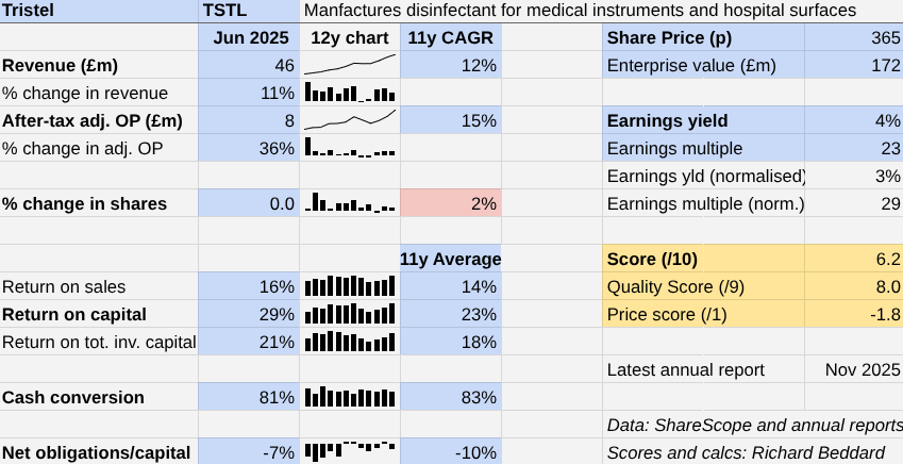

Chief executive Matt Sassone had a good first year at Tristel (LSE:TSTL). Revenue in the year to June 2025 increased 11%, which is typical of the last decade. Revenue growth outpaced cost inflation, leading to a 36% jump in adjusted profit.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

My number for profit growth is more than the company’s own, which is 25%. The difference is share-based payments, which I include in adjusted costs, but Tristel does not. Either way, profit growth was well above the 11-year average of 15%.

Uniqueness is a rare and beautiful thing

For over 30 years, Tristel has been the only company to make hospital disinfectant from chlorine dioxide.

It makes high-level disinfectant for simple medical instruments, such as endoscopes and ultrasound probes. This is delicate equipment typically used in hospital outpatient departments.

Traditional disinfection methods require heat, which is unsuitable for delicate instruments, ultraviolet light, or other high-level chemicals such as peracetic acid and hydrogen peroxide.

These are harsher chemicals that are more hazardous for humans to handle. Hence, they are often used in washing machines. Washing machines and machines that bathe instruments in ultraviolet light are expensive, and it takes longer to send instruments to be washed in centralised facilities than cleaning them in situ.

Tristel’s most established product is Trio. It is a three-step pre-wetted wipe system for cleaning, disinfecting and rinsing endoscopes used in departments such as ENT and cardiology. Tristel is dominant in these markets in the UK and claims a 20% global market share.

- Watch our video: ARK Invest’s Cathie Wood: why we’re betting big on Tesla

- Retail top picks for 2026 revealed

- Sector Screener: time to grab Tesco and Sainsbury’s shares?

The company also has high hopes for Tristel ULT and Tristel OPH. It claims 8% share of the ultrasound market and 1% of the ophthalmology market.

Tristel ULT, which disinfects ultrasound probes, and Tristel OPH, which decontaminates devices used in cataract surgery and glaucoma diagnosis, are foam disinfectants applied with a dry wipe.

After Covid, Tristel launched a high-level surface disinfectant brand, Cache, which is growing sales modestly and accounts for 8% of revenue (compared to 87% for medical device decontamination).

Cache is a lower margin product that competes against less effective disinfectants. Tristel is focusing its marketing for Cache on critical care departments where, it says, efficacy trumps price.

No big, obvious, risks

Because Tristel’s products are unique, popular, and the company is financially strong, there are few big, obvious, risks.

The arrival of new management at successful businesses can be unsettling, but even though Matt Sassone is green and the chief financial officer even greener, I am giving them the benefit of the doubt because I do not expect Tristel’s strategy to change much.

Tristel’s biggest customer is NHS Supply Chain, the NHS procurement arm. However, the company’s roll-out means that today only 39% of revenue comes from home, and a substantial amount of that is not NHS.

Trio uses pre-wetted wipes. These are not good for the environment because they contain plastic to maintain their integrity and elongate shelf-life.

Although Tristel does not disclose how much revenue it makes from individual products, Trio is a significant money spinner, and, I think, its highest value major product.

This year the company disclosed the revenue from ENT departments, a major user of Trio. It was £17 million (37% of revenue).

If Tristel does not develop a more sustainable product, Trio may lose some of its lustre.

Make America clean again

Although chlorine dioxide is a common chemical, Tristel has patented the many ways it is packaged, delivered, and the way the disinfection process is verified.

The company has grown as it has expanded into new territories. This requires trials, regulatory approval, and device certifications.

Tristel counts 158 patents in 32 countries and compatibility with 72 medical device manufacturers covering 2,161 models. It says these barriers prevent copycats.

Its largest opportunity is the US, a market it entered with Tristel ULT late in 2023. It followed up with a second launch in May 2025, when the Food and Drug Administration (FDA) approved Tristel OPH.

The company is targeting large networks of hospitals, clinics and treatment centres. These are big customers, but purchasing pathways are “complex” and it is experiencing a lag as customers learn about the product. It achieved £108,000 of US revenue in 2025.

Although the numbers seem small, Tristel has primarily been selling Tristel ULT which earns royalties. Royalty payments generate relatively low revenue but have a bigger impact on profit.

At the company’s AGM on Friday, the company reported strong growth in revenue in the current year, probably as conventional sales from Tristel OPH kicked in.

- Five top share trades for 2026

- Five macro themes tipped to shape markets in 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Tristel is taking different approaches to selling its first two US products. Tristel’s US manufacturing partner, Parker Laboratories, sells Tristel ULT alongside its own ultrasound gel product.

But Tristel is using a direct sales force and distributors, to market Tristel OPH. As it establishes itself in markets, it generally prefers to move towards direct sales.

The company is also broadening and improving its product portfolio.

After the year end, Tristel launched VisiClean, a detergent for cleaning medical devices, which it is bundling with Tristel ULT. VisiClean covers the dirty device with a pink dye. The pink dye is broken down at the disinfection stage by chlorine dioxide, proving it has been successfully applied.

This enables Tristel to address more of the decontamination process for ultrasound, like it does with Trio.

Like Tristel’s disinfectants, The VisiClean process can be tracked and audited to ensure compliance on Tristel’s 3T digital platform. This is to be bifurcated into a free 3T Lite version based on the current version, and an enhanced 3T Pro product that will earn the company recurring revenues.

Besides geographic expansion and production innovation, Tristel is also considering acquisitions. It would buy other novel businesses that could benefit from its global commercial footprint.

Semi-sustainable

Tristel says it is focusing research and development on waste management.

It has developed Tank, a system for distributing concentrated Cache surface disinfectant and diluting and storing it in reusable bottles in hospitals. Cache is marketed as a sustainable alternative to pre-wetted plastic wipes.

It looks like Tristel is also trying to improve the sustainability of its big pre-wetted wipe product, Trio. The company says it is “exploring low-carbon wipe substrates” in collaboration with specialist manufacturers. Its general design goal is to develop products using circular economy principles.

Aside from the contradiction between the environmental credentials of Trio and Tristel’s newer products, I think the company is a force for good. It makes hospitals safer by preventing the spread of infection.

I remain sceptical of the executive share plan, which rewards three-year profit and Total Shareholder Return growth. This depends on the popularity of the shares when they vest rather than the long-term performance of the business. Executive and employee share options have diluted shareholders by 2% on average per year.

However, the company is an accredited UK Living Wage Employer, which means all employees earn above the voluntary living wage. Tristel boasts 87% employee retention globally, and a 100% apprentice retention rate.

Tristel | TSTL | Manufactures hospital disinfectant | 09/12/2025 | 6.2/10 |

How capably has Tristel made money? | 3.0 | |||

Tristel has achieved double-digit profit growth for over a decade by developing unique disinfectants and introducing them into new geographical markets. It is highly profitable and cash generative. The company's founder retired in September 2024. The CFO retired in June. | ||||

How big are the risks? | 2.5 | |||

Unique, prosperous, and financially strong, there are few obvious risks. Tristel is under new management, but the CEO has had a good year. Trio, Tristel's primary product, uses pre-wetted wipes strengthened with plastic. To meet environmental targets customers and Tristel would almost certainly prefer it to be plastic free. | ||||

How fair and coherent is its strategy? | 2.5 | |||

Although the company has mooted acquisitions, it is focused on exploiting its unique IP by doing what it has done in the past: protecting and improving its IP and rolling it out worldwide. Tristel makes hospitals safer and rewards employees, but I remain sceptical of the executive pay level and targets. | ||||

How low (high) is the share price compared to normalised profit? | -1.8 | |||

High. A share price of 365p values the enterprise at £172 million, about 29 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

I would like the chance to add the shares back to the Share Sleuth portfolio, at the right price.

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.8 | 9.5% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.3% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.2% | |

5 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | |

6 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.4 | 5.9% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.8% | |

8 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.2% | |

9 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | 0.0 | 5.1% | |

10 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

11 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | |

12 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.6 | 4.8% | |

13 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.1 | 4.8% | |

14 | Auto Trader | Online marketplace for motor vehicles | 7.0 | 0.3 | 4.6% | |

15 | Volution | Manufacturer of ventilation products | 8.5 | -1.4 | 4.2% | |

16 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.2% | |

17 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.0 | 4.0% | |

18 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

20 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.0 | 3.9% | |

21 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.6 | 3.8% | |

22 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.9 | 3.8% | |

23 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.7 | 3.6% | |

24 | Judges Scientific | Manufactures scientific instruments | 7.0 | -0.2 | 3.6% | |

25 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.7 | 3.5% | |

26 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.3 | 3.3% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.5 | 3.0% | |

28 | Tristel | Manufactures hospital disinfectant | 6.2 | 8.0 | -1.8 | 2.5% |

29 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.5 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.7 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.